Gas Insulated Substation Market Size, Trends & Growth by 2034

Gas Insulated Substation Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Voltage Types (High Voltage & Ultra High Voltage) & Application (Power Transmission and Distribution & Manufacturing and Processing)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPTE100000459

- Category : Energy and Power

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

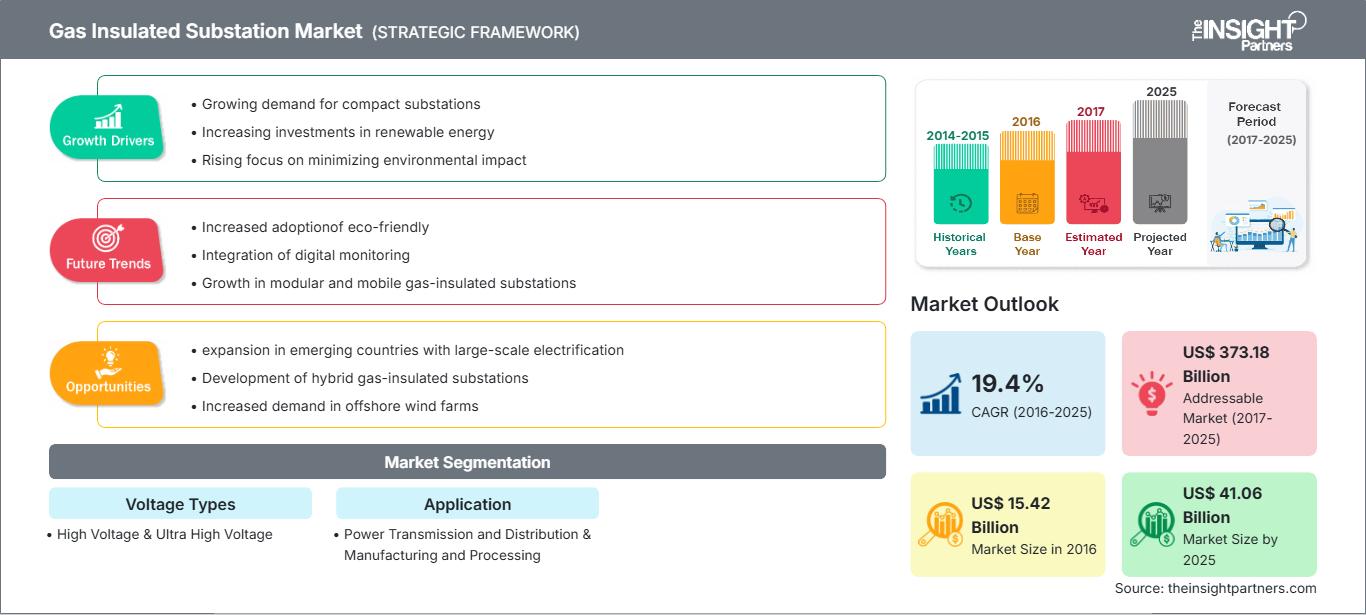

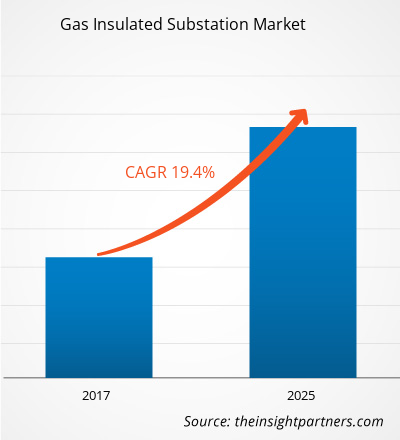

The gas-insulated substation market size is expected to reach US$58.32 billion by 2034 from US$26.43 billion in 2025. The market is anticipated to register a CAGR of 14.10% during 2026–2034.

Gas Insulated Substation Market Analysis

The gas-insulated substation (GIS) market is poised for sustained growth, driven by the convergence of urbanization, renewable energy integration, and grid modernization initiatives. Unlike conventional air-insulated substations, GIS offers a compact footprint, superior reliability, and enhanced safety, making it indispensable for space-constrained environments such as metropolitan areas and industrial complexes. Strategic opportunities lie in the development of SF₆-free alternatives and digital monitoring systems, which align with global sustainability mandates. Vendors should prioritize modular and hybrid GIS solutions to cater to diverse applications, from high-voltage transmission corridors to industrial processing plants. Additionally, partnerships with utilities for turnkey solutions and predictive maintenance services will differentiate providers in a competitive landscape.

