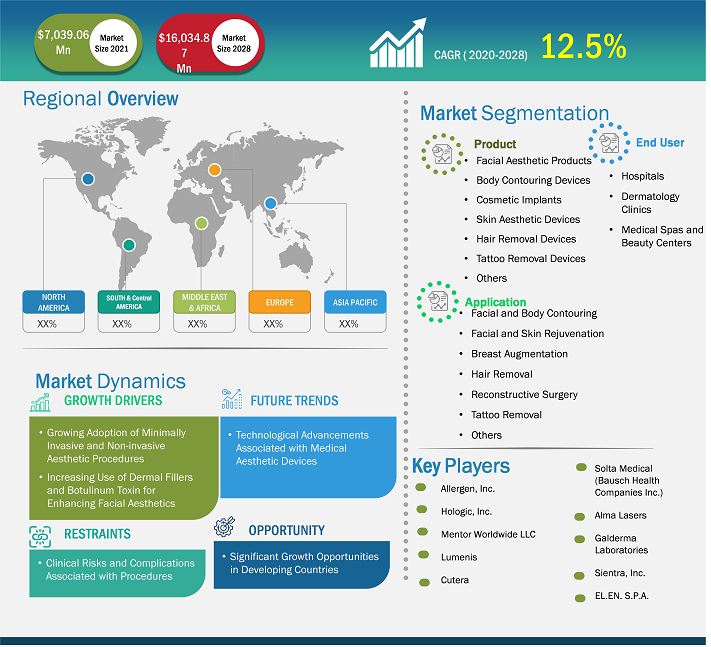

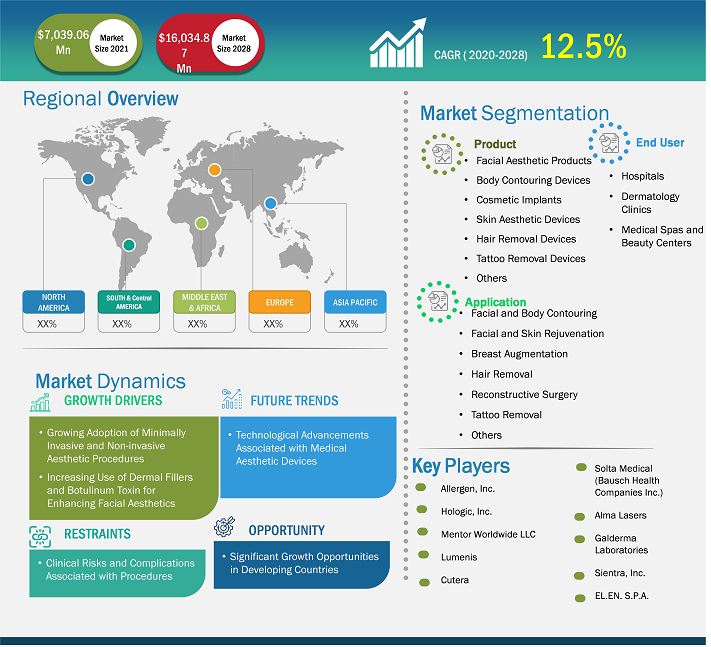

[Research Report] The medical aesthetics market generated US$ 7,039.06 million in 2021 and is projected to hit US$ 16,034.87 million by 2028, rising at a record annual growth rate of 12.5% during 2021–2028.

Market Insights and Analyst View:

The medical aesthetics market is estimated to flourish with a significant growth rate during 2021–2028. The market's growth is attributed to the growing awareness among young and adults about skin aesthetic procedures. In addition, the market’s growth is widely defined by the availability of minimally invasive medical aesthetic procedures and products requiring less effort and providing faster results. Key factors, such as increasing product launches and a growing number of medical aesthetic clinics and hospitals, significantly contribute to the growth of the global medical aesthetic market.

In addition, the growing medical tourism in the Asia Pacific region has led to the growth of the medical aesthetic market. Moreover, there is a rise in the trend of adopting Korean beauty techniques and products that has enhanced the sale of Korean brands for skin aesthetics. There is a rise in ‘K’ beauty, leveraging Korea medical aesthetic market. Further, people in the old age group widely use facial aesthetic products and body contouring products. At the same time, cosmetic implants are widely used in young people.

Growth Drivers and Challenges:

The World Health Organization (WHO) recognizes waste reduction in healthcare delivery as an important aspect of strengthening health systems. Technological advancements have led to the development of surgical approaches that minimize waste and achieve better results with the available resources. Minimally invasive surgeries (MIS) are among the approaches that result in low waste generation and reduced medical expenses; moreover, these surgeries ensure low absenteeism at the workplace, which has a net positive effect on the productivity of an economy. According to the American Society of Plastic Surgeons, 17.7 million surgical and minimally invasive cosmetic procedures were performed in the US in 2018. The use of these surgeries rose sharply by 228% during 2018–2000 in the US, and they now account for ~90% of aesthetic interventions in the country. Minimal invasiveness results in faster recovery, lesser scarring, limited stress, and better patient satisfaction.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Medical Aesthetics Market: Strategic Insights

