Healthcare Staffing Market Dynamics and Trends by 2028

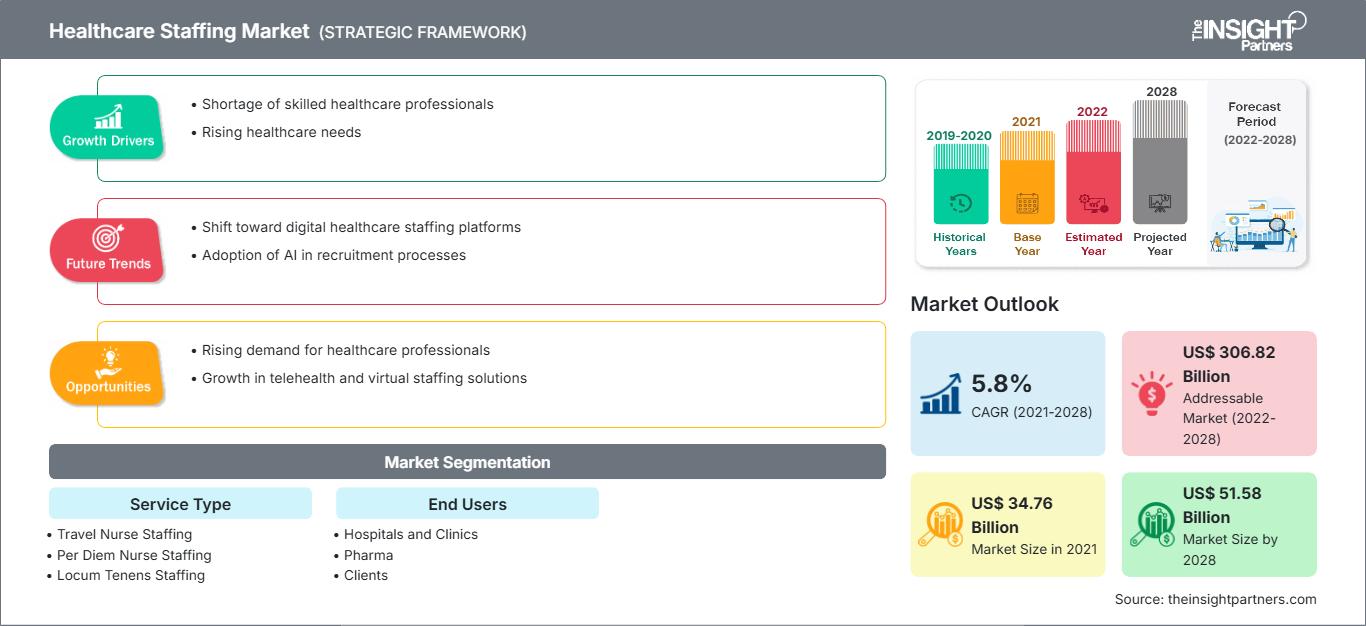

Healthcare Staffing Market Forecast to 2028 - Analysis By Service Type (Travel Nurse Staffing, Per Diem Nurse Staffing, Locum Tenens Staffing, Allied Healthcare Staffing, and Others), and End Users (Hospitals and Clinics, Pharma, Clients, and Government Agencies)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Status : Published

- Report Code : TIPRE00002858

- Category : Life Sciences

- No. of Pages : 274

- Available Report Formats :

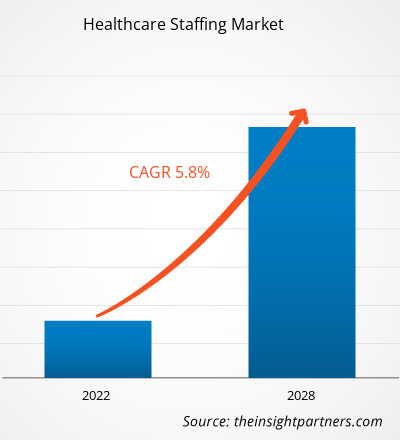

[Research Report] The healthcare staffing market is expected to grow from US$ 34.76 billion in 2021 to US$ 51.58 billion by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028.

Market Insights and Analyst View:

Healthcare staffing refers to recruiting, hiring, and deploying qualified healthcare professionals to fill temporary or permanent positions in healthcare facilities and organizations. According to a Healthcare Staffing Industry Overview Survey conducted by Harris Williams and Company, healthcare staffing is an 11.1-billion-dollar industry with an annual expected growth rate of seven percent. The growth of telehealth and telemedicine has created an opportunity for healthcare staffing, with the need for remote medical professionals and telehealth support staff. Healthcare facilities often turn to staffing agencies to fill temporary gaps in their workplace, offering flexibility and cost-effectiveness compared to permanent hires. Such factors are expected to propel the healthcare staffing market growth during the forecast period.

