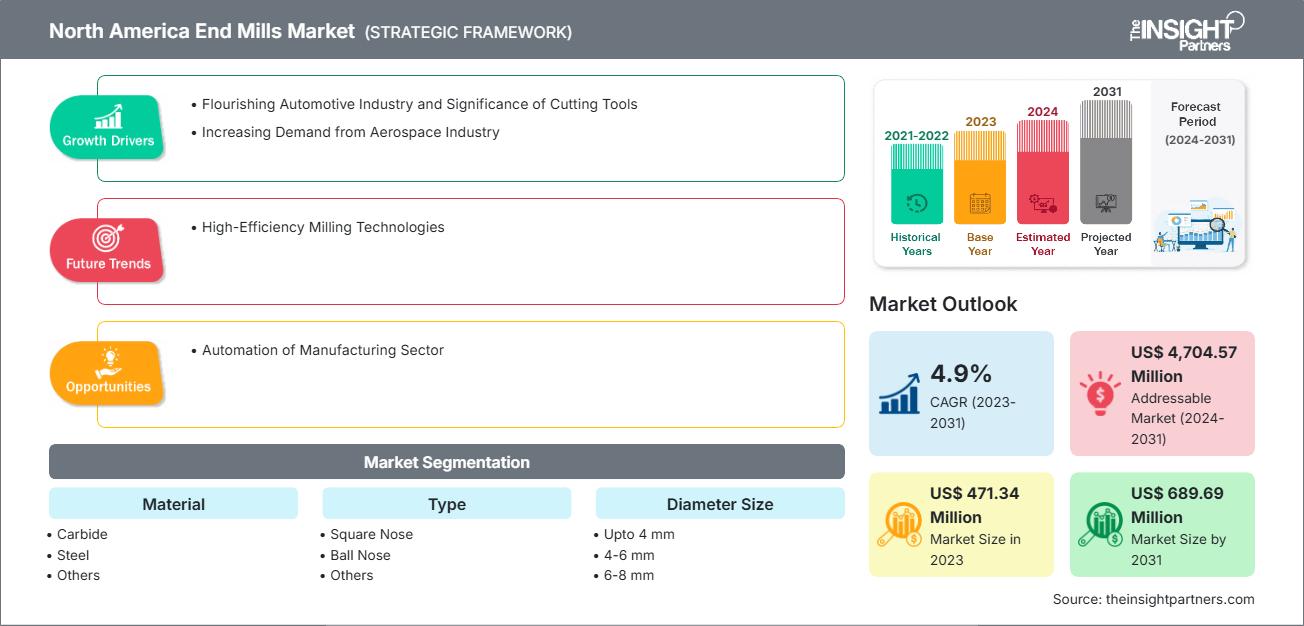

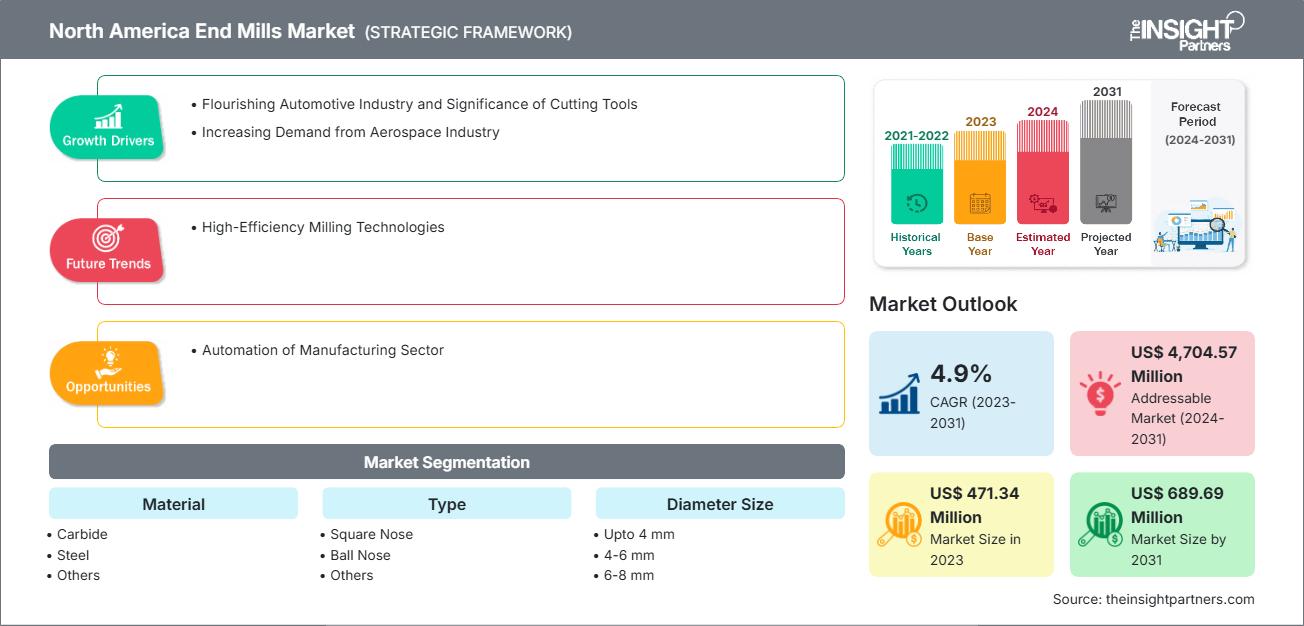

The North America end mills Market size is expected to reach US$ 689.69 million by 2031 from US$ 471.34 million in 2023. The market is estimated to record a CAGR of 4.9% from 2023 to 2031.

Executive Summary and North America End Mills Market Analysis:

The US, Canada, and Mexico are the significant economies in North America. The well-established infrastructure in developed countries, including the US and Canada, helps manufacturing firms explore the limits of science, technology, and commerce. Technological advancements in the region have led to high competition in the manufacturing industry. As per the National Institute of Standards and Technology (NIST), the manufacturing sector in the US was valued at US$ 2.3 trillion in 2021, accounting for a 12.0% share of the total GDP that year. It ranks second among the largest machinery and equipment manufacturing countries in the world. It is also a leading fabricated metal product manufacturer across the world. Thus, a robust machine manufacturing base drives the demand for metal-cutting machines in North America, in turn bolstering the end mills market growth.

North American countries have flourishing aerospace and defense industries, which can be mainly ascribed to stable economies, developed infrastructure, high technology adoption rate, and increasing government involvement. In March 2023, the Government of Canada invested US$ 7.44 million to support the opening of H55 in Canada. H55, a Swiss-based business renowned for providing electric propulsion systems, is a spin-off of Solar Impulse, the first electric airplane provider in the world. The rising trend of prototyping with on-demand metal cutting machines in the aerospace industry offers practical ways to rapidly manufacture aerospace sheet metal parts without the need for complicated manufacturing setups. This trend of rapid prototyping may generate a massive demand for metal-cutting machines, which is expected to bolster the end mills market growth in North America in the future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America End Mills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America End Mills Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America End Mills Market Segmentation Analysis:

