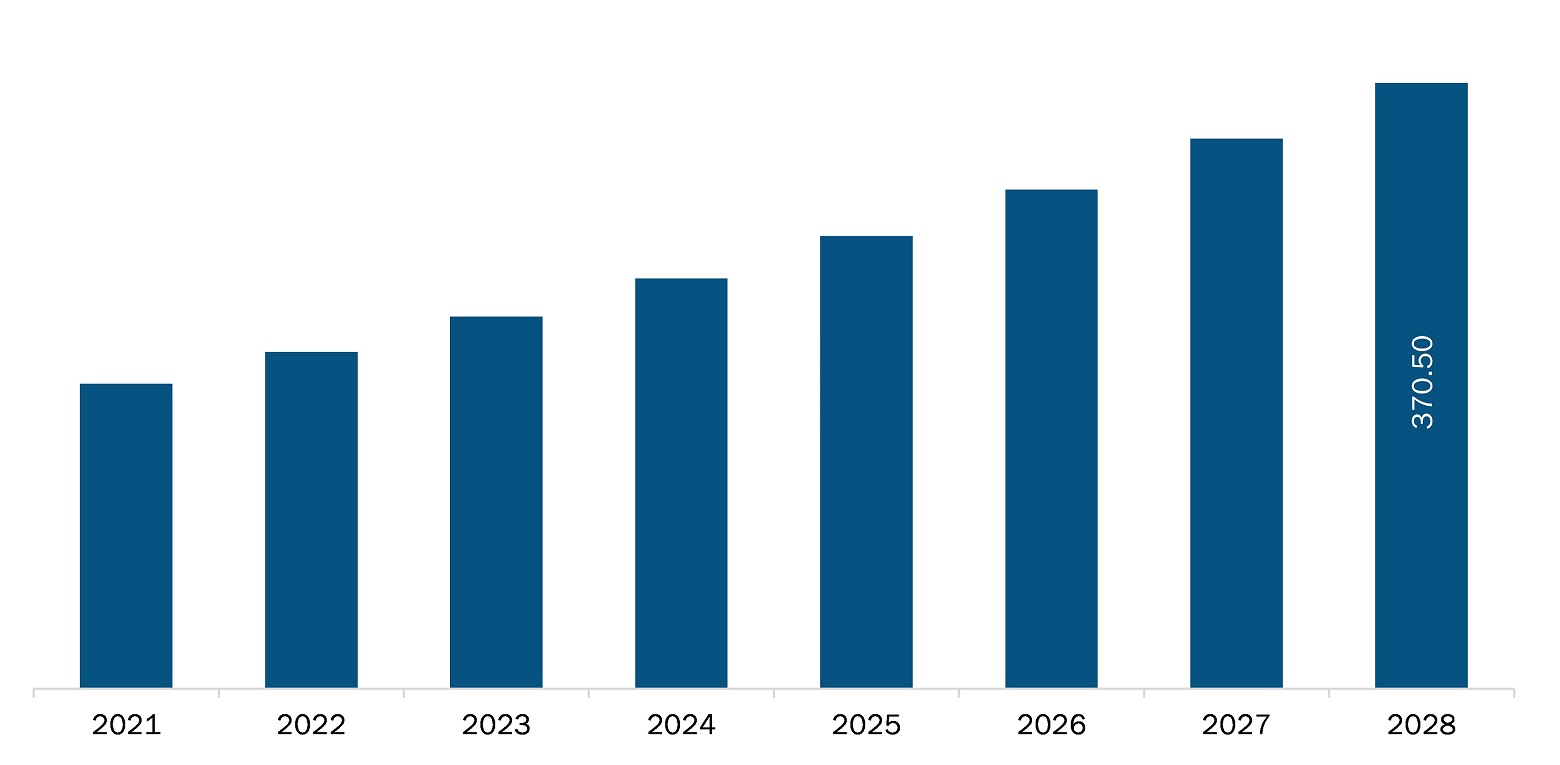

The Middle East and Africa dermal fillers market is expected to reach US$ 370.50 million by 2028 from US$ 186.54 million in 2021; it is estimated to grow with a CAGR of 10.3% from 2021 to 2028.

The growth of the market is attributed to the factors such as preference for minimally invasive procedures, growth in population of age 30–65 years, and rise in the attraction of consumers toward beauty and wellness. However, the high cost of surgeries hinders the market growth.

People from the age group 30–65, struggling with the signs of aging such as lack of skin elasticity, wrinkles, and dark spots, are the major target of the dermal filler market players. Women of age 40–54 are the prime adopters of get dermal filler treatments. The younger age brackets make up a much smaller portion of the population pursuing dermal fillers. Also, long work hours and changing lifestyle have contributed significantly to rising levels of stress, resulting in several issues on the exterior appearance, especially on the skin and hair. Also, the increasing level of pollution shows detrimental effects on an individual’s physical appearance. Thus, international grooming products and at-home services have gained popularity to a great extent. Shifting focus on appearance has significantly increased the demand for beauty and dermatology products across the world. Premium beauty brands are now offering additional services, such as skin diagnosis, at their outlets to attract customers. Furthermore, the number of specialty skin clinics offering target treatments for various skin issues has also ramped up in recent years. In addition, the beauty industry is growing rapidly as the millennial women, of aged 25–34, are increasingly purchasing cosmetic products. Thus, the increasing acceptance of beauty devices and products among both men and women is likely to be a prevalent trend in the Europe dermal fillers market in the coming years.

Countries in the Middle East witnessed considerable growth in the number of COVID-19 cases in 2020. While many industries have been adversely affected by the pandemic, the cosmetic industry in this region witnessed a steady demand. Cosmetic clinics in the UAE have been adhering to all of the necessary regulations set by their authorities, such as routine cleaning and regular COVID-19 testing of employees, to ensure safety of employees and clients, among others. However, the dermal fillers market players recorded reduced demand for cosmetic treatments during the pandemic. The healthcare sectors in the Middle East and African countries mainly focused on the treatment and diagnosis of COVID-19 patients, which resulted in the delays of cancellation of appointments for the dermatological surgeries. In January 2021, Dubai Health Authority directed all licensed hospitals and one-day surgery clinics to suspend all nonurgent surgical procedures. Thus, the dermal fillers market Middle East and Africa experienced moderate impact of the COVID-19 pandemic.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MIDDLE EAST AND AFRICA DERMAL FILLERS MARKET SEGMENTATION

By Product

- Biodegradable

- Non-Biodegradable

By Material

- Calcium Hydroxylapatite

- Hyaluronic Acid

- Collagen

- Poly-L-Lactic Acid

- Polymethylmethacrylate (PMMA)

- Fat Fillers

- Other

By Application

- Facial Line Correction Treatment

- Lip Enhancement

- Face Lift

- Scar Treatment

- Others

By End User

- Dermatology Clinics

- Multispecialty Hospitals

- Ambulatory Surgical Centers

- Others

By Country

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Company Profiles

- AbbVie Inc.

- Galderma

- Merz Pharma

- Suneva Medical

- HUADONG MEDICINE CO., LTD

- TEOXANE LABORATORIES

- Prollenium Medical Technologies

Middle East and Africa Dermal Fillers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 186.54 Million |

| Market Size by 2028 | US$ 370.50 Million |

| CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For