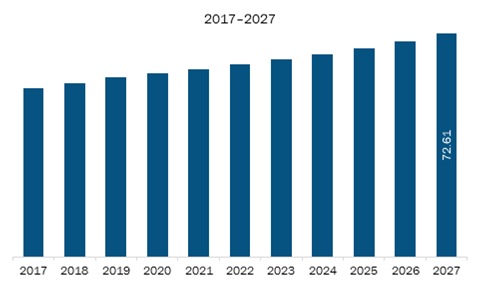

The drinking water adsorbents market in MEA is expected to grow from US$ 58.49 million in 2019 to US$ 72.61 million by 2027; it is estimated to grow at a CAGR of 2.8% from 2020 to 2027. Similarly, the drinking water adsorbents market in SAM is expected to grow from US$ 44.81 million in 2019 to US$ 57.25 million by 2027; it is estimated to grow at a CAGR of 3.2% from 2020 to 2027.

Bio-based adsorbents getting highly adopted is the major factor driving the MEA & SAM drinking water adsorbents market. Water quality has deteriorated over time, owing to the factors such as anthropogenic activity, unplanned urbanization, rapid industrialization, and unskilled use of natural water supplies. Further, increased awareness of the importance of providing impacts because of current environmental policies has moved the research community toward the creation of robust, economically viable, and environmentally sustainable processes capable of extracting pollutants from water while still protecting the health of populations. Owing to this, the demand for a few bio-based or organic adsorbents such as coconut shells, coal, and wood is growing in the drinking water adsorbents industry. Because of their superior adsorption performance, these products are highly useful in water quality management and purification. Further, they can also be used in a variety of applications for environmental preservation and regeneration. Moreover, bio-based adsorbents (also known as bio sorbents) are useful for purifying water as they can be generated from low-cost feedstocks, such as waste agricultural biomass or byproducts, have adsorption capacities comparable to other chemical adsorbents, and can be disposed of safely. Thus, the increasing focus on environment, which paves the way for the adoption of bio-based adsorbents, is emerging as a crucial trend in the MEA & SAM drinking water adsorbents market.

The ongoing COVID-19 pandemic is adversely impacting the MEA and SAM. Iran, Saudi Arabia, Qatar, South Africa, and the UAE are among the MEA countries with a high number of COVID-19 cases and deaths. These countries have experienced hindered economic and industrial growth in the past few months. The region comprises several growing economies such as the UAE, which are the prospective markets for drinking water adsorbents providers due to the presence of huge and diverse customer base. Most of the businesses in these countries have suspended their operations and are expected to operate with a slower pace. The MEA countries are taking significant containment measures to control the infection spread. The COVID-19 outbreak has severely affected the drinking water adsorbents market due to the shutdown of various drinking water adsorbents facilities in the MEA. In SAM, Brazil has reported the highest number of COVID-19 cases, followed by Ecuador, Peru, Chile, and Argentina, among others. The governments of SAM countries are taking several initiatives to protect people and control the spread of COVID-19 through lockdowns, trade bans, and travel restrictions. These measures are affecting their economic growth due to lower export revenues, both from the drop in commodity prices and reduction in export volumes. The outbreak has also resulted in the shutdown of production plants, which has impacted the growth of the chemical industries in SAM, thereby limiting the drinking water adsorbents market growth in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA & SAM drinking water adsorbents market. The MEA & SAM drinking water adsorbents market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA & SAM Drinking Water Adsorbents Market Segmentation

MEA & SAM Drinking Water Adsorbents Market – By Product

- Zeolite

- Clay

- Activated Alumina

- Activated Carbon

- Manganese Oxide

- Cellulose

- Others

MEA & SAM Drinking Water Adsorbents Market, by Country

- MEA

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- SAM

- Brazil

- Argentina

- Rest of SAM

MEA & SAM Drinking Water Adsorbents Market - Companies Mentioned

- BASF SE

- Dupont

- KURARAY CO. LTD

- Lenntech B.V.

- Purolite

Middle East & Africa and South America Drinking Water Adsorbents Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$US$ 44.81 Million |

| Market Size by 2027 | US$ 72.61 Million |

| CAGR (2020 - 2027) | 2.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For