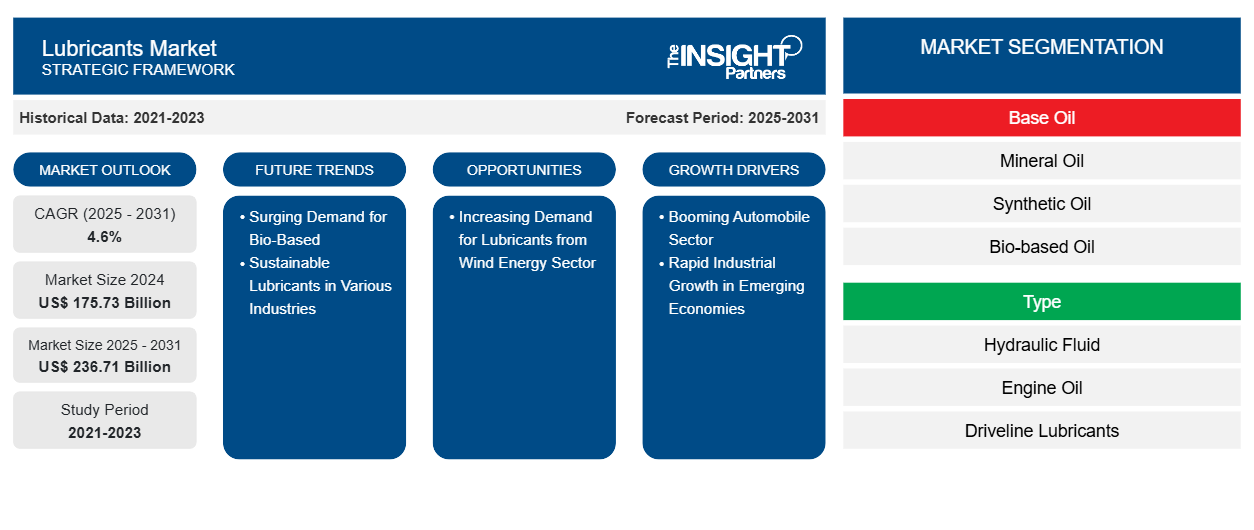

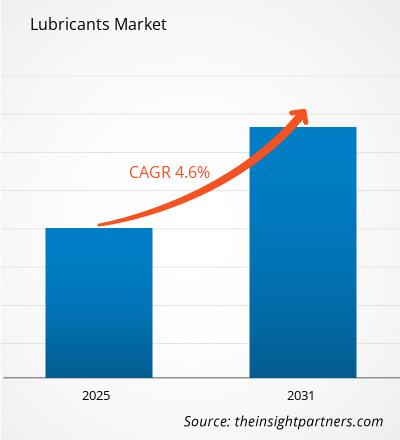

The lubricants market size is projected to reach US$ 236.71 billion by 2031 from US$ 175.73 billion in 2024; the market is expected to register a CAGR of 4.6% during 2025–2031. The surging demand for bio-based and sustainable lubricants in various industries is expected to be a key trend in the market.

Lubricants Market Analysis

Manufacturers globally are investing in improving their supply chain to increase automobile sales in developing regions. According to the Society of Indian Automobile Manufacturers (SIAM), in India, sales of passenger vehicles increased to nearly 2,854,242 units in November 2023 from ~2,409,535 units in November 2022. The South African automotive manufacturing industry is the 22nd largest in the world in terms of number of vehicles produced and is the largest on the African continent, accounting for more than ~54% of vehicles assembled on the continent in 2023. According to the International Organization of Motor Vehicle Manufacturers (OICA), Brazil was the largest manufacturer and exporter of light and commercial vehicles in 2023 in South & Central America. The country reported production of nearly 2.3 million vehicles in 2022. Traditionally, lubricants have been essential in internal combustion engine (ICE) vehicles, where they reduce friction, prevent wear, and help manage engine heat. However, the rise of EVs has introduced a new dynamic to the lubricants market. Electric vehicles, despite not having traditional engines, still rely on lubricants in several components such as transmissions, motors, and other drivetrain parts. Thus, the growing automobile industry is accelerating the demand for lubricants, contributing to better vehicle performance and longevity.

