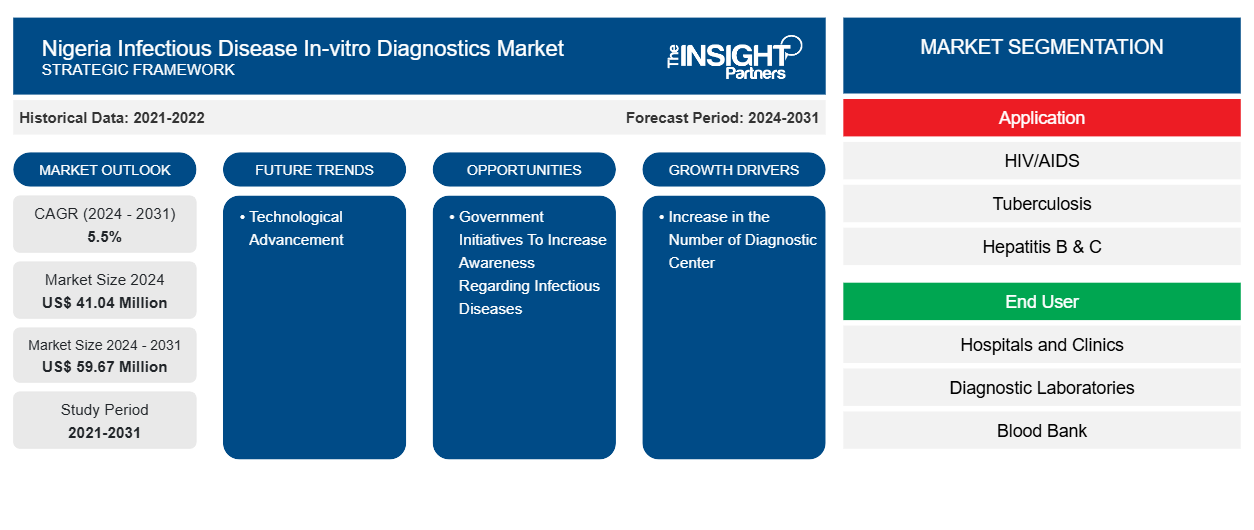

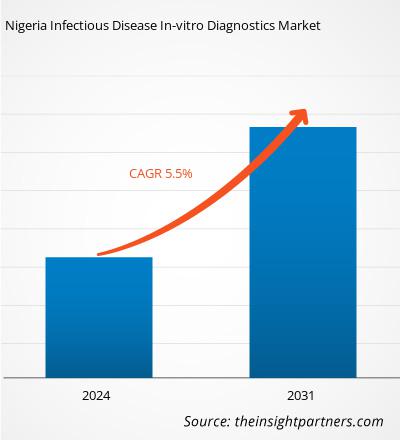

The Nigeria Infectious Disease In-vitro Diagnostics Market size is projected to reach US$ 59.67 million by 2031 from US$ 41.04 million in 2024. The market is estimated to register a CAGR of 5.5% during 2024–2031. Technological advancements are likely to bring new Nigeria Infectious Disease In-vitro Diagnostics Market trends in the coming years.

Nigeria Infectious Disease In-vitro Diagnostics Market Analysis

The Nigerian in-vitro diagnostics (IVD) market for infectious diseases is expanding due to several key drivers and emerging opportunities. The rising prevalence of infectious diseases, such as Lassa fever, HIV, and malaria, necessitates timely and accurate diagnostic solutions. This demand is further supported by government initiatives like the National Health Insurance Scheme (NHIS), which enhances accessibility to diagnostic services. Technological advancements, particularly in point-of-care testing (POCT) and molecular diagnostics, are pivotal in providing rapid and precise results, crucial for effective disease management in resource-limited settings. Integrating artificial intelligence (AI) and machine learning (ML) into diagnostic processes also revolutionizes data analysis, leading to more accurate and personalized disease detection. These developments present significant opportunities for stakeholders to invest in innovative diagnostic technologies that cater to the growing healthcare needs of Nigeria's population.

Nigeria Infectious Disease In-vitro Diagnostics Market Overview

Key players are focusing on boosting local manufacturing capacity, fostering innovation, and reducing dependency on imported diagnostic products. In May 2025, Codix Pharma Ltd, a Nigerian pharmaceutical firm, commissioned Codix Bio Ltd, an IVD manufacturing facility in Sagamu, Ogun State. This facility, the first in Nigeria and the second in sub-Saharan Africa, is expected to produce over 147 million rapid diagnostic test kits annually for malaria, HIV, and hepatitis B and C. This development addresses the need for timely, affordable, locally produced diagnostics, especially for underserved populations. Such initiatives strengthen healthcare independence, improve disease surveillance, and propel market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nigeria Infectious Disease In-vitro Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nigeria Infectious Disease In-vitro Diagnostics Market Drivers and Opportunities

Increasing Number of Diagnostic Centers

As of May 2025, there are 937 Diagnostic centers in Nigeria, representing a 3.65% increase from 2023. Of these locations, 899 Diagnostic centers, which is 95.94% of all Diagnostic centers in Nigeria, are single-owner operations, while the remaining 38, 4.06%, are part of larger brands. The top three states with the most Diagnostic centers are Lagos, with 256 Diagnostic centers; Federal Capital Territory, with 104 Diagnostic centers; and Enugu State, with 72 Diagnostic centers.

