Generative AI in the Chemical Market Trends & Future Prospects by 2031

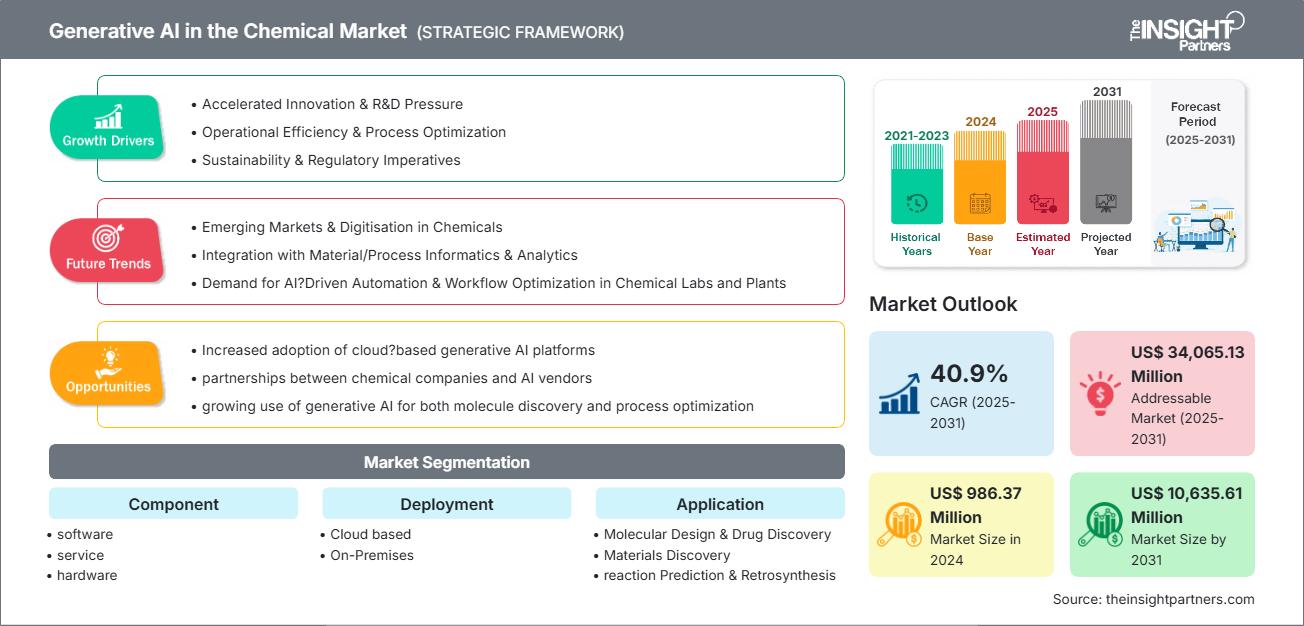

Generative AI in the Chemical Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Report Coverage : by Component (software, service, hardware), Deployment (Cloud based, On-Premises), Application (Molecular Design & Drug Discovery, Materials Discovery, reaction Prediction & Retrosynthesis, Others), Technology (Generative Adversarial Networks (GANs), Natural Language Processing (NLP), Machine Learning (ML), 3D Generative Design Tools) and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Upcoming

- Report Code : TIPRE00042066

- Category : Technology, Media and Telecommunications

- No. of Pages : 150

- Available Report Formats :

