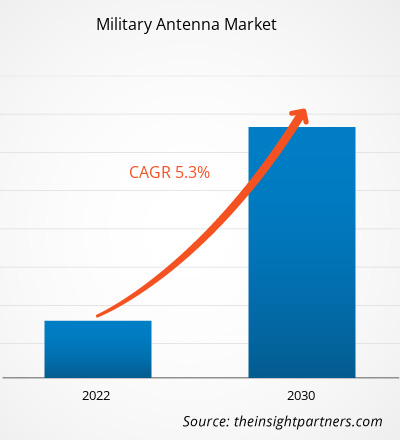

The Military Antenna Market size is projected to reach US$ 5,298.16 million by 2030 from US$ 3,497.23 million in 2022. The market is expected to register a CAGR of 5.3% in 2022–2030. End users of military antennas can change depending on the explicit application and the organization responsible for defense and security. It can be utilized by military forces such as air forces, national armies, naval forces, and border security agencies. It can also be leveraged in military air traffic control systems. End users of military antennas can vary based on geopolitical context and the specific requirements of each country or organization such as ground bases, naval and airborne platforms.

Military Antenna Market Analysis

Manufacturers develop different types of antennas with low, medium, and high frequencies to meet the requirements of end users. Quality control processes are employed throughout manufacturing to ensure the final product meets the standards as per the end user’s requirements. This involves inspecting the raw materials, verifying the dimensions' accuracy, and understanding the application of antennas in different platforms such as naval, ground, or airborne. A few major manufacturers of military antenna operating in the market include BAE Systems, Thales SA, Comrod Communication AS, Eylex Pty Ltd, L3Harris Technologies Inc, Hascall-Denke Corp, Lockheed Martin Corp, MTI Wireless Edge Ltd, Raytheon Technologies Corp, and Rohde and Schwarz GmbH and Co KG.

Military Antenna Market Overview

Raw material and components suppliers operating in the military antenna market provide polymer matrix, iron, nickel, metal alloy, carbon fiber, and graphite to manufacture military antennas. Suppliers play a major role in ensuring the quality and availability of the product, and their operations impact the overall supply chain. The assortment of raw materials depends on the desired quality, texture, functionality, and resistance required in communication, navigation, and surveillance systems. However, variations in the prices of raw materials can impact the expenditure of production and the overall price of the product.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Antenna Market Drivers and Opportunities

Rising Integration of Electronically Steered Phased Array Antennas

The proliferation of communication on-the-move solutions, primarily for military vehicles, fighter aircraft, and naval ships, is boosting the demand for electronically steered phased array antennas. The advanced array antennas can support tracking and maintaining satellite links even when the vehicles are moving. There is a surging demand for advanced technologies to meet the ever-changing battlefield requirements. For instance, in October 2023, Keysight Technologies, Inc. launched the Phased Array Antenna Control and Calibration solution that facilitates satellite designers fabricating active electronically scanned arrays specifically for satellite communications applications to test their designs in time of validation.

Growing Incidents of Unstable Geopolitical Scenario and Advent of Modern Warfare Technologies

The growing unstable geopolitical scenario worldwide regarding India-Pakistan, China-Taiwan, China-India, Russia-Ukraine, Russia-US, and the Israel-Palestine war is boosting the demand for advanced surveillance, communication, and navigation systems. The unstable geopolitical occurrences like wars between nations are jeopardizing the common life and also increasing the national security threat and uncertainties, which is the major reason behind growing focus on strengthening the security forces to combat such unwanted situations. The advanced communication and surveillance systems facilitate the development of a comprehensive and accurate analysis, aiding more precise threat assessments and target engagements. Thus, modern warfare scenarios emphasize heightened situational awareness, rapid data sharing, integrated defense systems, improved target engagement, electronic warfare capabilities, and compliance with evolving threats. Thus, the growing adoption of advanced warfare devices and equipment further drives the development of high-frequency military antennas to meet modern battlefield requirements. For instance, in 2023, Washington-based networking solution company Cambium Networks is anticipated to demonstrate its new PTP 700 beam-steering outdoor unit equipped with an advanced antenna at the Association of United States Army Annual Meeting and Exposition 2023. In addition, in 2023, the Space Force collaborated with the National Oceanic and Atmospheric Administration (NOAA) to manage the growing number of military satellites in orbit. Space Force is anticipated to use NOAA Antennas for its military satellite missions in upcoming projects.

Military Antenna Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Military Antenna Market analysis are antenna type, frequency, platform, application, and geography.

- Based on antenna type, the Military Antenna Market has been segmented into aperture antennas, dipole antennas, travelling wave antennas, monopole antennas, loop antennas, array antennas, and others. The dipole antennas segment held a larger market share in 2022.

- By frequency, the market has been segmented into high frequency, very high frequency, and ultra-high frequency. The high-frequency segment held the largest share of the market in 2022.

- In terms of platform, the market has been segregated into marine, ground, and airborne. The ground segment dominated the market in 2022.

- By application, the market has been segmented into communication, telemetry, electronic warfare, surveillance, and navigation. The communication segment held the largest share of the market in 2022.

Military Antenna Market Share Analysis by Geography

The geographic scope of the Military Antenna Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the Military Antenna Market in 2022, and it is likely to retain its dominance during the forecast period as well. Moreover, in 2022, Europe accounted for the second largest share followed by Asia Pacific. Further, Asia Pacific is likely to surpass the European region by 2030. Europe is one of the major regions in terms of advancement in the defense sector. The growing geopolitical instability among countries such as Ukraine and Russia is fueling the demand for strong and advanced surveillance and communication devices and systems in the military sector. Russia, Germany, France, Italy, and the UK are a few of the major countries in terms of military expenditure. The growing proliferation of ground-based long-frequency antennas for larger area coverage is one of the major trends in the military antenna market. Increasing integration of satellite-based communication devices for catering to airborne and naval force requirements is one of the key driving factors for the military antenna market.

Military Antenna Market Regional Insights

The regional trends and factors influencing the Military Antenna Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Military Antenna Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Military Antenna Market

Military Antenna Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,497.23 Million |

| Market Size by 2030 | US$ 5,298.16 Million |

| Global CAGR (2022 - 2030) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Military Antenna Market Players Density: Understanding Its Impact on Business Dynamics

The Military Antenna Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Military Antenna Market are:

- Thales SA

- Comrod Communication AS

- Eylex Pty Ltd

- L3Harris Technologies Inc

- Hascall-Denke Corp

- Lockheed Martin Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Military Antenna Market top key players overview

Military Antenna Market News and Recent Developments

The Military Antenna Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for military antenna market and strategies:

- In July 2023, L3Harris Technologies announced a contract from Maxar Technologies to design and build reflector antennas for two geostationary communication satellites. The two nine-meter unfurlable mesh reflector antennas will provide high-power signals and improved service quality across the satellites’ coverage areas. Similar to an umbrella, the flexible architecture of the antenna makes it collapsible, lightweight, compact and easy to integrate onto nearly any spacecraft configuration. (Source: L3Harris Technologies, Press Release/Company Website/Newsletter)

- On October 2023, MTI Wireless Edge Ltd, the technology group renowned for its cutting-edge communication and radio frequency solutions, secured substantial orders from the Indian divisions of two major Original Equipment Manufacturers (OEMs) totaling approximately US$ 0.6 million for our state-of-the-art 5G backhaul antenna solution. (Source: MTI Wireless Edge Ltd, Press Release/Company Website/Newsletter)

Military Antenna Market Report Coverage and Deliverables

The “Military Antenna Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For