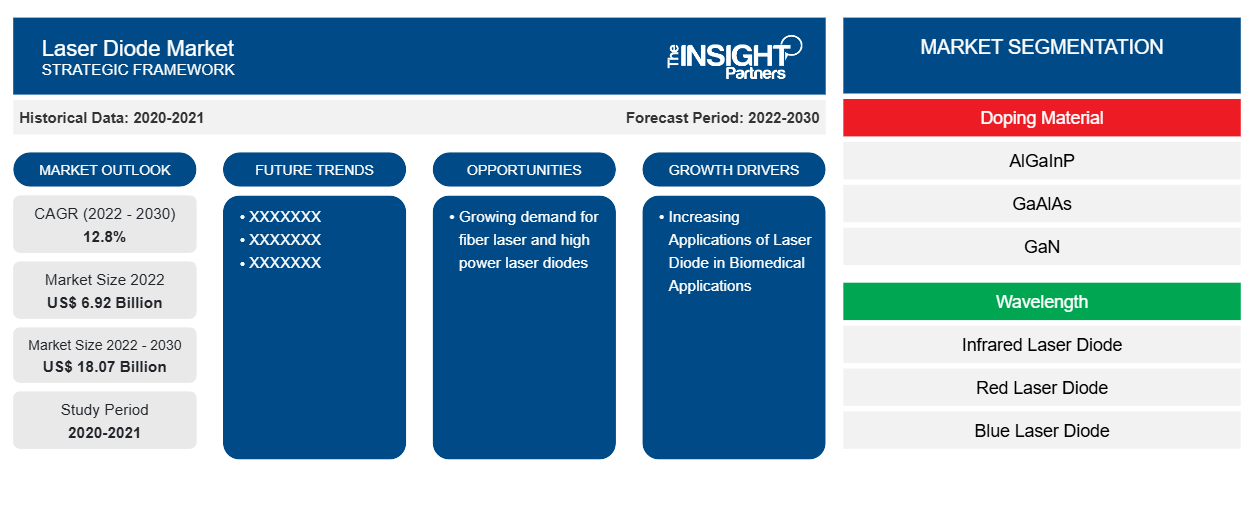

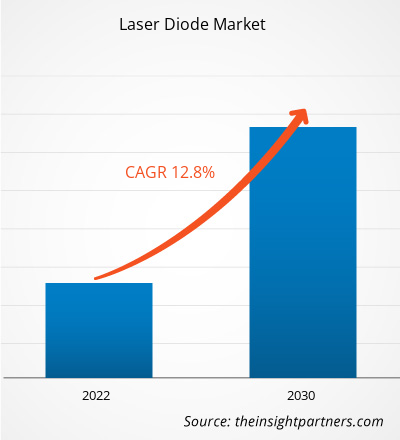

The Laser Diode market is projected to grow from US$ 6.92 billion in 2022 to US$ 18.07 billion by 2030; it is expected to expand at a CAGR of 12.8% from 2022 to 2030. Growing demand for fiber laser and high-power laser diodes are expected to be key trends in the market.

Laser Diode Market Analysis

Laser diodes are widely used for various applications across hundreds of industries and markets, both industrial and commercial. The key functionality of laser diode devices is signal processing, which takes the form of sensing and communications, further increasing the demand for laser diodes for sensing applications. Fiber optics communications rely heavily on the signal processing power of laser diodes to carry signals for telephony, cable, and internet, contributing to the demand for laser diodes. Further, the growing adoption of laser diodes for sensing applications, such as smartphones for gesture control and facial recognition features, contributes to the laser diode market growth. The use of laser diode for data communication and LiDAR systems for automotive also propels the market growth. The rise in integration of technologies such as IoT across several industries such as healthcare, automotive, and building requires fiber optics communication technologies, which drives the demand and adoption of laser diodes.

Laser Diode Market Industry Overview

Laser diodes are semiconductor devices similar to light-emitting diodes (LED) but possess several unique attributes such as compact size, efficient work even in low input, and compatibility with modern electronics. Several advantages of laser diodes, such as higher intensity, simpler integration, consistent output, lower overall cost, and superior performance, propel their demand in numerous end-use industries, including automotive, consumer electronics, healthcare, and military & defense. Laser diodes are widely used in laser pointers and specific scientific and industrial applications (optical pumping of other lasers, spectroscopy, surface hardening, and others).

