Chicken Powder Market Size, Share & Forecast 2031

Chicken Powder Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Chicken Meat Powder, Chicken Broth Powder, Chicken Protein Powder, and Others), Nature (Organic and Conventional), Category (Low-Fat and Regular), Application (Food and Beverages [RTE and RTC Meals; Soups, Sauces, and Dressings; Savory Snacks; Noodles and Pastas; and Others], Dietary Supplements, Pet Food, and Animal Feed), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Dec 2025

- Report Code : TIPRE00030092

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 337

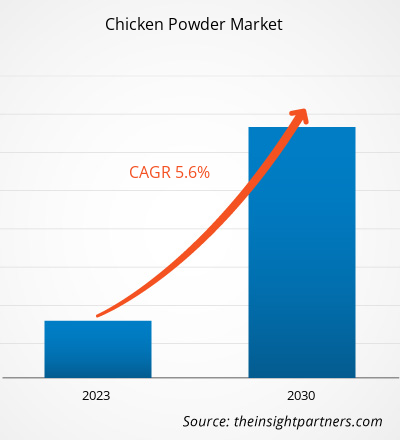

The chicken powder market size is projected to reach US$ 902.14 million by 2031 from US$ 607.05 million in 2024. The market is expected to register a CAGR of 5.9% from 2025 to 2031.

Chicken Powder Market Analysis

The chicken powder demand is influenced by growing consumer preference for convenient, flavorful, and versatile food ingredients. With the rising trends of busy lifestyles, manufacturers are now incorporating chicken powder to improve the taste of instant noodles, in soups, snacks, and ready meals, generating opportunities within the convenience food industry. Increasing urbanization and growing foodservice sectors increase consumption in seasonings, marinades, and processed foods. The demand in health-conscious consumers is triggered by clean-label, low-sodium, and natural formulations that promote product innovation and premium products. In developing economies, growing disposable income and a move toward packaged food offer great potential growth. Meanwhile, the globalization of cuisine and the increased popularity of home-cooking favor the wider use of poultry flavors. These factors provide growing possibilities for manufacturers to establish differentiated and high-quality chicken powder products that address the changing needs of consumers and the industry.

Chicken Powder Market Overview

Chicken powder is a dehydrated flavoring consisting of chicken meat, broth, fats, and natural flavor compounds, commonly mixed with salt, spices, and, in some cases, vegetable extracts to form a rich, umami-enhancing additive. It is produced by methods that include spray drying or dehydration, which transform liquid chicken essence into a shelf-stable powder, which is used in soups, snacks, marinades, and convenience foods. The market is evolving rapidly, with consumers and manufacturers demanding clean-label, natural, and low-additive formulations without losing the authentic flavor. Emerging trends include the rise of organic and reduced-sodium varieties, premium products made from real chicken stock, and innovations targeting health-conscious shoppers. There is increased product development based on global cuisines, home cooking, and value-added seasonings, as the product is developing based on the emerging culinary trends, more differentiated flavors and functional blends are being made available by brands.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONChicken Powder Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Chicken Powder Market: Drivers and Opportunities

Market Drivers:

- Increasing Demand for Convenience Foods: Increased consumption of instant noodles, soups, snacks, and ready-to-eat meals increases the demand for chicken powder as a flavor enhancer.

- Growing Foodservice Industry: Restaurants, cloud kitchens, and catering services that use chicken as their main staple ingredient depend on its seasoning to ensure uniform flavor and cut down preparation time.

- Shift Toward Umami-Rich and Global Flavors: Bold, savory flavors are gaining popularity and pushing manufacturers to add chicken powder to marinades and sauces, and in fusion dishes.

- Increasing Demand for Natural and Clean-Label Ingredients: Demand for chicken powder with fewer additives, low sodium, and natural formulations is stimulated by health-conscious consumers.

- Rising Urbanization and Disposable Incomes: Emerging markets are more accepting of processed products, and the demand for poultry-based flavorings remains consistent.

Market Opportunities:

- Premium and Organic Chicken Powders: High growth potential lies in the development of high-quality, organic, and real stock formulations.

- Innovation in Health-Focused Products: Additive-free, allergen-free, and low-sodium versions appeal to health-conscious customers.

- Adoption in Emerging Markets: Growing consumption of convenience foods in Asia Pacific, Africa, and South and Central America provides huge prospects for growth.

- Diversification Into Specialty Flavors and Functional Blends: There are available prospects in the development of gourmet, regional, and fortified chicken powders to suit the changing culinary demands.

- Expansion in E-Commerce and Direct-to-Consumer Channels: With online retail growth, manufacturers will reach more potential customers, market niche varieties of chicken powder, and sell in large quantities or customized seasoning packages directly to consumers.

Chicken Powder Market Report Segmentation Analysis

The chicken powder market is divided into different segments to give a clearer view of how they work, their growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Type

- Chicken Meat Powder: Applied in seasonings, snacks, and ready meals, it contains high amounts of umami and is known to be rich and concentrated in the flavor and taste of chicken.