Lubricants Market Overview

Various countries across the globe are undergoing industrialization, leading to a surge in the use of machinery and equipment in several sectors. Industries such as manufacturing, construction, mining, and agriculture heavily rely on machinery that requires lubricants for optimal performance and longevity. The increased industrial activity and growing construction and agriculture industries are expected to increase the demand for lubricants.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lubricants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lubricants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lubricants Market Drivers and Opportunities

Rapid Industrial Growth in Emerging Economies Fuels Market Growth

The global lubricants market continues to grow steadily, supported by its essential role across a wide array of industrial applications. Key lubricant categories—including mineral and synthetic oils, greases, compressor oils, and cutting fluids—are extensively utilized in sectors such as oil and gas, textiles, mining and metallurgy, power generation, paper and pulp, chemicals and petrochemicals, agriculture, manufacturing, food and beverage, and pharmaceuticals. These lubricants are critical for ensuring the seamless operation of industrial machinery, enhancing productivity, and minimizing unplanned downtime. A notable driver behind the increasing demand for lubricants is the accelerated growth of the mining sector, particularly in emerging and industrial economies. According to Trading Economics, China reported a 5.4% increase in industrial production as of November 2024, signaling continued momentum in sectors that rely heavily on resource extraction and processing. The mining industry, in particular, is witnessing substantial expansion, driven by rising global consumption of minerals and metals used in construction, manufacturing, and renewable energy technologies. Mining operations inherently involve rigorous mechanical activity under extreme conditions, including abrasive environments, variable temperatures, and high operational loads. The heavy-duty equipment employed—such as haul trucks, drilling rigs, crushers, and conveyors—requires consistent and high-performance lubrication to operate efficiently. Proper lubrication reduces mechanical friction, prevents component failure, controls thermal buildup, and provides resistance to oxidation and corrosion.

Given the high capital investment associated with mining equipment, companies are increasingly adopting preventative maintenance strategies where lubricants play a central role. High-performance synthetic lubricants are gaining traction for their extended service life, superior performance in extreme conditions, and ability to improve fuel efficiency and reduce total cost of ownership. In addition to the mining industry, broader industrial growth is also positively impacting lubricant consumption. The manufacturing sector, in particular, is seeing renewed investment in automation and advanced machinery, further increasing the need for specialized lubricants to support smooth operational cycles and reduce energy losses. Furthermore, sustainability concerns are prompting lubricant manufacturers to innovate with environmentally friendly alternatives. Bio-based and low-toxicity formulations are being developed to meet both regulatory compliance and corporate environmental responsibility goals. In conclusion, the lubricants market is set to benefit from both the resurgence of global industrial activity and the strategic emphasis on equipment longevity and operational efficiency. With mining and heavy industries driving demand, coupled with advancements in lubricant formulations, the market outlook remains optimistic for the foreseeable future.

Increasing Demand for Lubricants from Wind Energy Sector to Create Growth Opportunities in the Market

Wind energy is among the fastest-growing renewable energy technologies, holding a potential share for consuming lubricants in the power industry. As per the data published by WindEurope, in 2023, Europe installed 18.3 GW of new wind power capacity and is expected to install 260 GW of new wind power capacity over 2024–2030. As several countries in the region are embracing renewable energy sources, particularly wind power, the need for specialized lubricants to ensure the smooth functioning of wind turbines becomes paramount. These lubricants enhance the operational efficiency and lifespan of the intricate machinery involved in harnessing wind energy. The expanding wind energy sector requires a reliable and consistent supply of high-performance lubricants to mitigate wear and tear, reduce friction, and prevent corrosion in the mechanical components of wind turbines. This demand opens avenues for research and development, encouraging innovation in lubricant formulations tailored to the unique challenges posed by the wind energy environment.

Lubricants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lubricants market analysis are base oil, type, and end-use industry.

By base oil, the lubricants market is segmented into mineral oil, synthetic oil, and bio-based oil.

Based on type, the market is segmented into hydraulic fluid, engine oil, driveline lubricants, metalworking fluids, grease, process oils, coolants, and others.

In terms of end-use industry, the market is segmented into automotive, building and construction, power generation, mining and metallurgy, food processing, oil and gas, marine, aviation, and others. The automotive segment is further segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Lubricants Market Share Analysis by Geography

The geographical scope of the lubricants market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to dominate the market over the forecast period. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles compared to 2021. According to the China Association of Automobile Manufacturers, ~6,000 fuel-cell electric vehicles were sold in China in 2023, a year-on-year rise of 72%. According to the India Brand Equity Foundation, the annual production of automobiles in 2023 reached 25.9 million vehicles in India. In September 2024, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 2,773,039 units. Lubricants are used in automotive components such as engines, transmissions, and differentials where they provide lubrication to reduce friction, and enhance fuel efficiency, subsequently ensuring optimal performance and longevity of vehicles.

