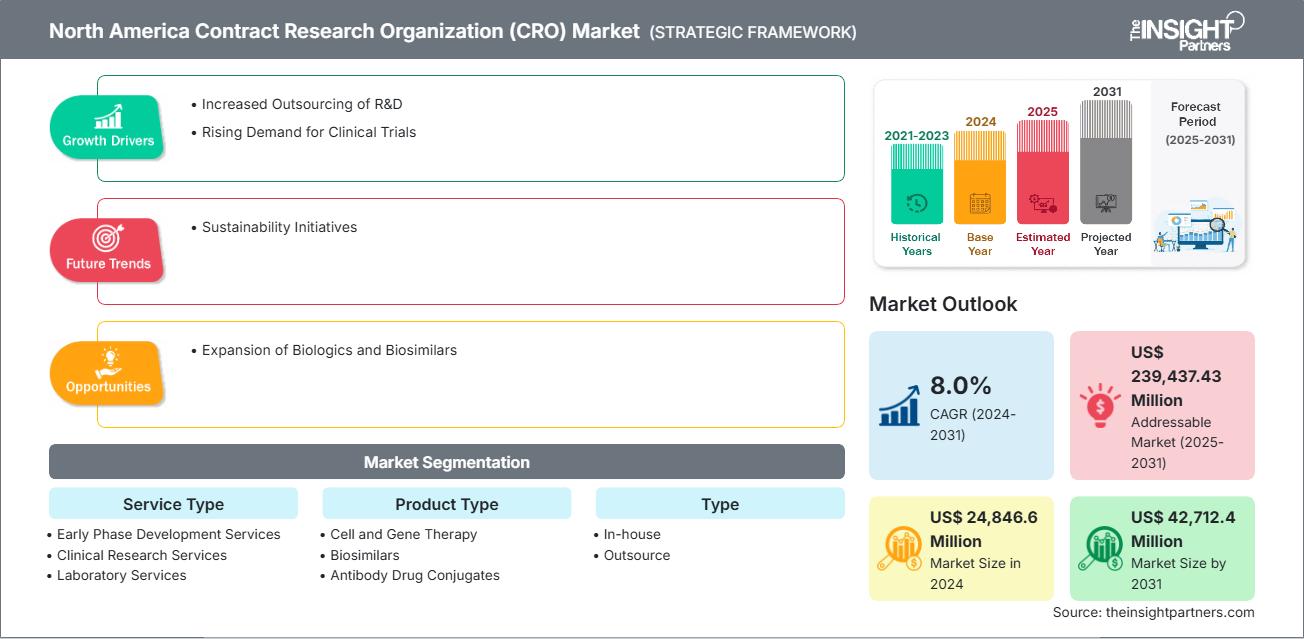

The North America Contract Research Organization (CRO) Market size is expected to reach US$ 42,712.4 Million by 2031 from US$ 24,846.6 Million in 2024. The market is estimated to record a CAGR of 8.0% from 2024 to 2031.

Executive Summary and North America Contract Research Organization (CRO) Market Analysis:

The contract research organization market in North America is segmented into the US, Canada, and Mexico. The US holds the largest market share, followed by Canada. The growth in North America is characterized by growing demand for contract research organizations by the healthcare market players, growing support from the government to provide cost-effective healthcare service, increasing strategic developments by the contract research organization players to enhance services, and a growing healthcare industry that demands frameworks and guidelines based on the real-world data for their business models

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Contract Research Organization (CRO) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Contract Research Organization (CRO) Market Segmentation Analysis:

- By Service Type, the North America Contract Research Organization (CRO) Market is segmented into Early Phase Development Services, Clinical Research Services, Laboratory Services, and Post-Approval Services. Clinical Research Services held the largest share of the market in 2024.

- By Product Type, the North America Contract Research Organization (CRO) Market is segmented into Cell and Gene Therapy, Biosimilars, Antibody Drug Conjugates, and Others. Biosimilars held the largest share of the market in 2024.

- By Type, the North America Contract Research Organization (CRO) Market is segmented into In-house and Outsource. Outsource held the largest share of the market in 2024.

- By Application, the North America Contract Research Organization (CRO) Market is segmented into Oncology, Neurology, Cardiology, Infectious Diseases, Metabolic Disorder, Nephrology, Respiratory, Dermatology, Ophthalmology, Hematology, and Others. Oncology held the largest share of the market in 2024.