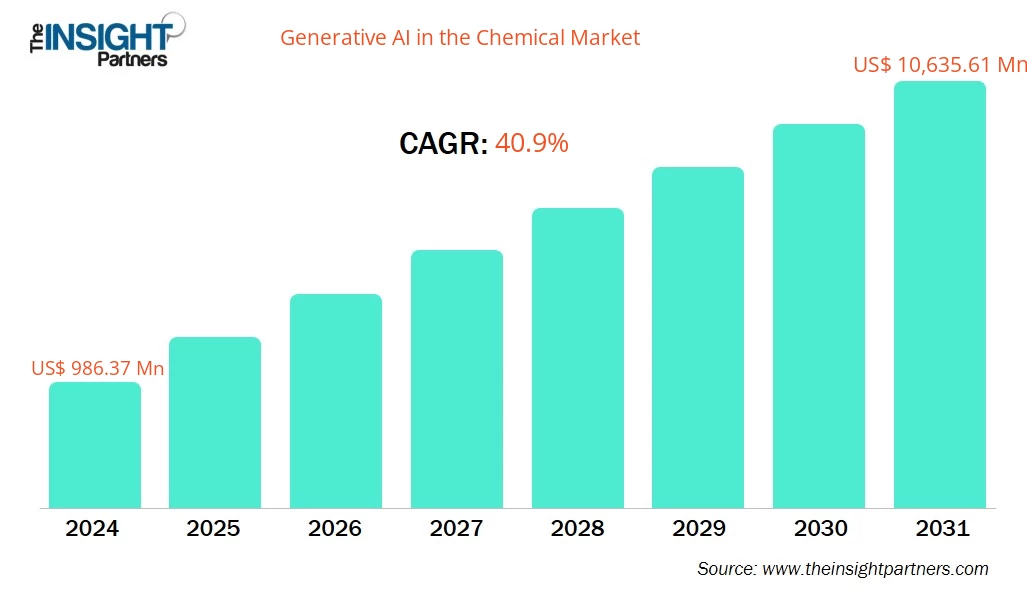

The Generative AI in Chemical Market size is expected to reach US$ 10,635.61 million by 2031 from US$ 986.37 million in 2024. The market is anticipated to register a CAGR of 40.9% during 2025–2031.

Generative AI in the Chemical Market Analysis

The forecast for generative AI in the chemical market indicates strong growth across the chemical and materials sector, driven by accelerating R&D needs, digital transformation of chemical manufacturing, and sustainability imperatives.

Key growth enablers include:

- The push for faster materials/molecule discovery, where generative AI offers the ability to propose novel molecular structures and reaction pathways.

- Adoption of AI‑driven process optimization and production efficiency in chemicals manufacturing, enabling cost savings and performance improvements.

- Supportive initiatives in digitalisation, cloud computing, and integration of generative AI models within chemical value‑chains (labs → plant → formulation), providing a platform for market expansion.

As a result, chemical companies and materials firms are increasingly investing in generative AI technologies to shorten development cycles, cut experimentation costs, and deliver more sustainable, high‑performance products.

Generative AI in the Chemical Market Overview

Generative AI in Chemical refers to the use of advanced algorithmic techniques, including generative adversarial networks (GANs), variational autoencoders (VAEs), reinforcement learning, and large language / chemical‑language models, applied to chemical and materials workflows. These systems support tasks such as de‑novo molecular or material generation, reaction pathway prediction, process parameter optimisation, catalyst and formulation design, and other forms of chemical innovation.

In the broader chemical industry, from specialty chemicals, polymers, coatings, and agrochemicals to fine chemicals and materials, generative AI helps accelerate discovery, reduce the number of physical experiments needed, optimise manufacturing and raw‑material usage, and align with sustainability and circular‑economy goals. As such, generative AI is emerging as a foundation for innovation, productivity, and competitive differentiation for chemical companies, research organisations, and materials firms.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGenerative AI in the Chemical Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Generative AI in the Chemical Market: Drivers and Opportunities

Market Drivers:

- Accelerated Innovation & R&D Pressure: The chemical/materials sectors face increasing pressure to innovate faster, and generative AI offers the ability to explore larger molecular/materials spaces with fewer physical experiments.

- Operational Efficiency & Process Optimization: Generative models contribute to refining chemical processes, improving yields, reducing waste, lowering energy use (important for chemical manufacturing), and enabling more agile production.

