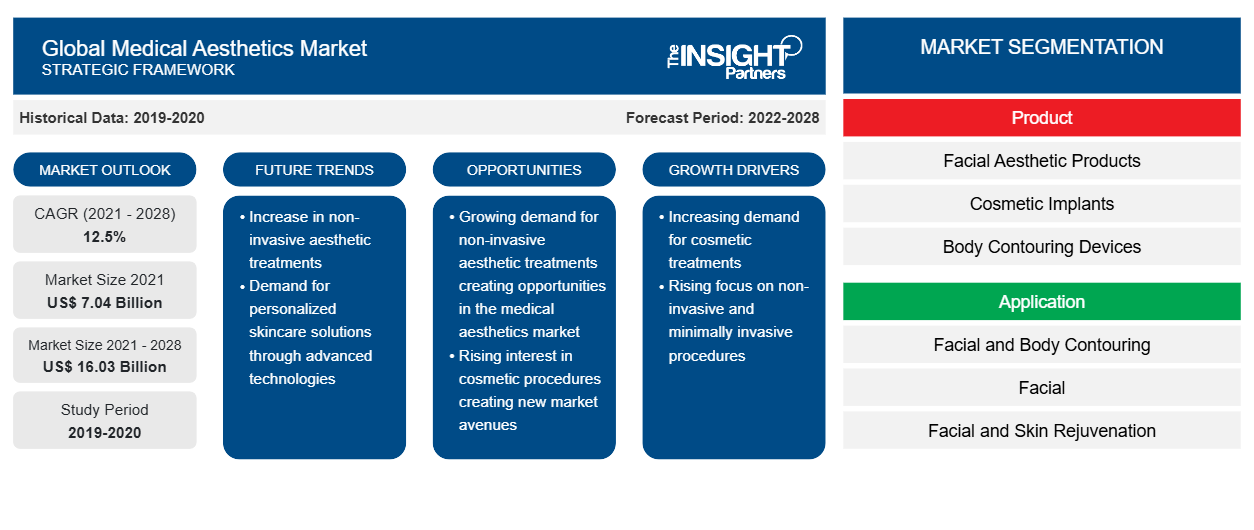

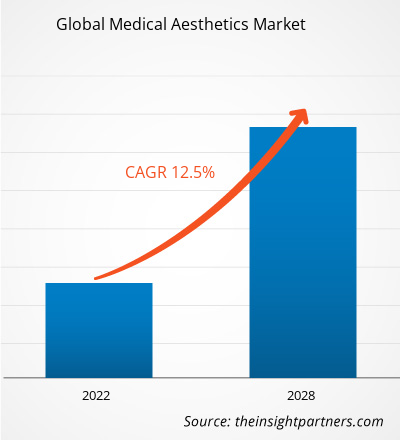

[Research Report] The medical aesthetics market generated US$ 7,039.06 million in 2021 and is projected to hit US$ 16,034.87 million by 2028, rising at a record annual growth rate of 12.5% during 2021–2028.

Market Insights and Analyst View:

The medical aesthetics market is estimated to flourish with a significant growth rate during 2021–2028. The market's growth is attributed to the growing awareness among young and adults about skin aesthetic procedures. In addition, the market’s growth is widely defined by the availability of minimally invasive medical aesthetic procedures and products requiring less effort and providing faster results. Key factors, such as increasing product launches and a growing number of medical aesthetic clinics and hospitals, significantly contribute to the growth of the global medical aesthetic market.

In addition, the growing medical tourism in the Asia Pacific region has led to the growth of the medical aesthetic market. Moreover, there is a rise in the trend of adopting Korean beauty techniques and products that has enhanced the sale of Korean brands for skin aesthetics. There is a rise in ‘K’ beauty, leveraging Korea medical aesthetic market. Further, people in the old age group widely use facial aesthetic products and body contouring products. At the same time, cosmetic implants are widely used in young people.

