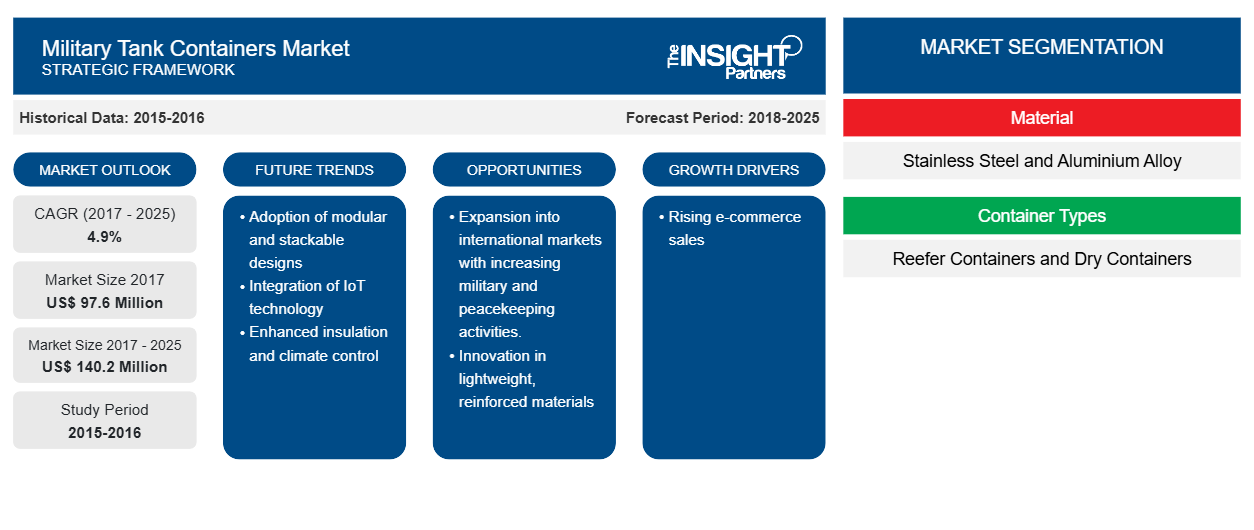

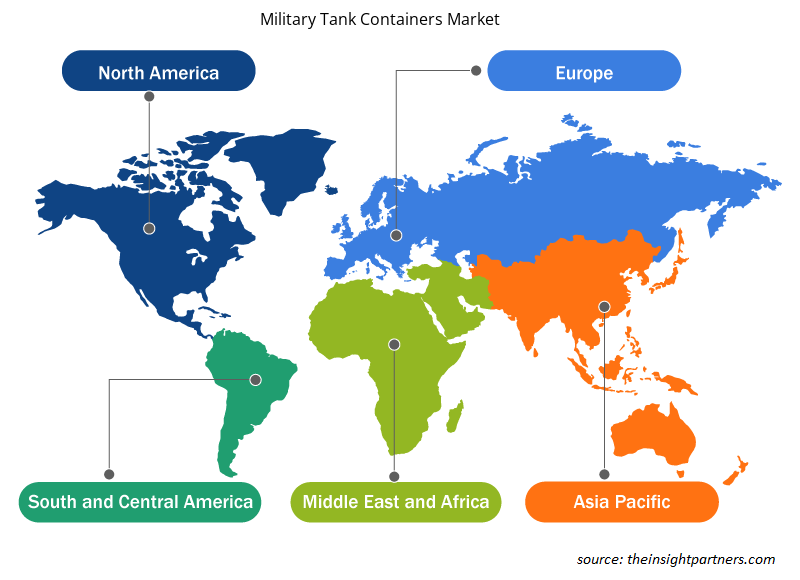

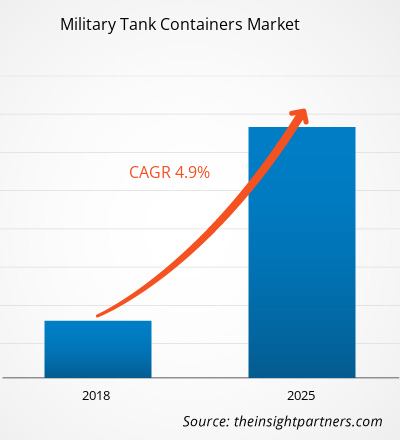

In terms of revenue, the global military tank container market was valued at US$ 97.6 million in 2017 and is projected to reach US$ 140.2 million by 2025.