- By End User, the North America Contract Research Organization (CRO) Market is segmented into Pharmaceutical and Biotech Companies, Medical Device Companies, Academic and Research Institutes, and Others. Pharmaceutical and Biotech Companies held the largest share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 24,846.6 Million |

| Market Size by 2031 | US$ 42,712.4 Million |

| CAGR (2024 - 2031) | 8.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Contract Research Organization (CRO) Market Players Density: Understanding Its Impact on Business Dynamics

The North America Contract Research Organization (CRO) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Contract Research Organization (CRO) Market top key players overview

North America Contract Research Organization (CRO) Market Outlook

The Contract Research Organization (CRO) industry is growing strongly across the globe, owing to the rising outsourcing of research and development (R&D) operations in pharmaceutical, biotechnology, and medical device firms. With the healthcare sector becoming increasingly competitive and innovation-driven, firms are under tremendous pressure to speed up drug discovery. Contracting R&D to CROs enables companies to access their specialized expertise, sophisticated infrastructure, and global connectivity without significant investments. CROs offer full-service solutions, from preclinical research to clinical trials, regulatory affairs, and post-marketing surveillance, and thus help sponsors concentrate on their core competencies.

Discovery CROs are forming long-term strategic partnerships with pharmaceutical and biotechnology companies, academic institutions, and other CROs. These collaborations can involve co-developing drugs, joint ventures, or preferred provider agreements, allowing both parties to leverage each other's strengths. Such partnerships can significantly reduce the time required to bring a drug to market, accelerating the process by months compared to traditional outsourcing. In the US, it typically takes 10 to 15 years and over US$2.5 billion to develop a single drug, with most costs arising from the discovery and development phases. By sharing expertise, resources, and technologies, these collaborations foster innovation, help mitigate risks, and distribute research costs. Therefore, the market is well-positioned for continued growth due to rising dependence on R&D outsourcing to achieve efficiency, save costs, and get life-saving drugs to patients more quickly.

North America Contract Research Organization (CRO) Market Country Insights

By country, the North America Contract Research Organization (CRO) Market is segmented into the United States, Canada, and Mexico. The United States held the largest share in 2024.

The US is the largest market for contract research organizations and is estimated to continue its dominancy owing to the presence of leading contract research organizations, a well-established healthcare industry that provides a broader scope for contract research organizations, and a growing shift toward outsourcing R&D and clinical trial services. Contract research organizations are crucial to the biotechnology, pharmaceutical, and medical device industries owing to their offering of outsourced research services that help accelerate the typically prolonged and complicated drug development process. Due to the need for quicker drug development and technical developments, the landscape for contract research organizations in the US is evolving quickly. The regulatory environment heavily impacts the operation of contract research organizations. Initiatives such as real-time assessment, which permits simultaneous data assessment during clinical trials, have been established by the US FDA. Contract research organizations manage and evaluate data in real time related to this change. There is a growing number of clinical trials with increasing investments in research and development in the country. According to an article published in the United States National Library of Medicine in May 2023, 437,533 clinical trials were registered in 221 countries in 2023, an increase from 399,499 in 2022, among which 140,492 (31%) were registered in the US. Contract research organizations help lower the risks of trial delays and regulatory obstacles by assisting pharmaceutical businesses in navigating this environment.

Therefore, the above-mentioned benefits offered by contract research organizations are contributing to the growth of the market in the US

North America Contract Research Organization (CRO) Market Company Profiles

Some of the key players operating in the market include Parexel International Corp, IQVIA Holdings Inc, Syneos Health Inc, Medpace Holdings Inc, Thermo Fisher Scientific (PPD Inc), ProPharma Group, Precision Medicine Group, LLC., O4 Research Ltd, Julius Clinical, Siron Clinical, Clinmark sp. z o.o., Pharmaxi LLC, Smerud Medical Research Group, AURIGON GMBH.

These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Contract Research Organization (CRO) Market Research Methodology

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations

- Industry trade journals and other relevant publications

- Government documents, statistical databases, and market reports

- News articles, press releases, and webcasts specific to companies operating in the market

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research

- Enhance the expertise and market understanding of the analysis team

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, Business Development Managers, Market Intelligence Managers, and National Sales Managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For