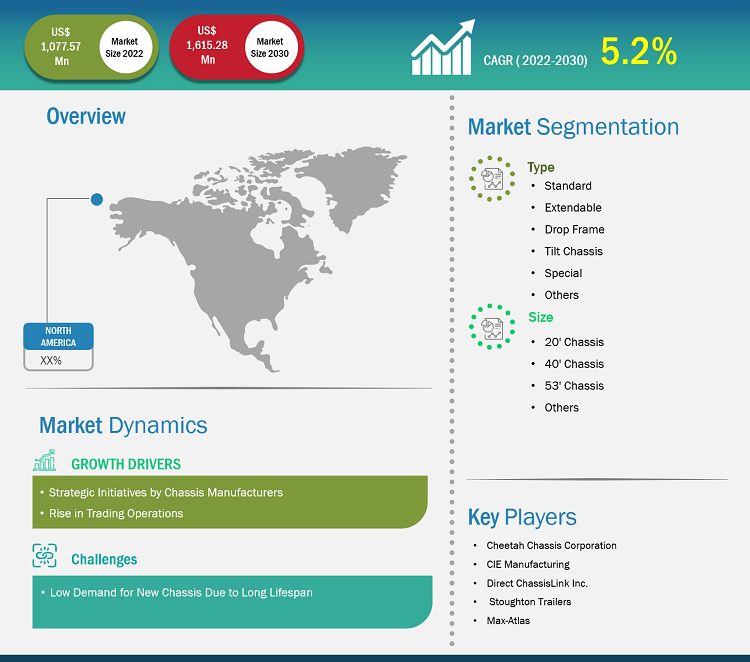

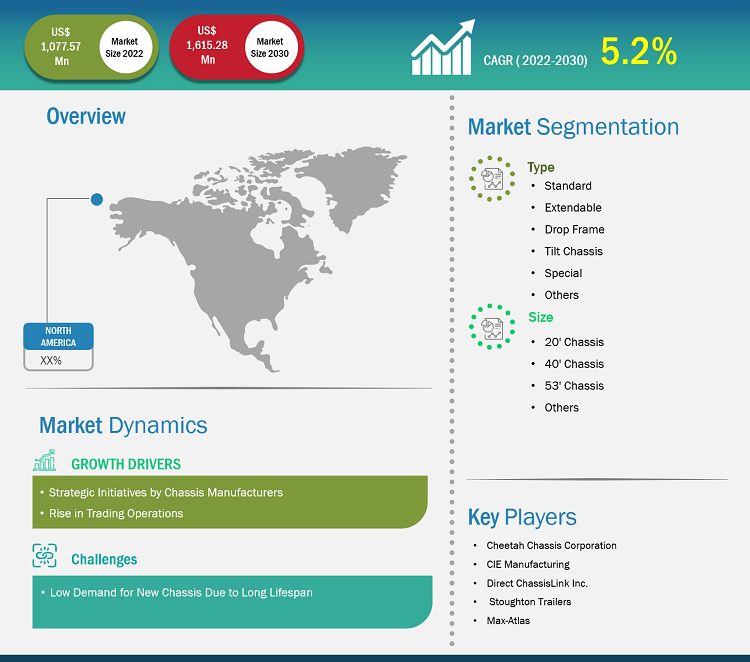

The North America chassis container market accounted for US$ 1,077.57 million in 2022 and is expected to register a CAGR of 5.2% during 2022–2030 to account for US$ 1,615.28 million by 2030.

Analyst Perspective:

Based on geography, the North America chassis container market is segmented into the US and Canada. The region is a pioneer in adopting and expanding its business capabilities to meet the growing customer demand. With globalization, there is a rising demand for goods and services across international borders. Further, according to the Bureau of Economic Analysis, a significant rise in import and export activities between the US and China was observed in 2022 compared to 2021. The increase in trade requires large containers and chassis to transport goods from ports and warehouses. Key chassis container market players are thus taking strategic initiatives to boost the sales of container chassis to meet the growing demand. In June 2022, GIC, OMERS Infrastructure, and Wren House jointly acquired Direct Chassis Link Inc. (DCLI), a chassis leasing company in the US. This acquisition will strengthen the DCLI capabilities to reach more customers and leverage the constant support from the GIC, OMERS Infrastructure, and Wren House. Moreover, market players are building new chassis manufacturing units to cater to the rising chassis demand amid the chassis shortage issue in the US. In addition, CIEM expanded its California manufacturing plant in 2020. In March 2022, TRAC Intermodal partnered with American Made Chassis (AMC) to manufacture and supply new marine container chassis. Strategic partnerships among the chassis container market players to manufacture container chassis lead to increased collaboration in design, manufacturing, and distribution capabilities of market players, aiding the chassis container market expansion in North America. Cheetah Chassis Corporation CIE Manufacturing is one of the key players operating in the chassis container market in North America.

