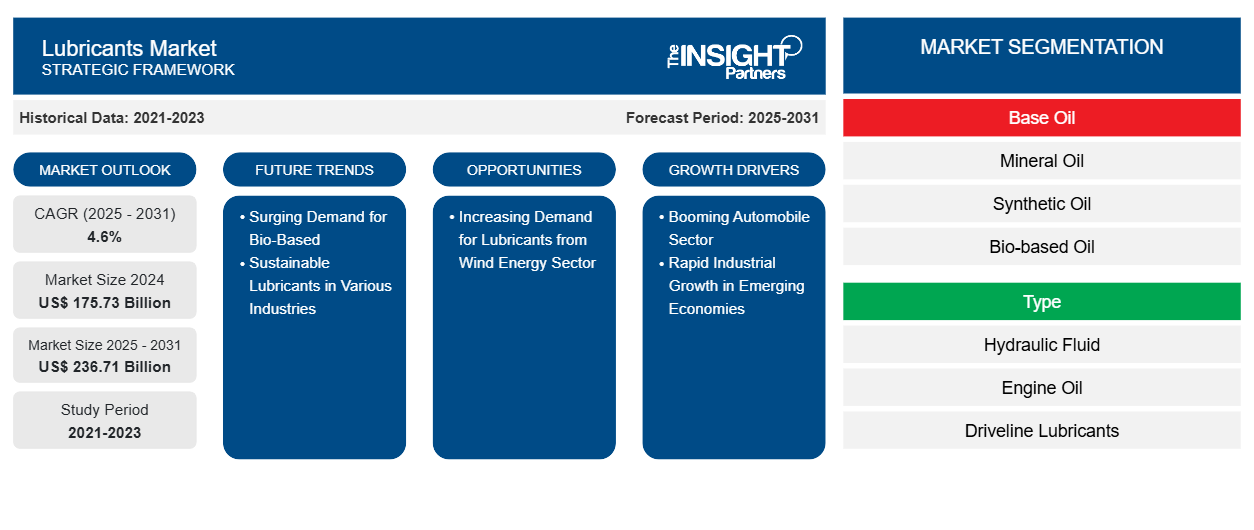

Lubricants Market Dynamics and Trends by 2031

Lubricants Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Base Oil (Mineral Oil, Synthetic Oil, and Bio-based Oil), Type (Hydraulic Fluid, Engine Oil, Driveline Lubricants, Metalworking Fluids, Grease, Process Oils, Coolants, and Others), End-Use Industry [Automotive (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), Building and Construction, Power Generation, Mining and Metallurgy, Food Processing, Oil and Gas, Marine, Aviation, and Others], and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2025

- Report Code : TIPRE00003547

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 360

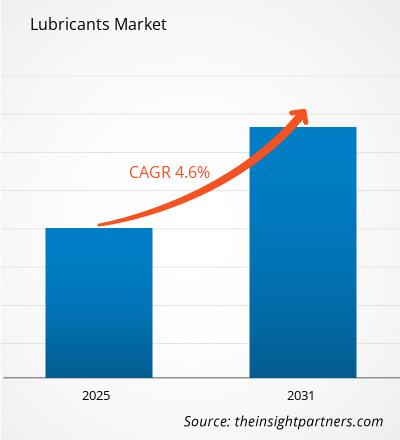

The lubricants market size is projected to reach US$ 236.71 billion by 2031 from US$ 175.73 billion in 2024; the market is expected to register a CAGR of 4.6% during 2025–2031. The surging demand for bio-based and sustainable lubricants in various industries is expected to be a key trend in the market.

Lubricants Market Analysis

Manufacturers globally are investing in improving their supply chain to increase automobile sales in developing regions. According to the Society of Indian Automobile Manufacturers (SIAM), in India, sales of passenger vehicles increased to nearly 2,854,242 units in November 2023 from ~2,409,535 units in November 2022. The South African automotive manufacturing industry is the 22nd largest in the world in terms of number of vehicles produced and is the largest on the African continent, accounting for more than ~54% of vehicles assembled on the continent in 2023. According to the International Organization of Motor Vehicle Manufacturers (OICA), Brazil was the largest manufacturer and exporter of light and commercial vehicles in 2023 in South & Central America. The country reported production of nearly 2.3 million vehicles in 2022. Traditionally, lubricants have been essential in internal combustion engine (ICE) vehicles, where they reduce friction, prevent wear, and help manage engine heat. However, the rise of EVs has introduced a new dynamic to the lubricants market. Electric vehicles, despite not having traditional engines, still rely on lubricants in several components such as transmissions, motors, and other drivetrain parts. Thus, the growing automobile industry is accelerating the demand for lubricants, contributing to better vehicle performance and longevity.

Lubricants Market Overview

Various countries across the globe are undergoing industrialization, leading to a surge in the use of machinery and equipment in several sectors. Industries such as manufacturing, construction, mining, and agriculture heavily rely on machinery that requires lubricants for optimal performance and longevity. The increased industrial activity and growing construction and agriculture industries are expected to increase the demand for lubricants.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLubricants Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lubricants Market Drivers and Opportunities