Growth Drivers and Challenges:

The job outlook for advanced practice nurses, nurse practitioners, and physician assistants (collectively known as “physician extenders”) is witnessing positive growth, as the US Bureau of Labor Statistics is projecting growth on the horizon of 45% and 31% through 2030, respectively, in the number of such jobs. This segment of clinicians will undoubtedly be an integral piece of the solution to bridge the gap in physicians that threatens to derail the healthcare delivery system.

Healthcare systems recognize that recruiting and including extenders as part of the clinical staff has other benefits. Physician extenders within an organization often mean more efficient throughput, increased patient volume, and lower overhead and liability costs, leading to better patient satisfaction and clinical outcomes. This realization is evidenced in the 2021 Review of Physician and Advanced Practitioner Recruiting Incentives report, published by Merritt Hawkins, a division of AMN Healthcare, where it was reported that for the first time in the report’s 28-year history, nurse practitioners were the most sought-after type of medical provider. Presently, the world is struggling with the COVID-19 pandemic. This infection leads to pneumonia, severe and acute respiratory disorders, multiple organ failure, and in severe cases, death. The geriatric population is more prone to COVID-19. Demand for nurse staffing increased significantly during the pandemic. According to EHRN, from September 2020 to December 2020, demand for hospital staffing increased by 50,000 nurses or 245%.

The use of physician extenders is growing because of their valuable role in healthcare delivery. Beyond providing coverage in areas that have historically been short on providers due to geography, physician extenders supplement the delivery system by acting as the senior medical personnel in a number of environments, including, but not limited to, outpatient and clinic settings. They are often able to assess, treat, and diagnose patients in the absence of a licensed medical doctor. These attributes are expected to boost the growth of healthcare staffing market strategies during the forecasted period.

Thus, above mentioned factors are expected to boost the healthcare staffing services market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHealthcare Staffing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Healthcare Staffing Market” is segmented based on service type, end-user, and geography. Based on service type, the healthcare staffing market is segmented into travel nurse staffing, per diem nurse staffing, locum tenens staffing, allied healthcare staffing, and others. The healthcare staffing market is segmented into hospitals and clinics, pharma, clients, and government agencies based on end-user. The healthcare staffing market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on service type, the healthcare staffing market is segmented into travel nurse staffing, per diem nurse staffing, locum tenens staffing, allied healthcare staffing, and others. The travel nurse staffing segment held the largest share of the market. Moreover, the locum tenens staffing segment is expected to register the highest CAGR of 6.3% in the market during the forecast period. Locum tenens is a temporary staffing solution for resolving physician and advanced practitioner shortage problems. Over 90% of medical facilities in the US have, at some point, hired locum tenens physicians and advanced practitioners that practice critical care, primary care, emergency medicine, internal medicine, anesthesiology, surgeons, and other fields of medicine. The primary cause of increased demand for locum tenens providers is a scarcity of medical professionals. The growing physician shortage crisis worsens yearly, especially in rural communities with fewer healthcare facilities. An estimated 40,000 physicians now work locum tenens assignments each year, and more than 90 percent of hospitals and other facilities use locum tenens physicians to fill positions. While locum tenens assignments are available for every physician specialty, some specialties are in higher demand than others. Primary care, family medicine, urgent care, and anesthesiology are the most highly sought-after. Thus, the growing adoption of locum tenens can be healthcare staffing market trends for the forecast period.

The healthcare staffing market is segmented into hospitals and clinics, pharma, clients, and government agencies based on end-user. In 2021, the hospitals and clinics segment held the largest share of the market. However, the client segment is expected to register the highest CAGR of 6.2% in the market during the forecast period. Historically, hospitals and clinics have been at the core of the global healthcare system, and nursing services are central to providing hospital care. They have also functioned as the traditional place of work for nursing personnel and especially registered nurses (RN). Latest hospital expansion, scientific advances, and technological development led to the use of an increasing number of healthcare staff. The increasing prevention of chronic diseases and the rising need for patient data management and to enhance the patient care segment is expected to grow remarkably.

Moreover, adapting to digital transformation in clinics and hospitals is boosting the growth of the global healthcare staffing market. The majority of hospitals and healthcare service providers and top medical recruiting companies are working with other organizations to fulfill the demand raised by the healthcare industry. For instance, in June 2023, Jackson Healthcare completed its acquisition of LRS Healthcare, a healthcare staffing firm based in Omaha.