Growth Drivers and Challenges:

The World Health Organization (WHO) recognizes waste reduction in healthcare delivery as an important aspect of strengthening health systems. Technological advancements have led to the development of surgical approaches that minimize waste and achieve better results with the available resources. Minimally invasive surgeries (MIS) are among the approaches that result in low waste generation and reduced medical expenses; moreover, these surgeries ensure low absenteeism at the workplace, which has a net positive effect on the productivity of an economy. According to the American Society of Plastic Surgeons, 17.7 million surgical and minimally invasive cosmetic procedures were performed in the US in 2018. The use of these surgeries rose sharply by 228% during 2018–2000 in the US, and they now account for ~90% of aesthetic interventions in the country. Minimal invasiveness results in faster recovery, lesser scarring, limited stress, and better patient satisfaction.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Medical Aesthetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Medical Aesthetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The modern concept of natural and harmonious rejuvenation is based on a comprehensive, three-dimensional, multi-layered approach that combines several active ingredients and techniques in surgical procedures such as skin relaxation, volume enlargement, volume repositioning, reshaping, surface renewal, and skin tightening, depending on the specific patient needs. Since the appearance of the skin is considered an important factor in wellbeing and health, the number of aesthetic procedures performed around the world is increasing steadily. Further, nonsurgical procedures include facial injections and cryolipolysis, among others. These short procedures that help correct facial lines, wrinkles, cellulite reduction, and unwanted fat reduction with minimal side effects. The International Society of Aesthetic Plastic Surgery (ISAPS) defines a nonsurgical cosmetic procedure as an effective and safe procedure for those who willing to undergo subtle enhancement and surgical result enhancement with lower recovery periods; these procedures often do not require extensive training, unlike surgical procedures that are associated with greater risks. As per ISAPS estimations, the number of nonsurgical cosmetic procedures have increased by 51.4% from 2011 to 2017. With the proliferation of the medical aesthetics industry, competition is also inevitably increasing. It is a heterogeneous industry as the competition is not only among beauty clinics specializing in surgical cosmetic procedures, but other beauty service providers such as salons and also compete with them.

In the past 20 years, minimally invasive procedures have undergone continuous innovations. In 2017, doctors performed 15.7 million minimally invasive procedures in North America. Thus, surge in the adoption of minimally invasive and non-invasive aesthetic procedures is driving the medical aesthetics market growth.

In contrast, clinical risks and complications associated with procedures are hindering the growth of the medical aesthetic market. Cutaneous and aesthetic surgeries are generally considered low-risk surgeries in terms of patient morbidity and mortality. However, most adverse events go unreported due to a lack of regulation and insufficient enforcement. Many aesthetic procedures, such as spas and beauty salons, are performed in non-medical or quasi-medical settings. Most individual doctors and even hospitals tend to brush these adverse events under the rug to avoid adverse media exposure. However, a lot of awareness about these problems has been showcased and brought to the public attention, leading to obstacles to market growth.

Report Segmentation and Scope:

The “Global Medical Aesthetics Market” is segmented based on product, application, and end user. Based on product, the medical aesthetics market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices, and others. Based on application, the market is classified into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. Based on end user, the market is segmented into hospitals, dermatology clinics, and medical spas and beauty centers. On the basis of geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis:

Based on product, the medical aesthetic market is bifurcated into facial aesthetic products (dermal fillers, botulinum toxin, and microdermabrasion devices), body contouring devices (liposuction devices, nonsurgical fat reduction devices, and cellulite reduction devices), cosmetic implants (breast implants, facial implants, and others), skin aesthetic devices (laser skin resurfacing devices, light therapy devices, nonsurgical skin tightening devices, and micro-needling products), hair removal devices, tattoo removal devices, and others. In 2021, the facial aesthetic products segment held the largest market share by product. The same segment of the medical aesthetics market is also expected to witness the fastest CAGR during 2021 – 2028.

On the basis of application, the medical aesthetic market is classified into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. In 2021, the facial and body contouring segment held the largest share of the market by application. At the same time, the breast augmentation segment is expected to grow at the fastest CAGR during the forecast years.