Market Size Value in US$ 7,039.06 Million in 2021 Market Size Value by US$ 16,034.87 Million by 2028 Growth rate CAGR of 12.5% from 2021-2028 Forecast Period 2021-2028 Base Year 2021

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Global Medical Aesthetics Market: Strategic Insights

| Market Size Value in | US$ 7,039.06 Million in 2021 |

| Market Size Value by | US$ 16,034.87 Million by 2028 |

| Growth rate | CAGR of 12.5% from 2021-2028 |

| Forecast Period | 2021-2028 |

| Base Year | 2021 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

The modern concept of natural and harmonious rejuvenation is based on a comprehensive, three-dimensional, multi-layered approach that combines several active ingredients and techniques in surgical procedures such as skin relaxation, volume enlargement, volume repositioning, reshaping, surface renewal, and skin tightening, depending on the specific patient needs. Since the appearance of the skin is considered an important factor in wellbeing and health, the number of aesthetic procedures performed around the world is increasing steadily. Further, nonsurgical procedures include facial injections and cryolipolysis, among others. These short procedures that help correct facial lines, wrinkles, cellulite reduction, and unwanted fat reduction with minimal side effects. The International Society of Aesthetic Plastic Surgery (ISAPS) defines a nonsurgical cosmetic procedure as an effective and safe procedure for those who willing to undergo subtle enhancement and surgical result enhancement with lower recovery periods; these procedures often do not require extensive training, unlike surgical procedures that are associated with greater risks. As per ISAPS estimations, the number of nonsurgical cosmetic procedures have increased by 51.4% from 2011 to 2017. With the proliferation of the medical aesthetics industry, competition is also inevitably increasing. It is a heterogeneous industry as the competition is not only among beauty clinics specializing in surgical cosmetic procedures, but other beauty service providers such as salons and also compete with them.

In the past 20 years, minimally invasive procedures have undergone continuous innovations. In 2017, doctors performed 15.7 million minimally invasive procedures in North America. Thus, surge in the adoption of minimally invasive and non-invasive aesthetic procedures is driving the medical aesthetics market growth.

In contrast, clinical risks and complications associated with procedures are hindering the growth of the medical aesthetic market. Cutaneous and aesthetic surgeries are generally considered low-risk surgeries in terms of patient morbidity and mortality. However, most adverse events go unreported due to a lack of regulation and insufficient enforcement. Many aesthetic procedures, such as spas and beauty salons, are performed in non-medical or quasi-medical settings. Most individual doctors and even hospitals tend to brush these adverse events under the rug to avoid adverse media exposure. However, a lot of awareness about these problems has been showcased and brought to the public attention, leading to obstacles to market growth.

Report Segmentation and Scope:

The “Global Medical Aesthetics Market” is segmented based on product, application, and end user. Based on product, the medical aesthetics market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices, and others. Based on application, the market is classified into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. Based on end user, the market is segmented into hospitals, dermatology clinics, and medical spas and beauty centers. On the basis of geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis:

Based on product, the medical aesthetic market is bifurcated into facial aesthetic products (dermal fillers, botulinum toxin, and microdermabrasion devices), body contouring devices (liposuction devices, nonsurgical fat reduction devices, and cellulite reduction devices), cosmetic implants (breast implants, facial implants, and others), skin aesthetic devices (laser skin resurfacing devices, light therapy devices, nonsurgical skin tightening devices, and micro-needling products), hair removal devices, tattoo removal devices, and others. In 2021, the facial aesthetic products segment held the largest market share by product. The same segment of the medical aesthetics market is also expected to witness the fastest CAGR during 2021 – 2028.

On the basis of application, the medical aesthetic market is classified into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal, and others. In 2021, the facial and body contouring segment held the largest share of the market by application. At the same time, the breast augmentation segment is expected to grow at the fastest CAGR during the forecast years.

Based on the end user, the medical aesthetics market is bifurcated into hospitals, dermatology clinics, medical spas and beauty centers, and home care. In 2021, the hospitals segment held the largest share of the market by end-user, and the same segment is expected to grow at the fastest CAGR during the forecast years.

Regional Analysis:

Based on geography, theglobal medical aesthetic market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2021, North America held the largest share of the global medical aesthetic market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The US medical aesthetic market was the leading in the North American region. Several factors drew market growth in the US, such as rising aesthetic procedures and the growing development of noninvasive aesthetic devices.

The Asia Pacific includes countries such as China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. This region accounted for over 26.57% of the global medical aesthetic market in 2021 owing to the large population of countries such as China and India, the increasing focus of market players, and the introduction of new products or therapies in the country. Moreover, the rising incidence of skin rejuvenation, growing awareness of cosmetic procedures to improve aesthetic appeal, increase in healthcare expenditure, and availability of technological advancements in aesthetic products helps to boost the growth of the medical aesthetic market in the region.

Industry Developments and Future Opportunities:

Various initiatives taken by top aesthetic medical device companies operating in the global medical aesthetic market are listed below:

- In January 2021, Allergan Aesthetics announced that they had entered into a warrant agreement with Cypris Medical, a privately held, medical device company in Chicago. After completing a clinical trial in 2021, Allergan Aesthetics will have the right to exercise an option to acquire Cypris Medical, including the company's Xact device. The planned clinical trial will evaluate the safety and effectiveness of Xact in treating midface descent and neck lifts.