Laser diodes are extensively used in the telecommunication sector as they are easily modulated and coupled with light sources, which makes them an ideal option for fiber optics communication. The telecommunications and optical data storage industries are among the largest consumers of laser diodes as they have an exceptionally fast response time. The diodes are used in various electronics and instruments, such as rangefinders, barcode readers, and consumer electronics. In addition, low and high-power diodes are used broadly in the printing sector as light sources for scanning images and high-speed and high-resolution printing plate manufacturing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Laser Diode Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Laser Diode Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Laser Diode Market Driver and Opportunities

Rise in Adoption of VCSEL for 3D Sensing Application

to Favor Market Growth

3D sensing technologies are used in various industries such as consumer electronics, medical, industrial, automotive, and automation. The 3D sensing technologies in these applications help to gain high precision and accuracy for the required task. For example, 3D sensing technologies in cameras help scan and render objects in 3D, one of the most common uses in smartphones, automobiles, drones, and robots. In consumer electronics such as smartphones, it is widely used for facial recognition and gesture control technologies. In industry automation, vertical-cavity surface-emitting laser (VCSEL) is used for accurate sensing technologies. In addition, it is widely adopted in virtual reality and gaming applications. Thus, the rise in these industries contributes to the requirement for 3D sensing technologies, which further demands VCSEL. To cater to the demand for VCSEL, several market players are introducing new VCSEL products. A few of them are mentioned below:

- In April 2022, TRUMPF launched new VCSEL products to expand their VCSEL product portfolio for 3D sensing in consumer and industrial applications.

- In March 2021, IQE PLC unveiled an IQVCSELTM product line to expand its VCSEL portfolio for service communication and advanced sensing markets.

- In March 2021, Lumentum Operations LLC launched five and six-junction VCSEL array products for advanced consumer and other 3D sensing applications.

Further, the use of VCSEL-based imaging increases the power and wavelength for 3D sensing. Its ability to produce higher power outputs makes it an optimal solution for its robotics and autonomous vehicle applications. Thus, the rise in the adoption of VCSEL for 3D sensing applications contributes to the laser diode market growth.

Increasing Applications of Laser Diode in Biomedical Applications

Because of direct electrical pumping, diode lasers are by far the most efficient light sources known. They can be produced in large quantities and at a reasonable cost because they are based on chip technology. Their small size allows for extremely tiny laser systems. All of these characteristics expand their application potential, including biomedical applications. This, in turn, is expected to create lucrative growth opportunities for the laser diode market during the forecast period.

Laser Diode Market Report Segmentation Analysis

The key segments that contributed to the derivation of the Laser Diode market analysis are coverage doping material, wavelength, and application.

- By application, the laser diode market is segmented into automotive, consumer electronics, healthcare, military & defense, and others. Laser diodes play a crucial role in modern telecommunications. They are commonly used in fiber-optic communication systems for numerous tasks, including optical fiber transmission, fiber optic networking, telecom data transmission, data storage, etc.

- The Laser diodes serve as efficient light sources for transmitting data through optical fibers, enabling high-speed communication over long distances. In fiber-optic networks, laser diodes are used in transmitters to convert electrical signals into optical signals for transmission through the fiber-optic cables. Moreover, it facilitates the transmission of voice, data, and video signals in telecommunication networks, ensuring rapid and reliable communication. Laser diodes contribute significantly to the efficiency and speed of data transmission in modern telecommunications infrastructure. Thus, laser diodes are used vastly in the telecommunication sector.

- Laser diodes are widely used in consumer electronics for various purposes. They are commonly found in devices such as DVD and Blu-ray players, optical disc drives, laser printers, and barcode scanners. Additionally, laser diodes are integral in the operation of a few types of laser pointers and range finders. Their compact size and efficiency make them suitable for applications where precise and focused light is required, contributing to the advancement of technology in consumer products. Thus, considering the various applications and suitable sizes, laser diodes are used widely in consumer electronics.

