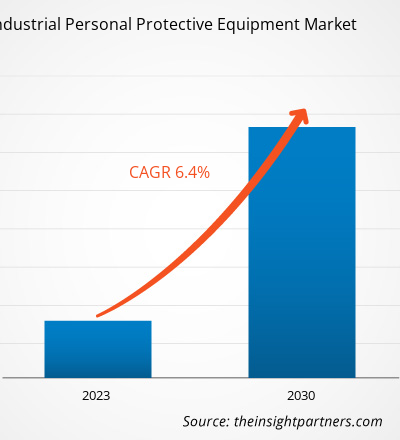

[Research Report] The industrial PPE market size grew from US$ 66,265.71 million in 2022 and is expected to account for US$ 108,959.51 million in 2030; at a CAGR of 6.4% from 2022 to 2030.

Market Insights and Analyst View:

Industrial personal protective equipment (PPE) include products used for personal safety at workplaces and heavy industries, including oil & gas, construction, manufacturing, chemicals, mining, and pharmaceuticals. Industrial PPE comprise products such as protective footwear, hand and arm protection equipment, head and face protection equipment, fall protection equipment, and hearing protection aids. The rising awareness of personal safety in heavy industries where workers are exposed to various industrial hazards and accidents is driving the growth of the industrial PPE market.

Growth Drivers and Challenges:

Global government agencies, such as the Occupational Safety and Health Administration (OSHA) and the Federal Highway Administration, have specific standards for wearing high-visibility clothing, primarily for highway construction. These agencies commonly refer to industry consensus standards issued by the International Safety Equipment Association and the American National Standards Institute. This is known as the ANSI/ISEA 107 Standard or American National Standard for High Visibility Safety Apparel and Headwear. Similarly, in Europe, the European Agency for Safety and Health at Work (EU-OSHA) and the European Network of Safety and Health Professional Organization (ENSHPO) establish mandates on the requirements for the design, manufacture, and distribution of PPE intended for use in the work environment and impose other occupational safety standards in industries such as construction, healthcare, oil & gas, automotive, and manufacturing. These organizations have also set regulations that place responsibilities on manufacturers to ensure that the PPE intended for use in the workplace are properly tested. They also ensure that the equipment carry the CE marking and meet essential health and safety requirements before they are placed in the European market. Further, according to "The Respiratory Protection Standard," 29 CFR 1910.134 of OSHA, it is mandatory for employees to have a complete respiratory program. Workers wearing respiratory protection must participate in a written respiratory program and follow OSHA's guidelines. Thus, supportive government regulations related to occupational safety are driving the global industrial PPE market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Personal Protective Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Personal Protective Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Industrial PPE" is segmented based on type, material, end-use industry, distribution channel, and geography. Based on type, the industrial PPE is segmented into hand and arm protection, body protection, respiratory protection, head and face protection, and others. Based on material, the industrial PPE is segmented into natural rubber, vinyl, polyethylene, nitrile, and others. Based on end-use industry, the industrial PPE is divided into manufacturing, construction, oil and gas, pharmaceuticals, and others. Based on distribution channel, the industrial PPE is segmented into wholesalers, national retailers, regional retailers, and online platforms. The industrial PPE, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis:

Based on type, the industrial PPE market is segmented into hand and arm protection, body protection, respiratory protection, head and face protection, and others. The hand and arm protection segment holds a significant share of the market. Hands and arm protection equipment include gloves, finger guards, and arm coverings. Protective equipment for hands and arms are resistant to cuts, burns, and punctures. In food and pharmaceutical industries, rubber or latex gloves are widely used to ensure food and drug safety and prevent contamination. In manufacturing and construction industries, hand gloves and arm guards protect workers from abrasions, bruises, and fractures while handling heavy machinery and tools. In the electrical industry, insulated rubber gloves protect against electrical shocks. In the chemicals industry, gloves and guards provide protection against hazardous and toxic chemicals. Various industries are mandating the use of hand and arm protection equipment to ensure safety. This factor is significantly driving the segment's growth in the industrial PPE market.

Regional Analysis:

Based on geography, the industrial PPE market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global industrial PPE market was dominated by North America; the market in this region was valued at US$ 21,407.13 million in 2022. Asia Pacific is the second major contributor to the market, which holds almost 27% of the global market share. Europe is expected to register a CAGR of ~7% in the industrial PPE market from 2022 to 2030. Increasing cases of work-related injuries and growing requirements for highly effective and high-quality industrial protective equipment in most prominent industries such as manufacturing, construction, oil & gas, and pharmaceuticals augment the industrial PPE market penetration in the region. Countries such as the UK, Germany, and France have advanced business infrastructure, which further contributes to market growth. The most significant trends in this market include the development of versatile and wearable accessories, sustainable clothing, and new embedded technologies. Since the COVID-19 pandemic in Europe, legislation for employees has constantly been evolving, and businesses are covering their employees' safety and health expenses. The rising number of construction sites in Europe and the uncertainty of the pandemic resulted in an increasingly intense need for PPE, thereby driving the industrial PPE market growth across the region.

Industry Developments and Future Opportunities:

- In September 2019, Vuzix Corporation launched "Vuzix Blade Smart Glasses," a safety-certified product for enterprises. It provides the necessary protection for various industry and worksite applications.

- In August 2021, Gales introduced a smart PPE footwear collection to offer protection and comfort to healthcare industry experts.

