Medical Foods for Inborn Errors of Metabolism Market Key Players and Forecast by 2031

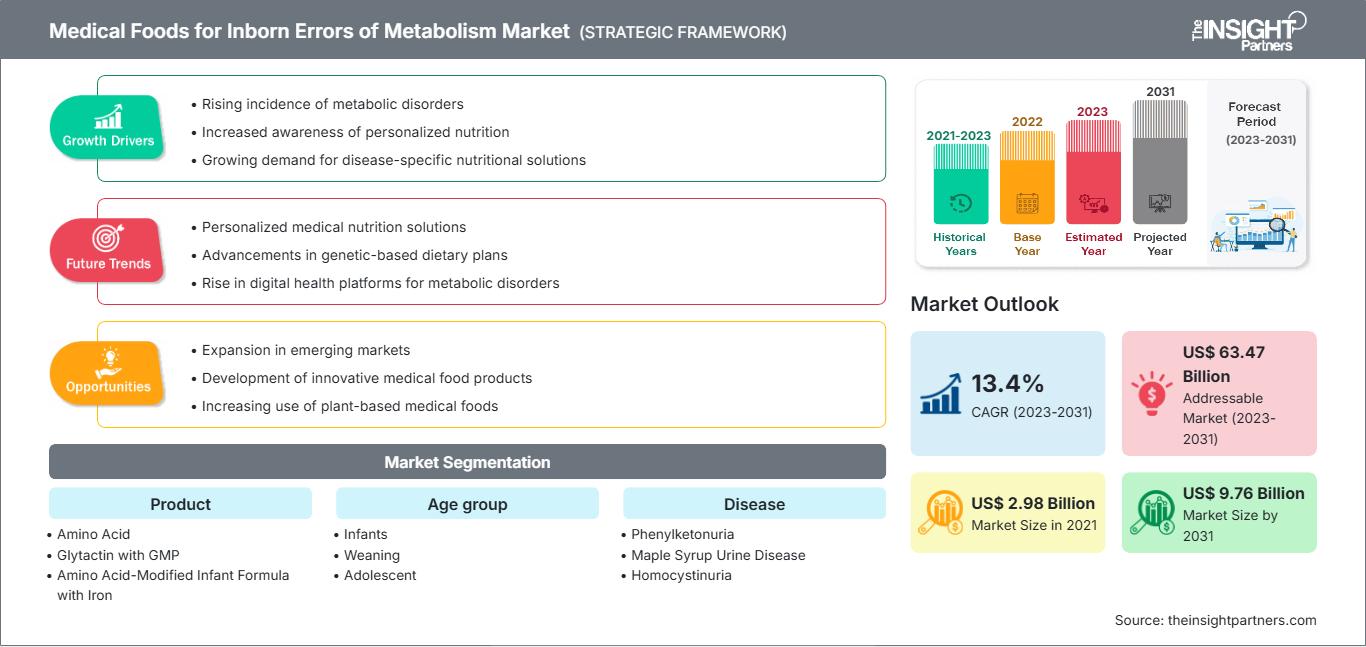

Medical Foods for Inborn Errors of Metabolism Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Amino Acid, Glytactin with GMP, Amino Acid-Modified Infant Formula with Iron, Low-Calcium/Vitamin D-Free Infant Formula with Iron, Low Protein Food, and Others), Age group (Infants, Weaning, Adolescent, and Adults), Disease (Phenylketonuria (PKU), Maple Syrup Urine Disease (MSUD), Homocystinuria, Urea Cycle Disorders, Methylmalonic Acidemia, Organic Acidurias, Propionic Acidemia, Isovaleric Acidemia, Disorders of Leucine Metabolism, Glutaric Acidemia Type I, Renal Disease, Tyrosinemia Types I and II, and Others), Forms (Powder, Liquids, Gels, and Others), Packaging (Can, Jar, Packets, Bottle, and Others), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, Drug Stores, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2021 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00011389

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

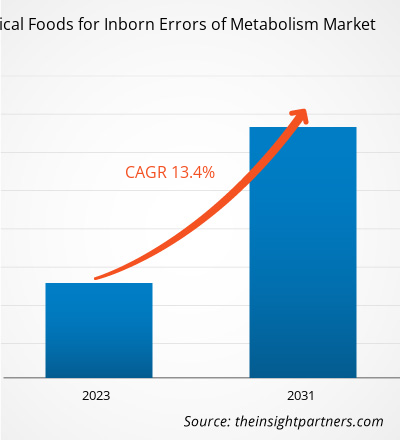

The Medical Foods for Inborn Errors of Metabolism Market Size was estimated to be US$ 2.98 billion in 2021 and US$ XX billion in 2023 and is expected to reach US$ 9.76 billion by 2031; it is estimated to record a CAGR of 13.4% in till 2031. Growing online distribution platforms are likely to remain key Medical Foods for Inborn Errors of Metabolism Market Trends.

