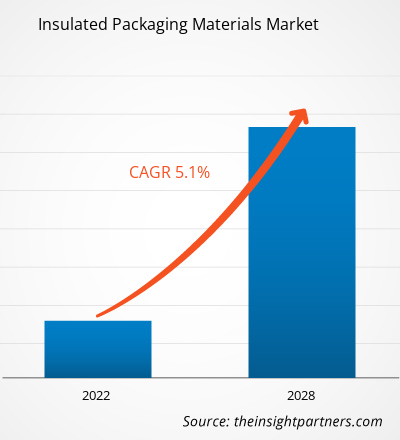

The insulated packaging materials market was valued at US$ 11,876.04 million in 2021 and is projected to reach US$ 16,799.84 million by 2028; it is expected to grow at a CAGR of 5.1% from 2021 to 2028.

Rising per capita disposable income, increasing investments in the improvement of cold chain infrastructure, growing end-user industries, and accessibility to medical facilities attribute to the growth of the insulated packaging materials market. In the past few years, the healthcare and pharmaceuticals industries have witnessed an unprecedented rise in demand for temperature-controlled/insulated packaging due to an increase in the demand and transportation of temperature-sensitive pharmaceuticals products and samples. In addition, rising consumer spending on packaged products and increasing global output of temperature-sensitive manufactured goods propel the growth of the insulated packaging materials market.

The insulated packaging materials market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth of the market in this region is mainly attributed to the rising demand for insulated packaging in countries such as India, China, Japan, and others. Asia-Pacific is one of the largest food & beverages industry due to the high population density and disposable income, and growth in distribution channel in the region. Furthermore, the demand for frozen food is growing in Asia-Pacific due to busy lifestyle and schedule. The increasing consumer preference toward convenience foods indirectly propels the demand for frozen products as they require less time and effort than cooking any item from scratch. Increasing disposable income is another aspect that has a significant impact on the frozen food market's growth because it boosts consumers' purchasing power. The insulated packaging materials market in Asia-Pacific is driven by an increase in disposable income and demand for frozen foods.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulated Packaging Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Insulated Packaging Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Insulated Packaging Materials Market

Due to the COVID-19, insulated packaging materials market has been impacted significantly due to the ineffective supply of raw materials, such as polyurethane, along with a significant impact on the production processes. Additionally, rise in crude oil prices have led to the fluctuation in raw material prices of insulated packaging materials, creating challenges in the market growth. However, the market has witnessed a significant investment and growth due to the rapid growth of various end-use industries, such as food & beverages, e-commerce, and pharmaceuticals. With the state of economic recovery, several industrial sectors are strategically planning to invest in advanced and bio-based insulated packaging materials with the rising need for advanced insulated packaging systems across food & beverages, medical and pharmaceuticals, chemicals, and other such facilities. This is expected to provide an impetus to insulated packaging materials market growth in the coming years. Before the COVID-19 pandemic, people were less engaged in buying perishable and edible items from online retail channels. However, the situation has been altered since the pandemic as consumers are actively buying perishable products, such as frozen food products and ready-to-eat food, through online portals. This has substantially raised the demand for advanced temperature-controlled packaging, thereby promoting the demand for insulated packaging materials.

The ongoing COVID-19 pandemic has significantly increased the demand for medicines and COVID-19 vaccines across the world. The trade for such medicines and vaccines is propelling the need for a suitable packaging system, such as insulated packaging, to maintain the product quality at the desired temperature. Thus, COVID-19 pandemic has had a positive impact on the growth of the global insulated packaging materials market and is expected to continue to do so during the coming years.

Market Insights

Surging Demand for Temperature-Sensitive Products Fuel Insulated Packaging Materials Market Growth

Temperature-sensitive products mainly belong to the food & beverages and pharmaceuticals industries. Changing consumer lifestyles, rising per capita disposable income, and adoption of convenience products increase the consumption of processed, frozen, and packaged food products. Additionally, the export–import trade of food and beverages is increasing significantly with the rise in global food demand. Globalization has enabled the successful export–import trade of such products amongst countries across the world.