- Chicken Broth Powder: Made of dehydrated chicken stock, it is used in soups, sauces, and even instant noodles due to its aromatic and broth-like taste.

- Chicken Protein Powder: Due to its high protein content, it finds wide application in dietary supplements, functional foods, and sports nutrition to enhance nutritional value.

- Others: This category includes chicken fat powder, hydrolyzed chicken bone and cartilage powder, and chicken extract powder.

By Nature

- Organic: Organically raised chicken and natural ingredients appeal to clean-label and health-conscious consumers demanding chemical-free seasonings.

- Conventional: Popular and affordable, it is designed to be used in mass markets in food processing, foodservice, and home cooking.

By Category

- Low-Fat: Developed to cater to health-conscious products where low amounts of fat are needed, but a savory flavor is required.

- Regular: Formulations of standard fat contents, which are predominantly utilized in snacks, instant foods, and flavor blends.

By Application

- Food and Beverages: This segment comprises RTE and RTC meals; soups, sauces, and dressings; savory snacks; noodles and pastas; and other food and beverage applications.

- Dietary Supplements: Chicken powder is used as a source of protein enrichment and as functional nutrition due to its amino acid composition.

- Pet Food: Offers pet food flavor and nutritional benefits in kibble, wet food, and pet treats.

- Animal Feed: Serves as a protein requirement and flavor enhancement factor to promote growth and dietary consumption in livestock and poultry.

By Geography:

- North America

- Europe

- Asia Pacific

- South and Central America

- Middle East & Africa

Chicken Powder Market Regional Insights

The regional trends and factors influencing the Chicken Powder Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Chicken Powder Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Chicken Powder Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 607.05 Million |

| Market Size by 2031 | US$ 902.14 Million |

| Global CAGR (2025 - 2031) | 5.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Chicken Powder Market Players Density: Understanding Its Impact on Business Dynamics

The Chicken Powder Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Chicken Powder Market top key players overview

Chicken Powder Market Share Analysis by Geography

Asia Pacific dominated the market due to the expansion of the food processing industry across the region. Emerging markets in South and Central America and MEA have untapped opportunities for chicken powder providers to expand.

The growth of the chicken powder market varies by region. The demand for premium indulgences continues to grow, positioning chicken powder in an evolving consumer landscape. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant market share

- Key Drivers: Growing consumption of ready-to-eat and convenience food products

- Trends: Shift toward clean-label and low-fat chicken powder seasonings.

2. Europe

- Market Share: Holds a significant market share

- Key Drivers: Rising demand for premium food ingredients in soups, snacks, and ready meals.

- Trends: Increasing preference for organic seasonings.

3. Asia Pacific

- Market Share: Dominated the market, with a rising market share every year

- Key Drivers: Rising disposable income and expansion of the foodservice industry.

- Trends: Growing demand for regional and fusion seasoning flavors.

4. South and Central America

- Market Share: Rapidly growing market, with a surging market share every year

- Key Drivers: Rapid growth in the food processing sector.

- Trends: Growing demand for value-added and fortified chicken powders.

5. Middle East and Africa

- Market Share: Although small, it is growing quickly

- Key Drivers: Increasing demand for packaged and processed foods.

- Trends: Growing adoption of poultry-based seasonings in quick-service restaurants.

Chicken Powder Market Players: Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as Lee Kum Kee Co Ltd, BRF SA, Proliver SRL, Weijia Food Ingredients Co Ltd, International Dehydrated Foods Inc, Ajinomoto Co Inc, Nestle SA, Kerry Group plc, Hangzhou Focus Corp, and Fuji Foods Inc.

This high level of competition urges companies to stand out by offering:

- Diverse product offering

- Sustainable and ethical sourcing

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Focusing on research and development activities to distinguish themselves in the market

- Expanding global footprint and capabilities through acquisitions of spices and seasoning manufacturers.

- Expanding product portfolio with the launch of organic products

Other companies analyzed during the course of research:

- Zhongshan Jolion Foodstuffs Co Ltd

- Massel Australia Pty Ltd

- A S Harrison & Co Pty Ltd

- Caldos del Norte SL

- Krio Krush Basic Foods

- BIN DAWOOD

- HE Stringer Flavours Ltd

- The Scoular Co

- ARIAKE JAPAN Co Ltd

- Symrise AG

Chicken Powder Market: News and Recent Developments

- Kerry Group – Product Launch in March 2025, Kerry Group introduced a new line of clean-label chicken broth powders formulated with reduced sodium and no artificial additives. The range is designed for use in soups, sauces, and premium ready meals, catering to rising consumer demand for natural and authentic poultry flavors.

- Givaudan – Expansion in January 2025, Givaudan expanded its savory ingredients facility in Singapore to increase production capacity for chicken powder and broth concentrates. The expansion supports growing demand across APAC, especially in instant noodles, snacks, and convenience foods.

Chicken Powder Market Report Coverage and Deliverables

The "Chicken Powder Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Chicken powder market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Chicken powder market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces and SWOT analysis

- Chicken powder market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the chicken powder market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For