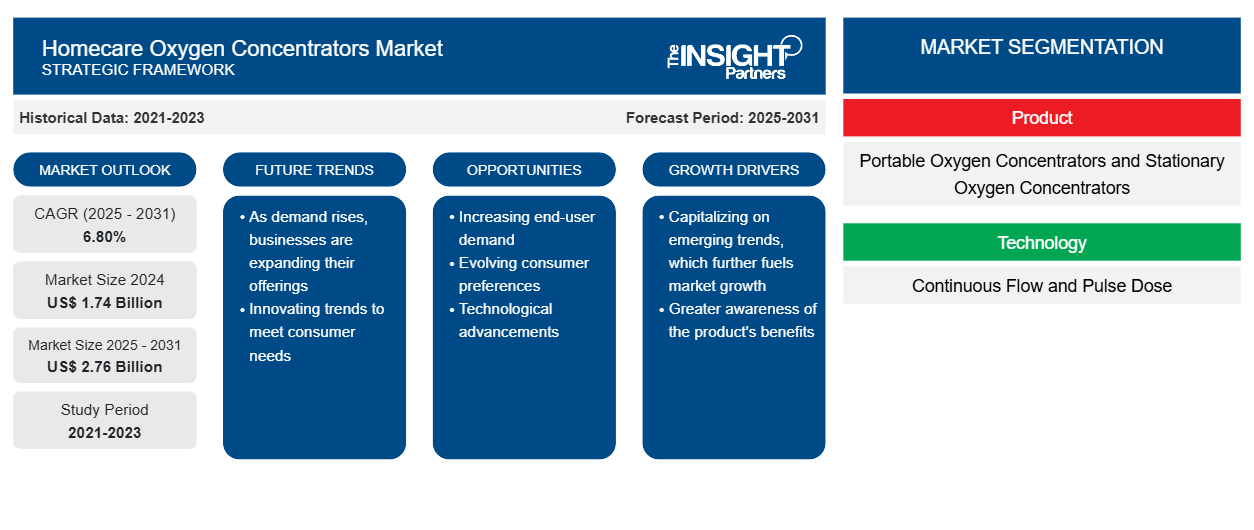

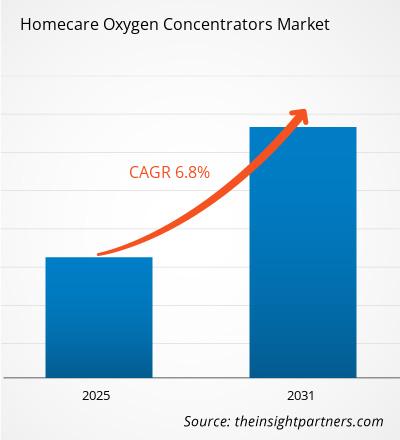

[Research Report] Homecare oxygen concentrators market size was valued at US$ 1,525.25 million in 2022 and is expected to reach US$ 2,580.23 million by 2031; it is estimated to register a CAGR of 6.8% from 2022 to 2031.

Market Insights and Analyst View:

An oxygen concentrator is a device that selectively separates nitrogen from air to deliver oxygen-enriched air. A home oxygen concentrator is prescribed for patients who need constant oxygen while at home or asleep. Key factors driving the growth of the homecare oxygen concentrators market include the growing preference for home-based oxygen therapy and the rising prevalence of respiratory diseases. However, the high cost of the homecare oxygen concentrators hinders market growth.

Growth Drivers and Restraints:

A huge population suffers from various types of respiratory diseases across the world. Infections, smoking, and genetic factors can cause serious respiratory complications. According to Cleveland Clinic, healthcare providers may prescribe an oxygen concentrator if the patient has asthma, bronchitis, pneumonia, respiratory trauma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, emphysema, heart failure, lung cancer, and sleep apnea. Furthermore, chronic obstructive pulmonary disease (COPD), asthma, and pneumonia are a few medical conditions that exert a huge burden on the private and public healthcare systems in various countries worldwide. COPD (chronic obstructive pulmonary disease) is a prevalent lung condition that causes reduced airflow and breathing difficulties, which may increase the demand for home care oxygen concentrators.