Key segments that contributed to the derivation of the web content management market analysis are material, type, diameter size, and end-use industry.

- Based on material, the North America end mills market is segmented into carbide, steel, and others. The carbide segment held the largest share of the market in 2023.

- In terms of type, the North America end mills market is segmented into square nose, ball nose, and others. The square nose segment held the largest share of the market in 2023.

- By diameter size, the North America end mills market is segmented into upto 4 mm, 4-6 mm, 6-8 mm, 8-12 mm, and Above 12 mm. The upto 4 mm segment held the largest share of the market in 2023.

- By end-use industry, the North America end mills market is segmented into automotive, heavy machinery, semiconductor and electronics, medical and healthcare, energy, aerospace and others. The automotive segment held the largest share of the market in 2023.

North America End Mills Market Report Scope

Report Attribute

Details

Market size in 2023

US$ 471.34 Million

Market Size by 2031

US$ 689.69 Million

CAGR (2023 - 2031) 4.9%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Material - Carbide

- Steel

- Others

By Type - Square Nose

- Ball Nose

- Others

By Diameter Size - Upto 4 mm

- 4-6 mm

- 6-8 mm

- 8-12 mm

- Above

By End-Use Industry - Automotive

- Heavy Machinery

- Semiconductor and Electronics

- Medical and Healthcare

- Energy

- Aerospace

- Others

Regions and Countries Covered

North America- US

- Canada

- Mexico

Market leaders and key company profiles

- NS TOOL USA, INC

- TOWA Corporation

- SDK Tool (China) Co., Limited

- Karnasch Professional Tools GmbH

- Hoffmann Group USA

- Kodiak Cutting Tools

- Harvey Tool Company

- Fullerton Tool Company, Inc

- PRECISION TECHNOLOGY CO.,LTD

- UNION TOOL Co.