Based on the end user, the medical aesthetics market is bifurcated into hospitals, dermatology clinics, medical spas and beauty centers, and home care. In 2021, the hospitals segment held the largest share of the market by end-user, and the same segment is expected to grow at the fastest CAGR during the forecast years.

Regional Analysis:

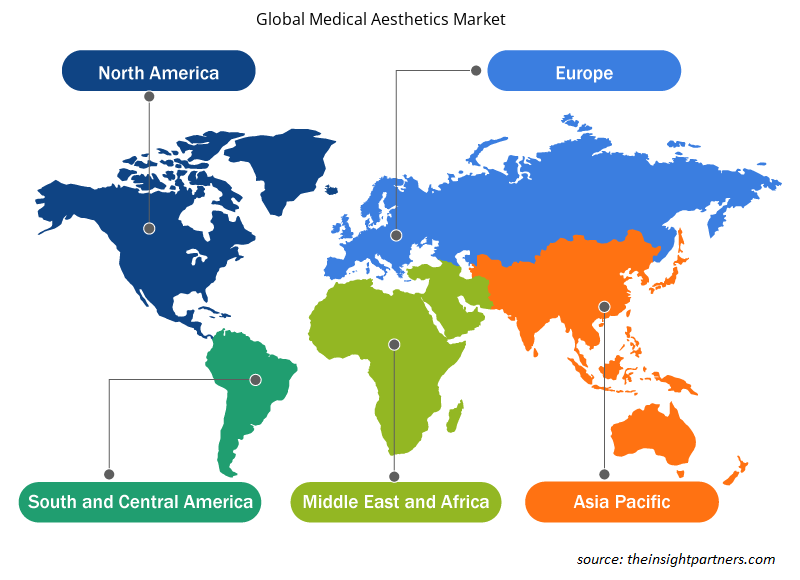

Based on geography, theglobal medical aesthetic market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2021, North America held the largest share of the global medical aesthetic market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The US medical aesthetic market was the leading in the North American region. Several factors drew market growth in the US, such as rising aesthetic procedures and the growing development of noninvasive aesthetic devices.

The Asia Pacific includes countries such as China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. This region accounted for over 26.57% of the global medical aesthetic market in 2021 owing to the large population of countries such as China and India, the increasing focus of market players, and the introduction of new products or therapies in the country. Moreover, the rising incidence of skin rejuvenation, growing awareness of cosmetic procedures to improve aesthetic appeal, increase in healthcare expenditure, and availability of technological advancements in aesthetic products helps to boost the growth of the medical aesthetic market in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by top aesthetic medical device companies operating in the global medical aesthetic market are listed below:

- In January 2021, Allergan Aesthetics announced that they had entered into a warrant agreement with Cypris Medical, a privately held, medical device company in Chicago. After completing a clinical trial in 2021, Allergan Aesthetics will have the right to exercise an option to acquire Cypris Medical, including the company's Xact device. The planned clinical trial will evaluate the safety and effectiveness of Xact in treating midface descent and neck lifts.

- In October 2020, Alma unveiled its new Alma Hybrid. Designed to enable endless options of ablative, non-ablative, and thermal treatments for skin rejuvenation and scar revision, Alma Hybrid creates a unique synergistic effect by combining the power of three core energies, including CO2 laser, 1570nm laser, and IMPACT for Trans Epidermal Delivery (TED).

- In May-2021, Galderma expanded its consumer care portfolio in Switzerland. The expansion offers consumers more options for their dermatology needs. The move includes the introduction of the dermatologist-recommended CETAPHIL line for sensitive skin, as well as the expansion of the DAYLONG brand for sun protection.

