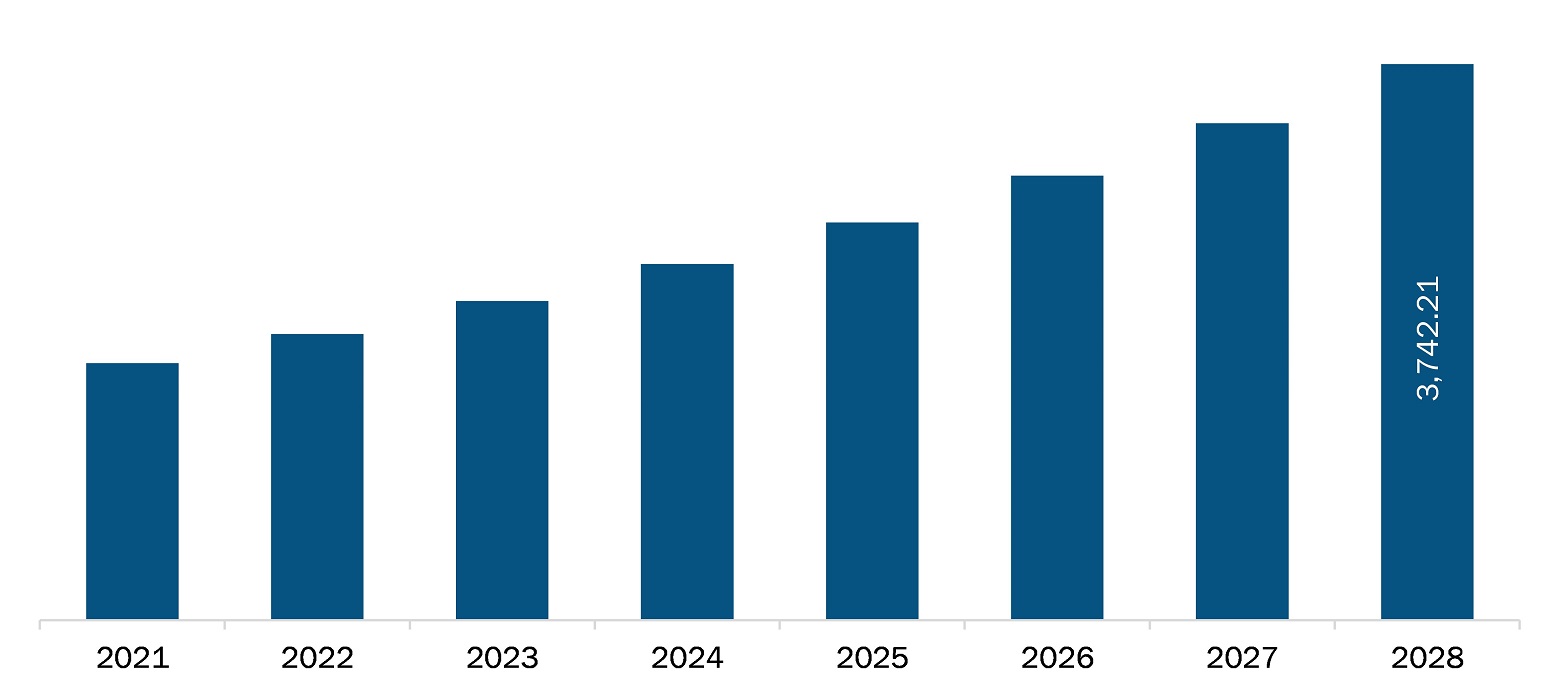

The North America dermal fillers market is expected to reach US$ 3,742.21 million by 2028 from US$ 1,728.95 million in 2021; it is estimated to grow with a CAGR of 11.7% from 2021 to 2028.

The growth of the market is attributed to the factors such as preference for minimally invasive procedures, growth in population of age 30–65 years, and rise in the attraction of consumers toward beauty and wellness. However, the high cost of surgeries hinders the North America Dermal Fillers market growth.