According to the World Health Organization (WHO), COPD is the seventh leading cause of poor health worldwide, and Nearly 90% of COPD deaths under 70 years of age occur in low- and middle-income countries. Similarly, as per the Global Initiative for Asthma – GINA 2023 Strategy Report, Asthma is a common, chronic respiratory disease affecting 1–29% of the population in different countries worldwide. According to the latest Global Burden of Diseases study, 2021, asthma affected more than 260 million people, leading to 455,000 deaths. Thus, there is a high prevalence of respiratory diseases globally, increasing the demand is fueling the homecare oxygen concentrators market growth.

However, the high cost of homecare oxygen concentrators is hindering the market growth. The high cost of homecare oxygen concentrators places a substantial financial burden on the patients, impacting their ability to afford and access critical respiratory support equipment for home use. Additionally, limited insurance coverage or high out-of-pocket expenses can deter patients from procuring homecare oxygen concentrators, impeding access to essential respiration therapy.

Opportunities:

Emerging countries such as India, China, Argentina, Brazil, UAE, and South Africa are expected to offer significant growth opportunities for homecare oxygen concentrators market players due to rising disposable incomes, expanding patient population, increasing R&D activities, improving healthcare infrastructure, growing CVD awareness, and relatively lenient guidelines compared to developed countries. According to the World Economic Forum, as of 2022, Russia, Brazil, China, India, and South Africa collectively accounted for a third of global health spending. As per the World Bank, health spending in India and China increased by 3.01% and 5.35%, respectively, from 2021 to 2021. Also, there has been an upsurge in heart failure cases over the past decade in emerging markets, which has resulted in a large number of cardiovascular disease-related deaths. As per the India Brand Equity Foundation, hospitals contribute to ~70% of the revenue of the healthcare sector in India. In China, the number of private hospitals reached 36,000 in 2022.

Moreover, the private hospitals account for ~57% of total number of hospitals in the country. The number of surgical centers and hospitals in developing markets is estimated to grow due to rising healthcare spending and a surge in the target patient population. Therefore, developing healthcare facilities in developing economies and a surge in hospitals would propel the awareness and adoption of respiratory devices, including oxygen concentrators, in emerging economies. Further, vast competition in developed or matured markets encourages homecare oxygen concentrator manufacturers to focus on developing markets, which will likely offer growth opportunities for providers to attain a significant position in the homecare oxygen concentrators market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Homecare Oxygen Concentrators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Homecare Oxygen Concentrators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global homecare oxygen concentrators market is segmented based on product, technology, and geography. Based on the product, the market is differentiated into portable oxygen concentrators and stationary oxygen concentrators. Based on technology, the market is bifurcated into pulse dose and continuous flow. The homecare oxygen concentrators market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The homecare oxygen concentrators market, by product, is segmented into portable oxygen concentrators and stationary oxygen concentrators. The portable oxygen concentrators segment held the largest homecare oxygen concentrators market share in 2022, and the same segment is anticipated to register the highest CAGR in the market during 2022-2031. The portable oxygen concentrators are generally small and lightweight and can be helpful to patients who need supplemental oxygen away from home. However, the functioning of portable oxygen concentrators is similar to that of stationary oxygen concentrators.

The homecare oxygen concentrators market is segmented based on the technology into continuous flow and pulse dose. The continuous flow segment held the largest market in 2022; the same segment is expected to register the highest CAGR from 2022 to 2031. The continuous flow segment will grow owing to the demand among patients with COPD or other severe respiratory disorders requiring more continuous flow of oxygen, which oxygen concentrators allow to be supplied continuously at the same rate.