Market Overview:

Container chassis is generally used by intermodal equipment providers (IEP), shipping lines, and motor carriers, which involve regional and local movement of containers by trucks. Chassis is used for moving containers from loading areas to the yard and from yard storage areas to the terminals.

Regulatory bodies and regulations such as the Federal Motor Carrier Safety Administration (FMCSA), Container Safety Certificate (CSC), and the International Organization for Standardization (ISO) have a strong influence on the chassis container market. In February 2021, Federal Motor Carrier Safety Administration (FMCSA) enforced its Intermodal Chassis rule that requires intermodal equipment providers (IEPs), motor carriers, and drivers to share responsibility for the safety of intermodal equipment used on highways. Further, government investments in highway and road infrastructure to enhance the quality of roads, railroads, ports, and air transport are anticipated to trigger the chassis container market growth in the coming years. An improved transportation infrastructure would boost logistics operations in the commercial and industrial sectors, thereby aiding in the secure and timely delivery of goods and services. In March 2023, the provincial Government of Newfoundland and Labrador announced an investment of ~US$ 1.4 billion to enhance road and highway transportation infrastructure over the next five years. Container chassis are used in various commercial and industrial transportation. Thus, government investments to boost the commercial and industrial segments of economies by improving road and highway infrastructure are projected to offer promising growth opportunities for the chassis container market during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Chassis Container Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Chassis Container Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Rise in Trading Operations is Boosting the North America Chassis Container Market Growth

Containers are widely used to transport consumer goods, industrial goods, raw materials such as steel and chemicals, construction materials, and agricultural products. In general, containers are used to ship a wide range of goods across international borders due to their ability to accommodate large volumes of cargo and their suitability for intermodal transportation. A rise in trade activities worldwide propels the demand for larger containers for transferring goods from one point to another. According to the World Trade Organization (WTO), in 2022, world trade has increased by an annual average of 4% in terms of volume and 6% in terms of value since 1995. As a result, North American countries also invest heavily in the shipping industry to enhance trading operations. For instance, the US Department of Agriculture (USDA) partnered with Port Houston to develop a dedicated chassis pool system at Port Houston terminals. According to the USDA, a trade worth nearly half a billion dollars of poultry and beef has been witnessed at Port of Houston in 2021. Thus, to meet the storage demand, the USDA has initiated a new program with the Port of Houston, which will upsurge the demand for shipping goods and drive the chassis container market. Further, container chassis are not limited to transferring goods by sea and land. They are also used for the intermodal transfer of containers via different modes of transportation, such as ships, trains, and trucks. Thus, the continuously growing trade activities across North America bolster the growth of the chassis container market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on axle, the North America chassis container market share is segmented into 2-Axles, 3-Axles, 4-Axles, and more than 4-Axles.

3-Axles are chassis designed to provide additional support and stability when transporting heavy loads. This 3-axles design is particularly suited for hauling overweight containers or cargo, as the added axle helps distribute the weight more evenly, reducing the stress on each individual axle. Owing to the reduced stress of each axle, it further increases the life span of the chassis. The additional axle enables heavier load transportation that also helps enhance stability and reduce the risk of accidents, ensuring safer transportation of goods. Owing to such advantages, the 3-axle chassis is suitable for various applications and industries, including agriculture, oil & gas, construction, and shipping. Various key chassis container market players are introducing new products by leveraging the versatile application of 3-axle chassis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Regional Analysis:

The chassis container market share in Canada is highly competitive due to the booming logistics and transportation industry in the region. DHL, DTDC, and FedEx are among the top logistics companies in Canada. These logistic companies use containers for shipping goods. According to the International Trade Administration, there were over 27 million e-Commerce users in Canada in 2022, accounting for 75% of the Canadian population. Thus, the demand for logistics and transportation is high in Canada, due to which the chassis container market share of Canada will continue to flourish in the upcoming years.