- In October 2020, Alma unveiled its new Alma Hybrid. Designed to enable endless options of ablative, non-ablative, and thermal treatments for skin rejuvenation and scar revision, Alma Hybrid creates a unique synergistic effect by combining the power of three core energies, including CO2 laser, 1570nm laser, and IMPACT for Trans Epidermal Delivery (TED).

- In May-2021, Galderma expanded its consumer care portfolio in Switzerland. The expansion offers consumers more options for their dermatology needs. The move includes the introduction of the dermatologist-recommended CETAPHIL line for sensitive skin, as well as the expansion of the DAYLONG brand for sun protection.

Covid-19 Impact:

Worldwide, due to an increased number of infected patients, healthcare professionals and leading organizations were distracted, and the focus was more on treating COVID-19-infected people. The focus on innovations and new product launches for aesthetic products was restricted. Moreover, cosmetic surgeons with a unique perspective of working with patients and their teams create difficulties and challenges in distress. For instance, in North America, in light of the pandemic of COVID-19, the American Society of Plastic Surgeons (ASPS) in May 2020 released a statement to urge the suspension of elective and non-essential procedures of cosmetic and laser surgeries in the US.

The ASPS also stated that the necessary action resulted in a detrimental financial effect on the aesthetic surgery community. However, the organization put in its best efforts to continue the consultations for medical interventions through virtual platforms. The ASPS encouraged the use of telehealth in order to arrange the preoperative consults and follow-up appointments of post-operative patients.

In addition, the cosmetic surgery societies implemented various strategies to curb financial losses and have amended their policies to support small businesses, such as the Small Business Administration offering expanded disaster impact loans and deferment of the federal income tax payments that helped companies to stabilize their losses.

Medical Aesthetics Market Report Scope

Competitive Landscape and Key Companies:

Some of the prominent medical aesthetics companies operating in the medical aesthetic market include ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc., and EL.EN. S.P.A., amongst others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve a large set of customers and subsequently increase their market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product ; Application ; End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoE, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global medical aesthetics market based on product is segmented into facial aesthetic products, cosmetic implants, body contouring devices, skin aesthetic devices, hair removal devices, tattoo removal devices, others. In 2021, the facial aesthetic products segment held the largest share of the market, by product and is also expected to witness fastest CAGR during 2021 to 2028.

The global medical aesthetics market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North American area holds the largest market for aesthetic skin devices. The United States held the most significant medical aesthetics market and is expected to grow due to factors such as the increasing number of people with obesity adopting aesthetic skin procedures, technological advancements by key players in aesthetic skin devices, and others.

The Asia Pacific region is expected to account for the fastest growth in the medical aesthetics market. In Japan and South Korea, the market is expected to grow owing to the development of the healthcare systems and proliferating medical tourism.

The factors that are driving and restraining factors that will affect medical aesthetics market in the coming years. Factors such as growing adoption of minimally invasive and non-invasive aesthetic procedures, increasing use of dermal fillers and botulinum toxin for enhancing facial aesthetic are driving the market growth. However, clinical risks and complications associated with procedures are likely to hamper the growth of the market.

The medical aesthetics market majorly consists of the players such as ALLERGAN, Hologic Inc., Mentor Worldwide LLC, Lumenis, Cutera, Solta Medical (Bausch Health Companies Inc.), Alma Lasers, Galderma Laboratories (Nestle), Sientra, Inc. and EL.EN. S.P.A. are amongst others.

Aesthetic Medicine comprises all medical procedures that are aimed at improving the physical appearance and satisfaction of the patient, using non-invasive to minimally invasive cosmetic procedures. The Aesthetic Medicine specialty is not confined to dermatologists and plastic surgeons as doctors of all specialties seek to offer services to address their patient's aesthetic needs and desires. Some Aesthetic Medicine procedures are performed under local anesthesia while some procedures don't require anesthetics at all.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Medical Aesthetics Market – By Product

1.3.2 Global Medical Aesthetics Market – By Application

1.3.3 Global Medical Aesthetics Market – By End User

1.3.4 Global Medical Aesthetics Market – By Geography

2. Medical Aesthetics Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Medical Aesthetics Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.2.2 Europe – PEST Analysis

4.2.3 Asia Pacific – PEST Analysis

4.2.4 Middle East and Africa (MEA) – PEST Analysis

4.2.5 South and Central America (SCAM) – PEST Analysis

4.3 Expert Opinions

5. Medical Aesthetics Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Adoption of Minimally Invasive and Non-invasive Aesthetic Procedures