Rapid Industrial Growth in Emerging Economies Fuels Market Growth

The global lubricants market continues to grow steadily, supported by its essential role across a wide array of industrial applications. Key lubricant categories—including mineral and synthetic oils, greases, compressor oils, and cutting fluids—are extensively utilized in sectors such as oil and gas, textiles, mining and metallurgy, power generation, paper and pulp, chemicals and petrochemicals, agriculture, manufacturing, food and beverage, and pharmaceuticals. These lubricants are critical for ensuring the seamless operation of industrial machinery, enhancing productivity, and minimizing unplanned downtime. A notable driver behind the increasing demand for lubricants is the accelerated growth of the mining sector, particularly in emerging and industrial economies. According to Trading Economics, China reported a 5.4% increase in industrial production as of November 2024, signaling continued momentum in sectors that rely heavily on resource extraction and processing. The mining industry, in particular, is witnessing substantial expansion, driven by rising global consumption of minerals and metals used in construction, manufacturing, and renewable energy technologies. Mining operations inherently involve rigorous mechanical activity under extreme conditions, including abrasive environments, variable temperatures, and high operational loads. The heavy-duty equipment employed—such as haul trucks, drilling rigs, crushers, and conveyors—requires consistent and high-performance lubrication to operate efficiently. Proper lubrication reduces mechanical friction, prevents component failure, controls thermal buildup, and provides resistance to oxidation and corrosion.

Given the high capital investment associated with mining equipment, companies are increasingly adopting preventative maintenance strategies where lubricants play a central role. High-performance synthetic lubricants are gaining traction for their extended service life, superior performance in extreme conditions, and ability to improve fuel efficiency and reduce total cost of ownership. In addition to the mining industry, broader industrial growth is also positively impacting lubricant consumption. The manufacturing sector, in particular, is seeing renewed investment in automation and advanced machinery, further increasing the need for specialized lubricants to support smooth operational cycles and reduce energy losses. Furthermore, sustainability concerns are prompting lubricant manufacturers to innovate with environmentally friendly alternatives. Bio-based and low-toxicity formulations are being developed to meet both regulatory compliance and corporate environmental responsibility goals. In conclusion, the lubricants market is set to benefit from both the resurgence of global industrial activity and the strategic emphasis on equipment longevity and operational efficiency. With mining and heavy industries driving demand, coupled with advancements in lubricant formulations, the market outlook remains optimistic for the foreseeable future.

Increasing Demand for Lubricants from Wind Energy Sector to Create Growth Opportunities in the Market

Wind energy is among the fastest-growing renewable energy technologies, holding a potential share for consuming lubricants in the power industry. As per the data published by WindEurope, in 2023, Europe installed 18.3 GW of new wind power capacity and is expected to install 260 GW of new wind power capacity over 2024–2030. As several countries in the region are embracing renewable energy sources, particularly wind power, the need for specialized lubricants to ensure the smooth functioning of wind turbines becomes paramount. These lubricants enhance the operational efficiency and lifespan of the intricate machinery involved in harnessing wind energy. The expanding wind energy sector requires a reliable and consistent supply of high-performance lubricants to mitigate wear and tear, reduce friction, and prevent corrosion in the mechanical components of wind turbines. This demand opens avenues for research and development, encouraging innovation in lubricant formulations tailored to the unique challenges posed by the wind energy environment.

Lubricants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the lubricants market analysis are base oil, type, and end-use industry.

By base oil, the lubricants market is segmented into mineral oil, synthetic oil, and bio-based oil.

Based on type, the market is segmented into hydraulic fluid, engine oil, driveline lubricants, metalworking fluids, grease, process oils, coolants, and others.

In terms of end-use industry, the market is segmented into automotive, building and construction, power generation, mining and metallurgy, food processing, oil and gas, marine, aviation, and others. The automotive segment is further segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and others.

Lubricants Market Share Analysis by Geography

The geographical scope of the lubricants market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to dominate the market over the forecast period. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles compared to 2021. According to the China Association of Automobile Manufacturers, ~6,000 fuel-cell electric vehicles were sold in China in 2023, a year-on-year rise of 72%. According to the India Brand Equity Foundation, the annual production of automobiles in 2023 reached 25.9 million vehicles in India. In September 2024, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 2,773,039 units. Lubricants are used in automotive components such as engines, transmissions, and differentials where they provide lubrication to reduce friction, and enhance fuel efficiency, subsequently ensuring optimal performance and longevity of vehicles.

China, Japan, and South Korea are leading countries in the shipbuilding sector. Shipbuilding greases confer properties such as resistance to elements and corrosive saltwater, resistance to high pressure, and increased lifespans for ship components.

Lubricants

Lubricants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 175.73 Billion |

| Market Size by 2031 | US$ 236.71 Billion |

| Global CAGR (2025 - 2031) | 4.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

The Lubricants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Lubricants Market News and Recent Developments

The lubricants market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the lubricants market are listed below:

- Castrol launched the 'First Car Love Stories' campaign in the UK to drive brand awareness and sales. (Castrol Limited, Company Website, August 2024)

- Repsol joined forces with Tekniker to develop lubricants using nanotechnology. (Repsol, Company Website, September 2024)

- Repsol launched its new lubricant packaging incorporating 60% recycled plastic content. (Repsol, Company Website, March 2024)

- Castrol launched a new VECTON fully synthetic commercial vehicle lubricant that meets new ACEA Heavy-Duty specifications. (Castrol Limited, Company Website, August 2024)

- ExxonMobil expanded Mobil branded lubricants and chemical products with a focus on quality product innovation. (ExxonMobil, Company News, September 2023)

- Shell Lubricants acquired UK-based MIDEL and MIVOLT, strengthening its product portfolio for the power and renewables sectors. (Shell, Company News, October 2023)

Lubricants Market Report Coverage and Deliverables

The "Lubricants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Lubricants market size and forecast for all the key market segments covered under the scope

- Lubricants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Lubricants market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the lubricants market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For