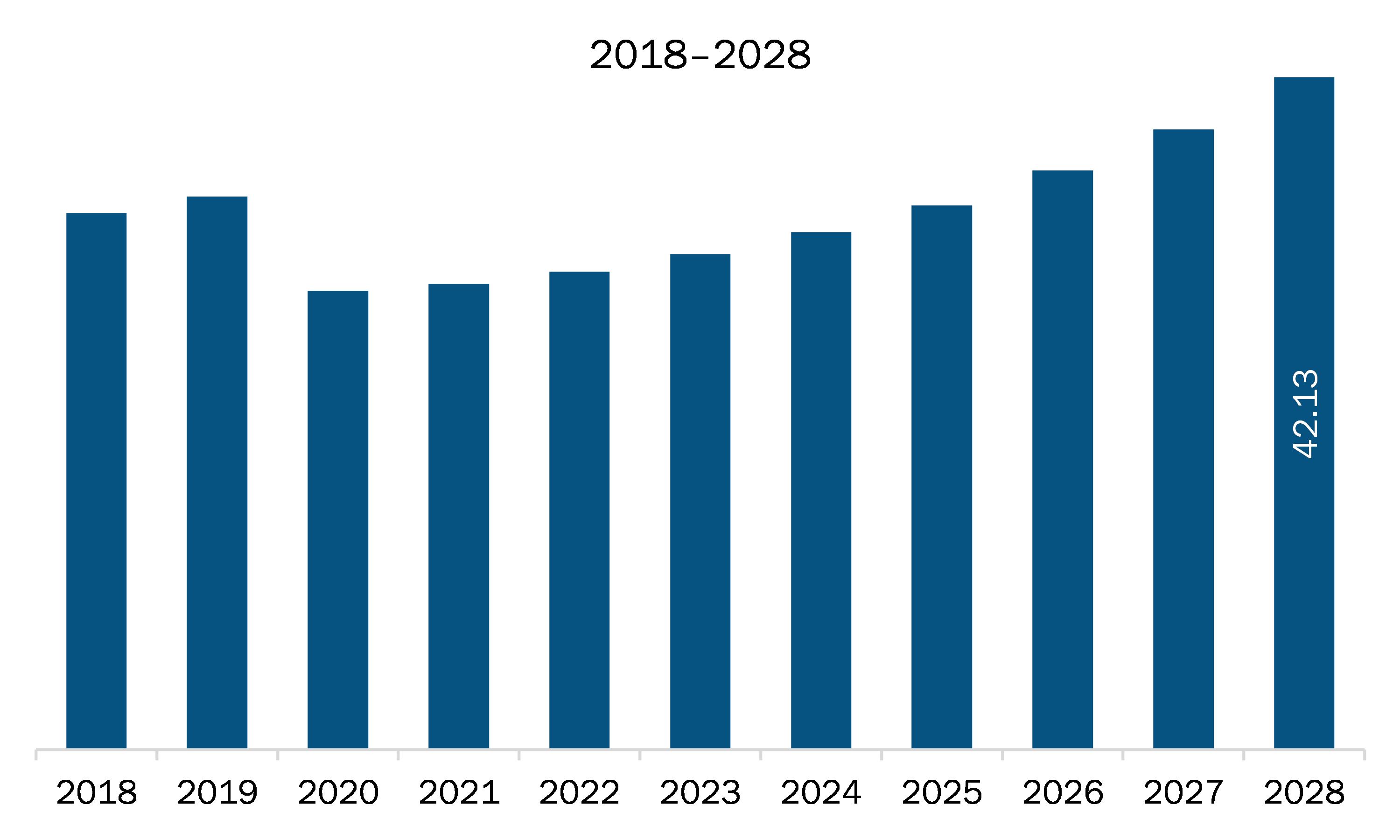

The North America broaching tools market is expected to grow from US$ 29.16 million in 2021 to US$ 42.13 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Accentuating manufacturing sector is expected to escalate the North America broaching tools market. Owing to the economic growth, the manufacturing sector has gained significant traction over the last two decades, especially in North America region. Broaching tools are widely used for producing various industrial components and sub-assembly parts. The rising demand for high speed and accurate finishing process from the end-use sectors such as automotive, aerospace & defense, and construction is encouraging broaching tools manufacturers to introduce advanced tools in the North America market. The manufacturing sector is one of North America’s key economic growth drivers. Factors such as low labor cost, increasing young population, and government benefits in form subsidiaries and tax incentives attract organizations to set up larger manufacturing bases in North America. Further, government initiatives are propelling the growth of the manufacturing sector in North America region. Also, the growing disposable income among the masses is leading to increasing adoption of the modern lifestyle in North America, which is fueling the demand for consumer electronics and automobiles, thus bolstering the manufacturing sector. Therefore, the growing manufacturing sector is anticipated to drive the growth of the North America broaching tools market.

In case of COVID-19, the US is the worst-hit country in North America due to the outbreak. The outbreak has created significant disruptions in primary industries such as manufacturing, healthcare, energy & power, electronics & semiconductor, aerospace & defense, and construction. A significant decline in the growth of mentioned industrial activities is impacting the performance of the North America broaching tools market. The increasing number of infected individuals has led governments of North American countries to shut down nation’s borders during Q2 of 2021. Most of the manufacturing plants are either temporarily shut or are operating with minimum staff strength; moreover, the supply chains of components and parts are disrupted. The US is one of the largest markets for broaching tools, especially due to its technologically advanced aerospace & defense and manufacturing sectors. However, the outbreak has severely affected the production and revenue generation due to lowered production volumes. Thus, the COVID-19 pandemic continues to have a negative impact on the growth of the broaching tools market in North America.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America broaching tools market. The North America broaching tools market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Broaching Tools Market Segmentation

North America Broaching Tools Market – By Type

- Internal Broaches

- External Broaches

- Special Broaches

North America Broaching Tools Market – By End User

- Manufacturing

- Automotive

- Aerospace and Defense

- Construction

- Others

North America Broaching Tools Market, by Country

- US

- Canada

- Mexico

North America Broaching Tools Market -Companies Mentioned

- American Broach & Machine Company

- Blohm Jung Gmbh

- Colonial Tool Group Inc.

- Ekin S. Coop

- Messer Räumtechnik Gmbh & Co. KG

- Miller Broach

- Mitsubishi Heavy Industries Machine Tool Co., Ltd.

- Nachi-Fujikoshi Corp

- The Broach Masters, Inc.

North America Broaching Tools Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 29.16 Million |

| Market Size by 2028 | US$ 42.13 Million |

| CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For