Covid-19 Impact:

Worldwide, due to an increased number of infected patients, healthcare professionals and leading organizations were distracted, and the focus was more on treating COVID-19-infected people. The focus on innovations and new product launches for aesthetic products was restricted. Moreover, cosmetic surgeons with a unique perspective of working with patients and their teams create difficulties and challenges in distress. For instance, in North America, in light of the pandemic of COVID-19, the American Society of Plastic Surgeons (ASPS) in May 2020 released a statement to urge the suspension of elective and non-essential procedures of cosmetic and laser surgeries in the US.

The ASPS also stated that the necessary action resulted in a detrimental financial effect on the aesthetic surgery community. However, the organization put in its best efforts to continue the consultations for medical interventions through virtual platforms. The ASPS encouraged the use of telehealth in order to arrange the preoperative consults and follow-up appointments of post-operative patients.

In addition, the cosmetic surgery societies implemented various strategies to curb financial losses and have amended their policies to support small businesses, such as the Small Business Administration offering expanded disaster impact loans and deferment of the federal income tax payments that helped companies to stabilize their losses.

Medical Aesthetics Global Medical Aesthetics Market Regional Insights

The regional trends and factors influencing the Global Medical Aesthetics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Global Medical Aesthetics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Global Medical Aesthetics Market

Global Medical Aesthetics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.04 Billion |

| Market Size by 2028 | US$ 16.03 Billion |

| Global CAGR (2021 - 2028) | 12.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Global Medical Aesthetics Market Players Density: Understanding Its Impact on Business Dynamics

The Global Medical Aesthetics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Global Medical Aesthetics Market are:

- ALLERGAN

- Hologic Inc.

- Mentor Worldwide LLC

- Lumenis

- Cutera

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Global Medical Aesthetics Market top key players overview

Competitive Landscape and Key Companies:

Some of the prominent medical aesthetics companies operating in the medical aesthetic market include ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc., and EL.EN. S.P.A., amongst others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Frequently Asked Questions

Which is the most influencing segment growing in the medical aesthetics market report?

The global medical aesthetics market based on product is segmented into facial aesthetic products, cosmetic implants, body contouring devices, skin aesthetic devices, hair removal devices, tattoo removal devices, others. In 2021, the facial aesthetic products segment held the largest share of the market, by product and is also expected to witness fastest CAGR during 2021 to 2028.

What is the market value of medical aesthetics market based on region?

The global medical aesthetics market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North American area holds the largest market for aesthetic skin devices. The United States held the most significant medical aesthetics market and is expected to grow due to factors such as the increasing number of people with obesity adopting aesthetic skin procedures, technological advancements by key players in aesthetic skin devices, and others.

The Asia Pacific region is expected to account for the fastest growth in the medical aesthetics market. In Japan and South Korea, the market is expected to grow owing to the development of the healthcare systems and proliferating medical tourism.

What are the factors impacting for the medical aesthetics market ?

The factors that are driving and restraining factors that will affect medical aesthetics market in the coming years. Factors such as growing adoption of minimally invasive and non-invasive aesthetic procedures, increasing use of dermal fillers and botulinum toxin for enhancing facial aesthetic are driving the market growth. However, clinical risks and complications associated with procedures are likely to hamper the growth of the market.

Who are the major players in the medical aesthetics market?

The medical aesthetics market majorly consists of the players such as ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc. and EL.EN. S.P.A. are amongst others.

What is Medical Aesthetics?

Aesthetic Medicine comprises all medical procedures that are aimed at improving the physical appearance and satisfaction of the patient, using non-invasive to minimally invasive cosmetic procedures. The Aesthetic Medicine specialty is not confined to dermatologists and plastic surgeons as doctors of all specialties seek to offer services to address their patient's aesthetic needs and desires. Some Aesthetic Medicine procedures are performed under local anesthesia while some procedures don't require anesthetics at all.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Medical Aesthetics Market

- ALLERGAN

- Hologic Inc.

- Mentor Worldwide LLC

- Lumenis

- Cutera

- Solta Medical (Bausch Health Companies Inc.)

- Alma Lasers

- Galderma Laboratories (Nestle)

- Sientra, Inc.

- EL.EN. S.P.A.

Get Free Sample For

Get Free Sample For