The global ready-to-eat food market is expected to grow at a compound annual growth rate (CAGR) of ~7% during 2021–2026. An average individual in the US consumes around 25–28 kg of ready-to-eat meals each year, accounting for spending of nearly US$200. Similarly, as per the data by the Frozen and Refrigerated Buyer, the US registered a significant sale of frozen food amounting to US$ 9,384.88 million in 2019. Frozen food requires thermally insulated packaging, containing refrigerants, to maintain product temperature. During domestic or international transportation, the temperature-sensitive goods can go through various physical and physiological stress, such as physical pressure, humidity, and fluctuating temperature. Thus, to avoid the damage of temperature-sensitive products, such as ready-to-eat products, ready-to-cook products, frozen food, vegetables, and certain medical supplies, manufacturers/packers use insulated packaging to maintain the product’s shelf-life and quality. The rising use of insulated packaging propels the demand for insulated packaging materials. In addition, rising consumer spending on packaged products and increasing global output of temperature-sensitive manufactured goods propel the growth of the insulated packaging materials market.

Material Type Insights

By material type, the global insulated packaging materials market is segmented into plastic, wood, corrugated cardboard, and others. The corrugated cardboard segment accounted for the largest market share in 2020 and is expected to register the highest CAGR during the forecast period. Corrugated cardboard is made of linerboard and fluted corrugated sheets. These components strengthen corrugated cardboard and allow it to withstand high pressure. Corrugated cardboard is typically produced using flute lamination machines, also known as corrugators. The cardboards are highly impact-resistant, bending-resistant, tear-resistant, and burst resistant.

Type Insights

Based on type, the global insulated packaging materials market is bifurcated into single use and reusable. The reusable segment accounted for a larger market share in 2020 and is expected to register a higher CAGR during the forecast period. Reusable packaging is intended to be used repeatedly or indefinitely for product distribution, transportation, and storage. The use of reusable packaging is increasing due to environmental issues, limited economic reasons, and government support for disposable units. Most insulating packaging solutions are one-time use, which create tons of waste that must be managed and have an undeniable impact on the environment. However, the reusable refrigerated packaging solution is the solution of the future, which can minimize the environmental impact of transporting cold chain medical devices and reduce costs. In addition, the manufacturers are manufacturing innovative packaging solutions. For instance, Liviri Fresh is a durable, heat-insulated, reusable transport container, and the size is very suitable for holding meal bags and perishable items, such as meat, seafood, fruits and vegetables, and juices. Thus, the growing need for environmentally friendly packaging solutions would boost the demand for reusable insulated packaging materials in the coming years.

A few players operating in the insulated packaging materials market are Sealed Air, FEURER Group GmbH, Sancell, The Wool Packaging Company Limited, CoolPac, Cascades Inc., ICEE Containers Pty Ltd, TemperPack, Icertech, and Insulated Products Corporation. The key companies adopt strategies such as mergers & acquisitions, and R&D to expand customer base and gain significant share in the global market, which also allow them to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the insulated packaging materials market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the insulated packaging materials market from 2019 to 2028

- Estimation of global demand for insulated packaging materials

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the insulated packaging materials industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the insulated packaging materials market growth

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the insulated packaging materials market growth

- Size of the market at various nodes

- Detailed overview and segmentation of the market, as well as the insulated packaging materials industry dynamics

- The insulated packaging materials market size in various regions with promising growth opportunities

Insulated Packaging Materials Market Regional Insights

The regional trends and factors influencing the Insulated Packaging Materials Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Insulated Packaging Materials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Insulated Packaging Materials Market

Insulated Packaging Materials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 11.88 Billion |

| Market Size by 2028 | US$ 16.8 Billion |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

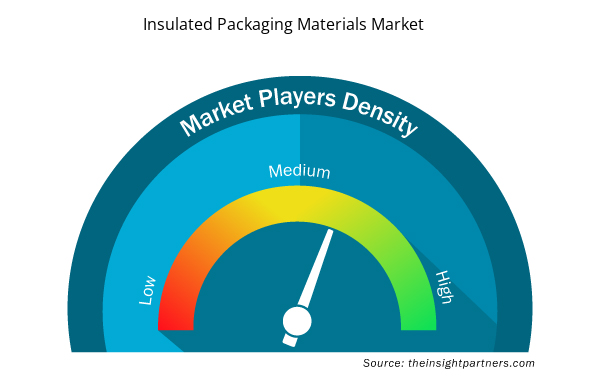

Insulated Packaging Materials Market Players Density: Understanding Its Impact on Business Dynamics

The Insulated Packaging Materials Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Insulated Packaging Materials Market are:

- Sealed Air

- FEURER Group GmbH

- Sancell

- The Wool Packaging Company Limited

- CoolPac

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Insulated Packaging Materials Market top key players overview

The report includes the segmentation of the insulated packaging material market as follows:

By Material Type

- Plastic

- Wood

- Corrugated Cardboard

- Others

By Type

- Single Use

- Reusable

By End User

- Pharmaceutical

- Food & Beverages

- Cosmetic

- Industrial

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- South America

- Brazil

- Argentina

- Rest of South America

Company Profiles

- Sealed Air

- FEURER Group GmbH

- Sancell

- The Wool Packaging Company Limited

- CoolPac

- Cascades Inc.

