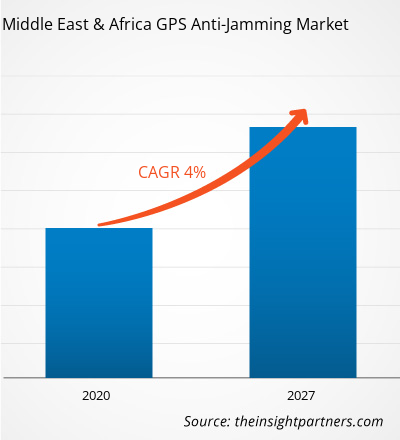

The GPS anti-jamming market in MEA is expected to grow from US$ 331.9 million in 2019 to US$ 448.5 million by 2027; it is estimated to grow at a CAGR of 4.0 % from 2020 to 2027.

The South Africa, UAE, and Saudi Arabia are major economies in MEA. The escalation in demand for GPS (Global Positioning System) technology in military applications is expected to upswing the MEA GPS anti-jamming market. The GPS technology has revolutionized modern warfare. Military organizations rely on this technology for accurate positioning, and communications. The GPS was initially developed with a prime focus on addressing military needs. Military GPS / Global Navigation Satellite System (GNSS) devices are now highly used in air, land, and sea navigation applications pertaining to logistical support, force deployment, and vehicle navigation; these applications precisely include conducting search and rescue operations, cartography and survey, aerial refueling, and precision guidance. Signal jamming is a major limitation faced by GPS-based military operations. GPS jamming devices transmit signals in the same frequency as satellite navigation, resulting in the transmission of erroneous information about the location; jamming may also lead to the disruption of satellite transmissions. A few military applications such as the GPS Jammer Location (JLOC) were designed to monitor GPS interference and provide threat detection alerts to military personnel deployed in the field. Thus, rise in demand of GPS in military applications will increase risk of signal jamming, as a result demand of GPS anti-jamming systems will also increase, which will drive the MEA GPS anti-jamming market.Further, in case of COVID-19, MEA is highly affected especially Saudi Arabia. The outbreak is impacting the economic and industrial growth of the region in a substantial manner. The region comprises of many growing economies which are prospective markets for the demand of GPS anti-jamming market players, owing to the huge investments in infrastructure development, transportation sector, military expenditure, and growing manufacturing & construction industries. Due to these factors, the demand for GPS anti-jamming solutions in anticipated to be high in the region but the ongoing COVID-19 outbreak may hinder this demand in coming quarters due to decline in industrial activities and investments which will affect the MEA GPS anti-jamming market. The MEA region is also anticipated to be especially impacted as there is already pressure on oil-based economies in this region due to falling and uncertain oil prices. In addition to this, the factory lockdowns, business shutdowns and travel bans are further aggravating the economic problems of the countries present in the MEA region. Hence, the estimated decline in MEA’s economic growth and impact of COVID-19 on growth on various industries in the region is expected to negatively impact the of GPS anti-jamming market in 2020 and 2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA GPS anti-jamming market. The MEA GPS anti-jamming market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA GPS Anti-Jamming Market Segmentation

MEA GPS Anti-Jamming Market – By Receiver Type

- Military & Government Grade

- Commercial Grade

MEA GPS Anti-Jamming Market – By Anti-Jamming Technique

- Nulling Technique

- Beam Steering Technique

- Civilian Techniques

MEA GPS Anti-Jamming Market – By Application

- Flight Control

- Surveillance and Reconnaissance

- Position Navigation and Timing

- Targeting

- Casualty Evacuation

MEA GPS Anti-Jamming Market – ByEnd User

- Military

- Civilian

MEA GPS Anti-Jamming Market, by Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA GPS Anti-Jamming Market - Companies Mentioned

- BAE SYSTEMS PLC

- FURUNO ELECTRIC CO., LTD.

- infiniDome Ltd.

- L3HARRIS Technologies, Inc.

- Lockheed Martin Corporation

- NovAtel Inc.

- Raytheon Technologies

- Thales Group

Middle East & Africa GPS Anti-Jamming Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 331.9 Million |

| Market Size by 2027 | US$ 448.5 Million |

| Global CAGR (2020 - 2027) | 4.0 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Receiver Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- BAE SYSTEMS PLC

- FURUNO ELECTRIC CO., LTD.

- infiniDome Ltd.

- L3HARRIS Technologies, Inc.

- Lockheed Martin Corporation

- NovAtel Inc.

- Raytheon Technologies

- Thales Group

Get Free Sample For

Get Free Sample For