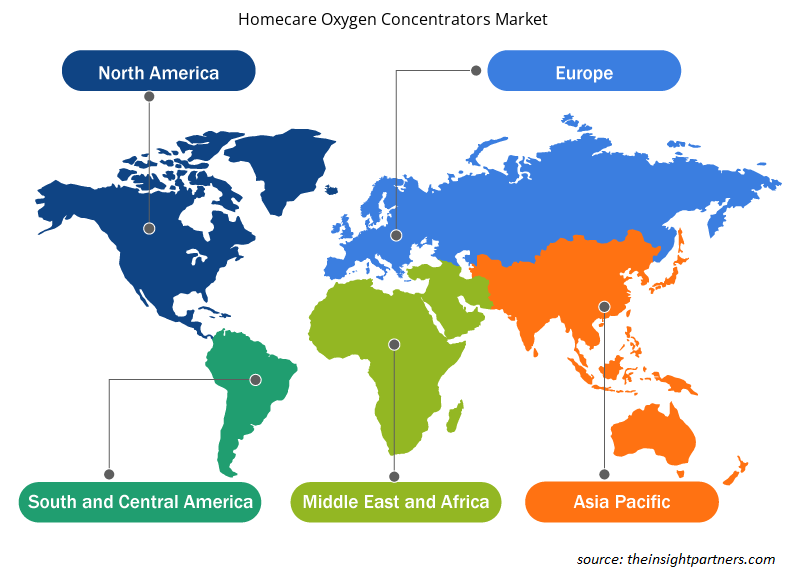

Regional Analysis:

Based on geography, the global homecare oxygen concentrators market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. Asia Pacific is estimated to register the highest CAGR during 2022–2031, owing to an increasing aging population, rising prevalence of respiratory diseases, and increasing healthcare expenditure. India, China, Japan, and South Korea are among the important markets for homecare oxygen concentrators in the Asia-Pacific region. A significant increase in asthma cases in these countries drives the need for homecare oxygen concentrators. Furthermore, the governments of these countries are investing heavily in healthcare infrastructure, which is expediting the growth of the market. Furthermore, regulatory rules in the Asia Pacific are more adaptable and less stringent. This, combined with increased competition in established markets (Europe, Japan, and Australia), will fuel the growth of the Asia Pacific homecare oxygen concentrators market.

In 2022, North America held the largest share of the global homecare oxygen concentrators market size. The US has a high prevalence of respiratory diseases, which propels North America's market growth. According to the Asthma and Allergy Foundation of America, around 26 million people in the US had asthma in 2022, one of the world's most common respiratory diseases. Respiratory infections cause more severe disease, hospitalizations, and death in older persons than in younger ones due to age-related features such as frailty and immunosenescence. Asthma is one of the most common respiratory diseases for seniors. According to the 2021 Census, the older population reached 55.8 million (16.8%) of the US population in 2021. The population of 65 and above is predicted to increase between 2012 and 2050. This growth needs a greater understanding of respiratory diseases' impact on older adults, as patients with respiratory disorders usually experience trouble breathing and oxygen shortage. Thus, the country has a high demand which fuels the US homecare oxygen concentrators market growth.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global homecare oxygen concentrators market are listed below:

- In July 2023, Emerson launched the ASCO Series 588 Stationary Oxygen Concentrator Manifold. The ASCO Series 588 Stationary Oxygen Concentrator Manifold is the healthcare industry's first turnkey manifold solution designed to optimize respiratory therapy equipment designs and accelerate product speed to market. Oxygen concentrators must reach patients who rely on them rapidly. Thus, the devices must be easily available and reliable. The Series 588 manifold is specifically developed to improve energy efficiency, longevity, and reliability by simplifying device design and assembly.

- In February 2023, Ventec Life Systems, Inc. (a subsidiary of React Health Holdings) acquired the respiratory business of the Invacare Respiratory Product line following Invacare’s exit in November of 2022. This acquisition includes products such as P5NXG, Platinum 10L Concentrator, Platinum POC (Portable Oxygen Concentrator), HomeFill Equipment/Cylinders, Pediatric Oxygen Flow Meter, Oxygen Analyzer, and Service Parts & Accessories.