- ICEE Containers Pty Ltd

- TemperPack

- Icertech

- Insulated Products Corporation

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material Type, Type, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which region held the fastest CAGR in the global insulated packaging materials market?

Asia-Pacific is estimated to register the fastest CAGR in the market over the forecast period. Asia-Pacific comprises several major economies such as India, China, Japan, South Korea, and Australia. These countries are witnessing an upsurge in industrialization and urbanization activities, which is offering ample opportunities for the key players in the insulated packaging materials market. Asia-Pacific is the fastest-growing economic region, as well as the largest continental economy in the world. The rising demand for insulated packaging in countries such as India and China attributed to the enhanced economic conditions and lifestyles, which is fueling the growth of the insulated packaging industry.

Based on end user, which segment is leading the global insulated packaging materials market during the forecast period?

On the basis of end user, food and beverage segment is leading the insulated packaging materials market during the forecast period. Insulated food and beverage packaging provides handling resistance, prevents physical damage, and preserves the nutritional aspects of the product. Food and beverage products must be protected from temperature and pressure changes because they are perishable in nature and can become inedible after reaching their destination. Further, the manufacturers are innovating their products. For instance, FEURER introduced a new generation of insulating boxes in the market. These are ultra-light, incredibly stable, 100% recyclable, customizable, hygienic, and temperature resistant. The FEURER thermal boxes composed of EPP make the transport of foodstuffs and food safer and more comfortable. The broad range of insulated containers offers clever solutions for catering, gastronomy, delivery service, food trade, and private households.

Based on type, which segment is expected to grow at the fastest rate during the forecast period

The reusable segment is expected to grow at the fastest rate during the forecast period. Reusable packaging is intended to be used repeatedly or indefinitely for product distribution, transportation, and storage. The increasing use of reusable packaging is due to environmental issues, limited economic reasons, and government support for disposable units. Most insulating packaging solutions are one-time use, represent tons of waste that must be managed, and have an undeniable impact on the environment.

Which region held the largest share of the global insulated packaging materials market?

In 2020, Asia-Pacific held the largest revenue share of the global insulated packaging materials market. Asia-Pacific continent comprises several developing and developed economies such as India, China, Japan, South Korea, and Australia. These emerging countries are witnessing an upsurge in industrialization and urbanization activities, offering ample opportunities for the key market players in the insulated packaging market. Asia-Pacific is the fastest growing economic region, as well as the largest continental economy in the world. The rising demand for insulated packaging in emerging countries like India, China and Brazil is attributed to the enhanced economic conditions as well as lifestyles, which is fueling the growth of insulated packaging industry. Asia-Pacific is one of the largest food and beverage industry due to the high population density and disposable income. The growing distribution channel in Asia-Pacific drive the market for food & beverages industry.

Based on material type, why corrugated cardboard segment accounted for the largest share in the global insulated packaging materials market?

The corrugated cardboard segment held the largest share in the global insulated packaging materials market in 2020. Corrugated cardboard is made up of linerboard and fluted corrugated sheets. These components strengthen corrugated cardboard and allow it to withstand high pressure. Corrugated cardboard is typically produced using flute lamination machines, also known as corrugators. The cardboards are highly impact-resistant, bending-resistant, tear-resistant, and burst resistant.

Can you list some of the major players operating in the global insulated packaging materials market?

The major players operating in the global insulated packaging materials market are Sealed Air, FEURER Group GmbH, Sancell, The Wool Packaging Company Limited, CoolPac, Cascades Inc., ICEE Containers Pty Ltd, TemperPack, Icertech, and Insulated Products Corporation among few others.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Insulated Packaging Materials Market

- Sealed Air

- FEURER Group GmbH

- Sancell

- The Wool Packaging Company Limited

- CoolPac

- Cascades Inc.

- ICEE Containers Pty Ltd

- TemperPack

- Icertech

- Insulated Products Corporation

Get Free Sample For

Get Free Sample For