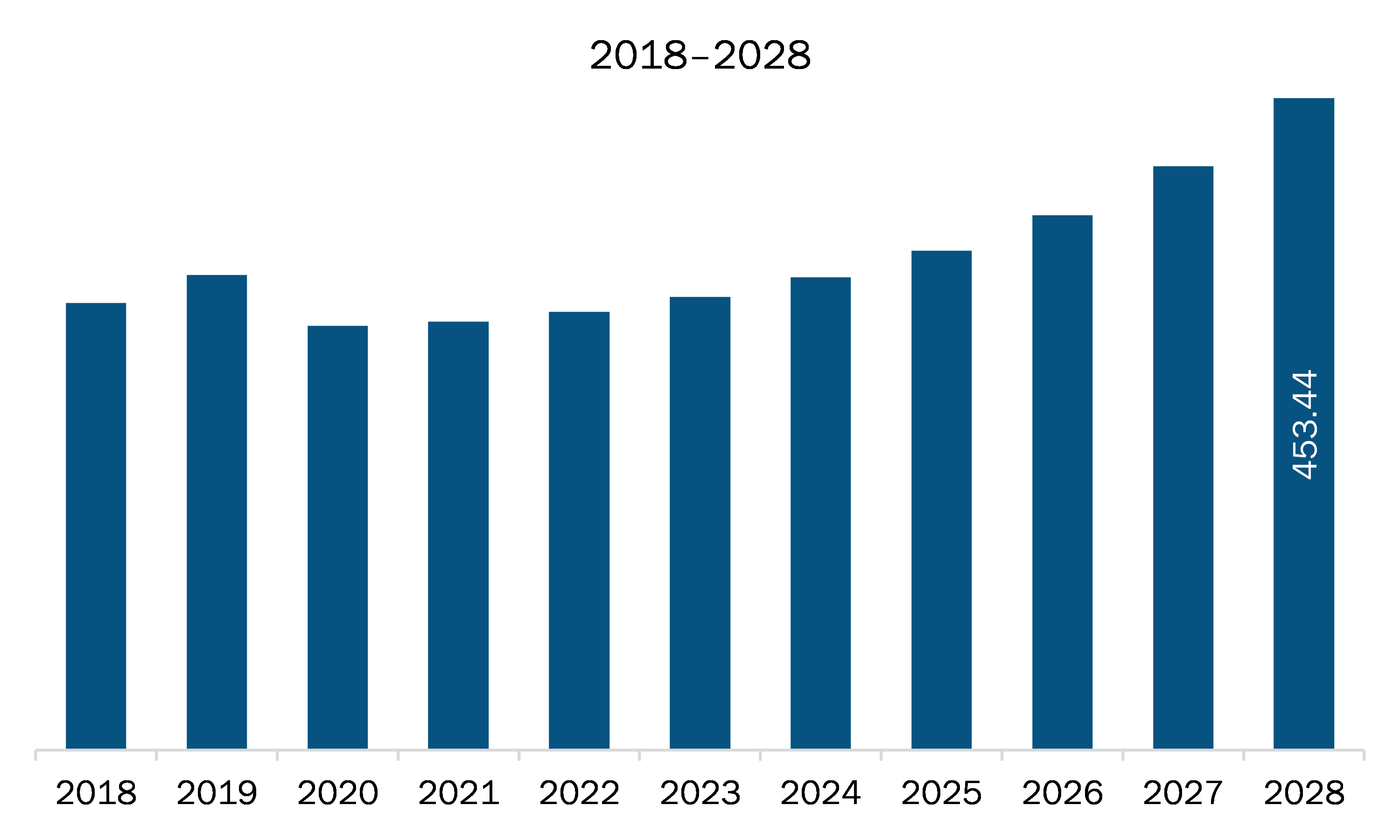

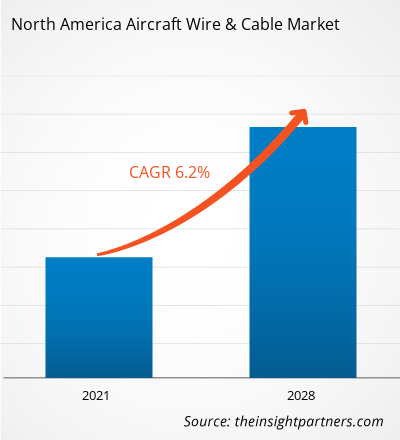

The aircraft wire & cable market in North America is expected to grow from US$ 295.17 million in 2020 to US$ 453.44 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Deliveries and orders of aircraft rising is the major factor driving the North America aircraft wire & cable market. The North America aviation industry is growing at an unprecedented rate, recording substantial number of production volumes of military and commercial aircraft fleet. In the past few years, the commercial aircraft fleet has seen tremendous growth due to the influx of new low-cost carriers (LCCs) and fleet expansion strategies adopted by the full-service carriers (FSCs). Commercial aviation industry is predicted to upsurge soon due to the rising air travel passengers and aircraft procurement. Air passenger traffic in North America, has been surging with time, which is compelling the demand for commercial aircraft. Airbus and Boeing are the two aircraft manufacturing giants with significantly greater volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) are continuously encountering orders for various aircraft models from different civil airlines. In 2020, orders and deliveries of aircraft experienced a downfall due to pandemic, which led to halt in the deliveries. Due to the surging production volumes to bridge the gap between demand and supply of aircraft, the OEMs are procuring large volumes of aircraft wires and cables. At present, the demand for wide body and narrow body aircraft fleet is high. However, the inclination toward long-range, narrow body type is increasing as the most of commercial aviation companies are focusing on increasing fleet size along with lowering operational costs. The tremendous rise in the procurement of aircraft wires and cables by aircraft giants such as Boeing and Airbus is a crucial factor driving the market for the same.

The ongoing COVID-19 is having a very devastating impact over the North America region. North America is one of the most important regions for adopting and developing new technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Due to COVID-19, several aircraft manufacturers in the region faced challenges, which includes shutdowns of production sites and disruptions in the workplace, raw materials, and goods. For instance, in the