In recent years, the adoption of minimally invasive procedures has increased worldwide. Several minimally invasive dermatological techniques have been developed for facial rejuvenation. Injectable dermal fillers can be injected through a needle into the upper layers of the dermis to treat superficial fine wrinkles or into the deep dermis or subcutaneous space for facial volume augmentation. According to the statistics from the American Society of Plastic Surgeons (ASPS), more than 2.7 million dermal filler procedures were performed in 2019. Further, Allergan stated that the unit sales of dermal filler treatments increased by 17%. Age is a significant factor governing specific needs regarding medical aesthetic procedures. People of age 35–55 prefer minimally invasive aesthetic procedures over surgery. Minimally invasive cosmetic and aesthetic procedures have now become an established interdisciplinary topic, and plastic surgeons showing greater will to explore them. The rise of nonsurgical technologies and new treatment options has made aesthetics more accessible to a broader audience. Collectively, the greater benefits and accuracy of minimally invasive procedures over traditional surgical procedures are expected to drive the market during the forecast period. The ever-increasing interest in retaining a youthful physical appearance has facilitated various minimally invasive dermatological techniques. With the ever-increasing popularity of nonsurgical enhancement and an growing number of patients who have been treated, the demand for fillers continues to rise. Also, the surging inclination among people of age of 30–65 with signs of aging, such as lack of skin elasticity, wrinkles, and dark spots, is anticipated to drive the demand for dermal fillers in the coming years.

The COVID-19 pandemic has adversely affected aesthetic procedures and beauty treatment market. For instance, the US is a highly affected North American country by the pandemic. The extent of the COVID-19 infection is generally mild in adults, while it is adverse in elderly population, which has also contributed to a large number of death cases. The dermal fillers treatment is more common in geriatric population in the US. In North American countries, nonessential procedures were delayed or cancelled for limiting physical contact, to ultimately combat the spread of SARS-CoV-2, a causative agent of COVID-19. These conditions led to decreased demand for dermal fillers in North America in 2020.

The North America dermal fillers market is expected to reach US$ 3,742.21 million by 2028 from US$ 1,728.95 million in 2021; it is estimated to grow with a CAGR of 11.7% from 2021 to 2028. The growth of the market is attributed to the factors such as preference for minimally invasive procedures, growth in population of age 30–65 years, and rise in the attraction of consumers toward beauty and wellness. However, the high cost of surgeries hinders the market growth.

In recent years, the adoption of minimally invasive procedures has increased worldwide. Several minimally invasive dermatological techniques have been developed for facial rejuvenation. Injectable dermal fillers can be injected through a needle into the upper layers of the dermis to treat superficial fine wrinkles or into the deep dermis or subcutaneous space for facial volume augmentation. According to the statistics from the American Society of Plastic Surgeons (ASPS), more than 2.7 million dermal filler procedures were performed in 2019. Further, Allergan stated that the unit sales of dermal filler treatments increased by 17%. Age is a significant factor governing specific needs regarding medical aesthetic procedures. People of age 35–55 prefer minimally invasive aesthetic procedures over surgery. Minimally invasive cosmetic and aesthetic procedures have now become an established interdisciplinary topic, and plastic surgeons showing greater will to explore them. The rise of nonsurgical technologies and new treatment options has made aesthetics more accessible to a broader audience. Collectively, the greater benefits and accuracy of minimally invasive procedures over traditional surgical procedures are expected to drive the market during the forecast period. The ever-increasing interest in retaining a youthful physical appearance has facilitated various minimally invasive dermatological techniques. With the ever-increasing popularity of nonsurgical enhancement and an growing number of patients who have been treated, the demand for fillers continues to rise. Also, the surging inclination among people of age of 30–65 with signs of aging, such as lack of skin elasticity, wrinkles, and dark spots, is anticipated to drive the demand for dermal fillers in the coming years.

The COVID-19 pandemic has adversely affected aesthetic procedures and beauty treatment market. For instance, the US is a highly affected North American country by the pandemic. The extent of the COVID-19 infection is generally mild in adults, while it is adverse in elderly population, which has also contributed to a large number of death cases. The dermal fillers treatment is more common in geriatric population in the US. In North American countries, nonessential procedures were delayed or cancelled for limiting physical contact, to ultimately combat the spread of SARS-CoV-2, a causative agent of COVID-19. These conditions led to decreased demand for dermal fillers in North America in 2020.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Dermal Fillers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,728.95 Million |

| Market Size by 2028 | US$US$ 3,742.21 Million |

| CAGR (2021 - 2028) | 11.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For