Medical Foods for Inborn Errors of Metabolism Market Analysis

Inborn errors of metabolism refer to inherited disorders that are a result of mutations in genes coding for proteins functioning in metabolism. The inborn errors of metabolism are a heterogeneous group of disorders and are likely to be inherited through spontaneous mutation. The diseases usually involve failure of metabolic pathways that are either involved in breakdown or storage of biomolecules such as carbohydrates, proteins, and fatty acids. According to the National Center for Biotechnology Information (NCBI) in July 2023, inborn errors occur in 1 among 2,500 births making them significantly common across the world. A few commonly occurring inborn errors of metabolism include phenylketonuria (PKU), maple syrup urine disease, galactosemia, and fructose intolerance. Medical foods for inborn errors of metabolism act as nutritional treatment for patients with limited or compromised capacity to ingest, digest, absorb, or metabolize ordinary foods or nutrients. Thus, the increasing incidence of these diseases worldwide is expected to augment the demand for medical foods for inborn errors of metabolism, thereby supporting the market growth.

Medical Foods for Inborn Errors of Metabolism Market Overview

North America is the largest market for medical foods for inborn errors of metabolism market, with the US holding the largest market share, followed by Canada. The growth of the market in the US is driven by factors such as, the rising prevalence of inborn errors of metabolism, increasing newborn screening, and availability of a wide range of medical food for varied metabolic errors. Similarly, in Canada, increasing government initiatives to raise awareness regarding rare genetic disorders and well-established healthcare infrastructure are leading to market growth.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Foods for Inborn Errors of Metabolism Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Foods for Inborn Errors of Metabolism Market Drivers and Opportunities

Government Initiatives and Programs for Creating Awareness About Inborn Errors of Metabolism to Favor Market

Australian Government launched The Inborn Errors of Metabolism (IEM) program, which helps people and families who have problems breaking down protein in their food. They need a special diet, and the IEM program helps them pay for their specialized food. This initiative is important because people with an IEM need low-protein, high-fat, and phenylalanine-free diets. These foods are very expensive. The money is used to buy these foods, so they stay on their diets and stay healthy. Thus, growing such initiatives by governments to create awareness about inborn errors of metabolism is a major driver of global inborn errors of metabolism market share.

Developing Healthcare Industry Worldwide– An Opportunity

The healthcare industry has been witnessing rapid transformations during the previous years. Countries across the globe have preferred advanced solutions that are simple to use and effective in healthcare. With a need for better healthcare facilities, technology-enabled care (TEC) solutions are being preferred in the healthcare systems in emerging economies. Increase in the aging population, incidences of chronic illnesses, and lack of pediatric care, as well as genetic disorders, are likely to be the primary factors driving the growth of the healthcare industry.

Various established players in the industry have been investing significant amounts of their revenue in R&D activities for the development of better and advanced solutions to cater the increasing needs of their customers. Also, the availability of reimbursement for various medical foods increasing these days is expected to fuel the growth of the industry in the coming years. With regulations laid down by the government bodies, it is possible to obtain better and reliable health management solutions, ensuring quality care, patient safety, and disease management. For instance, In July 2023, The Food and Drug Administration (FDA) has released a revised draft guidance for the industry on optimizing and standardizing diet in clinical trials for drug product development. The guidance is titled "Inborn Errors of Metabolism That Use Dietary Management: Considerations for Optimising and Standardizing Diet in Clinical Trials for Drug Product Development." This guidance sets out the FDA's current recommendations for developing drug products that treat inborn errors of metabolism (IEM) where dietary management is a crucial part of patients' metabolic control. The FDA believes that optimizing and standardizing dietary management in these patients before and during clinical trials is vital to ensure an accurate evaluation of the efficacy of new drug products. The increasing focus towards preventive health and adoption of easy treatment options such as medical foods and nutritional supplements for the management of various metabolism associated diseases acquired during the birth are likely to offer opportunistic scenario for the growth of the market over coming years.

