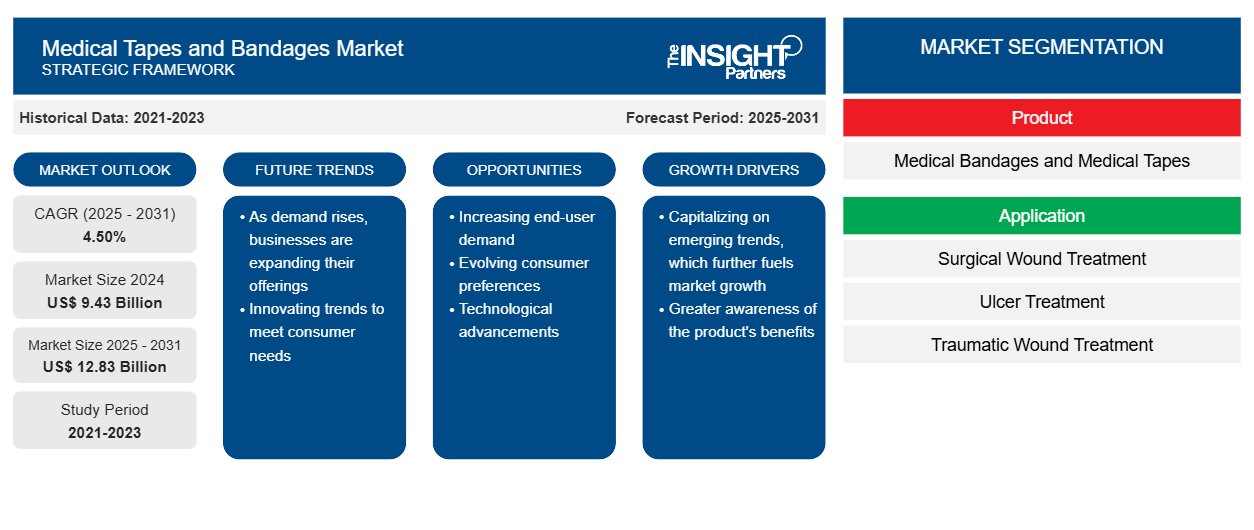

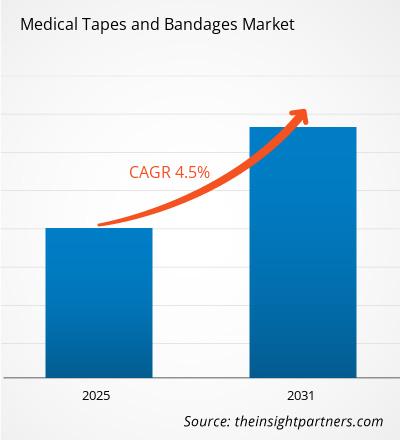

[Research Report] The Medical Tapes and Bandages Market Size is expected to grow from US$ 8.63 billion in 2022 to US$ 12.29 billion by 2031; it is estimated to register the growth rate of 4.5% over the forecast period.

Market Insights and Analyst View:

Medical tapes and bandages are products used to secure and protect wounds, injuries, and surgical incisions. These products include adhesive tapes, cohesive bandages, compression bandages, elastic bandages, and gauze dressings. The medical tapes and bandages market is primarily driven by the increasing prevalence of chronic disorders and injuries, rising demand for wound care products, and a surge in the geriatric population. Additionally, Technological advancements in medical tapes and bandages have led to the development of products with improved adhesion, flexibility, and breathability. Moreover, increasing product launches and strategic development by market players led to the growth of medical tapes and bandages.

Growth Drivers and Challenges:

According to the American College of Surgeons, approximately 1–2% of people globally are likely to experience a chronic wound once in their lifetime. Similarly, the Centers for Disease Control and Prevention (CDC) estimates that annually, ~385,000 sharp injuries occur among healthcare workers in the US, and the number is likely to reach up to 800,000 injuries annually. Besides sharp injuries, workplace injuries or occupational injuries are increasing worldwide. Poor working conditions are the major cause of the rise in chronic wounds. As per the International Labor Organization, ~2.3 million people suffer from work-related accidents every year. These wounds affect patients’ health and overall quality of life. The burden of chronic wounds eventually relates to the need for advanced wound care management to reduce the financial burden of national healthcare systems. Various countries spend significant amounts on treating injuries and avoiding associated risks. For instance, the US healthcare system spends over US$ 25 billion annually on treating wounds and related complications. Therefore, the demand for medical tapes and bandages is increasing with a surge in the prevalence of chronic wounds globally.

