Ketones Market Growth Drivers and Forecast by 2028

Ketones Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Form (Solid and Liquid) and Application (Food & Beverage, Dietary Supplements, Personal Care & Cosmetics, and Others)

Historic Data: 2018-2019 | Base Year: 2020 | Forecast Period: 2021-2028- Report Date : Nov 2021

- Report Code : TIPRE00008148

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 130

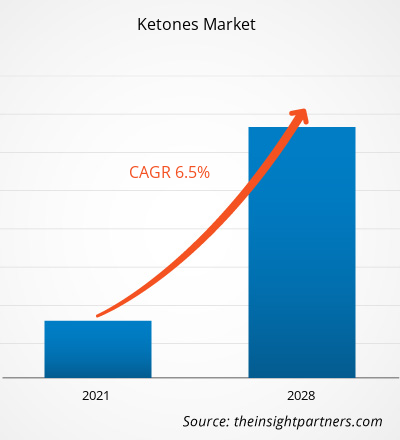

[Research Report] The ketones market was valued at US$ 4,286.5 million in 2020 and is projected to reach US$ 7,106.5 million by 2028; it is expected to grow at a CAGR of 6.5% from 2021 to 2028.

Ketones, such as acetone, methyl ethyl ketone, and diisobutyl ketones, are widely used as industrial solvents and chemical intermediates for manufacturing coatings, adhesives, paints, paint removers, rubbers, plastics, and pharmaceutical products. Moreover, exogenous ketones are used in dietary supplements. They commonly consist of ketone salts, also known as Beta-hydroxybutyrate or BHB, and ketone esters.

In 2020, Asia-Pacific held the largest share of the global ketones market and is estimated to register the highest CAGR in the market during the forecast period. Increased demand for health-beneficial supplements is one of the key factors driving the market growth in Asia-Pacific. Changing eating habits of people because of their hectic lifestyles and health concerns are also boosting the growth of the ketone supplement market in the area. Moreover, the chemical sector accounts for over 45% of world chemical output and more than 69% of global chemical jobs in Asia Pacific, according to The International Institute for Sustainable Development. In the chemical industry, ketones are extensively utilized as solvents and catalysts. Thus, the well-established chemicals industry in Asia-Pacific is expected to boost the growth of the ketones market in the coming period.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONKetones Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Ketones Market

The COVID-19 pandemic has drastically affected various industries in terms of sales and operations owing to many factors such as extended lockdowns across different regions, restrictions imposed on international trades, shutdown of manufacturing units, bans on travel, disintegration in supply chain, and shortage in the supply of raw materials. The food & beverages and chemical industry are among the significant sectors that suffered from severe disruptions, such as supply chain restriction and production plants shutdown, because of the COVID-19 outbreak. The shutdown of various plants and factories in leading regions such as North America, Europe, and Asia-Pacific has hindered the global supply chain, manufacturing activities, delivery schedules, and various products sales. All these factors affected the both the chemical and food & beverage industries in a negative manner. Ketones are often utilized as solvents, chemical intermediates, and as catalyst in the chemical industry. They also have great demand from paints & coating, adhesives, printing inks, and similar industries. Also, these are utilized in the electroplating industry as cold-cleaning solvents, vapor degreasing solvents, and laboratory chemicals. Ketones are also used in the production of dietary supplements, protein shakes & powders, and pharmaceuticals. Disruptions in terms of sourcing of raw materials from suppliers and temporarily closures of manufacturing bases due to indefinite lockdowns and temporary quarantines have restrained the growth of the market during the pandemic. However, the pandemic has generated the need for healthy living among the consumers. Therefore, the consumers have shifted their attention toward personal health and nutritional diet. Thus, the demand for weight-management products and ketone supplements surged during the pandemic, directly driving the ketones market. Sales have been slow in the first quarter of 2020, as many stores have closed. However, businesses are gaining ground as previously imposed limitations are being eased across various locations. Moreover, the introduction of COVID-19 vaccines by governments of different countries has further eased out the situation leading to rise in business activities across the world. The food & beverage processing industries are recovering their losses by opening their production units and starting the operations with half of the capacities. These factors are expected to propel the market growth during the forecast period.