5.1.2 Increasing Use of Dermal Fillers and Botulinum Toxin for Enhancing Facial Aesthetics

5.2 Market Restraints

5.2.1 Clinical Risks and Complications Associated with Procedures

5.3 Market Opportunities

5.3.1 Significant Growth Opportunities in Developing Countries

5.4 Future Trends

5.4.1 Technological Advancements Associated with Medical Aesthetic Devices

5.5 Impact analysis

6. Medical Aesthetics Market – Global Analysis

6.1 Global Medical Aesthetics Market Revenue Forecast and Analysis

6.2 Global Medical Aesthetics Market, By Geography - Forecast and Analysis

6.3 Market Positioning of Key Players

7. Medical Aesthetics Market Analysis and forecasts to 2028 – Product

7.1 Overview

7.2 Global Medical Aesthetics Market Share by Product 2021 & 2028 (%)

7.3 Facial Aesthetic Products

7.3.1 Overview

7.3.2 Facial Aesthetic Products Market Revenue and Forecast to 2028 (US$ Mn)

7.3.2.1 Dermal Fillers

7.3.2.1.1 Overview

7.3.2.1.2 Dermal Fillers Market Revenue and Forecast to 2028 (US$ Mn)

7.3.2.2 Microdermabrasion Devices

7.3.2.2.1 Overview

7.3.2.2.2 Microdermabrasion Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.3.2.3 Botulinum Toxin

7.3.2.3.1 Overview

7.3.2.3.2 Botulinum Toxin Market Revenue and Forecast to 2028 (US$ Mn)

7.4 Cosmetic Implants

7.4.1 Overview

7.4.2 Cosmetic Implants Market Revenue and Forecast to 2028 (US$ Mn)

7.4.2.1 Breast Implants

7.4.2.1.1 Overview

7.4.2.1.2 Breast Implants Market Revenue and Forecast to 2028 (US$ Mn)

7.4.2.2 Facial Implants

7.4.2.2.1 Overview

7.4.2.2.2 Facial Implants Market Revenue and Forecast to 2028 (US$ Mn)

7.4.2.3 Others

7.4.2.3.1 Overview

7.4.2.3.2 Others Market Revenue and Forecast to 2028 (US$ Mn)

7.5 Body Contouring Devices

7.5.1 Overview

7.5.2 Body Contouring Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.5.2.1 Nonsurgical Fat Reduction Devices

7.5.2.1.1 Overview

7.5.2.1.2 Nonsurgical Fat Reduction Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.5.2.2 Cellulite Reduction Devices

