Smoking Cessation Aids Market Insights & Forecast 2034

Smoking Cessation Aids Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Nicotine Replacement Therapy (NRT), Drugs, Electronic Cigarettes (ENDS): End-User (Retail Pharmacies, Online Channel, Hospital Pharmacies , Other End Users); and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00023325

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

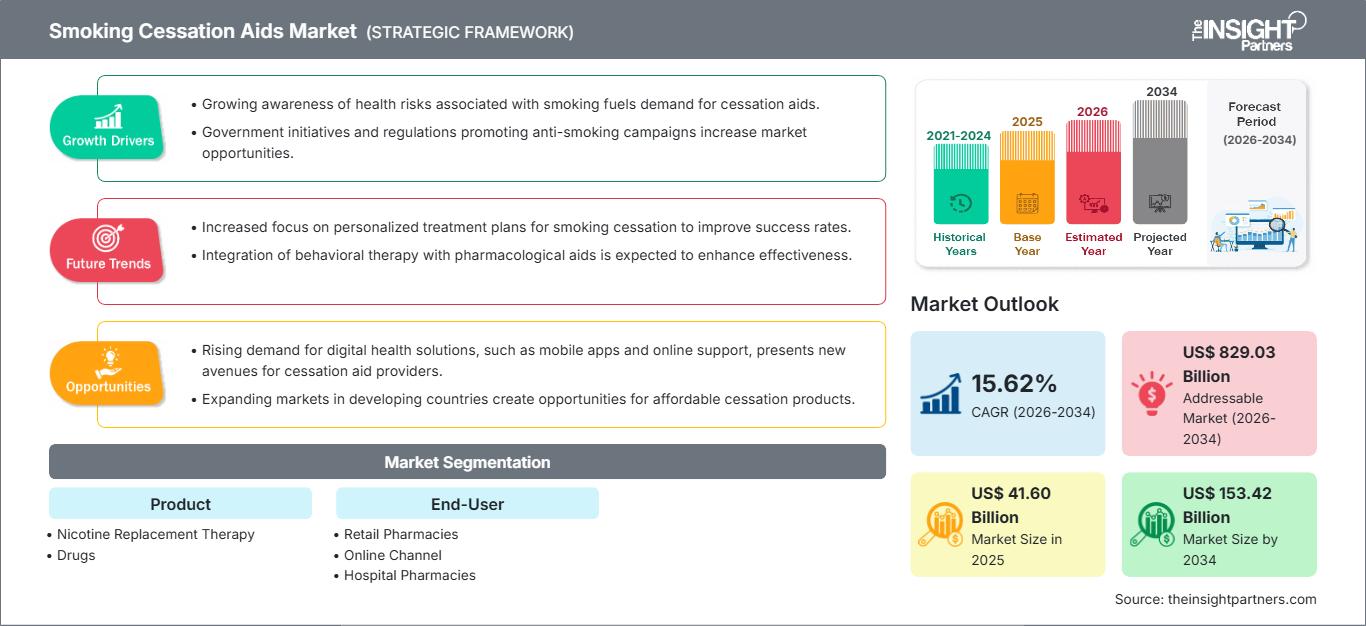

The Smoking Cessation Aids Market size is expected to reach a staggering US$ 153.42 billion by 2034, growing significantly from an estimated US$ 41.60 billion in 2025. The market is anticipated to register a high Compound Annual Growth Rate (CAGR) of 15.62% during the forecast period of 2026–2034.

Smoking Cessation Aids Market Analysis

The global smoking cessation aids market forecast indicates exceptional growth, primarily driven by a worldwide public health mandate to reduce tobacco-related mortality and morbidity. This is furthered by heavy government initiatives and anti-smoking legislation, especially in developed economies, coupled with increasingly sophisticated NRT products and the contentious yet rising category of e-cigarettes. Other factors also contributing to the acceleration of market penetration include the integration of pharmacological solutions with scalable digital health and behavioral therapy platforms that can offer personalized comprehensive cessation programs. The focus remains on novel drug formulations and user-friendly alternative nicotine delivery systems for improving the success rates of treatments.