- In July 2022, OMRON Healthcare announced its latest advancement in the Oxygen therapy category by launching a portable Oxygen concentrator. It is a medical molecular sieve-based oxygen concentrator that provides a continuous supply of high-purity oxygen (5L per minute) with a high concentration output of more than 90%. The product is intended to assist homecare providers in addressing nearly all COPD and respiratory patients' therapeutic and lifestyle requirements.

- In April 2022, CAIRE Inc. announced the expansion of its portfolio of solutions in Latin America. The Companion 5 and NewLife Intensity 10 stationary oxygen concentrators were announced to be launched in July, following an anticipated approval by the Brazilian Health Regularity Agency (Anvisa).

- In June 2021, OxyGo LLC acquired LIFE Corporation, a medical device manufacturer specializing in portable Emergency Oxygen and CPR administration equipment. LIFE Corporation, founded in 1985, specializes in AED companions that supply supplemental oxygen to a breathing victim before the starting of fibrillation, oxygen-enriched CPR to a non-breathing victim, or continued supplemental oxygen following successful defibrillation. LIFE also offers a full line of medical oxygen regulators and cylinders for LIFE products and EMTs, hospitals, and the home care market separately.

Competitive Landscape and Key Companies:

Omron Corporation, CAIRE Inc., Precision Medical Inc., Besco Medical, Inogen Inc, Koninklijke Philips N.V., Drive DeVilbiss International, Celesticare LLC, Nidek Medical Products Inc., and Longfian Scitech Co. Ltd are among the prominent players operating in the homecare oxygen concentrators market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Report ScopeHomecare Oxygen Concentrators Market Regional Insights

The regional trends and factors influencing the Homecare Oxygen Concentrators Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Homecare Oxygen Concentrators Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Homecare Oxygen Concentrators Market

Homecare Oxygen Concentrators Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.74 Billion |

| Market Size by 2031 | US$ 2.76 Billion |

| Global CAGR (2025 - 2031) | 6.80% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

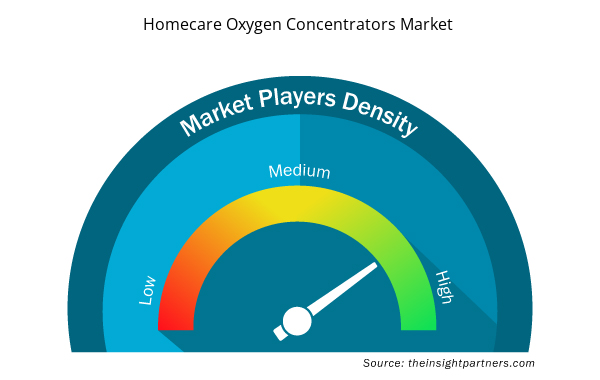

Homecare Oxygen Concentrators Market Players Density: Understanding Its Impact on Business Dynamics

The Homecare Oxygen Concentrators Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Homecare Oxygen Concentrators Market are:

- Omron Corporation

- CAIRE Inc.

- Precision Medical Inc.

- Besco Medical

- Inogen Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Homecare Oxygen Concentrators Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Terahertz Technology Market

- Intraoperative Neuromonitoring Market

- Adaptive Traffic Control System Market

- Dried Blueberry Market

- Portable Power Station Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Sterilization Services Market

- Long Read Sequencing Market

- Flexible Garden Hoses Market

- Vaginal Specula Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Technology, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Omron Corporation

- CAIRE Inc.

- Precision Medical Inc.

- Besco Medical

- Inogen Inc

- Koninklijke Philips N.V.

- Drive DeVilbiss International

- Celesticare LLC

- Nidek Medical Products Inc.

- Longfian Scitech Co. Ltd

Get Free Sample For

Get Free Sample For