7.5.2.2.1 Overview

7.5.2.2.2 Cellulite Reduction Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.5.2.3 Liposuction Devices

7.5.2.3.1 Overview

7.5.2.3.2 Liposuction Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.6 Skin Aesthetic Devices

7.6.1 Overview

7.6.2 Skin Aesthetic Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.6.2.1 Laser Skin Resurfacing Devices

7.6.2.1.1 Overview

7.6.2.1.2 Laser Skin Resurfacing Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.6.2.2 Micro-Needling Products

7.6.2.2.1 Overview

7.6.2.2.2 Micro-Needling Products Market Revenue and Forecast to 2028 (US$ Mn)

7.6.2.3 Nonsurgical Skin Tightening Devices

7.6.2.3.1 Overview

7.6.2.3.2 Nonsurgical Skin Tightening Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.6.2.4 Light Therapy Devices

7.6.2.4.1 Overview

7.6.2.4.2 Light Therapy Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.7 Hair Removal Devices

7.7.1 Overview

7.7.2 Hair Removal Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.8 Tattoo Removal Devices

7.8.1 Overview

7.8.2 Tattoo Removal Devices Market Revenue and Forecast to 2028 (US$ Mn)

7.9 Others

7.9.1 Overview

7.9.2 Others Market Revenue and Forecast to 2028 (US$ Mn)

8. Medical Aesthetics Market Analysis and Forecasts TO 2028 – Application

8.1 Overview

8.2 Global Medical Aesthetics Market Share by Application 2021 & 2028 (%)

8.3 Facial and Body Contouring

8.3.1 Overview

8.3.2 Facial and Body Contouring Market Revenue and Forecast to 2028 (US$ Mn)

8.4 Facial and Skin Rejuvenation

8.4.1 Overview

8.4.2 Facial and Skin Rejuvenation Market Revenue and Forecast to 2028 (US$ Mn)

8.5 Breast Augmentation

8.5.1 Overview

8.5.2 Breast Augmentation Market Revenue and Forecast to 2028 (US$ Mn)

8.6 Hair Removal

8.6.1 Overview

8.6.2 Hair Removal Market Revenue and Forecast to 2028 (US$ Mn)

8.7 Reconstructive Surgery

8.7.1 Overview

8.7.2 Reconstructive Surgery Market Revenue and Forecast to 2028 (US$ Mn)

8.8 Tattoo Removal

8.8.1 Overview

8.8.2 Tattoo Removal Market Revenue and Forecast to 2028 (US$ Mn)

8.9 Others

8.9.1 Overview

8.9.2 Others Market Revenue and Forecast to 2028 (US$ Mn)

9. Medical Aesthetics Market Analysis and Forecasts TO 2028 – End-User

9.1 Overview

9.2 Global Medical Aesthetics Market Share by End-User 2021 & 2028 (%)

9.3 Hospitals

9.3.1 Overview

9.3.2 Hospitals Market Revenue and Forecast to 2028 (US$ Mn)

9.4 Dermatology Clinics

9.4.1 Overview

9.4.2 Dermatology Clinics Market Revenue and Forecast to 2028 (US$ Mn)

9.5 Medical Spas and Beauty Centers

9.5.1 Overview

9.5.2 Medical Spas and Beauty Centers Market Revenue and Forecast to 2028 (US$ Mn)

9.6 Home Care

9.6.1 Overview

9.6.2 Home Care Market Revenue and Forecast to 2028 (US$ Mn)

10. Medical Aesthetics Market - Geography

10.1 North America: Medical Aesthetics Market

10.1.1 Overview

10.1.2 North America: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.3 North America: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.1.3.1 North America: Medical aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.1.3.2 North America: Medical aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.1.3.3 North America: Medical aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.1.3.4 North America: Medical aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.1.4 North America: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.1.5 North America: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.1.6 North America: Medical Aesthetics Market, by Country, 2021 & 2028 (%)

10.1.6.1 US: Medical Aesthetics Market– Revenue and Forecast to 2028 (USD Million)

10.1.6.1.1 US: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.6.1.2 US: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.1.6.1.2.1 US: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.1.6.1.2.2 US: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.1.6.1.2.3 US: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.1.6.1.3 US: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.1.6.1.4 US: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.1.6.1.5 US: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.1.6.2 Canada: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.6.2.1 Canada: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.6.2.2 Canada: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.1.6.2.2.1 Canada: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.1.6.2.2.2 Canada: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.1.6.2.2.3 Canada: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.1.6.2.3 Canada: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.1.6.2.4 Canada: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.1.6.2.5 Canada: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.1.6.3 Mexico: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.6.3.1 Mexico: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.1.6.3.2 Mexico: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.1.6.3.2.1 Mexico: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.1.6.3.2.2 Mexico: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.1.6.3.2.3 Mexico: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.1.6.3.3 Mexico: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.1.6.3.4 Mexico: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.1.6.3.5 Mexico: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2 Europe: Medical Aesthetics Market

10.2.1 Overview

10.2.2 Europe: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.3 Europe: Medical aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.3.1 Europe: Medical aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.3.2 Europe: Medical aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.3.3 Europe: Medical aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.3.4 Europe: Medical aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.4 Europe: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.5 Europe: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6 Europe: Medical Aesthetics Market, by Country, 2021 & 2028(%)

10.2.6.1 Germany: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.1.1 Germany: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.1.2 Germany: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.1.2.1 Germany: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.1.2.2 Germany: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.1.2.3 Germany: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.1.3 Germany: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.1.4 Germany: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.1.5 Germany: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6.2 France: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.2.1 France: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.2.2 France: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.2.2.1 France: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.2.2.2 France: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.2.2.3 France: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.2.3 France: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.2.4 France: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.2.5 France: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6.3 UK: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.3.1 UK: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.3.2 UK: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.3.2.1 UK: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.3.2.2 UK: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.3.2.3 UK: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.3.3 UK: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.3.4 UK: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.3.5 UK: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6.4 Italy: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.4.1 Italy: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.4.2 Italy: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.4.2.1 Italy: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.4.2.2 Italy: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.4.2.3 Italy: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.4.3 Italy: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.4.4 Italy: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.4.5 Italy: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6.5 Spain: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.5.1 Spain: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.5.2 Spain: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.5.2.1 Spain: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.5.2.2 Spain: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.5.2.3 Spain: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.5.3 Spain: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.5.4 Spain: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.5.5 Spain: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.2.6.6 Rest of Europe: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.6.1 Rest of Europe: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.2.6.6.2 Rest of Europe: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.2.6.6.2.1 Rest of Europe: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.2.6.6.2.2 Rest of Europe: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.2.6.6.2.3 Rest of Europe: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.2.6.6.3 Rest of Europe: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.2.6.6.4 Rest of Europe: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.2.6.6.5 Rest of Europe: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3 Asia Pacific: Medical Aesthetics Market

10.3.1 Overview

10.3.2 Asia Pacific: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.3.3 Asia Pacific: Medical aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.3.1 Asia Pacific: Medical aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.3.2 Asia Pacific: Medical aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.3.3 Asia Pacific: Medical aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.3.4 Asia Pacific: Medical aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.4 Asia Pacific: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.5 Asia Pacific: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6 Asia Pacific: Medical Aesthetics Market, by Country, 2021 & 2028 (%)

10.3.6.1 Japan: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.1.1 Japan: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.1.2 Japan: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.1.2.1 Japan: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.1.2.2 Japan: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.1.2.3 Japan: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.1.3 Japan: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.1.4 Japan: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.1.5 Japan: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6.2 China: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.2.1 China: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.2.2 China: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.2.2.1 China: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.2.2.2 China: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.2.2.3 China: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.2.3 China: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.2.4 China: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.2.5 China: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6.3 India: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.3.1 India: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.3.2 India: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.3.2.1 India: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.3.2.2 India: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.3.2.3 India: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.3.3 India: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.3.4 India: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.3.5 India: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6.4 South Korea: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.4.1 South Korea: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.4.2 South Korea: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.4.2.1 South Korea: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.4.2.2 South Korea: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.4.2.3 South Korea: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.4.3 South Korea: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.4.4 South Korea: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.4.5 South Korea: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6.5 Australia: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.5.1 Australia: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.5.2 Australia: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.5.2.1 Australia: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.5.2.2 Australia: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.5.2.3 Australia: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.5.3 Australia: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.5.4 Australia: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.5.5 Australia: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.3.6.6 Rest of Asia Pacific: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.6.1 Rest of Asia Pacific: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.3.6.6.2 Asia Pacific: Medical Aesthetics Market, by Product, 2019–2028 (USD Million)