- In August 2022, Canaria Technologies launched the Canaria-V, a noninvasive, wearable smart PPE device that estimates modifications in the wearer's physiology via transmissive photoplethysmography (PPG) technology and extracts metrics related to cognitive fatigue and heat stress.

Industrial Personal Protective Equipment Market Regional Insights

The regional trends and factors influencing the Industrial Personal Protective Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Personal Protective Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Personal Protective Equipment Market

Industrial Personal Protective Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 66.27 Billion |

| Market Size by 2030 | US$ 108.96 Billion |

| Global CAGR (2022 - 2030) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

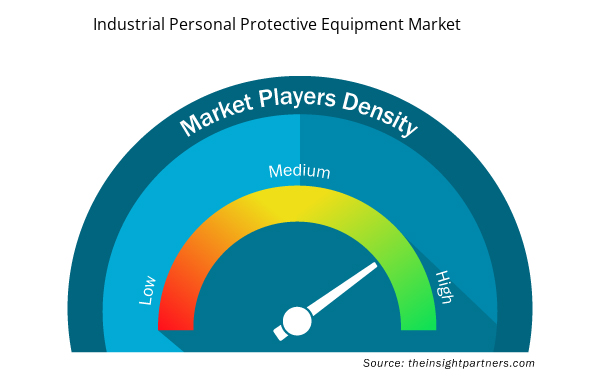

Industrial Personal Protective Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Personal Protective Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Personal Protective Equipment Market are:

- Honeywell International Inc

- Lakeland Industries Inc

- DuPont de Nemours Inc

- 3M Co

- Ansell Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Personal Protective Equipment Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies witnessed delays in product deliveries and a slump in sales of their products in 2020. The industrial PPE market witnessed similar impacts of the pandemic.

During the COVID-19 pandemic, the demand for industrial PPE from a few industries—including the healthcare industry and frontline personnel—increased. Items such as N95 respirators, face shields, and medical gloves saw a substantial increase in demand, creating a favorable impact on the industrial PPE market to a certain extent. Additionally, the demand for industrial PPE, such as gloves, masks, and antiviral protective jackets, increased in research laboratories involved in the development of vaccines for different SARS-CoV-2 variants. With an abrupt rise in demand, the global industrial PPE key industry participants ramped up their production capacities. Moreover, to prevent the spread of COVID-19, covering the nose and mouth was mandatory. N95 respirators were preferred for controlling the spread of the disease. Thus, the demand for such products surged during the pandemic. Further, with the increasing cases of COVID-19 across the region, the demand for PPE increased across pharmaceutical industries and biomedical research laboratories.

In 2021, various economies resumed operations as several governments announced relaxation in the previously imposed restrictions, which positively impacted the global marketplace. Moreover, manufacturers were permitted to operate at full capacity, which helped them overcome the demand and supply gap.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global industrial PPE market are Honeywell International Inc, Lakeland Industries Inc, DuPont de Nemours Inc, 3M Co, Ansell Ltd, VF Corp, Hultafors Group AB, Aramark, Kimberly-Clark Corp, and W. L. Gore and Associates Inc, among others. These market players are adopting strategic development initiatives to expand, further driving the market growth.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Unit Heater Market

- Medical and Research Grade Collagen Market

- Medical Audiometer Devices Market

- Bio-Based Ethylene Market

- Online Exam Proctoring Market

- MEMS Foundry Market

- Joint Pain Injection Market

- Sandwich Panel Market

- Small Molecule Drug Discovery Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, End-Use Industry, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on type, which segment is leading the global Industrial Personal Protective Equipment Market during the forecast period?

Based on type, the hand and arm protection segment held the largest share in the global industrial PPE market in 2022. Industries are mandating hand and arm protection equipment such as gloves, hand sleeves, and shoulder guards due to rising incidences of injuries at heavy industries such as construction, automotive, and mining. This factor is driving the segment’s growth.

What are the major driving factors for the global Industrial Personal Protective Equipment Market growtk?

Supportive government regulations for workplace safety and strategic development initiatives such as expansion, merger & acquisition, and partnerships by key market players are the key factors driving the global industrial PPE market.

Based on end-use industry, which segment held the largest market share in 2022?

Based on end-use industry, the construction segment is held the largest share in the global industrial PPE market in 2022. The rising concern of occupational safety in the construction industry is driving the industrial PPE demand.

Can you list some of the major players operating in the global Industrial Personal Protective Equipment Market?

Honeywell International Inc, Lakeland Industries Inc, DuPont de Nemours Inc, 3M Co, Ansell Ltd, VF Corp, Hultafors Group AB, Aramark, Kimberly-Clark Corp, and W. L. Gore and Associates Inc among others are a few players operating in the global industrial PPE market.

Which region is expected to register the fastest CAGR in the global Industrial Personal Protective Equipment Market?

Europe is estimated to register the fastest CAGR in the global industrial PPE market over the forecast period. Advancements in the heavy industries across the UK, France, and Germany, and rising awareness about injuries and hazards at workplaces are driving the Europe industrial PPE market growth.

Which region held the largest share of the global Industrial Personal Protective Equipment Market?

In 2022, North America held the largest share of the global industrial PPE market. Rising awareness of workplace safety coupled with favorable government regulations are the key factors driving the industrial PPE demand in North America.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Industrial Personal Protective Equipment Market

- Honeywell International Inc

- Lakeland Industries Inc

- DuPont de Nemours Inc

- 3M Co

- Ansell Ltd

- VF Corp

- Hultafors Group AB

- Aramark

- Kimberly-Clark Corp

- W. L. Gore and Associates Inc

Get Free Sample For

Get Free Sample For