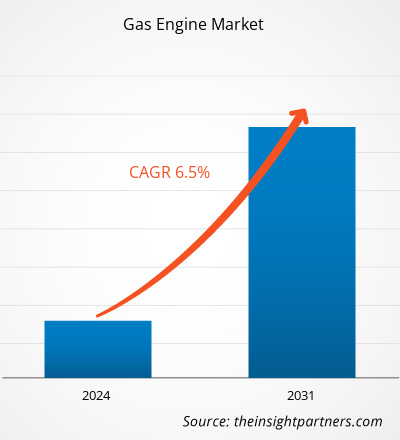

The gas engine market size is expected to reach US$ 8,095.93 million by 2031 from US$ 5,298.16 million in 2024. The market is estimated to register a CAGR of 6.4% during 2025–2031. The rising energy demand worldwide is likely to bring new trends to the market in the coming years.

Gas Engine Market Analysis

Increasing focus on the development of efficient fuel engines is one of the key factors driving the growth of the global gas engine market. In addition, rising product of natural gas and exploration and production activities across the globe is anticipated to further boost the demand for gas engines during the analyzed timeframe. Moreover, growing government incentives for clean energy transition across the globe is further projected to create opportunities for the key players operating in market.

Gas Engine Market Overview

The gas engine manufacturing industry is evolving with innovations in natural gas engine offerings to support emission targets. The rising demand for low-emission, fuel-efficient engines to reduce air pollution and the advent of special gas engines in the manufacturing, utilities, and remote generation application sectors propel the gas engine market growth. Also, biogas-powered engines with improved electric efficiency and low emissions are creating substantial growth opportunities for the market players. The gas engine manufacturers are focusing on offering advanced products to address the rising demand for high power outputs, meeting diesel engine standards. Major heavy industries, remote power plants, and manufacturing companies are selecting high-power gas engines due to enhanced electric efficiency and reduced fuel costs. The use of natural gas in gas engine combustion technology can resolve the emission problems, along with assisting customers in meeting new regulatory norms. There is an increase in the adoption of gas engines in South America, Africa, and Asia, while North America and Europe are focusing on adopting solar and wind energy during the forecast period. The increasing adoption of natural gas for power generation in commercial, industrial, and construction sectors is supporting the gas engine market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

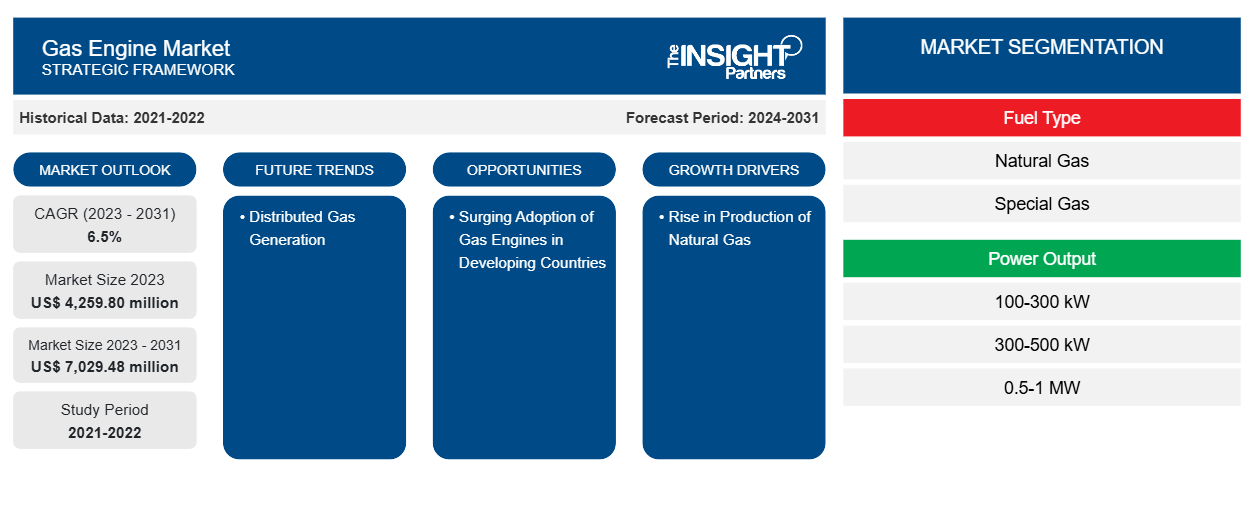

Gas Engine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Gas Engine Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Engine Market Drivers and Opportunities

Increasing Focus on Development of Efficient Fuel Engines

Several governments are imposing regulations to control the emissions of diesel and petrol engines, compelling engine manufacturers to opt for alternative fuel solutions such as natural gas. Gas engines release less emissions as compared to other types of engine to generate a sufficient amount of power. The emission monitoring and regulatory bodies are imposing stringent regulations on the use of diesel engines and generators. Various industries are deploying gas engines and generators for power generation to meet these regulatory standards.