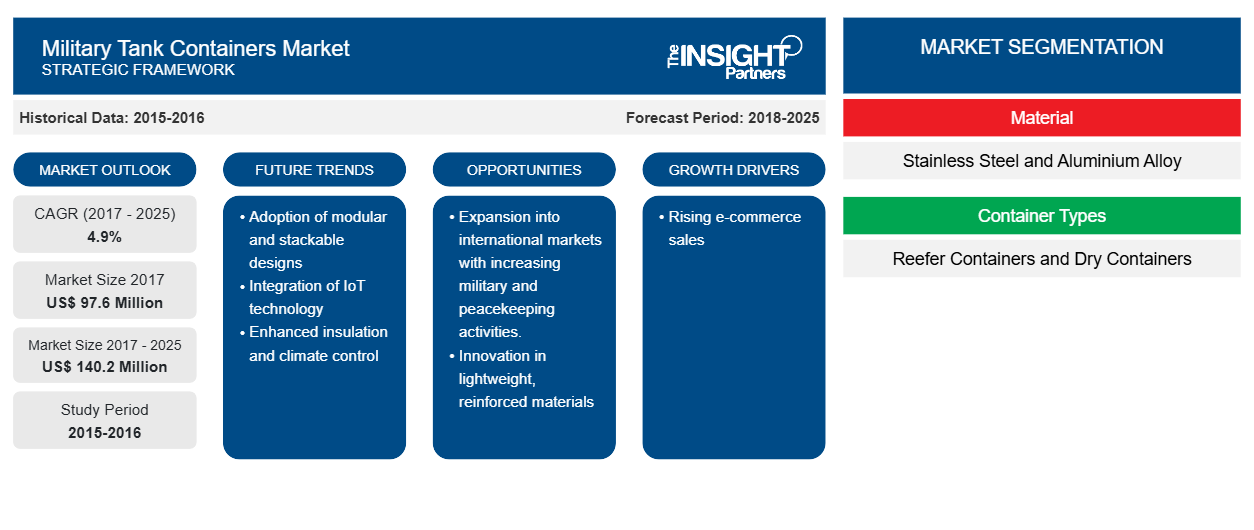

The military tank container market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. The most prominent region in the current market scenario stands for North America owing to the rapid deployment of troops by the US defense forces. The US Department of Defense (DoD) is constantly posting its troops in countries such as Afghanistan, Syria, Iraq, South Korea, Kuwait and Italy among others in order to deter different threats and maintain sustainable atmosphere. The deployment of large numbers of troops across the globe has led the country to invest significant amounts in the development as well procurement of military tank containers to transport essential commodities to the isolated troops. In addition, Canada on the other hand is also strengthening its logistic facility with these tank containers as the Canadian army is also deploying forces for peace keeping mission. The market for military tank containers is foreseen to witness an expeditionary growth in Asia Pacific region, pertaining to the huge demand for such containerization among defense forces especially Chinese, South Korean and Indian army. The rise in terrorist attacks and other political and warring activities in the above mentioned countries is leading the defense forces to deploy troops along the borders as well as in remote locations. The increasing number of troop deployment from these countries is anticipated to be reason behind the growth of military tank containers market in Asia Pacific region during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Tank Containers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Military Tank Containers Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights–Military Tank Container Market

Growing Deployments of Troops in Peacekeeping Missions Globally by Major Countries of the World

The US is the most powerful nation in the world in terms of the army troop deployments globally. According to US DoD, in 2016 the country spent close to US$ 596 Bn on defense and other related activities. In a recent development proposed by the US Government, there was an announcement of 10% increase in the budget for expenditure on the army troops for the DoD. The expenditure by the country on defense related activities is such that it is more than the next seven countries combined expenditures. Accordingly, the country has deployed approximately 2 lakh troops globally in close to 177 countries of the world. Out of the entire defense budget close to 35% of the share is allocated for the territorial military troops. Domestically, 1.1 Mn active troops are stationed while the rest have been deployed in countries like Afghanistan, Syria, Iraq, Germany, Egypt, South Korea, Kuwait and Italy. The tense political situation in the Middle East has resulted in the larger troops of the army being deployed in those countries for longer times. The troops are usually deployed at strategic locations in such cases to gain competitive advantage and these locations usually face water scarcity. The demand for optimal supply of water and fuel at such locations for efficient operations has been growing and thereby driving the demands for military tank containers.

