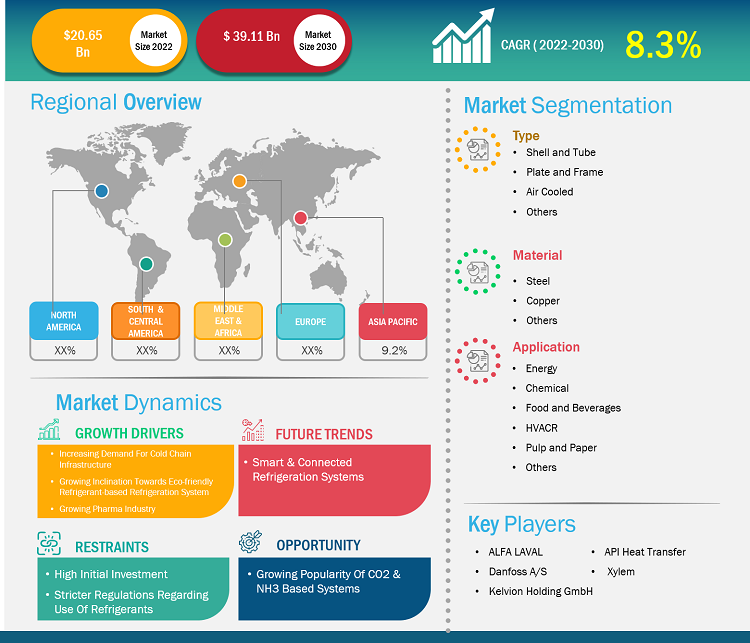

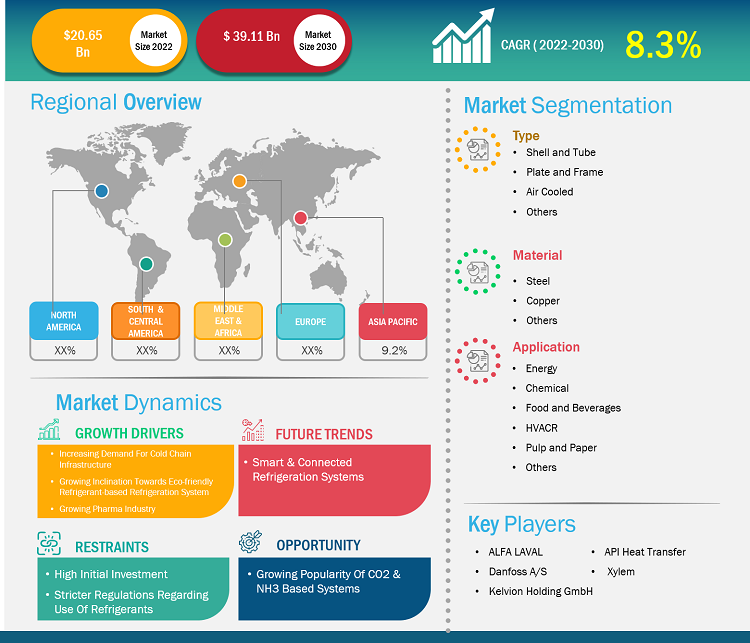

The heat exchanger market size was valued at US$ 20.65 billion in 2022 and is expected to reach US$ 39.11 billion by 2030; it is likely to register a CAGR of 8.3% from 2022 to 2030.

Analyst Perspective:

A heat exchanger is a device that is generally used for heating or cooling elements, depending on customer’s needs; it is primarily employed in various process and discrete industries. The industry uses heat exchangers for cooling in order to prevent overheating of critical machinery or flammable materials. The market for heat exchangers is growing globally. The major industrial sectors driving the demand are energy, chemical, food, HVAC, and marine, among others. All major process industries across the globe use heat exchangers for several applications. Industry 4.0, rapid industrialization, and technological advancements in oil & gas industries are all boosting the growth of the market.