Smoking Cessation Aids Market Overview

Smoking cessation aids are medically and technologically diverse products designed to assist individuals in overcoming nicotine addiction and quitting tobacco use. These aids function primarily by managing the physical and psychological challenges of nicotine withdrawal, thereby significantly increasing the chance of successful cessation. The product spectrum includes OTC Nicotine Replacement Therapies (such as gums, patches, and lozenges), prescription drugs (like Bupropion and Varenicline), and newer generation Electronic Nicotine Delivery Systems (ENDS), including e-cigarettes and vaping products. The market landscape is defined by stringent regulatory environments controlling marketing and distribution, a high level of R&D investment into novel non-nicotine drugs, and an increasing reliance on accessible channels like online pharmacies and retail pharmacies for product distribution.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSmoking Cessation Aids Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Smoking Cessation Aids Market Drivers and Opportunities

Market Drivers:

- Rising Awareness of Smoking-Related Health Risks Globally: The widespread publication of research linking smoking to serious chronic diseases, including cancer, cardiovascular disease, and COPD, is increasing public awareness and driving proactive decisions to quit, thereby spiking demand for effective cessation aids.

- Government Initiatives and Public Health Campaigns Promoting Cessation: Governments worldwide are implementing high taxes on tobacco, initiating widespread public awareness campaigns, and providing subsidized cessation programs, which directly incentivizes and facilitates the use of NRT and prescription drugs.

- Increasing Adoption of Nicotine Replacement Therapy and Prescription Drugs: NRT remains the bedrock of cessation programs because of its clinically proved efficacy and over-the-counter availability. At the same time, prescription drugs provide vital assistance for severely dependent smokers, fortifying the market's pharmacological segment.

Market Opportunities:

- Expansion in Emerging Markets with Growing Healthcare Infrastructure: Emerging economies in the Asia-Pacific and Latin American regions are experiencing a rise in chronic disease prevalence. As their public health infrastructure expands, access to and awareness of effective, affordable smoking cessation aids presents a vast, untapped market opportunity.

- Development of Innovative E-Cigarette Technologies and Digital Cessation Programs: Innovation in ENDS focuses on improving safety profiles and customizing nicotine delivery. Furthermore, the development of integrated digital therapeutics (apps, wearables) offers scalable, remote behavioral support, which is often crucial for long-term cessation success.

- Strategic Partnerships for Global Distribution and Awareness Campaigns: Collaborations between pharmaceutical giants and non-profit public health organizations are essential for launching large-scale awareness campaigns and ensuring the widespread, affordable distribution of cessation products in developing regions.

Smoking Cessation Aids Market Report Segmentation Analysis

The smoking cessation aids market is analyzed across key product types and distribution channels to provide a clearer understanding of consumer preference and market dynamics.

By Product:

- Nicotine Replacement Therapy (NRT):

- Drugs:

- Electronic Cigarettes (ENDS):

By End-User:

- Retail Pharmacies:

- Online Channel:

- Hospital Pharmacies:

- Other End Users:

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The regional trends and factors influencing the Smoking Cessation Aids Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Smoking Cessation Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Smoking Cessation Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 41.60 Billion |

| Market Size by 2034 | US$ 153.42 Billion |

| Global CAGR (2026 - 2034) | 15.62% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Smoking Cessation Aids Market Players Density: Understanding Its Impact on Business Dynamics

The Smoking Cessation Aids Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Smoking Cessation Aids Market top key players overview

Smoking Cessation Aids Market Share Analysis by Geography

The market growth trajectory for smoking cessation aids is heavily influenced by regional regulatory environments, tobacco use rates, and public health investments. Below is a summary of market share and trends by region:

North America

- Market Share: Holds the largest market share due to advanced healthcare infrastructure, high consumer awareness, and a robust regulatory environment that supports the use and reimbursement of cessation aids.

- Key Drivers: Strong government mandates (e.g., FDA regulation of ENDS); high healthcare expenditure facilitating access to prescription drugs; and widespread public health campaigns.

- Trends: Increasing focus on integrating telehealth and digital apps with pharmaceutical aids; ongoing debate and regulation surrounding the classification and sale of vaping products.

Europe

- Market Share: Commands a significant share, propelled by proactive anti-smoking policies implemented by national health systems (like the NHS) and high adoption rates of e-cigarettes as a harm-reduction strategy.

