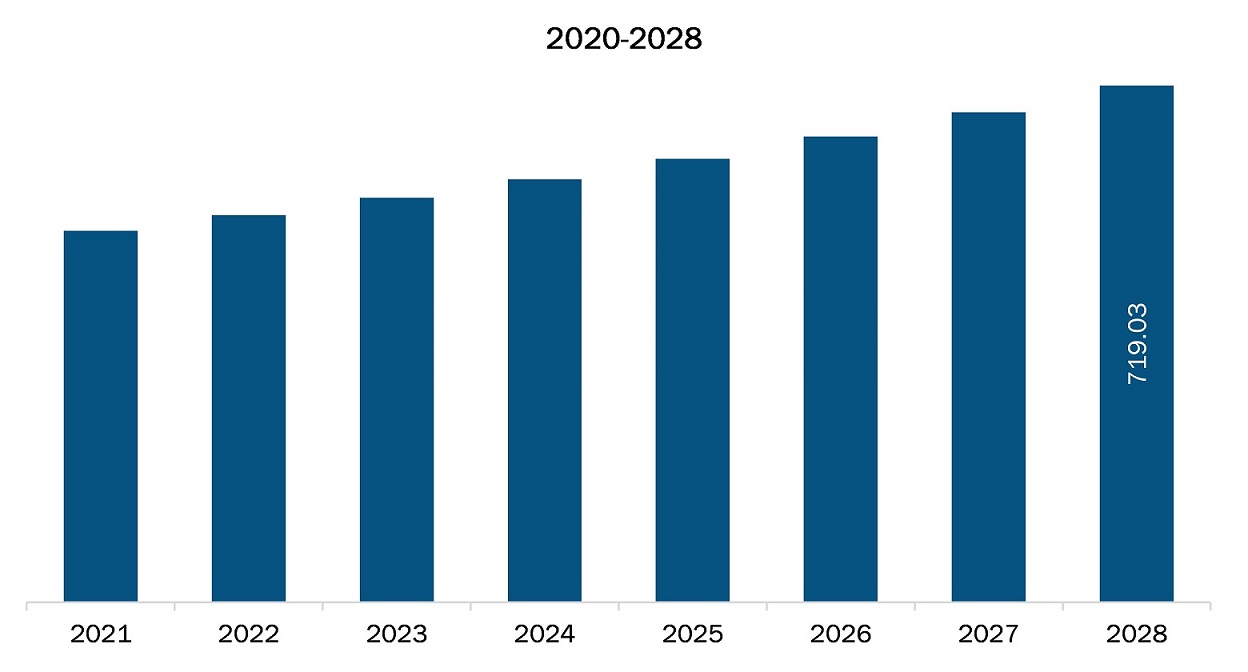

The North America colonoscopes market is expected to reach US$ 719.03 million by 2028 from US$ 516.92 million in 2021; it is estimated to grow at a CAGR of 4.8% from 2021 to 2028.

A few factors such as the increasing prevalence of colorectal cancer, growing research activities to extend its applications in therapeutic areas, technological advancements in colonoscopy devices, and development of robotic colonoscopes drive the market growth in the region. However, the availability of alternative diagnostic tests for rectal diseases hampers the growth of the market.

Colorectal cancer is a malignant tumor that develops in the tissues of colon or rectum. Colon and rectal cancer are often grouped due to common features of both conditions. Colorectal cancer is the third most common cancer type (excluding skin cancer) diagnosed every year in the US. In 2021, 149,500 adults are estimated to be diagnosed with colorectal cancer in the country. The incidence of this cancer type has been rising in young people since the mid-1990s. Among men and women of age 30–39 in the US, colorectal cancer is estimated to be the fourth most diagnosed cancer. It is estimated to cause 52,980 deaths (28,520 men and 24,460 women) in 2021. Furthermore, it is the second leading cause of cancer death in the country, among men and women combined, while it stands as the third leading cause of cancer death when men and women are considered separately. Such a high prevalence makes it the second most frequently occurring cancer, after breast cancer, and the second leading cause of death, after lung cancer. In ideal situations, where the cancer is diagnosed in early stages, doctors can remove the tumor via surgical procedures. A colonoscopy is an important screening test for colorectal cancer, and it has become a part of routine cancer screening. The annual count of adults getting screened for cancer surged by 3.3 million in the US during 2014–2016, which is considered a prime factor associated with a 30% decrease in colon cancer mortality rate in people older than 50 in the past decade. In its updated screening guidelines released in 2018, the American Cancer Society quoted colonoscopies as the gold standard for detecting cancers and precancerous polyps in the colon. In addition, studies suggest that colonoscopy can help reduce colorectal cancer incidence by ~40% and mortality by ~50%, which indicates a promising future for the North America colonoscopy devices market growth. Also, to significantly reduce the adenoma “miss rate” of standard forward-viewing colonoscopy, manufacturers across globe are continuously striving to improve the current colonoscopy techniques, by exploring more advanced optics and wider-angle visualization tools along with a user-friendly, intuitive endoscopic platform interface. The introduction of such technologies is fuelling the colonoscope market growth.

In North America, the US was heavily impacted by the COVID-19 pandemic. Due to the spread of the novel coronavirus, many cities were closed, resulting in treatments and cancellationsof various surgeries. During the initial phase of the COVID-19 outbreak in 2019, healthcare systems in the US quickly adapted to reduce disease transmission and reserve hospital beds for the infected. Although elective and non-urgent procedures were initially required to be delayed, prolonged delays or cancellations could lead to other public health crises due to the rising incidence of preventable and chronic diseases. The COVID-19 pandemic has resulted in several changes in gastroenterological practice, both directly and in response to recommendations from professional societies. The technology platform and healthcare modeling data showed an initial 90% decrease in colonoscopies and biopsies year over year; an estimated 1.7 million missed colonoscopies. Also, it estimated that an additional 4,500 deaths could be due to colon cancer alone over the next decade due to COVID-19-related delays. As a result, the COVID-19 pandemic has had a negative impact on the colonoscopes market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA COLONOSCOPES MARKET SEGMENTATION

By Product Type

- Fiber Optic Colonoscopy Devices

- Video Colonoscopy Devices

By Application

- Colorectal Cancer

- Lynch Syndrome

- Ulcerative Colitis

- Crohn's Disease

- Polyp

By End User

- Hospitals

- Ambulatory Surgery Center

- Other End Users

By Country

- US

- Canada

- Mexico

Company Profiles

- Fujifilm Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- PENTAX Medical

- Boston Scientific Corporation

- Ambu A/S

- SonoScape Medical Corp.

North America Colonoscopes Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 516.92 Million |

| Market Size by 2028 | US$ 719.03 Million |

| CAGR (2021 - 2028) | 4.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For