Laser Diode Market Share Analysis By Geography

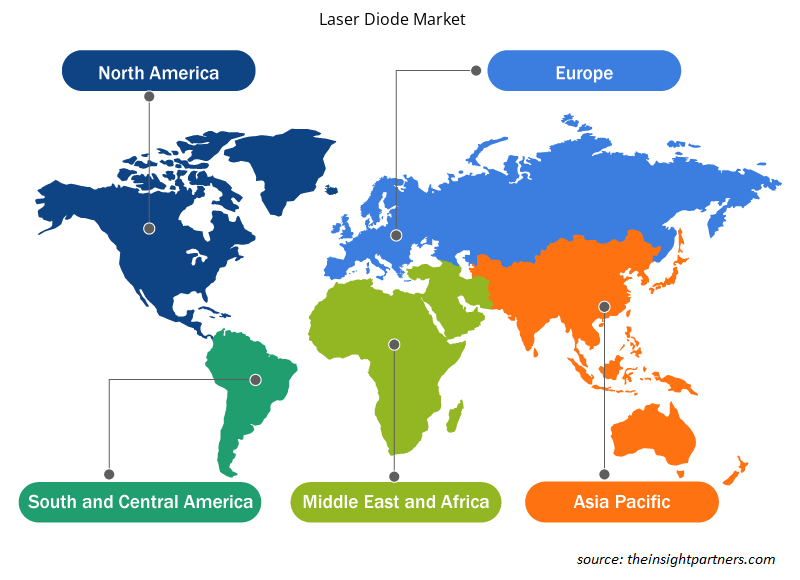

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

The Asia Pacific laser diode market size was valued at US$ 3.46 billion in 2022 and is projected to reach US$ 10.77 billion by 2030; it is expected to register a CAGR of 15.2% from 2022 to 2030. The Asia Pacific laser diode market is segmented into Australia, China, India, Japan, South Korea, and the rest of Asia Pacific. China accounted for the largest share of the Asia Pacific laser diode market in 2022. China is one of the strong players in the semiconductor industry due to government initiatives such as Made in China 2025 to promote local manufacturing across the country. China's semiconductor industry consists of various companies contributing to the flourishing demand for semiconductors in several industries, such as automotive, consumer electronics, telecommunications, and aerospace.

A few of the major electronics manufacturers in the country include BYD Electronics and Huawei Technologies Co., Ltd., among others. Thus, to boost local production, the electronics companies invest to procure required technologies from China. For instance, in June 2020, Huawei Technologies Co., Ltd., a China-based manufacturer of telecommunications equipment and consumer electronics, invested in China-based VCSEL provider Vertilite to provide VCSEL laser diode supplies to Huawei Technologies Co., Ltd. Thus, such demand for laser diodes contributes to the laser diode market growth in the country.

Laser Diode Market Regional Insights

The regional trends and factors influencing the Laser Diode Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Laser Diode Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Laser Diode Market

Laser Diode Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.92 Billion |

| Market Size by 2030 | US$ 18.07 Billion |

| Global CAGR (2022 - 2030) | 12.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Doping Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Laser Diode Market Players Density: Understanding Its Impact on Business Dynamics

The Laser Diode Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Laser Diode Market are:

- Coherent Corp

- IPG Photonics Corporation

- Nuvoton Technology Corporation

- Sharp Corp

- Sheaumann Laser Inc.

- Sumitomo Electric Industries Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Laser Diode Market top key players overview

Laser Diode Market News and Recent Developments

The Laser Diode market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Laser Diode Market are listed below:

- Mitsubishi Electric Corporation announced that it will begin shipping samples of its 50Gbps distributed-feedback (DFB) laser diode for optical-fiber communication in fifth-generation (5G) mobile base stations. (Source: Magic, Press Release, March 2022)

Laser Diode Market Report Coverage & Deliverables

The Laser Diode market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Laser Diode Market Size and Forecast (2020–2030)" provides a detailed analysis of the market covering below areas-

- Laser Diode Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Laser Diode Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Laser Diode Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Laser Diode Market

- Detailed company profiles.

Frequently Asked Questions

What are the deliverable formats of the Laser Diode market report?

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

What are the options available for the customization of this report?

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

What is the expected CAGR of the Laser Diode market?

The global Laser Diode market was estimated to grow at a CAGR of 12.8% during 2022 - 2030.

Which are the leading players operating in the Laser Diode market?

Coherent Corp, IPG Photonics Corporation, Nuvoton Technology Corporation, Sharp Corp, Sheaumann Laser, Inc., Sumitomo Electric Industries Ltd, TRUMPF SE + Co KG, Jenoptik AG, Mitsubishi Electric Corp Other players considered are ThorLabs, Lumentum Operations LLC, Hamamatsu Photonics, MKS Instrument, Ushio Inc., Blueglass Ltd, Nichia Corporation, Kyocera, RPMC Lasers, Toptica, and ams-OSRAM AG are the major market players.

What are the future trends of the Laser Diode market?

Growing demand for fiber laser and high-power laser diodes are the major trends in the market.

What are the driving factors impacting the Laser Diode market?

The rise in adoption of VCSEL for 3D sensing applications and increasing investment in laser technology are the major factors that drive the global Laser Diode market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Laser Diode Market

- Coherent Corp

- IPG Photonics Corporation

- Nuvoton Technology Corporation

- Sharp Corp

- Sheaumann Laser, Inc.

- Sumitomo Electric Industries Ltd

- TRUMPF SE + Co KG

- Jenoptik AG

- Mitsubishi Electric Corp

- ams-OSRAM AG

Get Free Sample For

Get Free Sample For