Gas Insulated Substation Market Overview

Gas-insulated substations are advanced electrical infrastructure systems that encapsulate switchgear components within a sealed environment filled with insulating gas, traditionally SF₆. This design minimizes space requirements by up to 90% compared to air-insulated substations, while delivering high operational reliability and low maintenance needs. GIS technology is increasingly favored in urban centers, offshore platforms, and industrial facilities where land scarcity and environmental constraints are critical considerations. The market is shaped by global trends such as smart grid deployment, renewable energy integration, and stringent environmental regulations aimed at reducing greenhouse gas emissions. Emerging economies in the Asia Pacific and Africa are accelerating GIS adoption through large-scale electrification projects, while developed regions focus on retrofitting aging infrastructure with compact, digital-ready substations.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGas Insulated Substation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Insulated Substation Market Drivers and Opportunities

Market Drivers

- Urbanization and Space Constraints: Global urbanization is accelerating, with megacities expanding vertically and horizontally. Traditional air-insulated substations (AIS) require large land parcels, which are scarce and expensive in urban areas. GIS technology solves this challenge by reducing the footprint by up to 90%, enabling installations in underground vaults, basements of commercial complexes, and high-rise buildings. This compactness also minimizes visual impact, which is critical for cities enforcing aesthetic and zoning regulations. Additionally, GIS systems offer enhanced safety features, making them suitable for densely populated environments where operational reliability and personnel protection are paramount.

- Renewable Energy Integration and Grid Reliability: The energy mix is shifting toward renewables, introducing variability and intermittency in power generation. This requires substations that can handle dynamic load profiles and maintain grid stability. GIS provides superior insulation and operational resilience under harsh conditions, including extreme temperatures, humidity, and pollution. Its sealed design prevents contamination, ensuring uninterrupted performance in renewable corridors, offshore wind farms, and solar parks. Governments worldwide are mandating GIS deployment in renewable projects to meet decarbonization targets and ensure reliable power delivery.

- Regulatory Push for Environmental Compliance and Safety Standards: SF₆, the traditional insulating gas in GIS, is a potent greenhouse gas with a global warming potential thousands of times higher than CO₂. Regulatory bodies such as the EU under the F-Gas Regulation and IEC standards are enforcing strict emission controls and leak detection requirements. Utilities are compelled to adopt GIS systems with advanced monitoring, predictive maintenance, and eco-friendly alternatives to SF₆. Furthermore, urban safety regulations favor GIS due to its enclosed design, which minimizes fire hazards and enhances operational security compared to AIS.

Market Opportunities

- Innovation in SF₆-Free and Low-GWP Technologies: Sustainability is becoming a competitive differentiator. Manufacturers investing in alternative insulation technologies, such as vacuum-based systems or fluoronitrile blends, can capture an early mover advantage. These solutions not only comply with environmental mandates but also appeal to utilities committed to ESG goals. Companies offering turnkey GIS solutions with eco-friendly insulation will gain traction in regions with aggressive climate policies, such as Europe and North America.

- Digitalization and Smart Monitoring Solutions: Utilities are transitioning from reactive to predictive maintenance strategies. GIS integrated with IoT sensors, SCADA systems, and AI-driven analytics enables real-time condition monitoring, fault prediction, and remote diagnostics. This reduces downtime, optimizes asset performance, and lowers lifecycle costs. Vendors can leverage this trend by offering subscription-based digital services, creating recurring revenue streams beyond hardware sales. Integration with smart grid platforms further enhances the value proposition.

- Expansion in Emerging Economies and Retrofit Projects: Developing regions in the Asia Pacific, Africa, and Latin America are investing heavily in electrification and industrialization, creating demand for compact, reliable substations. GIS providers that localize manufacturing, offer cost-effective modular designs, and support regional standards can penetrate these high-growth markets effectively. Additionally, retrofitting aging AIS infrastructure in mature markets like North America and Europe presents a lucrative upgrade opportunity, especially for utilities seeking space optimization, enhanced safety, and compliance with modern environmental norms.

Gas Insulated Substation Market Report Segmentation Analysis

By Voltage Type

- High Voltage: ~36–138 kV, dominates due to grid upgrade projects.

- Ultra High Voltage: above 138 kV, growing with infrastructure expansions like HVDC networks.

By Application

- Power Transmission and Distribution: Largest share, key for urban and industrial grids.