Regional Analysis:

Based on geography, the healthcare staffing market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America's healthcare staffing market has been analyzed based on three major countries — the US, Canada, and Mexico. The US healthcare staffing market is estimated to hold the largest healthcare staffing market share during the forecast period. The healthcare staffing market growth in the US is attributed to the various market players, and a dynamic scenario has been established in this region has transformed the dynamics of cell line development in the region. The growth in North America is characterized by an increase in the number of chronic diseases in the US, rising public health awareness, increasing strategic activities by the government, and the presence of leading players. Moreover, increasing focus on advanced method incorporation in healthcare, government, and private initiatives for the promotion of precision medicine and massive funds from government and private bodies are further expected to stimulate growth and contribute to the healthcare staffing market in North America.

Furthermore, various launches of technologically advanced products for cell line development are expected to boost market growth. For instance, in August 2020, Medical Solutions launched a new brand identity following recent acquisitions and industry growth. The company's largest acquisition ever in the healthcare staffing industry by acquiring Omaha-based C&A Industries in late 2019. With the acquisition, Medical Solutions grew from a USD 500 million to a USD 1 billion+ company, expanded its market share, and further diversified its value proposition, primarily into the allied health space and non-clinical staffing.

Asia-Pacific is the second leading region in the global cell development market. The UK is holding the largest share in the Asia-Pacific healthcare staffing market during the forecast period due to the factors such as the prevalence of chronic diseases in the countries, advanced healthcare infrastructure, and growing government initiatives for the implementation of medical professional recruitment policies are likely to be the significant factors driving the growth of healthcare staffing market in this region.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global healthcare staffing market are listed below:

- In Feb 2022, AMN Healthcare was honored as one of Staffing Industry Analysts’ 2022 Staffing 100, the staffing industry leaders, by the Chief Clinical Officer of AMN Healthcare. The company was honored for its leadership skills during an era of unprecedented difficulty in staffing.

- In Feb 2022, Maxim Healthcare Services announced the separation of its two business units into independently operated companies, Maxim Healthcare Services, and Maxim Healthcare Staffing, and has retired the umbrella Maxim Healthcare Group brand. The move allowed each to build on existing growth, expand services and better serve its healthcare customers.

- In Jan 2022, CHG Healthcare Services provided more than 30% of the temporary medical employees, including physicians, nurses, and other key professionals in the United States, making it a key player in the recruitment and hiring of healthcare staff at a crucial time of COVID-19 pandemic to combat major staff shortage by hospitals.

- In July 2021, Jackson Healthcare received USD 34 million from Georgia’s tab for providing staffing help to hospitals and nursing homes in the pandemic. As per the contract, the company supplied healthcare staff, from doctors to nurses to respiratory therapists, to dozens of hospitals and nursing homes across Georgia throughout the COVID-19 pandemic through its subsidiary, HWL.

- In Feb 2022, Cross Country Healthcare acquired substantially all the assets of Selected, a cloud-based matching and hiring talent platform that pairs educators with schools based on mutually shared preferences to ensure a tailored and long-term fit. The acquisition ensured a balanced talent equilibrium across the healthcare and education industries.

Covid-19 Impact:

Reliable and timely COVID-19 observation of vital signs is an integral part of the monitoring, prevention, touch recording, and control of infections and clinical management of COVID-19. For instance, an ERDF-funded project is helping to tackle the COVID-19 crisis in Italy. New sensing devices created by the MEDIWARN project allow healthcare staff to monitor patients suffering from the disease at a distance. It is difficult and dangerous for medical and nursing staff to monitor COVID-19 patients in person. Patients infected and symptomatic need to be isolated in rooms with negative pressure. The new and advanced devices allow staff to monitor such patients more easily from another room. Thus, the COVID-19 pandemic increased demand for healthcare monitoring and awareness, boosting the healthcare staffing market in the forecasted period.

Healthcare Staffing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 34.76 Billion |

| Market Size by 2028 | US$ 51.58 Billion |

| Global CAGR (2021 - 2028) | 5.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Healthcare Staffing Market Players Density: Understanding Its Impact on Business Dynamics

The Healthcare Staffing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global healthcare staffing market are Envision Healthcare Corp., AMN Healthcare Inc., Cross Country Healthcare Inc., Jackson Healthcare (LocumTenens.Com), Adecco Group, Maxim Healthcare Services Inc., Favorite Healthcare Staffing Inc., Aya Healthcare Inc., Medical Solutions LLC, and CHG Healthcare Services. among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their healthcare staffing market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For