Medical Foods for Inborn Errors of Metabolism Market Report Segmentation Analysis

Key segments that contributed to the derivation of the medical foods for inborn errors of metabolism market analysis are product, age group, disease, form, packaging, distribution channel.

- Based on product, the medical foods for inborn errors of metabolism market is segmented into Amino Acid, Glytactin with GMP, Amino Acid-Modified Infant Formula with Iron, Low-Calcium/Vitamin D-Free Infant Formula with Iron, Low Protein Food, Others. The Amino Acid segment held a largest market share in 2023.

- By age group, the market is segmented into infants, weaning, adolescent, adults. The infants segment held the largest share of the market in 2023.

- In terms of disease, the market is segmented into Phenylketonuria(PKU), Maple syrup urine disease(MSUD), Homocystinuria, Urea Cycle Disorders , Methylmalonic Acidemia, Organic Acidurias, Propionic Acidemia, Isovaleric Acidemia, Disorders of Leucine Metabolism, Glutaric Acidemia Type I, Renal Disease, Tyrosinemia Types I and II, Others). The PKU segment dominated the market in 2023.

- In terms of form, the market is segmented into powder, liquids, gels, others. The powder segment dominated the market in 2023.

- In terms of packaging, the market is segmented into can, jar, packets, bottle, others. The can segment dominated the market in 2023.

- In terms of distribution channel, the market is segmented into retail pharmacies, hospital pharmacies, online pharmacies, drug stores, others. The hospital pharmacies segment dominated the market in 2023.

Medical Foods for Inborn Errors of Metabolism Market Share Analysis by Geography

The geographic scope of the medical foods for inborn errors of metabolism market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the medical foods for inborn errors of metabolism market. The market for medical foods for inborn errors of metabolism (IEMs) in the US holds the largest share among the countries of North America. Several government bodies in the country are engaged in establishing comprehensive guidelines for the management of IEMs. For instnace, in December 2023, the FDA announced the creation of a new advisory committee that will focus on potential treatments for genetic metabolic diseases. The committee, called the Genetic Metabolic Diseases Advisory Committee, will offer independent and knowledgeable advice and recommendations to the FDA on technical, scientific, and policy issues pertaining to medical products for genetic metabolic diseases. The members of the committee will evaluate evidence related to the applications brought before them and provide their recommendations for FDA consideration. The committee will comprise experts in the areas of management of inborn errors of metabolism, metabolic genetics, small population trial design, epidemiology, statistics, translational science, pediatrics, and other related specialties. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Medical Foods for Inborn Errors of Metabolism Market Regional InsightsThe regional trends and factors influencing the Medical Foods for Inborn Errors of Metabolism Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Foods for Inborn Errors of Metabolism Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Medical Foods for Inborn Errors of Metabolism Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.98 Billion |

| Market Size by 2031 | US$ 9.76 Billion |

| Global CAGR (2023 - 2031) | 13.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Foods for Inborn Errors of Metabolism Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Foods for Inborn Errors of Metabolism Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Medical Foods for Inborn Errors of Metabolism Market top key players overview

Medical Foods for Inborn Errors of Metabolism Market News and Recent Developments

The medical foods for inborn errors of metabolism market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for medical foods for inborn errors of metabolism:

- In October 2022, Galen launched TYR EASY Tablets, which is the first solid-dose protein substitute option for tyrosinaemia, in the UK market. The tablets are specifically designed to support dietary management for patients over the age of 8 with tyrosinaemia (TYR), providing them with more options for protein substitutes that best match their daily needs. (Source: Galen, Press Release, 2022)

- In December 2021, SFI Health announced the launch of two new medical foods in the US: EQUAZEN PRO and Ther-Biotic PRO IBS Relief. Both medical foods have been made from clinically-proven ingredients and have undergone extensive testing in clinical studies to assess their safety and effectiveness. EQUAZEN® PRO helps rebalance omega fatty acid levels, while supporting healthy fatty acid metabolism. (Source: SFI Health, Press Release/Company Website/Newsletter, 2021)

Medical Foods for Inborn Errors of Metabolism Market Report Coverage and Deliverables

The “Medical Foods for Inborn Errors of Metabolism Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For