Cummins Inc. and Liberty Energy Inc. announced the launch of the industry’s first natural gas variable-speed, large-displacement engine to power Liberty’s digiPrime hydraulic fracturing platform, set for deployment in the first half of 2025. This follows the strategic partnership between the two companies in June 2024, aimed at jointly developing innovative technology for the completions and services market. The Cummins HSK78G natural gas engine, initially introduced in March 2019 as part of a fixed-speed generator set for the power generation sector, has demonstrated exceptional reliability in providing consistent power across varying natural gas sources and operational environments. The recent advancements in Liberty’s digiPrime platform utilize the HSK78G engine and enhance its response time and load acceptance. This collaboration highlights a significant step in the ongoing growth of the gas engine market, which continues to innovate in areas of efficiency and operational performance, particularly within sectors such as hydraulic fracturing and energy production. Thus, the rise in the development of efficient fuel engines, owing to stringent regulations related to gas engines, is propelling the market growth.

Government Incentives for Clean Energy Transition

Governments are increasingly supporting the transition to cleaner energy sources as part of their broader environmental sustainability goals. This is crucial for the global push for decarbonization and the reduction of greenhouse gas emissions. Various incentives, subsidies, and tax breaks are provided by the governments to encourage the adoption of cleaner and more energy-efficient technologies. Gas engines, being a cleaner alternative to coal and oil, are well-positioned to benefit from these supportive policies. For instance, the growing emphasis on clean, energy-efficient solutions in transportation has led to the development of several government grant programs aimed at supporting the transition of transit fleets to sustainable technologies. The Federal Transit Administration (FTA) has played a significant role through its Low-No Emission and Bus Facilities Grants. These grants are specifically designed to aid transit agencies in transitioning their fleets to cleaner, more energy-efficient alternatives such as renewable natural gas (RNG). Since 2022, the FTA has awarded over US$ 500 million to fund various natural gas projects, significantly offsetting capital expenditures for agencies and facilitating the adoption of clean energy technologies. These federal grants, particularly in the transportation sector, promote the use of natural gas-powered buses and vehicles, which are increasingly viewed as a viable and environmentally friendly alternative to diesel and gasoline-powered options.

Gas Engine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the gas engine market analysis are fuel type, power output, end user, and application.

- In terms of fuel type, the market is categorized into natural gas and special gas. The natural gas segment dominated the gas engine market share in 2024.

- By power type, the market is categorized into 100–300 kW, 300–500 kW, 0.5–1 MW, 1–2 MW, 2–5 MW, 5–10 MW, and 10–15 MW. The 5–10 MW segment dominated the market in 2024.

- Based on end user, the market is divided into remote power generation, midstream oil and gas, heavy industries, light manufacturing, utilities, biogas, data centers, MUSH, and commercial. The heavy industries segment dominated the market in 2024.

