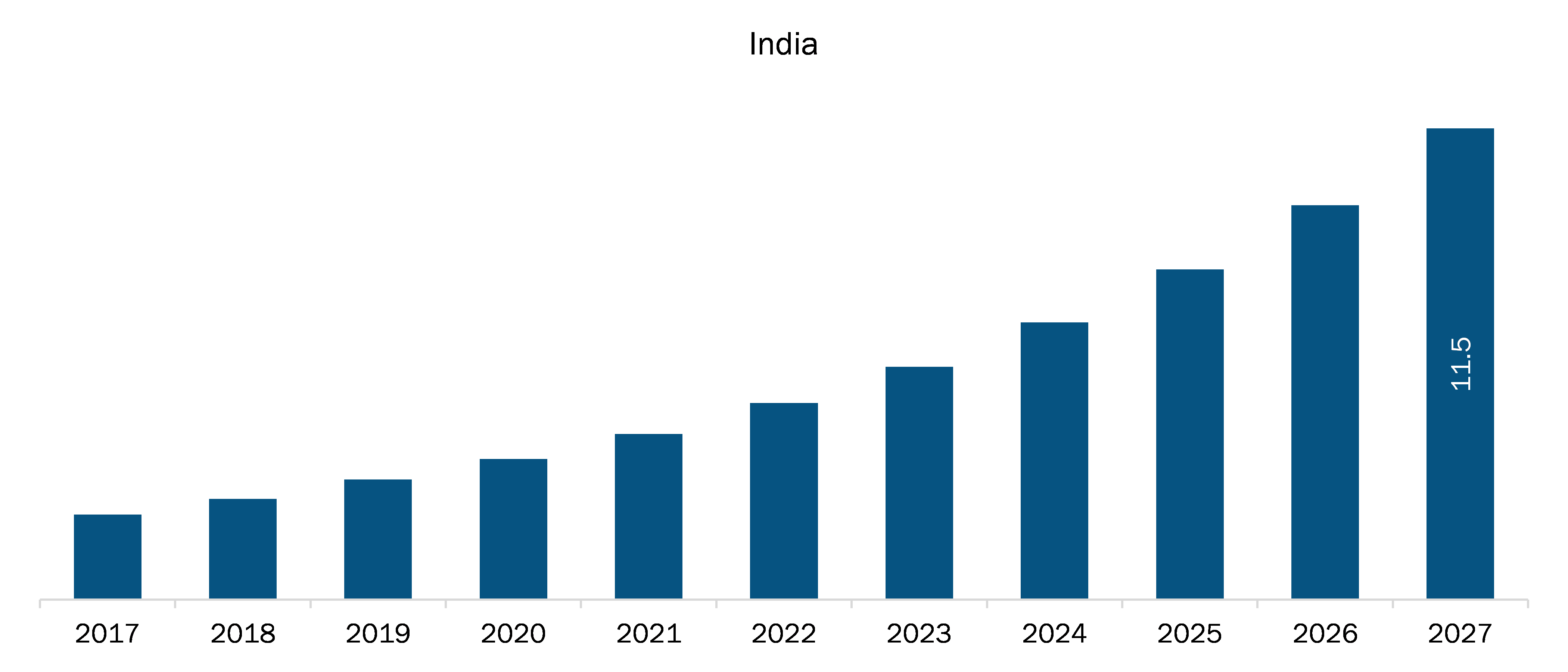

The e-commerce logistics market in India was valued at US$ 2.93 billion in 2019 and is projected to reach US$ 11.48 billion by 2027; it is expected to grow at a CAGR of 18.8% from 2020 to 2027.

India has a strong e-commerce industry, which has transformed the way business is done in India. As per the data provided by India Brand Equity Foundation, India has the fastest growing e-commerce sector, which is expected to grow by 1200% by 2026. Increasing penetration of smartphones and Internet among the people is fueling the growth of e-commerce sector in India. This, in turn, is positively influencing the growth of the e-commerce logistics market in India.

Social media use has increased during the COVID-19 pandemic, which is expected to bolster the growth of e-commerce sales during the forecast period. Also, as per the Vice President of Amazon India, the number of seller registrations is witnessing substantial growth on Amazon.in. He further added that categories, such as athletic and open footwear, sports equipment, TVs, laptops, and pet toys, have noticed a high jump since lockdown was announced. Additionally, e-commerce players are targeting smaller towns with anintention to increase their India E-commerce Logistics market shares. With this, several e-commerce logistics players are focused on expanding their delivery networks to cater to customers across remote locations. For instance, in 2018, Ecom Express Pvt. Ltd. announced its service expansion by 8,000 PIN codes across India. Thus, rising number of e-commerce players, coupled with increasing social media usage as well as the expansion of services to remote areas, offers lucrative growth opportunities to the e-commerce logistics market in India.

The Indian e-commerce logistics market is dominated by two players, i.e., Amazon and Flipkart, capturing over half of the e-commerce logistics market share. These players have their own in-house captive arms that manage over 80% of their logistics requirements.

The COVID-19 pandemic has resulted in fueling the growth of the e-commerce logistics sector. E-commerce players are seeking alternative warehousing locations to help in the continuity of their business, along with mitigating delivery delays. With the rising awareness for social distancing among Indians, people have started opting for online platforms more than before, even in rural areas. Further, extended lockdowns in several countries have resulted in disrupting the supply chain. E-commerce logistics players are leveraging options, such as contactless deliveries, to mitigate the risk of infection, further boosting the demand for online sales. Also, several retailers across the country are going online to expand their reach. It has offered a wider choice of goods to the customers at competitive pricing, thus boosting e-commerce sales. According to a report published by Unicommerce titled – E-commerce Trends Report 2020, as of June 2020, India's e-commerce industry noticed an overall order-volume growth of 17% post the outbreak of COVID-19.

Some of the key players operating in the India e-commerce logistics market include Amazon.com, Inc.; Aramex; Blue Dart Express Limited; Delhivery Pvt Ltd; Ecom Express Private Limited; Ekart Logistics; FedEx Corporation; Gati-Kintetsu Express Private Limited; Mahindra Logistics Ltd; and Shiprocket.

India E-commerce Logistics Market Revenue and Forecast to 2027 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IndiaE-commerce Logistics Market – Segmentation

The report segments the Indiae-commerce logistics market as follows:

E-commerce logistics Market – by Service Type

- Transportation

- Warehousing

- Value-Added Services

E-commerce logistics Market – by Operational Area

- Domestic

- International

E-commerce logistics Market – by EndUser

- B2B

- B2C

IndiaE-commerce Logistics Market – Companies Mentioned

- Shiprocket

- FedEx Corporation

- Ecom Express Private Limited

- Gati-Kintetsu Express Private Limited

- Ekart Logistics

- Mahindra Logistics Ltd

- Amazon.com, Inc.

- Aramex

- Blue Dart Express Limited

- Delhivery Pvt Ltd.

India E-commerce Logistics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 2.93 Billion |

| Market Size by 2027 | US$ 11.48 Billion |

| CAGR (2020 - 2027) | 18.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For