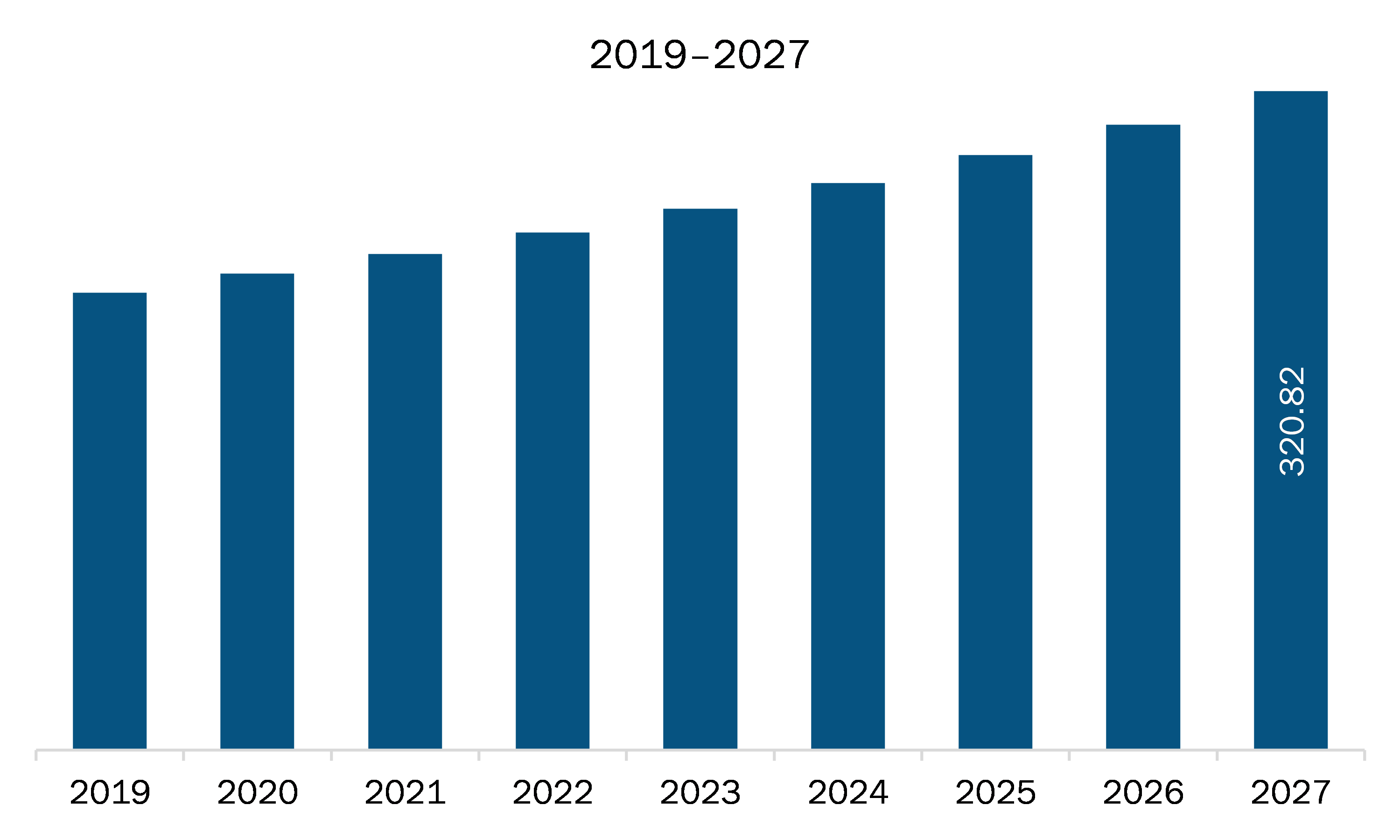

The Middle East and Africa mouthwash market is expected to grow from US$ 232.04 million in 2020 to US$ 320.82 million by 2027; it is estimated to grow at a CAGR of 4.7% from 2020 to 2027.

Increasing recommendation from dental physicians for the treatment of plague and gingivitis fuels the growth of the mouthwash market. Besides, mouthwash when used in mouthwashes, antimicrobial ingredients such as cetylpyridinium, chlorhexidine, and essential oils have been shown to reduce plaque and gingivitis when combined with daily brushing and flossing. Further, mouthwash boosts oral health and gives breathe a makeover as it contains fluoride, which can help reduce cavities and demineralization of teeth. Fluoride rinse mouthwash contains 0.05% of Sodium Fluoride, which is enough to avoid tooth decay. Also, herbal mouthwashes have potential benefits in plaque and inflammation control as supplements to patients' daily oral hygiene with gingivitis. The increasing prevalence of dental problems, such as dental caries, gingivitis, and plaques is one of the significant factors expected to propel the market growth over the coming years.

The COVID-19 pandemic has become the most significant challenge in Middle East and Africa as it is reducing imports due to disruptions in trade. The crisis is increasing the shortages of goods, resulting in a considerable price increase. However, improved purchasing power due to rapid urbanization, and increased promotions of naturally-sourced products have been boosting the awareness about the benefits of organic personal care products, including oral care products, in countries such as Saudi Arabia, the UAE, and South Africa. As a result, consumers in these countries are increasingly preferring products with altered chemical content and added natural ingredients, leading to a rise in the consumption of organic oral care products. Further, with an easing of restrictions, dental care is now available to patients in the UAE, which will positively impact the Mouthwash market growth during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Middle East and Africa Mouthwash Market Segmentation

- Middle East and Africa Mouthwash Market – By Product Type

- Fluoride

- Cosmetics

- Antiseptics

- Oral Gels

- Middle East and Africa Mouthwash Market – By Flavour

- Active Salt

- Mint Fresh Tea

- Natural Lemon

- Herbs

- Fruit and Gums

- Middle East and Africa Mouthwash Market – By Indication

- Mouth Ulcers

- Aphthous Ulcers

- Post Oral Surgery

- Oral Lesions

- Periodontitis

- Gingivitis

- Receding Gums

- Frequent Dry Mouth

- Chronic Bad Breath

- Toothache

- Middle East and Africa Mouthwash Market – By Distribution Channel

- Hypermarkets

- Supermarkets

- Online Stores

- Independent Pharmacies / Drugstores

- Hospital Pharmacies

- Independent Grocery Stores

- Middle East and Africa Mouthwash Market – By End User

- Adult

- Kids

- Middle East and Africa Mouthwash Market – By Country

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Middle East and Africa Mouthwash Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 232.04 Million |

| Market Size by 2027 | US$ 320.82 Million |

| CAGR (2020 - 2027) | 4.7% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For