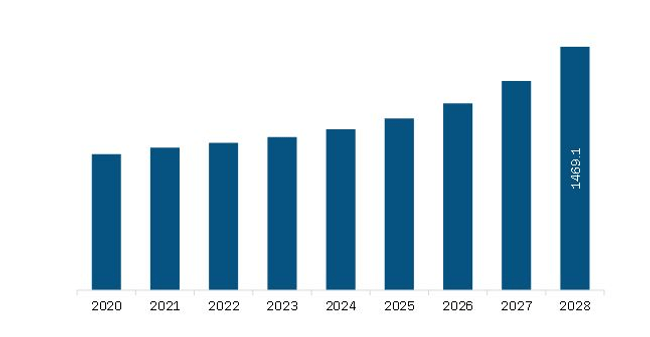

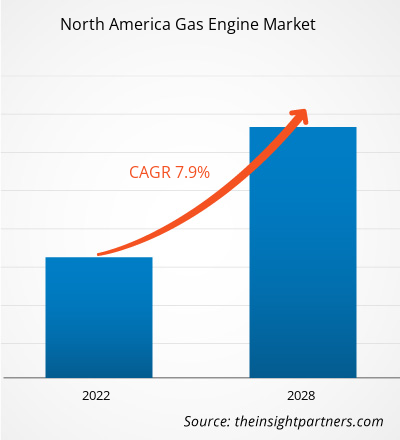

The North America gas engine market is expected to reach US$ 1,469.1 million by 2028 from US$ 861.3 million in 2021. The market is estimated to grow at a CAGR of 7.9% from 2021–2028.

Governments of various countries are imposing certain regulations to control the emissions of diesel and petrol engines, thus compelling engine manufacturers to opt for alternative fuel solutions such as natural gases. Gas engines release less emissions to generate a sufficient amount of with power high efficiency. The emission monitoring and regulatory bodies from various countries are imposing stringent regulations on the use of diesel engines and generators. To meet these regulatory standards, various industries are deploying gas engine and generators for power generation. Moreover, in December 2020, Rolls-Royce launched MTU Series 500, a new series of gas engines, with a power range of 250–550 kilowatt. The engines are specially designed to meet the emission goals by using hydrogen as a power source, which is offering low fuel costs and low fuel consumption for industrial and utility sectors. Similarly, in June 2020, Kawasaki Heavy Industries, Ltd., a heavy equipment manufacturer, launched a new model KG-18-T gas engine. The company introduced a two-stage turbocharging system with 51% electrical efficiency for power generation. Thus, the rise in such development’s activities owing to stringent regulations related to gas engines is propelling the North America market’s growth.

During the COVID-19 pandemic, approximately 2/3rd of the Americans is forced to work remotely. With businesses started to reopen, several companies are still choosing to opt for the WFH strategy and even to reduce their previous capacity for an extended period, which is expected to have negative impact on the gas engines market growth. Also, COVID-19 pandemic is having a huge impact on natural gas consumption and export of LNG gas in the US market. The slowdown of gas demand is further impacting the growth of the market. Moreover, the loss in revenues is expected to restrain several power plants to invest in new gas engines procurement as they are cutting their budgets to moderate the losses.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the gas engine market. The North America gas engine market is expected to grow at a good CAGR during the forecast period.

North America Gas Engine Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Gas Engine Market Segmentation

By Fuel Type

- Natural Gas

- Special Gas

By Power Output

- 100-300 kW

- 300 - 500 kW

- 0.5-1 MW

- 1-2 MW

- 2-5 MW

- 5-10 MW

- 10-20 MW

By End-User

- Remote

- Mining

- Drilling

- Others

- Mid-Stream Oil & Gas

- Heavy Industries

- Chemicals

- Paper

- Metals

- Food and Beverages

- Others

- Light Manufacturing

- Utilities

- Grid

- IPP

- Others

- Biogas

- Datacenters

- MUSH

- Commercial

By Country

- North America

- US

- Canada

- Mexico

Companies Mentioned

- INNIO Jenbacher GmbH & Co OG

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse, LLC

- Kawasaki Heavy Industries, Ltd.

- Liebherr; MAN SE

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- MTU (Rolls-Royce Power Systems AG)

- 2G ENERGY AG

- MAN SE

North America Gas Engine Report Scope

Report Attribute

Details

Market size in 2021

US$ 861.3 Million

Market Size by 2028

US$ 1,469.1 Million

Global CAGR (2021 - 2028)

7.9%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Fuel Type - Natural Gas

- Special Gas

By Power Output - 100 - 300 kW

- 300-500kW

- 0.5- 1 MW

- 1-2 MW

- 2-5 MW

- 5-10 MW

- 10-20 MW

By End-User - Remote

- Mid-Stream Oil and Gas

- Heavy Industries

- Light Manufacturing

- Utilities

- Biogas

- Datacenters

- MUSH

- Commercial

Regions and Countries Covered

North America - US

- Canada

- Mexico

Market leaders and key company profiles

INNIO Jenbacher GmbH & Co OG

Caterpillar Inc.

Cummins Inc.

Fairbanks Morse, LLC

Kawasaki Heavy Industries, Ltd.

Liebherr; MAN SE

Mitsubishi Heavy Industries, Ltd.

W

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 861.3 Million |

| Market Size by 2028 | US$ 1,469.1 Million |

| Global CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Long Read Sequencing Market

- Water Pipeline Leak Detection System Market

- Maritime Analytics Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Foot Orthotic Insoles Market

- Visualization and 3D Rendering Software Market

- Ketogenic Diet Market

- Oxy-fuel Combustion Technology Market

- Hummus Market

- Photo Printing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Energy and Power : READ MORE..

- INNIO Jenbacher GmbH & Co OG

- Caterpillar Inc.

- Cummins Inc.

- Fairbanks Morse, LLC

- Kawasaki Heavy Industries, Ltd.

- Liebherr; MAN SE

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- MTU (Rolls-Royce Power Systems AG)

- 2G ENERGY AG

- MAN SE

Get Free Sample For

Get Free Sample For