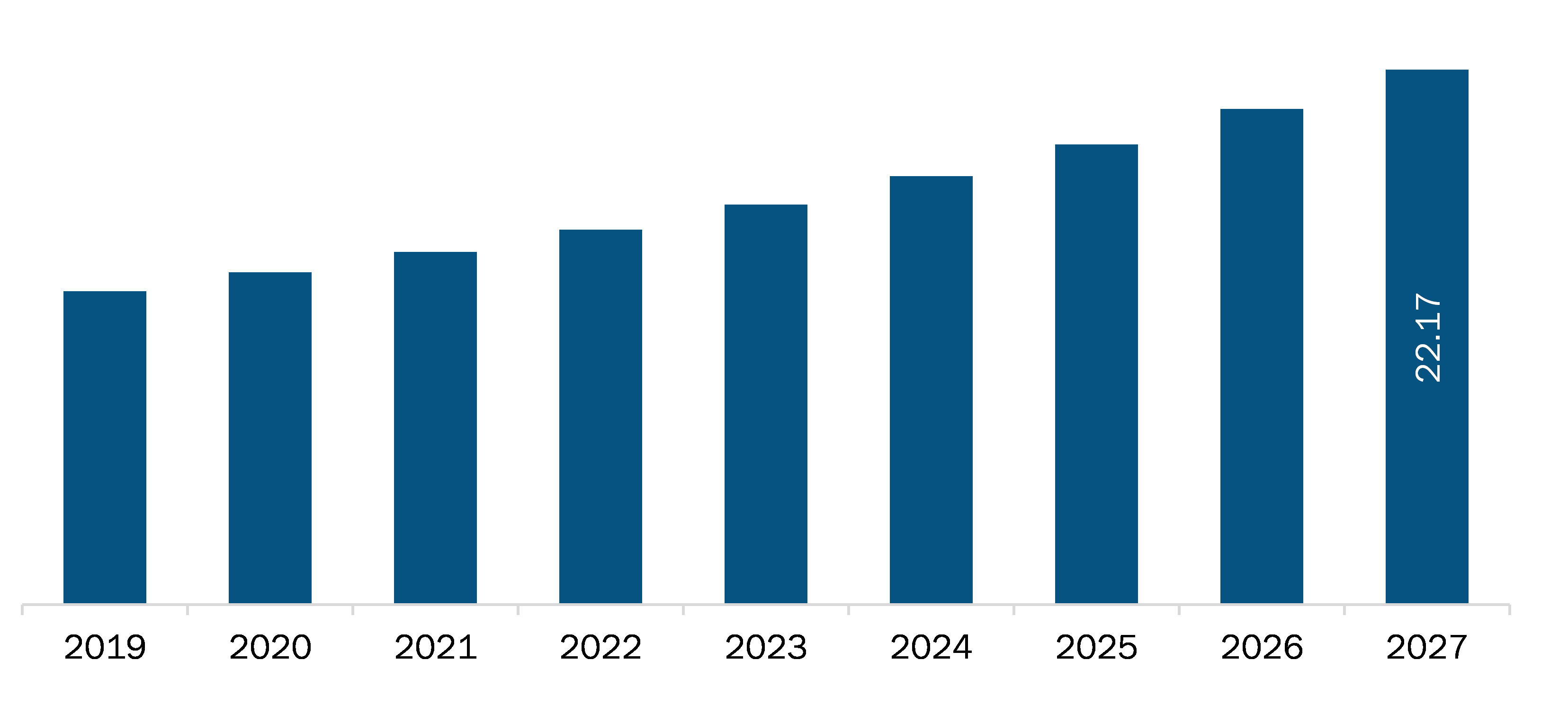

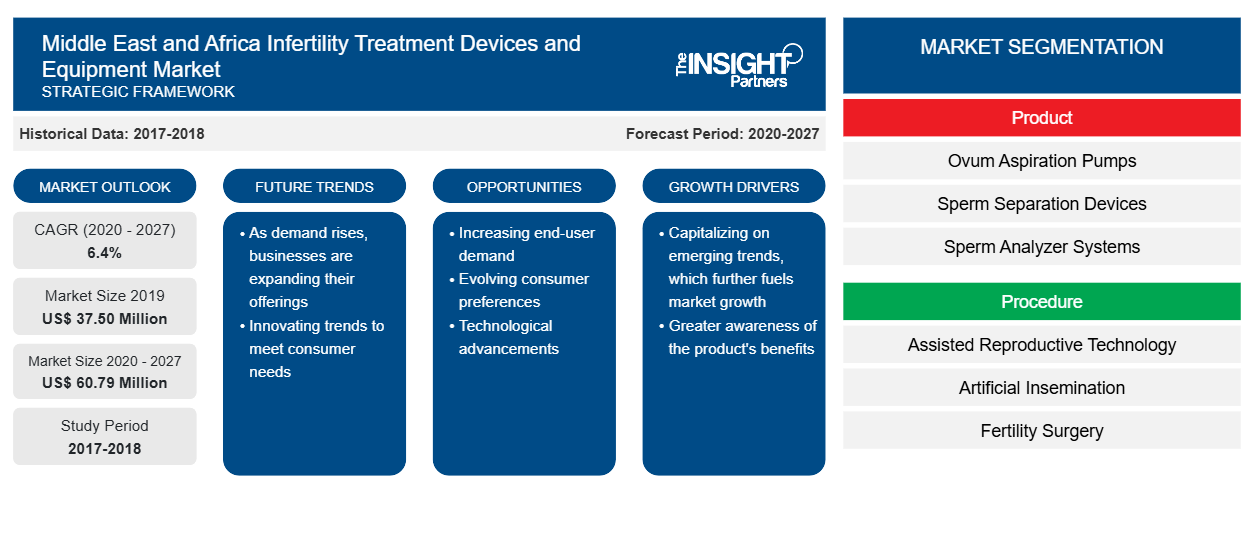

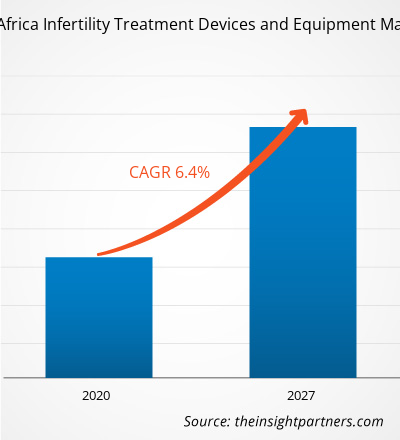

The Middle East & Africa infertility treatment devices and equipment market is expected to reach US$ 60.79 million in 2027 from US$ 37.50 million in 2019. The market is estimated to grow with a CAGR of 6.4% from 2020-2027.

Infertility is defined as not being able to get pregnant or conceive. It can be primary infertility (refers to couples who cannot become pregnant after at least 1 year having sex without using birth control methods) and secondary infertility (refers to couples who cannot get pregnant more than once). There are many different infertility treatment devices and equipment options available for patients. Many factors are contributing to low fertility rate, thus in coming years, the number of patients seeking infertility treatment will raise. Many companies have developed novel device and procedures for simple, effective and cost effective fertility treatment. The scope of the infertility treatment devices and equipment market includes product, procedure, end-user, and region.

South Africa Infertility Treatment Devices and Equipment Market Revenue and Forecasts to 2027 (US$ MN)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growth in In Vitro Fertilization Procedure

The Middle East & Africa region has shown high growth in the infertility treatment devices and equipment market. According to data from the report ‘In Vitro Fertilization (IVF) & Fertility in the MENA region,’ it is estimated that compared to 10% worldwide, infertility in the middle east region is 15% or higher, with male infertility a growing problem occurring in approximately 50% of the cases in the Middle East due to lifestyle, diabetes, obesity, and genetics related factors, as the countries have one of the highest diabetic and obesity rates in the world. The increase in the number of IVF clinics in private and governmental sections was a positive competition and increased the quantity and quality of treatment services in these countries. Another benefit of this development was the decrease in infertility treatment services in the Middle East region. The cost of one cycle of assisted reproductive technology (ART) treatment on average is less than 2000 dollars about 1000 dollars for diagnostic and imaging tests, drugs, and stimulation protocols and about 1000 dollars for operation, ovum pickup, fertilization, embryo culture, and transfer and also cryopreservation of extra embryos in Iran compared to more than 20000 dollars in UK and United States. Therefore, cost-effective IVF procedures in the Middle East & Africa region is projected to offer a lucrative opportunity to grow the infertility treatment devices and equipment market.