10.3.6.6.2.1 Asia Pacific: Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.3.6.6.2.2 Asia Pacific: Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.3.6.6.2.3 Asia Pacific: Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.3.6.6.3 Asia Pacific: Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.3.6.6.4 Asia Pacific: Medical Aesthetics Market, by Application, 2019–2028 (USD Million)

10.3.6.6.5 Asia Pacific: Medical Aesthetics Market, by End User, 2019–2028 (USD Million)

10.4 Middle East & Africa: Medical Aesthetics Market

10.4.1 Overview

10.4.2 Middle East & Africa: Medical Aesthetics Market - Revenue and Forecast to 2028 (US$ Million)

10.4.3 Middle East & Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

10.4.3.1 Middle East & Africa Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.4.3.2 Middle East & Africa Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.4.3.3 Middle East & Africa Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.4.3.4 Middle East & Africa Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.4.4 Middle East & Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

10.4.5 Middle East & Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

10.4.6 Middle East & Africa: Medical Aesthetics Market, by Country, 2021 & 2028 (%)

10.4.6.1 Saudi Arabia: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.4.6.1.1 Saudi Arabia: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.4.6.1.2 Saudi Arabia Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

10.4.6.1.2.1 Saudi Arabia Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.4.6.1.2.2 Saudi Arabia Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.4.6.1.2.3 Saudi Arabia Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.4.6.1.2.4 Saudi Arabia Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.4.6.1.3 Saudi Arabia Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

10.4.6.1.4 Saudi Arabia Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

10.4.6.2 UAE: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.4.6.2.1 UAE: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.4.6.2.2 UAE Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

10.4.6.2.2.1 UAE Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.4.6.2.2.2 UAE Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.4.6.2.2.3 UAE Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.4.6.2.2.4 UAE Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.4.6.2.3 UAE Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

10.4.6.2.4 UAE Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

10.4.6.3 South Africa: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.4.6.3.1 South Africa: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

10.4.6.3.2 South Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

10.4.6.3.2.1 South Africa Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.4.6.3.2.2 South Africa Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.4.6.3.2.3 South Africa Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.4.6.3.2.4 South Africa Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.4.6.3.3 South Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

10.4.6.3.4 South Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

10.4.6.4 Rest of Middle East and Africa: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.4.6.4.1 Rest of Middle East and Africa: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.4.6.4.2 Rest of Middle East & Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

10.4.6.4.2.1 Rest of Middle East & Africa Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.4.6.4.2.2 Rest of Middle East & Africa Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.4.6.4.2.3 Rest of Middle East & Africa Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.4.6.4.2.4 Rest of Middle East & Africa Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.4.6.4.3 Rest of Middle East & Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

10.4.6.4.4 Rest of Middle East & Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

10.5 South and Central America: Medical Aesthetics Market

10.5.1 Overview

10.5.2 South and Central America: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.5.3 South and Central America Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

10.5.3.1 South and Central America Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.5.3.2 South and Central America Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.5.3.3 South and Central America Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.5.3.4 South and Central America Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.5.4 South and Central America Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

10.5.5 South and Central America Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

10.5.6 South and Central America: Medical Aesthetics Market Share by Country – 2021 & 2028, (%)

10.5.6.1 Brazil: Medical Aesthetics Market- Revenue and Forecasts To 2028 (USD Million)

10.5.6.1.1 Brazil: Medical Aesthetics Market- Revenue and Forecasts To 2028 (USD Million)

10.5.6.1.2 Brazil Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

10.5.6.1.2.1 Brazil Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.5.6.1.2.2 Brazil Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.5.6.1.2.3 Brazil Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.5.6.1.2.4 Brazil Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.5.6.1.3 Brazil Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

10.5.6.1.4 Brazil Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

10.5.6.2 Argentina: Medical Aesthetics Market- Revenue and Forecasts To 2028 (USD Million)

10.5.6.2.1 Argentina: Medical Aesthetics Market- Revenue and Forecasts To 2028 (USD Million)

10.5.6.2.2 Argentina Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

10.5.6.2.2.1 Argentina Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.5.6.2.2.2 Argentina Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.5.6.2.2.3 Argentina Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.5.6.2.2.4 Argentina Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.5.6.2.3 Argentina Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

10.5.6.2.4 Argentina Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

10.5.6.3 Rest of South and Central America: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.5.6.3.1 Rest of South and Central America: Medical Aesthetics Market - Revenue and Forecast to 2028 (USD Million)

10.5.6.3.2 Rest of South and Central America Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

10.5.6.3.2.1 Rest of South and Central America Medical Aesthetics Market, by Facial Aesthetic Products, 2019–2028 (USD Million)

10.5.6.3.2.2 Rest of South and Central America Medical Aesthetics Market, by Cosmetic Implants, 2019–2028 (USD Million)

10.5.6.3.2.3 Rest of South and Central America Medical Aesthetics Market, by Body Contouring Devices, 2019–2028 (USD Million)

