Oilfield Service Equipment Market Size, Growth & Forecast to 2031

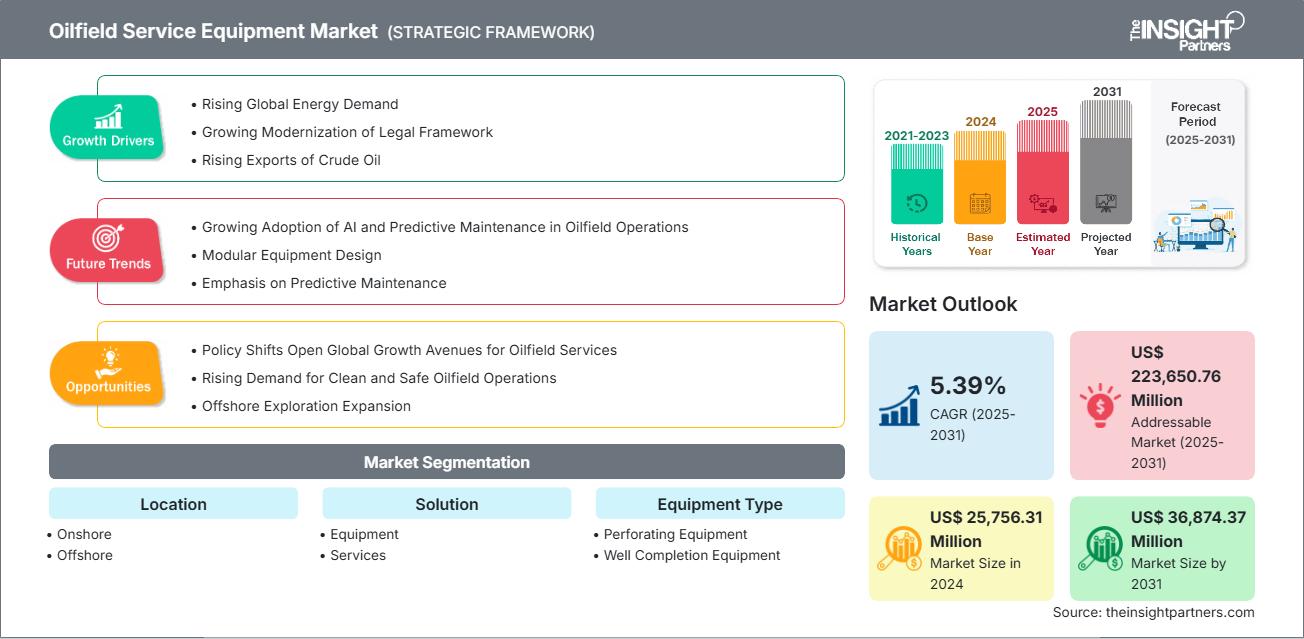

Oilfield Service Equipment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Location (Onshore and Offshore), Solution (Equipment and Services), Equipment Type (Perforating Equipment [Tubing Conveyed Perforating, Wireline Conveyed Perforating and Pump Down Perforating] and Well Completion Equipment [Packers, Sand Control Tools, Multistage Completion Tools, Liner Hanger Systems, Control Valves, and Others]), Service (Perforating Service and Well Completion Service), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPRE00040999

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 373

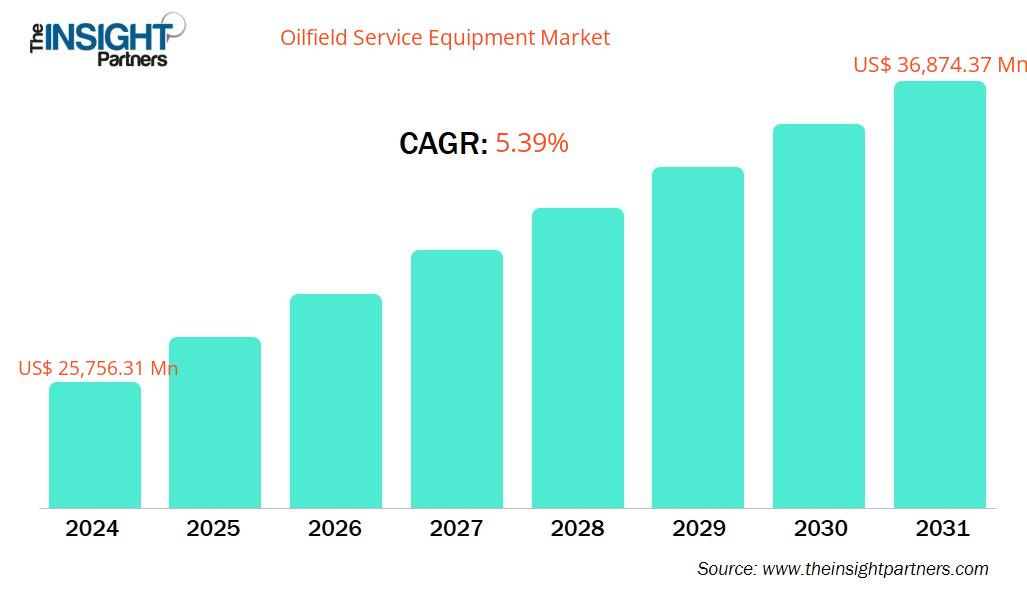

The oilfield service equipment market size is projected to reach US$ 36,874.37 million by 2031 from US$ 25,756.31 million in 2024. The market is expected to register a CAGR of 5.39% during 2025–2031.