China, Japan, and South Korea are leading countries in the shipbuilding sector. Shipbuilding greases confer properties such as resistance to elements and corrosive saltwater, resistance to high pressure, and increased lifespans for ship components.

Lubricants Market Regional Insights

The regional trends and factors influencing the Lubricants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Lubricants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Lubricants Market

Lubricants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 175.73 Billion |

| Market Size by 2031 | US$ 236.71 Billion |

| Global CAGR (2025 - 2031) | 4.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

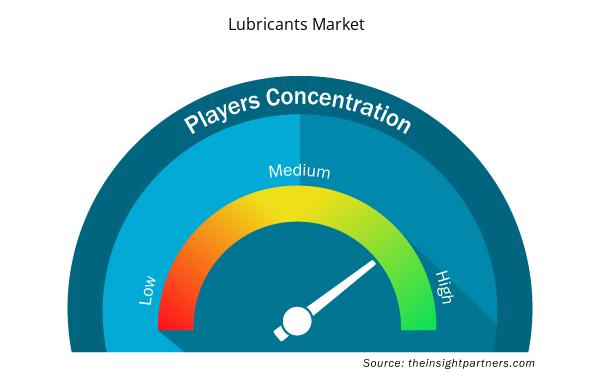

Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

The Lubricants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Lubricants Market are:

- Castrol Ltd

- Shell Plc

- Pennzoil

- Quaker State Lubrication Limited

- TotalEnergies SE

- Repsol Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Lubricants Market top key players overview

Lubricants Market News and Recent Developments

The lubricants market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the lubricants market are listed below:

- Castrol launched the 'First Car Love Stories' campaign in the UK to drive brand awareness and sales. (Castrol Limited, Company Website, August 2024)

- Repsol joined forces with Tekniker to develop lubricants using nanotechnology. (Repsol, Company Website, September 2024)

- Repsol launched its new lubricant packaging incorporating 60% recycled plastic content. (Repsol, Company Website, March 2024)

- Castrol launched a new VECTON fully synthetic commercial vehicle lubricant that meets new ACEA Heavy-Duty specifications. (Castrol Limited, Company Website, August 2024)

- ExxonMobil expanded Mobil branded lubricants and chemical products with a focus on quality product innovation. (ExxonMobil, Company News, September 2023)

- Shell Lubricants acquired UK-based MIDEL and MIVOLT, strengthening its product portfolio for the power and renewables sectors. (Shell, Company News, October 2023)

Lubricants Market Report Coverage and Deliverables

The "Lubricants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Lubricants market size and forecast for all the key market segments covered under the scope

- Lubricants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Lubricants market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the lubricants market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Base Oil, Product Type, and End Use, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on base oil, which segment held the largest share in the global lubricants market?

The mineral oil segment held the largest share of the global lubricants market in 2024.

Which region held the largest share of the global lubricants market?

In 2024, Asia Pacific held the largest share of the global lubricants market due to the growing construction, automotive, and oil and gas industries.

What is the expected CAGR of the lubricants market?

The market is expected to register a CAGR of 4.3% during 2024–2031.

Which are the leading players operating in the lubricants market?

BP Plc, Chevron Corporation, Exxon Mobil Corporation, TotalEnergies, FUCHS, Shell plc, China National Petroleum Corporation, Petro‐Canada Lubricants Inc, Valvoline Inc, LUKOIL, Repsol, ENEOS Corporation, Gulf Oil International Ltd, CEPSA COMERCIAL PETRÓLEO, S.A.U, and Petrofer are among the key players operating in the lubricants market.

What are the future trends in the lubricants market?

The surging demand for bio-based and sustainable lubricants in various industries is expected to be a key trend in the market.

What are the factors driving the lubricants market?

The booming automobile sector and rapid industrial growth in emerging economies are driving the market growth.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Lubricants Market

- BP Plc

- Chevron Corporation

- Exxon Mobil Corporation

- TotalEnergies

- FUCHS

- Shell plc

- China National Petroleum Corporation

- Petro?Canada Lubricants Inc

- Valvoline Inc

- LUKOIL

- Repsol

- ENEOS Corporation

- Gulf Oil International Ltd

- CEPSA COMERCIAL PETRÓLEO S.A.U

- Petrofer

Get Free Sample For

Get Free Sample For