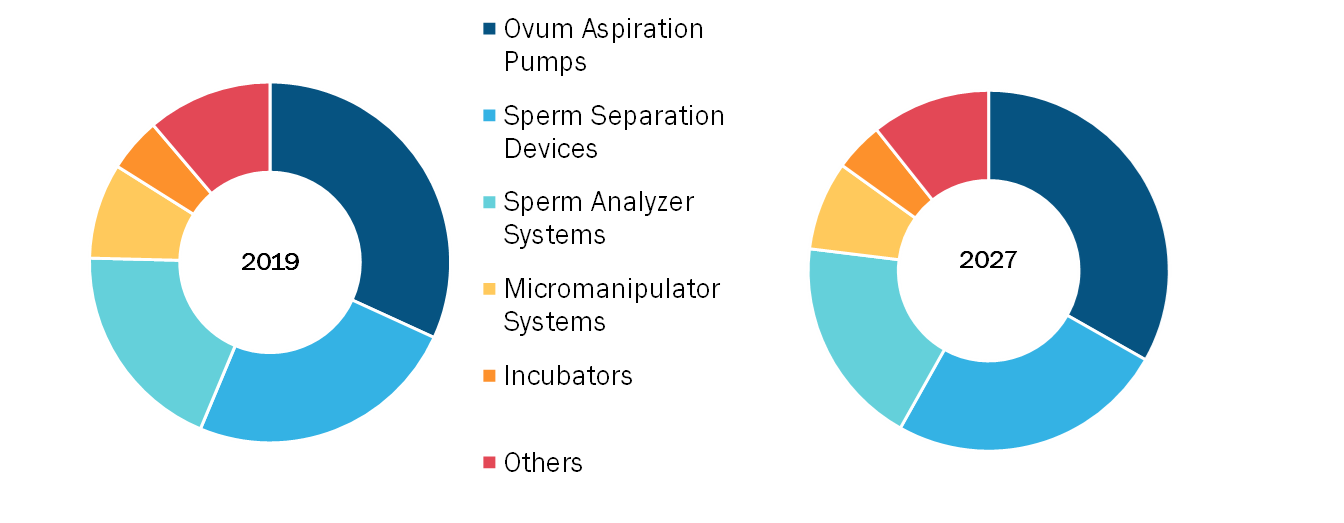

Product- Based Market Insights

Based on product, the infertility treatment devices and equipment market is segmented into ovum aspiration pumps, sperm separation devices, sperm analyzer systems, micromanipulator systems, incubators, and others. The ovum aspiration pumps segment held the largest share of the market in 2019, also the same segment is anticipated to register the highest CAGR in the market during the forecast period.

Middle East & Africa Infertility Treatment Devices and Equipment Market, by Product – 2019 and 2027

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Procedure- Based Market Insights

Based on procedure, the infertility treatment devices and equipment market, is segmented into assisted reproductive technology, artificial insemination, and fertility surgery. The artificial insemination segment held the largest share of the market in 2019, whereas the assisted reproductive technology segment is anticipated to register the highest CAGR in the market during the forecast period.

End-User - Based Market Insights

Based on end-user, the infertility treatment devices and equipment market, is segmented into fertility clinics, hospitals and other healthcare facilities, and clinical research institutes. The fertility clinics segment held the largest share of the market in 2019, also the same segment is anticipated to register the highest CAGR in the market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Middle East and Africa Infertility Treatment Devices and Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product launches and approvals are commonly adopted strategies by companies to expand their footprint worldwide and meet the growing demand. The players operating in the infertility treatment devices and equipment market adopt the expansion, collaboration, and product launch strategies to enlarge customer base across the world. These strategies allow the players to maintain their brand name globally. For instance, in April 2018, The Cooper Companies, Inc. has acquired the assets of The LifeGlobal Group and its affiliates, a leading global provider of in-vitro fertilization (IVF) devices.

MIDDLE EAST & AFRICAINFERTILITY TREATMENT DEVICES AND EQUIPMENT MARKET SEGMENTATION

By Product

- Ovum Aspiration Pumps

- Sperm Separation Devices

- Sperm Analyzer Systems

- Micromanipulator Systems

- Incubators

- Others

By Procedure

- Assisted Reproductive Technology

- In Vitro Fertilization

- Intracytoplasmic Sperm Injection

- Others

- Artificial Insemination

- Intrauterine Insemination

- Intratubal Insemination

- Intracervical Insemination

- Fertility Surgery

- Tubal Ligation Reversal

- Varicocelectomy

- Laparoscopy

- Others

By End User

- Fertility Clinics

- Hospitals and Other Healthcare Facilities

- Clinical Research Institutes

By Country

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

Company Profiles

- Cooper Surgical, Inc.

- Eppendorf AG

- Hamilton Thorne, Inc

- INVO Bioscience

- Vitrolife

Middle East and Africa Infertility Treatment Devices and Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 37.50 Million |

| Market Size by 2027 | US$ 60.79 Million |

| CAGR (2020 - 2027) | 6.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

Middle East and Africa Infertility Treatment Devices and Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Middle East and Africa Infertility Treatment Devices and Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Middle East and Africa Infertility Treatment Devices and Equipment Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For