- Sustainability & Regulatory Imperatives: With stricter environmental regulations and the drive toward green chemistry, generative AI supports the design of less hazardous materials, recycling‑friendly formulations, optimized feedstocks, and lower‑carbon processes.

Market Opportunities:

- Emerging Markets & Digitisation in Chemicals: Emerging economies that are expanding their chemical/manufacturing base (e.g., India, China) present growth opportunities for adopting generative AI solutions, especially in materials, specialty chemicals, and polymers.

- Integration with Material/Process Informatics & Analytics: Combining generative AI with big data, analytics, simulation/physics‑based modelling, and IoT in manufacturing plants opens a broader context for value‑creation, not just molecule design but full lifecycle optimisation.

- Demand for AI‑Driven Automation & Workflow Optimization in Chemical Labs and Plants: The trend toward “lab of the future” and “digital plant” means that generative AI will increasingly be embedded in end‑to‑end workflows, from discovery to scale‑up to manufacturing, providing broad addressable market potential.

Generative AI in the Chemical Market Segmentation Analysis

The market is analysed through multiple segmentation dimensions:

By Technology:

- Machine Learning (ML)

- Deep Learning (DL)

- Quantum Computing

- Reinforcement Learning (RL)

- Molecular Docking / Generative Chemistry Engines

By Deployment Mode:

- On‑premises

- Cloud‑based

- Hybrid

By Application:

- Discovery of New Materials / Molecules

- Production Optimization

- Feedstock Optimization

- Pricing Optimization

- Process Management & Control

- Product Portfolio Optimization

- Load Forecasting of Raw Materials

By End‑Use Industry:

- Specialty Chemicals & Materials

- Pharmaceuticals / Fine Chemicals

- Polymers & Plastics

- Agrochemicals

- Bulk Chemicals & Manufacturing

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Generative AI in the Chemical Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 986.37 Million |

| Market Size by 2031 | US$ 10,635.61 Million |

| Global CAGR (2025 - 2031) | 40.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Generative AI in the Chemical Market Players Density: Understanding Its Impact on Business Dynamics

The Generative AI in the Chemical Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Generative AI in the Chemical Market – Share Analysis by Geography

1. North America

- Market Share: Holds the largest share, driven by strong chemical/manufacturing infrastructure, early AI adoption, well‑funded R&D, and large chemical firms investing in digitalization.

- Key Drivers: Presence of major AI & chemical companies, strong academia–industry links, regulatory environment supportive of innovation.

- Trends: Increased adoption of cloud‑based generative AI platforms, partnerships between chemical companies and AI vendors, and growing use of generative AI for both molecule discovery and process optimization.

2. Europe

- Market Share: Significant share, supported by strong chemical industry (specialty chemicals, materials) and supportive regulatory environment (e.g., EU chemical strategy, sustainability agenda).

- Key Drivers: Demand for sustainable chemicals, materials innovation, and digitalization mandates.

- Trends: Interoperable AI platforms, cross‑border collaborations, and emphasis on green and circular‑economy chemical processes.

3. Asia Pacific

- Market Share: Fastest‑growing region, driven by rapid industrialisation, expansion of chemical manufacturing, increasing R&D investment, and growing private-sector adoption of AI.

- Key Drivers: Strong government initiatives for AI and digital manufacturing, growing specialty chemical sector, low cost of implementation, enabling leapfrog adoption.

- Trends: Adoption of generative AI for feedstock/production optimisation, localisation of AI workflows (language, data sets), and expanding partnerships between Western AI players and APAC chemical firms.

4. South & Central America

- Market Share: Emerging market with growing adoption potential.

- Key Drivers: Expansion of chemical and materials manufacturing, need for process efficiency, interest in digital and AI solutions for cost control.

- Trends: Cloud‑based generative AI solutions aimed at SMEs and mid‑sized chemical firms, customised for local feedstock/production conditions.