- Key Drivers: Government-backed cessation programs; high penetration of retail pharmacies; and supportive regulatory framework (e.g., EU Tobacco Products Directive) for NRT.

- Trends: Emphasis on developing smoke-free policies in public spaces; strong growth in the e-cigarette segment despite tightening regulations on flavorings and marketing.

Asia Pacific

- Market Share: Expected to be the fastest-growing region during the forecast period. This rapid growth is linked to a massive population base, high smoking prevalence, and improving access to modern medical treatments.

- Key Drivers: Rising health awareness among middle-class populations; government-supported health IT initiatives; and expanding retail pharmacy networks in countries like China and India.

- Trends: Significant opportunity for generic drug manufacturers (e.g., Cipla, Dr. Reddy's) to offer affordable cessation drugs; complex regulatory landscape for e-cigarettes, with bans in some countries contrasting with open markets in others.

South and Central America

- Market Share: Emerging market demonstrating growth, contingent on improving economic conditions and public health spending.

- Key Drivers: Growing awareness campaigns from regional health organizations; expansion of private healthcare access; and high willingness among smokers to try alternatives.

- Trends: Preference for lower-cost, generic NRT products; market size highly correlated with political stability and investment in public health campaigns.

Middle East and Africa

- Market Share: A developing market with growth concentrated in high-income Gulf Cooperation Council (GCC) nations.

- Key Drivers: Government-led Vision plans emphasizing public health improvements; increasing investments in hospital infrastructure and specialty clinics.

- Trends: Adoption of sophisticated Western NRT and prescription drug protocols in private healthcare; complex cultural factors influence the effectiveness of public health campaigns.

Smoking Cessation Aids Market Competitive Landscape: Product and Innovation

High Market Density and Competition

The smoking cessation aids market features intense competition between major pharmaceutical companies that dominate the prescription and NRT segments, and specialized technology companies focused on e-cigarettes.

Differentiation is achieved through:

- Next-Generation NRT Formulation: Developing faster-acting or more discreet NRT forms (e.g., specialized sublingual films, micro-lozenges) to improve user compliance.

- Drug Pipeline Innovation: Investing in non-nicotinic drugs with fewer side effects or novel mechanisms of action to address treatment gaps.

- Digital Integration: Partnering with tech firms to embed pharmacological aids within comprehensive digital behavioral support ecosystems, maximizing the chances of quitting successfully.

Major Companies operating in the Smoking Cessation Aids Market are:

- Pfizer Inc. (United States)

- GlaxoSmithKline plc. (United Kingdom)

- Dr. Reddy's Laboratories (India)

- Johnson and Johnson Services, Inc. (United States)

- Cipla Inc. (India)

- Perrigo Company plc (Ireland)

- Bausch Health Companies Inc. (Canada)

- Glenmark (India)

- NJOY (United States)

Disclaimer: The companies listed above are not ranked in any particular order.

Smoking Cessation Aids Market News and Recent Developments

- Bausch Health continues to provide labeling information for Wellbutrin XL (bupropion), emphasizing neuropsychiatric safety considerations when used for smoking cessation.

- The company also launched the Breathefree Lung Wellness Center in Delhi in November 2025, offering integrated lung diagnostics and personalized counseling to support smoking cessation efforts.

- Dr. Reddy’s announced a definitive agreement in June 2024 to acquire Nicotinell and its associated global NRT brands Nicotab, Habitrol, and Thrive from Haleon plc, significantly expanding its OTC smoking cessation portfolio.

Smoking Cessation Aids Market Report Coverage and Deliverables

The “Smoking Cessation Aids Market Size and Forecast (2021–2034)” report provides a detailed analysis of the market covering the following areas:

- Smoking Cessation Aids Market size and forecast at global, regional, and country levels for all key market segments covered under the scope

- Smoking Cessation Aids Market trends, along with market dynamics including major drivers, restraints, and emerging opportunities

- Detailed PEST and SWOT analysis

- Smoking Cessation Aids Market analysis covering key market trends, global and regional outlook, major players, regulatory landscape, and recent market developments

- Industry landscape and competition analysis including market concentration, heat map assessment, leading companies, and notable developments in the Smoking Cessation Aids Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For