- Manufacturing and Processing: Emerging demand in industrial facilities seeking reliable power with low-footprint substations.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Gas Insulated Substation Market Regional Insights

The regional trends and factors influencing the Gas Insulated Substation Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Gas Insulated Substation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Gas Insulated Substation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 26.43 Billion |

| Market Size by 2034 | US$ 58.32 Billion |

| Global CAGR (2026 - 2034) | 14.10% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Voltage Types

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Gas Insulated Substation Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Insulated Substation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Gas Insulated Substation Market top key players overview

Gas Insulated Substation Market Share Analysis by Geography

North America

- Market Share: Holds a moderate share of the global GIS market.

- Key Drivers:

- Modernization of aging transmission infrastructure.

- Rising adoption of digital substations and IoT-enabled monitoring.

- Strong demand for compact solutions in urban and industrial settings.

- Trends: Increasing deployment of modular GIS and SF₆-free technologies.

Europe

- Market Share: Accounts for a significant portion of the global market.

- Key Drivers:

- Stringent environmental regulations and decarbonization targets.

- Urban grid densification and underground installations.

- Integration of renewable energy into high-voltage corridors.

- Trends: Rapid shift toward SF₆ alternatives and digital-ready substations.

Asia Pacific

- Market Share: Dominates the global GIS market with the largest share.

- Key Drivers:

- Massive urbanization and industrial infrastructure development.

- Government-led grid expansion projects in China and India.

- Accelerated renewable energy corridor build-outs.

- Trends: Localized manufacturing, hybrid GIS deployment, and smart-grid integration.

Central & South America

- Market Share: Represents a small but steadily growing share.

- Key Drivers:

- Grid expansion for industrial and rural electrification.

- Retrofit projects converting AIS to GIS.

- Infrastructure investments in mining and renewable sectors.

- Trends: Adoption of compact outdoor GIS and modular upgrades.

Middle East & Africa

- Market Share: Holds a developing share with high growth potential.

- Key Drivers:

- Modernization of infrastructure for oil & gas and utilities.

- Need for substations resilient to harsh environments.

- Investments in high-voltage and renewable projects.

- Trends: Growing interest in hybrid indoor/outdoor GIS and SF₆-free solutions.

Gas Insulated Substation Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The gas-insulated substation market is highly competitive, with global players focusing on innovation, sustainability, and digital integration capabilities. Differentiation strategies include:

- Development of SF₆-free insulation technologies and low-GWP alternatives.

- Integration of IoT-enabled monitoring and predictive maintenance solutions.

- Modular and hybrid GIS designs for flexible deployment in urban and industrial environments.

- Value-added services such as turnkey installation, lifecycle management, and digital analytics platforms.

Opportunities and Strategic Moves:

- Partnerships with utilities and renewable energy developers for large-scale grid modernization projects.

- Expansion into emerging markets through localized manufacturing and cost-effective modular solutions.

- Investment in digitalization, including AI-driven asset monitoring and SCADA interoperability.

- Development of eco-friendly GIS systems to comply with global environmental regulations and ESG commitments.

Major Companies Operating

- Schneider Electric SE

- Siemens AG

- ABB Group

- Eaton Corporation Limited

- Mitsubishi Electric Corporation

- General Electric

- Crompton Greaves Limited

- Toshiba Corporation

- Alstom SA

Disclaimer: The companies listed above are not ranked in any particular order

News & Recent Developments

- In August 2024, GE Vernova announced that its Grid Solutions business had manufactured, delivered, and commissioned the world's first 245 kilovolt (kV) SF₆-free Gas Insulated Substation (GIS) for RTE in France. Grid Solutions deployed its advanced B105 SF₆-free GIS, a solution that supported RTE in replacing sulfur hexafluoride (SF₆)—a gas with a global warming potential 24,300 times greater than CO₂—with its g³ alternative. The g³ technology enabled about a 99% reduction in the CO₂ equivalent of the gas contribution to global warming compared to SF₆.

- In May 2025, Hitachi Energy announced that it had delivered the world's first sulfur hexafluoride (SF₆)-free 550 kV Gas Insulated Substation (GIS) to the Central China Branch of the State Grid Corporation of China (SGCC). This pioneering achievement marked a significant step toward decarbonizing the power grid and contributed to China's target of achieving carbon neutrality by 2060.

Report Coverage and Deliverables

The "Gas Insulated Substation Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Gas Insulated Substation Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gas Insulated Substation Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gas Insulated Substation Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Gas Insulated Substation Market

- Detailed company profiles

Frequently Asked Questions

1. Compact design for high-density urban areas.

2. Integration with renewables and smart grids.

3. Environmental benefits (SF₆ reduction) and reliability gains.

1. SF₆-free gases and low‑GWP insulation.

2. Digital monitoring and predictive maintenance.

3. Modular/hybrid indoor-outdoor GIS designs.

2. North America is the fastest-growing region with strong upgrade demand.

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For