10.5.6.3.2.4 Rest of South and Central America Medical Aesthetics Market, by Skin Aesthetic Devices, 2019–2028 (USD Million)

10.5.6.3.3 Rest of South and Central America Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

10.5.6.3.4 Rest of South and Central America Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

11. Impact of COVID-19 Pandemic on Global Medical Aesthetics Market

11.1 North America: Impact Assessment of COVID-19 Pandemic

11.2 Europe: Impact Assessment Of COVID-19 Pandemic

11.3 Asia-Pacific: Impact Assessment of COVID-19 Pandemic

11.4 Middle East and Africa: Impact Assessment of COVID-19 Pandemic

11.5 South and Central America: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Organic Developments

12.3 Inorganic Developments

13. Company Profiles

13.1 Allergan Plc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Hologic, Inc.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Lumenis

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Cutera Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Solta Medical

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Alma Lasers

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Galderma

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Sientra

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 El.En. S.p.A.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Mentor Worldwide, LLC

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 2. North America Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 3. North America Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 4. North America Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 5. North America Medical Aesthetics Market, by Skin Aesthetic Devices – Revenue and Forecast to 2028 (USD Million)

Table 6. North America Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 7. North America Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 8. Number of Surgical Procedure Performed in 2018

Table 9. Number of Non-Surgical Procedure Performed in 2018

Table 10. US Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 11. US Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 12. US Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 13. US Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 14. US Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 15. US Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 16. US Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 17. Canada Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 18. Canada Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 19. Canada Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 20. Canada Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 21. Canada Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 22. Canada Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 23. Canada Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 24. Mexico Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 25. Mexico Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 26. Mexico Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 27. Mexico Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 28. Mexico Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 29. Mexico Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 30. Mexico Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 31. Europe Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 32. Europe Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 33. Europe Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 34. Europe Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 35. Europe Medical Aesthetics Market, by Skin Aesthetic Devices – Revenue and Forecast to 2028 (USD Million)

Table 36. Europe Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 37. Europe Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 38. Number of Cosmetic Surgery in Germany, 2018

Table 39. Germany Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 40. Germany Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 41. Germany Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 42. Germany Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 43. Germany Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 44. Germany Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 45. Germany Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 46. France Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 47. France Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 48. France Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 49. France Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 50. France Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 51. France Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 52. France Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 53. UK Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 54. UK Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 55. UK Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 56. UK Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 57. UK Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 58. UK Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 59. UK Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 60. Number of Cosmetic Procedures, Italy, 2018

Table 61. Italy Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 62. Italy Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 63. Italy Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 64. Italy Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 65. Italy Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 66. Italy Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 67. Italy Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 68. Spain Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 69. Spain Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 70. Spain Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 71. Spain Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 72. Spain Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 73. Spain Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 74. Spain Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 75. Rest of Europe Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 76. Rest of Europe Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 77. Rest of Europe Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 78. Rest of Europe Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 79. Rest of Europe Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 80. Rest of Europe Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 81. Rest of Europe Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 82. Asia Pacific Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 83. Asia Pacific Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 84. Asia Pacific Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 85. Asia Pacific Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 86. Asia Pacific Medical Aesthetics Market, by Skin Aesthetic Devices – Revenue and Forecast to 2028 (USD Million)

Table 87. Asia Pacific Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 88. Asia Pacific Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 89. Japan Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 90. Japan Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 91. Japan Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 92. Japan Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 93. Japan Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 94. Japan Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 95. Japan Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 96. China Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 97. China Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 98. China Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 99. China Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 100. China Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 101. China Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 102. China Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 103. Number of Cosmetic Surgery in India, 2018

Table 104. India Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 105. India Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 106. India Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 107. India Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 108. India Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 109. India Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 110. India Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 111. South Korea Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 112. South Korea Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 113. South Korea Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 114. South Korea Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 115. South Korea Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 116. South Korea Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 117. South Korea Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 118. Australia Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 119. Australia Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 120. Australia Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 121. Australia Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 122. Australia Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 123. Australia Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 124. Australia Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 125. Asia Pacific Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 126. Asia Pacific Medical Aesthetics Market, by Facial Aesthetic Products– Revenue and Forecast to 2028 (USD Million)

Table 127. Asia Pacific Medical Aesthetics Market, by Cosmetic Implants – Revenue and Forecast to 2028 (USD Million)

Table 128. Asia Pacific Medical Aesthetics Market, by Body Contouring Devices – Revenue and Forecast to 2028 (USD Million)

Table 129. Asia Pacific Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 130. Asia Pacific Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 131. Asia Pacific Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 132. Middle East & Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 133. Middle East & Africa Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 134. Middle East & Africa Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 135. Middle East & Africa Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 136. Middle East & Africa Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 137. Middle East & Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 138. Middle East & Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 139. Saudi Arabia Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 140. Saudi Arabia Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 141. Saudi Arabia Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 142. Saudi Arabia Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 143. Saudi Arabia Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 144. Saudi Arabia Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 145. Saudi Arabia Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 146. UAE Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 147. UAE Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 148. UAE Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 149. UAE Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 150. UAE Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 151. UAE Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 152. UAE Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 153. South Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 154. South Africa Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 155. South Africa Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 156. South Africa Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 157. South Africa Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 158. South Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 159. South Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 160. Rest of Middle East & Africa Medical Aesthetics Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 161. Rest of Middle East & Africa Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 162. Rest of Middle East & Africa Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 163. Rest of Middle East & Africa Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 164. Rest of Middle East & Africa Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 165. Rest of Middle East & Africa Medical Aesthetics Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 166. Rest of Middle East & Africa Medical Aesthetics Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 167. South and Central America Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 168. South and Central America Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 169. South and Central America Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 170. South and Central America Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 171. South and Central America Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 172. South and Central America Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 173. South and Central America Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