5. Middle East & Africa

- Market Share: Developing region with strong growth potential due to increasing investment in chemicals manufacturing, petrochemicals, and materials.

- Key Drivers: National strategies for digital manufacturing, chemicals industry diversification, and interest in sustainable manufacturing.

- Trends: Implementation of generative AI in integrated chemical hubs (e.g., petrochemicals, polymers), partnership models with global AI vendors.

Generative AI in the Chemical Market – Players Density: Understanding Its Impact on Business Dynamics

The market for generative AI in chemical is becoming increasingly competitive due to the presence of major AI/tech vendors, specialized chemistry/AI firms, and traditional chemical companies innovating via AI partnerships.

This competitive environment pushes vendors to differentiate through:

- Seamless integration of generative AI with chemical informatics, simulation platforms, lab automation, and manufacturing systems.

- Scalable, cloud‑based generative AI solutions tailored for chemical/materials workflows (molecule design, process optimisation, manufacturing).

- AI‑enabled automation not only for discovery but for plant processes (catalyst design, feedstock optimisation, predictive maintenance).

- Interoperability with chemical databases, processing systems (PLM, MES), and third‑party laboratories or manufacturing facilities.

Generative AI in the Chemical Market: Major Companies

Listed below are some of the major companies operating in the generative AI in the chemical market:

- Insilico Medicine

- Cyclica

- Atomwise

- Molecular AI

- Chemify

- Recursion Pharmaceuticals

- BenevolentAI

- Exscientia

- DeepCure

- BenchSci

Other companies analysed during the research include:

- Schrödinger, Inc.

- Zymergen

- Cloud Pharmaceuticals

- IBM Corporation

- Google LLC

- Microsoft Corporation

- NVIDIA Corporation

- Mitsui Chemicals, Inc.

- Omya AG

Generative AI in the Chemical Market News and Recent Developments

- In May 2023, IBM Japan and Mitsui Chemicals announced a collaboration to enhance discovery speed and precision by integrating IBM Watson Discovery with generative AI models (GPT) in chemical applications.

- Generative AI is increasingly being used in chemical companies to optimise workflows. According to a study by Accenture, gen AI has the potential to impact about 31% of working hours in the chemical industry through automation or augmentation.

- Vendors in the generative‑AI chemical space are forming partnerships with chemical manufacturers, launching solutions focused on both molecular discovery and manufacturing process optimisation, signalling a strategic shift from R&D tools to end‑to‑end value‑chain support.

Generative AI in the Chemical Market Report Coverage and Deliverables

The “Generative AI in Chemical Market Size and Forecast (2024–2034)” report provides a detailed analysis covering:

- Global and regional market size and forecast for all key market segments covered under the scope

- Market trends, along with market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat‑map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

1. Data quality and accessibility: Generative AI models require large, high‑quality datasets of chemical structures, reaction data, and manufacturing process data, which are often proprietary or incomplete.

2. Integrating generative AI workflows into legacy chemical manufacturing and lab environments.

3. Regulatory and safety concerns in novel material/chemical generation (ensuring AI‑designed molecules meet safety, regulatory, and environmental standards).

4. Technical complexity and required investment in computational power, infrastructure, and talent.

1. Specialty chemicals & materials manufacturers, using generative AI to design new polymers, coatings, composites, and catalysts.

2. Pharmaceuticals / fine chemicals, leveraging generative AI for novel molecule discovery, formulation, and optimisation.

3. Polymers, plastics & agrochemicals, adopting AI for feedstock optimisation, process efficiency and sustainability.

4. Bulk chemicals and manufacturing, applying AI in process control, predictive maintenance, and raw‑material optimisation.

1. The imperative to increase operational efficiency, accelerate material/molecule discovery, and reduce time‑to‑market.

2. Growing need for process optimisation, feedstock efficiency, and sustainability in chemical manufacturing.

3. Increasing investment in digital transformation and AI adoption across the chemical and materials industries.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For