Key Player Analysis:

ChassisKing Inc, Cheetah Chassis Corp, Direct ChassisLink Inc, Max-Atlas Equipement Inc, STI HOLDINGS INC, CIE Manufacturing Inc, Bull Chassis, Jansteel USA Inc, Pro-Haul Manufacturing Inc, and Hercules Enterprise LLC are among the prominent market participants in the North America chassis container market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America chassis container market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the North America chassis container market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the North America chassis container market players are listed below:

Year | News |

Jan 2023 | Max-Atlas Equipment International Inc. of Saint-Jean-sur-Richelieu, the largest container chassis manufacturer in Canada, announces announced the sale of the Company company to a new group of four shareholders. The transaction, which closed on January 1, 2023, involved the transfer of all Company company shares held by the founders, Tibor Varga and Andrew Morena, to the new owners. One of the new shareholders, Stéphane Guérin, will serve as President and Chief Executive Officer of Max-Atlas. |

Apr 2022 | Stoughton Trailers, LLC, a one of the leaders in transportation equipment, announced the company signed an agreement to purchase property on highways 51 in the far northwest corner of the City of Stoughton. Depending on feasibility and local interest, the company’s plans for the site includeto constructing a new corporate headquarters building and possibly additional public and private developments. |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Cheetah Chassis Corp, Direct ChassisLink Inc, Max-Atlas Equipement Inc, STI HOLDINGS INC, are CIE Manufacturing Inc are the top key market players operating in the North America chassis container market.

In North America, the US significantly contributes to the automobile industry. According to the Alliance for Automotive Innovation Report in 2021, the automotive industry's ecosystem, beginning with automotive component manufacturers to the original vehicle manufacturers, generates over US$ 1 trillion annually for the US economy. The automotive sector in the US contributed 4.9% of its overall GDP, with manufacturing of vehicles and their parts representing 6% of the overall manufacturing in the country.

The demand for containers is growing with the rise in trading activities worldwide. These containers are used for the national and international shipping of high-volume goods due to their ability to hold a large amount of cargo. Considering the growing adoption of containers, manufacturers are scaling up their manufacturing operations, which propels the demand for chassis for these containers.

The List of Companies - North America Container Chassis Market

- ChassisKing Inc

- Cheetah Chassis Corp

- Direct ChassisLink Inc

- Max-Atlas Equipement Inc

- STI HOLDINGS INC

- CIE Manufacturing Inc

- Bull Chassis

- Jansteel USA Inc

- Pro-Haul Manufacturing Inc

- Hercules Enterprise LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to North America Chassis Container Market

Oct 2023

Connected Vehicle Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Technology (5G, 4G/LTE, 3G & 2G), Connectivity (Integrated, Tethered, Embedded), Application (Telematics, Infotainment, Driving assistance, Others) and Geography

Oct 2023

Global Archive - Hydrogen Fuel Cell Train Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, and Others), Component (Hydrogen Fuel Cell Pack, Batteries, Electric Traction Motors, and Others), Rail Type (Passenger Rail, Commuter Rail, Light Rail, Trams, Freight, and Others) and Geography

Oct 2023

Automotive High Voltage Cable Market

Forecast to 2030 - Global Analysis by Vehicle Type [Battery Electric Vehicles (BEV), Plugin Hybrid Electric Vehicles (PHEV), and Plugin Hybrid Vehicles (PHV)], Conductor Type (Copper and Aluminum), and Core Type (Multi Core and Single Core)

Oct 2023

40-Ft Electric Boat Market

Forecast to 2030 - Global Analysis by Propulsion (Pure Electric, Hybrid, and Sail Electric), Battery Type (Nickel-Based, Lead-Acid, and Lithium-Ion), Application (Fishing, Recreational, and Others), Voltage Architecture (12 V, 24 V, and 48 V), and Boat Type (Trawlers, Catamarans, Yachts, Power Cruisers, and Others)