Table 174. Brazil Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 175. Brazil Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 176. Brazil Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 177. Brazil Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 178. Brazil Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 179. Brazil Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 180. Brazil Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

Table 181. Argentina Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 182. Argentina Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 183. Argentina Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 184. Argentina Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 185. Argentina Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 186. Argentina Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 187. Argentina Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

Table 188. Rest of South and Central America Medical Aesthetics Market, By Product – Revenue and Forecast to 2028 (USD Million)

Table 189. Rest of South and Central America Medical Aesthetics Market, by Facial Aesthetic Products – Revenue and Forecast to 2028 (USD Million)

Table 190. Rest of South and Central America Medical Aesthetics Market, by Cosmetic Implants– Revenue and Forecast to 2028 (USD Million)

Table 191. Rest of South and Central America Medical Aesthetics Market, by Body Contouring Devices– Revenue and Forecast to 2028 (USD Million)

Table 192. Rest of South and Central America Medical Aesthetics Market, by Skin Aesthetic Devices– Revenue and Forecast to 2028 (USD Million)

Table 193. Rest of South and Central America Medical Aesthetics Market, By Application – Revenue and Forecast to 2028 (USD Million)

Table 194. Rest of South and Central America Medical Aesthetics Market, By End User – Revenue and Forecast to 2028 (USD Million)

Table 195. Developments Done By Companies

Table 196. Glossary of Terms, Medical Aesthetics Market

LIST OF FIGURES

Figure 1. Medical Aesthetics Market Segmentation

Figure 2. Medical Aesthetics Market Segmentation, By Region

Figure 3. Medical Aesthetics Market Overview

Figure 4. Facial Aesthetic Products Segment Held Largest Share of Medical Aesthetics Market

Figure 5. Asia Pacific to Show Significant Growth During Forecast Period

Figure 6. Medical Aesthetics Market, by Geography (US$ Million)

Figure 7. Global Medical Aesthetics Market – Leading Country Markets (US$ Million)

Figure 8. Global Medical Aesthetics Market, Industry Landscape

Figure 9. North America PEST Analysis

Figure 10. Europe PEST Analysis

Figure 11. Asia Pacific PEST Analysis

Figure 12. Middle East and Africa (MEA) PEST Analysis

Figure 13. South and Central America (SCAM) PEST Analysis

Figure 14. Medical Aesthetics Market Impact Analysis Of Driver And Restraints

Figure 15. Global Medical Aesthetics Market – Revenue Forecast and Analysis – 2020- 2028

Figure 16. Global Medical Aesthetics Market – By Geography Forecast and Analysis – 2021- 2028

Figure 17. Market Positioning of Key Players in Global Medical Aesthetics Market

Figure 18. Global Medical Aesthetics Market Share by Product 2021 & 2028 (%)

Figure 19. Facial Aesthetic Products Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 20. Dermal Fillers Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 21. Microdermabrasion Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 22. Botulinum Toxin Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 23. Cosmetic Implants Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 24. Breast Implants Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 25. Facial Implants Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 26. Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 27. Body Contouring Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 28. Nonsurgical Fat Reduction Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 29. Cellulite Reduction Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 30. Liposuction Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 31. Skin Aesthetic Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 32. Laser Skin Resurfacing Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 33. Micro-Needling Products Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 34. Nonsurgical Skin Tightening Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 35. Light Therapy Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 36. Hair Removal Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 37. Tattoo Removal Devices Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 38. Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 39. Global Medical Aesthetics Market Share by Application 2021 & 2028 (%)

Figure 40. Facial and Body Contouring Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 41. Facial and Skin Rejuvenation Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 42. Breast Augmentation Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 43. Hair Removal Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 44. Reconstructive Surgery Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 45. Tattoo Removal Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 46. Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 47. Global Medical Aesthetics Market Share by End-User 2021 & 2028 (%)

Figure 48. Hospitals Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 49. Dermatology Clinics Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 50. Medical Spas and Beauty Centers Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 51. Home Care Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 52. North America: Medical Aesthetics Market, by Key Country – Revenue (2021) (USD Million)

Figure 53. North America Medical Aesthetics Market Revenue and Forecast to 2028 (USD Million)

Figure 54. North America: Medical Aesthetics Market, by Country, 2021 & 2028 (%)

Figure 55. US: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 56. Canada: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 57. Mexico: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 58. Europe: Medical Aesthetics Market, by Key Country – Revenue (2021) (USD Million)

Figure 59. Europe: Medical Aesthetics Market Revenue and Forecast to 2028 (USD Million)

Figure 60. Europe: Medical Aesthetics Market, by Country, 2021 & 2028 (%)

Figure 61. Germany: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 62. France: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 63. UK: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 64. Italy: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 65. Spain: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)

Figure 66. Rest of Europe: Medical Aesthetics Market – Revenue and Forecast to 2028 (USD Million)