North America End Mills Market Players Density: Understanding Its Impact on Business Dynamics

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 471.34 Million |

| Market Size by 2031 | US$ 689.69 Million |

| CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The North America End Mills Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America End Mills Market top key players overview

North America End Mills Market Outlook

The automotive industry is an ever-evolving, multifaceted field that requires a variety of cutting tools to generate and develop parts that are assembled to produce a vehicle. Cutting tools are essential in the production and fabrication of all car-related products, from engine parts to transmission components and from body panels to interior trims. These cutting tools are primarily used in a broad range of manufacturing procedures, including turning, drilling, and milling, which are required to confirm the quality and safety of vehicles.

Milling helps create elaborate shapes and features for a variety of automotive components. End mills are the cutting tools made of high-speed steel or carbide. These tools are available in various shapes, sizes, and materials, each designed and developed for specific applications. With suitable cutting tools, such as end mills, manufacturers in the automotive industries look for techniques to enhance production proficiencies, reduce costs, and improve output quality. As a result, they deploy end mills that confer high precision, elasticity, and automation capabilities in their facilities. Thus, automotive industries across the world rely broadly on end mills for applications such as component fabrication, assembly, and surface finishing. In this industry, end mills are used mainly in the manufacturing of engine parts, body panels, and chassis components.

The continuous introduction of new vehicle models and the need for advanced manufacturing procedures would continue to propel the demand for end mills over the forecast period. The US is the largest manufacturer of automobiles. The burgeoning demand for automotive vehicles results in frequent investments in the automotive sector in the country. For instance, in February 2024, Schaeffler announced the expansion of its operations in the US with the addition of a new manufacturing facility concentrating on fabricating automotive electric mobility solutions. The company planned an investment of over US$ 230 million for the establishment of an advanced manufacturing facility in Ohio, US, along with its future expansion until 2032.

Additionally, the assembly plant of the Mazda-Toyota joint venture for manufacturing automotive parts in Huntsville in 2021, General Motors Company's Detroit/Hamtramck Assembly, Flint Truck Assembly, Lansing Delta Township Assembly, Orion Assembly. Ford Motor Company's Flat Rock Assembly Plant, Dearborn Truck, and Michigan Assembly Plant are a few of the major automotive manufacturing plants in the US. The flourishing automotive industry and the significance of cutting tools fuel the end mills market growth.

North America End Mills Market Country Insights

Based on country, the North America end mills market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

The US, Canada, and Mexico are the significant economies in North America. The well-established infrastructure in developed countries, including the US and Canada, helps manufacturing firms explore the limits of science, technology, and commerce. Technological advancements in the region have led to high competition in the manufacturing industry. As per the National Institute of Standards and Technology (NIST), the manufacturing sector in the US was valued at US$ 2.3 trillion in 2021, accounting for a 12.0% share of the total GDP that year. It ranks second among the largest machinery and equipment manufacturing countries in the world. It is also a leading fabricated metal product manufacturer across the world. Thus, a robust machine manufacturing base drives the demand for metal-cutting machines in North America, in turn bolstering the end mills market growth.

North American countries have flourishing aerospace and defense industries, which can be mainly ascribed to stable economies, developed infrastructure, high technology adoption rate, and increasing government involvement. In March 2023, the Government of Canada invested US$ 7.44 million to support the opening of H55 in Canada. H55, a Swiss-based business renowned for providing electric propulsion systems, is a spin-off of Solar Impulse, the first electric airplane provider in the world. The rising trend of prototyping with on-demand metal cutting machines in the aerospace industry offers practical ways to rapidly manufacture aerospace sheet metal parts without the need for complicated manufacturing setups. This trend of rapid prototyping may generate a massive demand for metal-cutting machines, which is expected to bolster the end mills market growth in North America in the future.

Company Profiles

Some of the key players operating in the market include NS TOOL USA, INC; TOWA Corporation; SDK Tool (China) Co., Limited; Karnasch Professional Tools GmbH; Hoffmann Group USA; Kodiak Cutting Tools; Harvey Tool Company; Fullerton Tool Company, Inc; PRECISION TECHNOLOGY CO.,LTD; UNION TOOL Co.; OSG USA, Inc; KYOCERA SGS Precision Tools, Inc.; and IZAR CUTTING TOOLS S.A.L., These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America End Mills Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For