second quarter of 2020, Boeing suspended its operations in Philadelphia, Puget Sound, South Carolina, and numerous other major production sites. The company’s revenues declined by US$ 18,401 million in 2020 compared with 2019, majorly due to less revenues in its commercial airplane and services businesses. Besides, due to global breakdown Boeing delivered 157 aircraft in 2020, which is down from 380 in 2019 and 806 in 2018. Due to disruption in the business of aircraft manufacturers, several wires & cables suppliers also suspended operations during the second quarter of 2020, and they witnessed additional disruptions in 2021. Thus, the North American aircraft wire & cable market has been shattered by the momentary shutdown of the aviation industry, reflecting severely less demand for various types of components, including wires & cables. Due to this, the aircraft wire & cable market players have been witnessing noteworthy less demand; however, as the unlock measures started, and airlines resumed their operations, the procurement rate of wires & cables begun to uprise at a slow pace.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America aircraft wire & cable market. The North America aircraft wire & cable market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Aircraft Wire & Cable Market Segmentation

North America Aircraft Wire & Cable Market – By Type

- Cable

- Wire

- Harness

North America Aircraft Wire & Cable Market – By Aircraft Type

- Commercial

- Military

North America Aircraft Wire & Cable Market – By Fit Type

- Line Fit

- Retrofit

North America Aircraft Wire & Cable Market – By Application

- Power Transfer

- Data Transfer

- Flight Control System

- Avionics

- Lighting

North America Aircraft Wire & Cable Market, by Country

- US

- Canada

- Mexico

North America Aircraft Wire & Cable Market - Companies Mentioned

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- PIC Wire & Cable

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

North America Aircraft Wire & Cable Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 295.17 Million |

| Market Size by 2028 | US$ 453.44 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Aircraft Type, Fit Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- PIC Wire & Cable

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

Get Free Sample For

Get Free Sample For