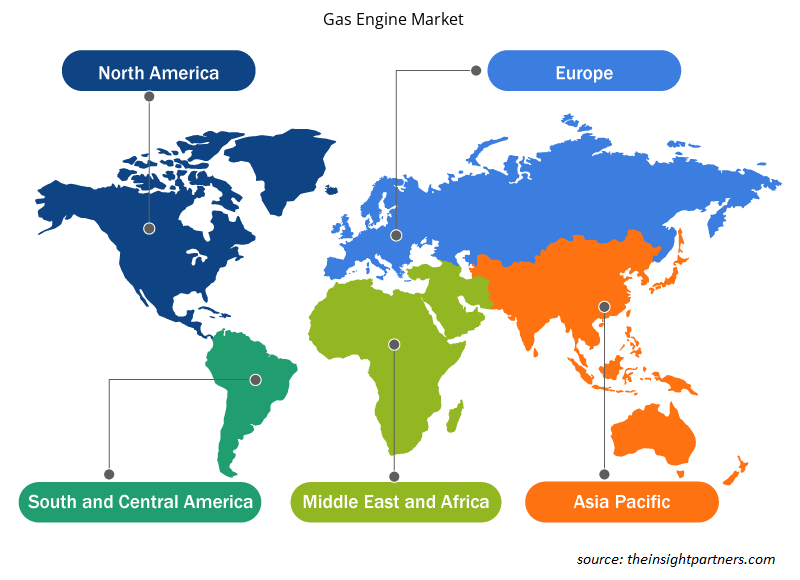

Gas Engine Market Share Analysis by Geography

The gas engine market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South and Central America (SAM). Europe dominated the market in 2024, followed by Asia Pacific and North America.

The gas engine market in Europe is segmented into Germany, France, the UK, Russia, and Italy. Europe has been a leader in the adoption of renewable energy solutions, and the shift toward cleaner energy sources is significantly boosting the gas engine market. Countries such as Germany, Italy, and the UK are transitioning to more sustainable energy solutions, integrating natural gas and hydrogen as part of their green energy strategies. MWM’s recent launch of the TCG 3020 series engine, capable of using a hydrogen admixture, reflects the continent’s focus on hydrogen and natural gas as future energy sources. Additionally, the UK’s commitment to carbon neutrality by 2050 and its investments in gas engine technology demonstrate the growing demand for energy-efficient, low-emission technologies. The European Union’s ambitious targets for reducing emissions by 2030 further fuel the demand for natural gas engines in power generation, transportation, and industrial applications.

Gas Engine Market Regional Insights

The regional trends and factors influencing the Gas Engine Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Gas Engine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Gas Engine Market

Gas Engine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5,298.16 Million |

| Market Size by 2031 | US$ 8,095.93 Million |

| Global CAGR (2025 - 2031) | 6.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Gas Engine Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Engine Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Gas Engine Market are:

- INNIO

- Caterpillar Inc

- Cummins Inc

- Fairbanks Morse, LLC

- Kawasaki Heavy Industries Ltd

- Liebherr

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Gas Engine Market top key players overview

Gas Engine Market News and Recent Developments

The gas engine market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the gas engine market are listed below:

- INNIO Group announces its newest Waukesha VHP P9390X engine upgrade designed for simpler operation and increased reliability. The VHP P9390X upgrade offers operators the latest engine technology, extending the life of the equipment by 60% while lowering downtime and reducing emissions across various operating conditions. (Source: INNIO Group, Press Release, September 2024)

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), a part of Mitsubishi Heavy Industries (MHI) Group, launched SGP M2000, a new natural gas engine cogeneration system with a generation output of 2,000 kW. The new package encloses a 16-cylinder natural gas-fired engine, modeled G16NB, that boasts an electrical efficiency of 44.3%, the highest level in the world for a 2,000 kW-class engine and makes a cogeneration system in compact packaging. (Source: Mitsubishi Heavy Industries, Press Release, March 2023)

Gas Engine Market Report Coverage and Deliverables

The "Gas Engine Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Gas engine market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gas engine market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gas engine market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the gas engine market

- Detailed company profiles

Frequently Asked Questions

What is the estimated market size for the global gas engine market in 2024?

The global gas engine market was valued at US$ 5.29 billion in 2024 and is projected to reach US$ 8.09 billion by 2031; it is expected to grow at a CAGR of 6.4% during 2025–2031.

What will be the global gas engine market size by 2031?

The global gas engine market is expected to reach US$ 8,095.93 million in the year 2031.

Which region is holding the major market share of global gas engine market?

The Europe held the largest market share in 2024, followed by APAC and North America.

What are the future trends of the global gas engine market?

Technological advancement in gas engine is the future trends of the global gas engine market.

What are the driving factors impacting the global gas engine market?

Increasing focus on the development of efficient fuel engines and rising production of natural gas are the driving factors impacting the global gas engine market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Gas Engine Market

- INNIO

- Caterpillar Inc

- Cummins Inc

- Fairbanks Morse, LLC

- Kawasaki Heavy Industries Ltd

- Liebherr

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd

- R Schmitt Enertec GmbH

- Wartsila Corp

- 2G ENERGY AG

- IHI Corp

- Guascor Energy S.A.U.

- Ningbo C.S.I. Power & Machinery Group Co., Ltd.

- Rolls-Royce Holdings Plc

Get Free Sample For

Get Free Sample For