Furthermore, the number of cardiovascular, orthopedic, general, cancer, and gynecological surgeries performed in hospitals is increasing rapidly worldwide. For instance, the European Commission said that ~ 1.14 million cesarean sections were performed in the European region in 2021. Furthermore, the surge in the geriatric population is one of the major factors responsible for severe health conditions leading to surgical treatment. Surgeries for hernias and cataracts are more common among elderly people. Furthermore, aesthetic surgeries are more common in the entertainment industry. These surgeries are performed on individuals who require the replacement or reconstruction of a body part due to deformity or injury. Therefore, the increasing number of surgeries performed at hospitals or other healthcare centers is causing the demand for medical tapes and bandages.

However, increasing awareness about technologically advanced wound care products is expected to hamper the medical tapes and bandages market growth. The conventional medical tapes and bandages take a long time to heal the wound, and sometimes it gets infected. Advanced wound care products maintain favorable conditions, expedite healing, and offer advantages above conventional medical tapes and bandages. Thus, the factors discussed above will likely hinder the growth of medical tapes and bandages.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Tapes and Bandages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Tapes and Bandages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Medical Tapes and Bandages Market Size” is segmented based on product, application, end-user, and geography. Based on product, the medical tapes and bandages market is bifurcated into medical bandages and medical tapes. Based on application, the medical tapes and bandages market is categorized into ulcer treatment, surgical wound treatment, sports injury treatment, traumatic wound treatment, and others. Based on end users, the medical tapes and bandages market is categorized into hospitals, ambulatory surgery centers, clinics, and home care settings. The medical tapes and bandages market based on geography is fragmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on Product, the medical tapes and bandages market size is bifurcated into medical bandages and medical tapes. In 2022, the medical bandage segment held the larger market share; however, the medical tapes segment is estimated to register a higher growth rate during 2022-2031, owing to the increase in wounds. Bandages are mainly used for wound dressing, sports injuries, and fractures, preventing infections and expediting healing.

Based on application, the medical tapes and bandages market is segmented into surgical wound treatment, ulcer treatment, traumatic wound treatment, sports injury treatment, and others. In 2022, the surgical wound treatment segment held the largest market share; however, the ulcer treatment segment is expected to exhibit a significant growth rate during the coming years, owing to the increasing prevalence of chronic diseases, particularly diabetes, contributing to market growth.

Based on end users, the medical tapes and bandages market is categorized into hospitals, ambulatory surgery centers, clinics, and home care settings. In 2022, the hospital segment held the major market share and is expected to register the fastest growth rate from 2022 to 2031, owing to the increase in surgical procedures in hospitals for various chronic conditions, which is expected to support the overall market growth.

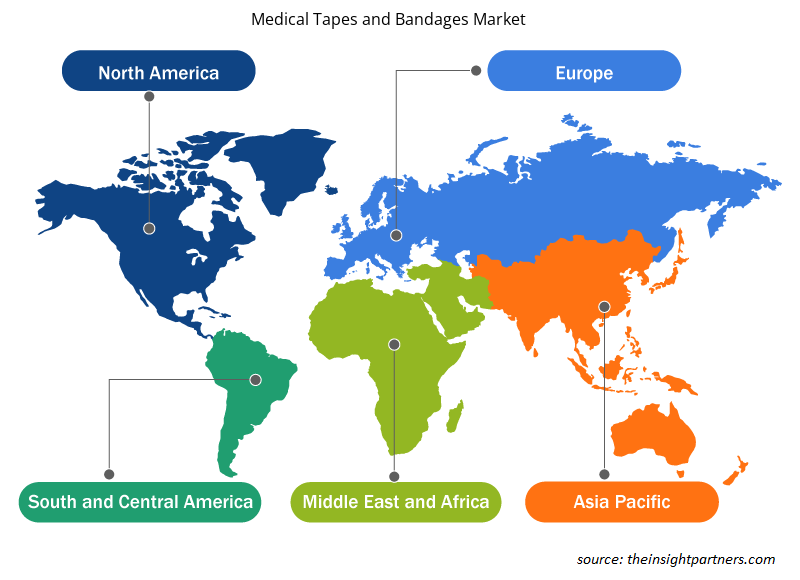

Regional Analysis:

The medical tapes and bandages market encompasses five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest medical tapes and bandages market share, closely followed by Europe, and Asia Pacific is estimated to register the highest CAGR during the forecast period. The major growth factors for the North American market are the surge in the geriatric population and the increasing number of surgical procedures performed annually in the region. The US accounts for the major market share in North America owing to the increase in surgical procedures and wound care in the US. According to the American Joint Replacement Registry (AJRR), it is estimated that by 2031, ~ 3.48 million people will be requiring knee replacement. The estimates are calculated by considering the baby boomers reaching old age in the United States.

Total Joint Replacement (TJR) is one of the most performed elective surgical procedures in the U.S. As per the American Academy of Orthopedic Surgeons (AAOS), by 2031, primary total hip replacement (THR) is projected to grow 171%. Primary total knee replacement (TKR) is expected to increase up to 189% for a projected 635,000 and 1.28 million procedures, respectively.

Meanwhile, some players are teaming up with start-up companies to develop joint ventures to strengthen their positions in the market. For instance, in March 2022, Medline and Hologenix partnered on a new CURAD brand of orthopedic products powered by CELLIANT infrared technology. This partnership substantially increases the commitment to expand the use of infrared in the orthopedic soft goods market.

However, Asia Pacific is the fastest-growing region in the global medical tapes and bandages market. The market in this region is expected to increase significantly in countries such as China, Japan, and India. The market's growth is attributed to the rising number of plastic surgeries and increasing demand for medical tourism in developing countries such as India and China. Moreover, the increase in surgical procedures and the surge in healthcare expenditure are expected to fuel market growth during 2022-2031. China accounts for the largest market share, and India is expected to exhibit the highest growth rate owing to the increasing number of surgical procedures and medical tourism in the country. The number of plastic surgeries performed in India is increasing day by day. According to the World Population Review report, ~ 370,656 plastic surgeries were performed in India during 2023. Additionally, China's changing attitudes toward self-image, growing wealth, technological advancements, and obsession with celebrity culture led to an increase in surgical procedures. In China, beauty is considered an advantage in the competitive mid-level workplace as applicants are often required to provide a photograph with their application.

Apart from Plastic surgeries, Orthopedic, and general surgeries are also propelling the market for medical tapes and bandages in China. According to the Economist Intelligence report, China has experienced a 20% increase in surgical volume in 2021 compared to 2021.

Moreover, The Lancet Commission for Global Surgery estimates that ~5,000 surgeries are required to reduce the surgical burden of disease for 1,00,000 people in low and middle-income countries, like India. As per the Ministry of Health and Family Welfare report, about two crore surgeries (which require hospitalization and general anesthesia) were conducted in 2021, and C-section was the most performed surgery. Out of the two crore surgeries done in 2021, 80 lakhs were general (including hernia, haemorrhoidectomy, trauma, cholecystectomy, and laparoscopy surgeries), followed by 50 lakh gynecology surgeries, out of which up to 70% or 35,00,000 were C-sections. Neurology, orthopedic gastrointestinal, oncology, and cardiology surgeries stood at 10 lakhs each. Additionally, the minimal cost of the surgeries in India attracts more foreign patients to visit India for various types of treatment. The lower cost of the surgeries is also responsible for the increasing medical tourism in India. The medical packages provided are very affordable to global health and wellness travelers. The leading hospitals in India have expertise in ophthalmology, cardiology, joint replacement, cardiothoracic surgery, urology, orthopedic surgery, gastroenterology, and multi-organ transplant surgery. All the surgeries are performed by expert surgeons who use the latest technological equipment, which are of comparatively lower prices than the other countries falling in the Western region.