With the rising burden of malaria, HIV, and tuberculosis, the demand for accurate and timely diagnostic services is surging. The increased availability of diagnostic centers, particularly in urban and semi-urban areas, has improved healthcare accessibility and reduced patient turnaround times, thereby boosting the adoption of IVD technologies. Establishing private labs such as 54gene and Lifebank and public initiatives under the Nigeria Centre for Disease Control (NCDC) has increased testing capacity for COVID-19 and Lassa fever. These centers rely on molecular diagnostics, immunoassays, and rapid test kits. Collaborations with international partners have led to capacity-building and technology transfer. Expansion of diagnostic capabilities improves accurate diagnosis, disease monitoring, supporting public health responses, and shaping healthcare policies contribute to market growth.

Government Initiatives To Increase Awareness Regarding Infectious Diseases

Through the Nigerian Center for Disease Control (NCDC) and the Ministry of Health, the government promotes public health campaigns targeting malaria, HIV/AIDS, and tuberculosis. These campaigns emphasize early detection, prevention, and management, encouraging more people to seek diagnostic testing. As awareness grows, healthcare providers and diagnostic centers are adopting advanced IVD technologies to meet the rising demand for reliable and rapid tests. Nationwide HIV screening programs supported by government initiatives have increased the need for efficient in-vitro diagnostic kits.

Partnerships with international health organizations and government subsidies help improve access to these diagnostic tools, especially in rural and underserved areas. This supportive environment attracts investments from diagnostic companies aiming to develop and distribute innovative testing solutions tailored to local needs. By creating sustained demand for diagnostic innovations, government-driven awareness campaigns are expected to create future growth opportunities for the Nigeria infectious disease .

Nigeria Infectious Disease Report Segmentation Analysis

Key segments that contributed to the derivation of the Infectious disease in-vitro diagnostics market analysis are application, end user, and geography.

- Based on application, the Nigeria infectious disease in-vitro diagnostics market is segmented into HIV/AIDS, tuberculosis, hepatitis b & c, malaria, and others. The malaria segment held the largest share of the market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By end user, the market is divided into hospitals and clinics, diagnostic laboratories, blood banks, and others. Hospitals and clinics held the largest Nigeria infectious disease in-vitro diagnostics market share in 2024.

Nigeria Infectious Disease In-vitro Diagnostics Market Share Analysis by Geography

The Nigeria Infectious Disease In-vitro Diagnostics Marketis expanding steadily, fueled by a high burden of communicable diseases such as HIV/AIDS, malaria, tuberculosis, and hepatitis. With a growing population and increasing demand for early and accurate disease detection, diagnostic technologies, remarkably rapid tests, and point-of-care diagnostics are being adopted. Urban areas are witnessing better penetration due to improved healthcare infrastructure, while rural areas remain underserved but represent significant growth potential. Government health initiatives, international donor funding, and a gradual shift toward localized manufacturing and public-private partnerships support the market. However, challenges such as limited diagnostic labs, stringent regulations, and insufficient skilled personnel persist. Overall, the sector holds strong potential for investment and innovation, particularly in portable and affordable diagnostic solutions.

Nigeria Infectious Disease In-vitro Diagnostics

Nigeria Infectious Disease In-vitro Diagnostics Market Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 41.04 Million |

| Market Size by 2031 | US$ 59.67 Million |

| CAGR (2024 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

Nigeria

|

| Market leaders and key company profiles |

|

Nigeria Infectious Disease In-vitro Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Nigeria Infectious Disease In-vitro Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Nigeria Infectious Disease In-vitro Diagnostics Market top key players overview

Nigeria Infectious Disease In-vitro Diagnostics Market News and Recent Developments

The Nigeria Infectious Disease In-vitro Diagnostics Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- Bruker Corporation announced expansions to its infectious disease testing solutions at the ESCMID Global conference in Vienna, including a broader assay menu for its BeGenius molecular diagnostics system and improvements to its microbial identification platforms. (Source: Bruker Corporation, Company Website, April 2025)

- bioMérieux, a world leader in the field of in vitro diagnostics, announced the launch of its WATCHFIRE molecular testing solution. The WATCHFIRE Respiratory (R) Panel, targeting 22 pathogens*, will run on the BIOFIRE FILMARRAY TORCH instrument, integrated with FIREWORKS™ software, to deliver real-time trending of viruses and bacteria present in wastewater samples. (Source: bioMérieux, Company Website, April 2025).

Nigeria Infectious Disease In-vitro Diagnostics Market Report Coverage and Deliverables

The "Nigeria Infectious Disease In-vitro Diagnostics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Infectious disease in-vitro diagnostics market size and forecast at country levels for all the key market segments covered under the scope

- Infectious disease in-vitro diagnostics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Infectious disease in-vitro diagnostics market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Infectious disease in-vitro diagnostics market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the Nigeria Infectious Disease In-vitro Diagnostics Market growth?

What would be the estimated value of the Infectious disease in-vitro diagnostics market by 2031?

Which are the leading players operating in the Nigeria Infectious Disease In-vitro Diagnostics Market?

Which service type segment dominated the Nigeria Infectious Disease In-vitro Diagnostics Market in 2024?

What are the future trends in the Nigeria Infectious Disease In-vitro Diagnostics Market?

What would be the expected CAGR of the Nigeria Infectious Disease In-vitro Diagnostics Market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For