Heat Exchanger Market Overview:

Manufacturers operating in the heat exchanger market are launching various products for petrochemical and refinery operations. For instance, in April 2023, Aggreko—a global provider of mobile modular power, temperature control, and energy solutions—launched two new rental heat exchanger families—the Large Nodal Heat Exchanger and the Hastelloy C Cross Flow Heat Exchanger. This off-the-shelf unit offers petrochemical and refinery customers the industry's largest heat exchanger and the only one made from Hastelloy. Both products are designed to ensure the smooth operation of petrochemical plants and refineries and handle complex chemical situations by maintaining customers' production rates and improving plant processes.

Further, various manufacturers operating in the heat exchanger market are launching compact heat exchangers to deliver fewer pressure drops and higher heat transfer in a compact design. For instance, in December 2022, Conflux Technology, a heat transfer product manufacturer, launched a new product to its commercial offering—a cartridge-based heat exchanger. Conflux Technology's latest launch is essentially a 3D-printed core that can be embedded into traditionally manufactured housings to deliver fewer pressure drops and higher heat transfer in a compact design. The company is also expanding its product line of compact heat exchangers for defense, aerospace, EV, automotive, industrial, and energy use cases.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Heat Exchanger Market: Strategic Insights

Market Size Value in US$ 20.65 billion in 2022 Market Size Value by US$ 39.11 billion by 2030 Growth rate CAGR of 8.3% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Heat Exchanger Market: Strategic Insights

| Market Size Value in | US$ 20.65 billion in 2022 |

| Market Size Value by | US$ 39.11 billion by 2030 |

| Growth rate | CAGR of 8.3% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Heat Exchanger Market Driver:

Use of Heat Exchangers in Oil & Gas Industry Drives Heat Exchanger Market Growth

According to the report published by the International Energy Agency (IEA) in June 2023, the global demand for oil is expected to grow by 6% from 2022 to 2028 and will reach up to 105.7 million barrels per day (mb/d) in 2028. The demand is growing due to the rising requirement for petrochemicals and the increasing need for oil in the aviation sector. In addition, the investments for the upstream segment in oil and gas exploration, extraction, and production are anticipated to reach their highest value since 2015 and are projected to grow by 11% year-on-year to US$ 528 billion in 2023, this is to benefit the heat exchanger market. In addition, the investment and expansion in the refineries is increasing due to the rise in oil and gas demand. For example, in April 2019, ExxonMobil made a huge investment in the expansion project of oil refineries within a manufacturing complex in Singapore to further enhance the competitiveness of the country’s facility. According to the Economic Times, in January 2023, Pertamina, a refinery arm of an Indonesian state energy firm, announced upgrading its old refineries and building new ones, thereby increasing its processing capacity to over 1.5 million barrels per day. Therefore, the rise in global oil demand and investment in the oil & gas industry contributes to the production of oil and gas, where heat exchangers are used to eliminate the heat generated during production. It helps maintain the rapid generation or dissipation of heat to enhance productivity in the oil & gas industry. These heat exchangers are used in various applications such as heat/oil transfer systems, fuel gas conditioning systems, cold ammonia flow control, lube oil systems, and selective catalytic reduction (SCR) units. For example, in fuel gas conditioning systems, the heat exchanger helps maintain the heat generated during the steady flow of dry, high-purity fuel and ensures system components are working in stable conditions for a long period. In the lube oil system, heat exchangers help to provide an optimal thermal environment for the smooth operation of critical components such as mixers, kettles, and electrical switchgear. Thus, with the growth in the oil & gas industry, the use of heat exchangers is increasing, which is driving the market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Heat Exchanger Market Segmental Analysis:

Based on material, the heat exchanger market is segmented into steel, copper, and others. The steel segment held the largest share of the heat exchanger market. Steel-based heat exchangers exhibit high mechanical strength and outstanding corrosion resistance. Stainless steel has good thermal conductivity, making it an optimal choice for heat exchangers to withstand ultra-high temperatures, extreme burst pressure, and harsh environments. Steel is stronger than aluminum and copper. It maintains its mechanical strength at higher temperatures than other common metal-based heat exchangers. Thus, its high mechanical strength enhances the performance of heat exchangers and helps reduce the potential for distortion or warping over extended contact to ultra-high temperatures. All these characteristics of steel fuel the market growth for the segment.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Heat Exchanger Market Regional Analysis:

The North America heat exchanger market size was valued at US$ 6.1 billion in 2022 and is projected to reach US$ 11.2 billion by 2030; it is expected to register a CAGR of 7.9% from 2022 to 2030. The North America heat exchanger market is segmented into the US, Canada, and Mexico. The US held the largest share of the heat exchanger market in North America in 2022. The region is adopting hydropower electricity generation as it is one of the clean sources of energy and is developing power plants to meet the growing energy demand. For instance, according to the US Department of Energy report for January 2021, the hydropower capacity increased by a net of 431 MW in 2019 since 2017. The capacity was increased from existing facilities, new facilities, and powering non-powered dams (NPDs), which resulted in a total net growth of 1,688 MW from 2010 to 2019. In addition, Mexico is planning to build many gas-fired power plants to increase the natural gas supply, including importing natural gas from the US. For instance, in November 2022, US-based New Fortress Energy announced the deal signed with the Mexican government to develop the LNG project Lakach offshore gas field in Mexico, which is expected to be completed by 2024. Thus, these plants generate the need for heat exchangers for gas drying, preheating natural gas, and liquefaction of natural gas in LNG plants. In the hydropower plant, heat exchangers minimize the downtime of turbines, generators, and transformers by reducing the heat generated. Thus, the rising establishment of hydropower plants contributes to the North America heat exchanger market growth.

Heat Exchanger Market Key Player Analysis:

Alfa Laval AB, Kelvion Holding GmbH, Danfoss AS, Xylem Inc., API Heat Transfer Inc., Chart Industries Inc, Guntner GmbH & Co KG, Larsen & Toubro Ltd, Hisaka Works Ltd, and Johnson Controls International Plc are a few of the key players operating in the heat exchanger market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the heat exchanger market. A few recent key heat exchanger market developments are listed below:

- In January 2023, L&T Heavy Engineering secured orders for one of the heaviest reactors and screw plug heat exchangers for a refinery in Mexico.

- In February 2022, Johnson Controls announced that it has added and installed fully integrated, factory-built, wrap-around heat exchangers (WAHX) to its YORK Solution Indoor and Outdoor air-handling units, meeting a growing need for energy-efficient dehumidification methods in a compact footprint.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The heat exchanger market was valued at US$ 20.65 billion in 2022 and is projected to reach US$ 39.11 billion by 2030; it is expected to grow at a CAGR of 8.3% during 2022–2030.

Use of heat exchangers in oil & gas industry, rise in industrialization, and surge in industry-specific applications are the driving factors impacting the heat exchanger market.

The key players, holding majority shares, in heat exchanger market includes Alfa Laval AB, Kelvion Holding GmbH, Danfoss AS, Xylem Inc., API Heat Transfer Inc., Chart Industries Inc, Guntner GmbH & Co KG, Larsen & Toubro Ltd, Hisaka Works Ltd, and Johnson Controls International Plc.

Introduction of heat exchanger as a service in a subscription based model is the future trends of the heat exchanger market.

APAC is anticipated to grow with the highest CAGR over the forecast period.

The shell and tube segment led the heat exchanger market with a significant share in 2022 and also expected to grow with the highest CAGR.

The heat exchanger market is expected to reach US$ 39.11 billion by 2030.

The Europe held the largest market share in 2022, followed by North America and APAC.

The List of Companies - Heat Exchanger Market

- Alfa Laval AB

- Kelvion Holding GmbH

- Danfoss AS

- Xylem Inc

- API Heat Transfer Inc

- Chart Industries Inc

- Guntner GmbH & Co KG

- Larsen & Toubro Ltd

- Hisaka Works Ltd

- Johnson Controls International Plc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Heat Exchanger Market

Sep 2023

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Sep 2023

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Sep 2023

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Sep 2023

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Sep 2023

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Sep 2023

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Sep 2023

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Sep 2023

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)