Moreover, the treatments are offered according to the patient’s requirements and affordability. Therefore, there is an increase in medical tourism due to the lower cost of treatment and better facilities and treatment provided by the hospitals. These will enable the conducting of more surgical procedures and will eventually grow the medical tapes and bandages market during 2022-2031.

Industry Developments and Future Opportunities:

Various initiatives taken by major market players operating in the global medical tapes and bandages market are listed below:

- In October 2023, Global Biomedical Technology launched its new wound care products under comfort release, focusing on reducing adhesive-related skin injuries. Comfort Release products incorporate a patented release technology that temporarily switches off the adhesive when it’s time to remove the dressing. This solution largely overcomes the risk of medical adhesive-related skin injuries (MARSI) when removing dressings.

- In June 2023, Crest Medical Ltd acquired two highly differentiated wound care product brands, Irripod and Stericlens, from CD Medical Ltd. Adding these brands to the Crest Medical portfolio will further enhance the group’s position in the pharma, retail, hospital, and occupational health markets.

- In May 2023, Medline launched CURAD Naturals, an adhesive bandage line containing various all-natural healing ingredients to treat and protect wounds gently and effectively. The inherent soothing powers of well-known ingredients such as Aloe Vera, Vitamin E, and ARM & HAMMER Baking Soda are infused directly into the wound pad and bandage surface to cover and protect wounds during healing.

Competitive Landscape and Key Companies:

Some of the major manufacturers operating in the global medical tapes and bandages market include Medtronic, B. Braun Melsungen AG, Cardinal Health, Medline Industries, Inc., Smith Nephew plc, Derma Sciences Inc., Johnson & Johnson Services, Inc., PAUL HARTMANN AG, BSN medical, Mölnlycke Health Care AB. These companies focus on geographical expansions, new product launches, strategic collaboration, and product approval to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. Their wide global presence allows them to serve a large consumer base and subsequently increase their market share.

Report ScopeMedical Tapes and Bandages Market Regional Insights

The regional trends and factors influencing the Medical Tapes and Bandages Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Tapes and Bandages Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Tapes and Bandages Market

Medical Tapes and Bandages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 9.43 Billion |

| Market Size by 2031 | US$ 12.83 Billion |

| Global CAGR (2025 - 2031) | 4.50% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

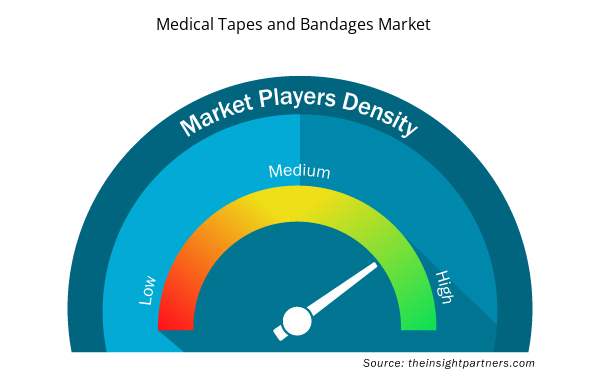

Medical Tapes and Bandages Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Tapes and Bandages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Tapes and Bandages Market are:

- B. Braun Melsungen AG

- Medtronic

- Cardinal Health

- Medline Industries, Inc.

- SmithNephewplc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Tapes and Bandages Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Educational Furniture Market

- Predictive Maintenance Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Public Key Infrastructure Market

- Hydrolyzed Collagen Market

- Tortilla Market

- Formwork System Market

- Radiopharmaceuticals Market

- Hot Melt Adhesives Market

- Pressure Vessel Composite Materials Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. B. Braun Melsungen AG

2. Medtronic

3. Cardinal Health

4. Medline Industries, Inc.

5. SmithNephewplc

6. Johnson & Johnson Services, Inc.

7. Derma Sciences Inc.

8. PAUL HARTMANN AG

9. BSN medical

10. Mölnlycke Health Care AB

Get Free Sample For

Get Free Sample For