Type Segment Insights

Based on type, the dry container segment dominated the global military tank container market in 2017. The advantages of an ISO dry tank container are reliability, cost-effectiveness and the safety measure achieved in transportation of bulk liquid to the remotest and inaccessible locations. As these tank containers are designed to meet specific standards and are therefore able to withstand extreme pressure and rough climatic conditions.

Material Segment Insights

Based on material, the stainless steel segment dominated the global military tank container market in 2017. Stainless steel tank containers are durable and low maintenance products that can last for a long period of time once manufactured and put to repeated use. Moreover, the hygienic properties of stainless steel make it an ideal choice for transportation of water, perishable food products and pharmaceuticals.

Supplies Segment Insights

Based on supplies, the fuel segment held the largest share in global military tank container market in 2017. The advantages of an ISO dry tank container are reliability, cost-effectiveness and the safety measure achieved in transportation of bulk liquid to the remotest and inaccessible locations. As these tank containers are designed to meet specific standards and are therefore able to withstand extreme pressure and rough climatic conditions.

End User Segment Insights

Based on end user, the homeland security segment held the largest share in global military tank container market in 2017. As a large number of personnel are deployed for peacekeeping missions, the frequency of usage of military tank containers for provisioning water, fuel, gases and food products and pharmaceuticals is also high that would be driving the demands by this end-user during the forecast period.

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

- In 2018, Krampitz signed an agreement with Norwegian Government to deliver and install an above ground gas station in the mobile containers. This agreement helped the company to establish its footprints in Norway, thereby increasing its customer base.

- In 2017, WEW Container Systems has signed an agreement with US Army to deliver additional Camel low-profile water tank. Under this contract WEW deliver 167 tanks to prime contractor Choctaw Defense for integration into the Camel II Unit Water Pod System. As per the contract, WEW Container Systems GmbH was supposed to deliver 167 camel low profile water tanks, out of which the company has partially fulfilled the requirements.

- In 2017, WEW launched integrated logistics services to support of tank container system. The company had updated its support services in order to bear the rigidities of multi-modal transport and storage in extremely harsh environmental conditions.

Military Tank Containers Market Regional Insights

The regional trends and factors influencing the Military Tank Containers Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Military Tank Containers Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Military Tank Containers Market

Military Tank Containers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 97.6 Million |

| Market Size by 2025 | US$ 140.2 Million |

| Global CAGR (2017 - 2025) | 4.9% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Military Tank Containers Market Players Density: Understanding Its Impact on Business Dynamics

The Military Tank Containers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Military Tank Containers Market are:

- WEW Container System GmbH

- Klinge Corporation

- Krampitz Tanksystem GmbH

- SEA BOX, Inc.

- AMA S.p.A

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Military Tank Containers Market top key players overview

The global military tank container market has been segmented as follows:

Military Tank Container Market – By Type

- Stainless Steel

- Aluminum Alloy

Military Tank Container Market – By Material

- Reefer Containers

- Dry Containers

Military Tank Container Market – By Supplies

- Water

- Fuel

- Others

Military Tank Container Market – By End User

- Homeland Security

- Military

Military Tank Container Market- By Region

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- UK

- Russia

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Rest of APAC

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

Military Tank Container Market – Companies Profiles

- WEW Container Systems GmbH

- Krampitz Tanksystems GmbH

- Klinge Corporation

- Seabox, Inc.

- Variel A.S.

- Ancora Sp. Z. O. O.

- AMA Spa

- Eurotainer

- Lava Engineering Company

- Saxon Containers Fze.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Fixed-Base Operator Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies

1. WEW Container System GmbH

2. Klinge Corporation

3. Krampitz Tanksystem GmbH

4. SEA BOX, Inc.

5. AMA S.p.A

6. ANCORA Sp. Z o. o.

7. VARIEL, a. s.

8. Eurotainer SA

9. LAVA Engineering Company

10. Saxon Containers Fze

Get Free Sample For

Get Free Sample For