Market Insights

Escalating Demand from Various Industries

Ketones are versatile organic compounds having multiple applications across various industries. Acetone, methyl ethyl ketone, methyl isobutyl ketone, and diisobutyl ketone are among the important ketones that are commonly used in the manufacturing of resins, plastics, paints and lacquers, varnishes, coatings, rubber products, and other industrial products. Acetone is used in nail polish removers. It is commonly used to degrease wool and degum silk in the textile industry. Acetone is often employed as a solvent in the manufacturing of lacquers used for automotive and furniture finishing. It can also be used to reduce the viscosity of lacquer solutions. The paints and coatings industry accounts for more than half of the demand generated for methyl ethyl ketone (MEK) products, as these materials can be used to produce a low-viscosity solution without impairing their film attributes. The automobile, electric goods, and furniture industries all employ these lacquers. Lacquers are excellent surface coating solvents and are essential in the creation of high-solid, low-emission coatings. MEKs are also used in the production of polymers and textiles, as well as printing inks, adhesives, insecticides, and rubber-based industrial cements. Ketones have wide applications in the food & beverage, and pharmaceuticals and nutraceuticals industries, wherein they are used in the manufacturing of supplements, energy drinks, ready-to-drink (RTD) shakes, and shake powders, among other products. Ketone-based food products and supplements help in the weight loss process as they trigger the use of fats deposited in the body. Furthermore, the growing popularity of ketones as a fractionating agent in the extraction of oils and fats, and rising demand for these compounds for sterilizing medical equipment owing to their ability to kill germs is expected to further drive the market growth during the forecast period. Ketones are also used in the manufacturing of personal care and cosmetic products owing to their pleasant odor. Moreover, they are used as chemical intermediates in various pharmaceutical product and chemical manufacturing plants. Thus, continuously rising demand for ketones from various industries, such as automotive, paints and coatings, adhesives, resin manufacturing, food & beverages, pharmaceuticals and nutraceuticals, and personal care and cosmetics, is contributing to the ketones market growth.

Form Insights

Based on form, the ketones market is bifurcated into solid and liquid. The liquid segment accounted for a larger market share in 2020 and the solid segment is expected to register a higher CAGR in the market during the forecast period. Liquid ketones are being used as solvents and catalysts in the manufacturing of coatings, adhesives, printing inks, chemical intermediaries, perfumes, lacquers, paint removers, lubricating agents, and plastics and resins, among other products. Acetone, diisobutyl ketone, methyl ethyl ketone, methyl isobutylene ketone, etc., are the most commonly available liquid ketones in market. Liquid ketones are known for their distinctive pleasant smell. Ketone esters are used in the liquid form in dietary supplements. Growing demand for liquid ketones from chemical manufacturing companies is a prime contributor to the growth of the market for liquid segment.

Application Insights

Based on application, the ketones market is segmented into food & beverage, dietary supplements, personal care & cosmetics, and others. The other application segment accounted for the largest market share in 2020, and the dietary supplements segment is expected to register the highest CAGR in the market during the forecast period. Other applications of ketones are chemical and industrial applications. Ketones such as methyl ethyl ketone, methyl isobutyl ketone, di-isobutyl ketone, and acetone are widely used chemical intermediates in the chemicals industry. Acetone is widely used as a chemical intermediate in the production of acrylic plastics, polycarbonates, and epoxy resins. Moreover, diisobutyl ketone is used as a chemical intermediate in the synthesis of diisobutyl carbinol. Additionally, methyl ethyl ketones are used as a chemical intermediate in the manufacturing of certain pharmaceutical products. Acrylic plastics and epoxy resins are extensively used in automotive and signage applications. Diisobutyl carbinol is used in the synthesis of hydrogen peroxide, lacquers, shellac, printing inks, vinyl-chloride-acetate resins, urea-melamine resins, and alkyd resins. Ketones are used as industrial solvents in the manufacturing of paints and coatings, adhesives, automotive finishes, rubbers, textiles, varnishes, printing inks, etc. In the coatings industry, they are widely used as solvents in the production of nitrocellulose and other cellulose esters, resins, and vinyl chloride-vinyl acetate. These solvents can be employed as active solvents or diluents, and they are frequently used in conjunction with other solvents. Methyl ethyl ketones are commonly used as a solvent in rubber manufacturing. Further, ketones are used as a fractionating agent in the extraction of oils and fats. They are used to sterilize medical equipment such as surgical instruments, hypodermic needles, syringes, and dental instruments.

A few players operating in the ketones market are Compound Solutions Inc.; Aurochemicals; Taj Pharmaceuticals Chemicals; Orchid Chemical Supplies Ltd; Hunan NutraMax Inc.; HEALTH SOURCES NUTRITION CO., LTD.; Advanced Biotech; Eastman Chemical Company; Royal Dutch Shell plc.; and SABIC.

Ketones Market Regional InsightsThe regional trends and factors influencing the Ketones Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Ketones Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Ketones Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 4.29 Billion |

| Market Size by 2028 | US$ 7.11 Billion |

| Global CAGR (2020 - 2028) | 6.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ketones Market Players Density: Understanding Its Impact on Business Dynamics

The Ketones Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Ketones Market top key players overview

Report Spotlights

- Progressive industry trends in the ketones market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the ketones market from 2019 to 2028

- Estimation of global demand for ketones

- Porter’s five forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the ketones market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the ketones market size at various nodes

- Detailed overview and segmentation of the market, as well as the ketones industry dynamics

- Size of the ketones market in various regions with promising growth opportunities

Ketones Market – by Form

- Solid

- Liquid

Ketones Market – by Application

- Food & Beverage

- Dietary Supplements

- Personal Care & Cosmetics

- Others

Company Profiles

- Compound Solutions Inc.

- Aurochemicals

- Taj Pharmaceuticals Chemicals

- Orchid Chemical Supplies Ltd

- Hunan NutraMax Inc.

- HEALTH SOURCES NUTRITION CO., LTD.

- Advanced Biotech

- Eastman Chemical Company

- Royal Dutch Shell plc.

- SABIC

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For