Oilfield Service Equipment Market Analysis

The market for oilfield service equipment is growing as a result of rising crude oil exports, modernizing laws, and rising global energy demand. Furthermore, changes in policy open up new opportunities for oilfield services to expand globally, and the growing need for safe and clean oilfield operations is anticipated to open doors for the major companies in the market for oilfield service equipment. The increasing use of AI and predictive maintenance in oilfield operations is a major trend defining the market.

Oilfield Service Equipment Market Overview

The market for oilfield service equipment includes a range of specialized tools, equipment, and technologies that are utilized during the course of oil and gas well lifecycles. Crucial upstream operations like exploration, drilling, well completion, production, and maintenance are supported by this equipment. Drilling rigs, mud pumps, blowout preventers, wellheads, fracturing equipment, downhole tools, and control systems are important parts. These instruments are necessary to enable the safe and effective extraction of hydrocarbons from offshore and onshore reservoirs, frequently under difficult geological circumstances. In order to guarantee operational dependability, reduce downtime, and boost well productivity—all of which eventually support global energy supply chains—the market is essential.

In addition to conventional oil and gas fields, oilfield service equipment is widely used in unconventional resource plays like tight oil, shale gas, and deepwater exploration. This market is becoming more and more significant as a result of the world's increasing energy demand, as operators look for cutting-edge machinery that can maximize recovery while adhering to strict safety and environmental regulations. IoT sensors, automation, AI, and real-time data analytics are just a few examples of the digital technologies that are being integrated to turn conventional oilfield equipment into smart systems that improve predictive maintenance and operational efficiency. In line with the industry's growing emphasis on sustainability, this digital transformation also facilitates environmental monitoring and regulatory compliance.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOilfield Service Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Oilfield Service Equipment Market Drivers and Opportunities

Market Drivers:

- Increasing Global Energy Demand: Growing oil and gas production and consumption, especially in emerging regions, drives exploration and production activities.

- Technological Advancements: Drilling, well completion, and production equipment developments improve efficiency and minimize operational costs.

- Shale Gas Boom: Expansion of shale gas exploration and production, particularly in North America, boosts demand for specialized oilfield service equipment.

- Aging Infrastructure: Replacement and upgradation of outdated equipment in mature oilfields stimulates the market growth.

Market Opportunities:

- Digital Oilfield Integration: Smart equipment solutions become possible when IoT, AI, and automation are implemented in oilfield operations.

- Offshore Exploration Expansion: More offshore drilling projects, particularly in deepwater areas, raise the need for sophisticated machinery.

- Sustainability Initiatives: The creation of energy-efficient and ecologically friendly machinery supports international ESG objectives.

- Strategic Partnerships: Equipment manufacturers and oil companies can work together to speed up market penetration and innovation.

Market Trends:

- Shift to Remote Operations: To improve safety and cut expenses, more and more remote monitoring and control systems are being used.

- Modular Equipment Design: Preference for equipment that can be scaled and customized to meet a variety of field conditions.

- Emphasis on Predictive Maintenance: Using analytics to monitor the health of equipment in real time and prevent failures.

- Emergence of Service-Based Models: Performance-based service agreements and leasing replace equipment sales.

Oilfield Service Equipment Market Report Segmentation Analysis

The oilfield service equipment market is divided into different segments to provide a clearer understanding of market dynamics, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Application:

- Onshore Lower expenses and simpler logistics are advantages of onshore operations. The equipment utilized here needs to be scalable for both small and large fields and able to adapt to a variety of terrains. The market is driven by shale developments and the rejuvenation of mature fields.

- Offshore Strong, corrosion-resistant machinery that can function in harsh conditions and high pressure is essential in offshore settings. High reliability and cutting-edge technologies are necessary for deepwater and ultra-deepwater projects.

By Solution:

- Equipment Includes equipment and machinery used in drilling, perforation, and completion. Equipment must be durable, efficient, and compatible with digital oilfield technologies. Demand is high for modular and automated systems.

- Services Encompasses operational support such as perforation and completion services. These services are growingly outsourced to enhance cost efficiency and leverage specialized expertise. Service providers focus on reliability, safety, and performance optimization.

By Equipment Type:

- Perforating Equipment Designed to create pathways between the wellbore and reservoir. Must ensure precision, safety, and compatibility with various well architectures. Used extensively in horizontal and multistage wells.

- Well Completion Equipment Enables efficient production and reservoir management. Equipment must support zonal isolation, flow control, and long-term durability. Intelligent completion systems are gaining traction.

By Perforating Equipment Type:

- Tubing Conveyed Perforating Suitable for high pressure wells and complex completions. Offers enhanced safety and control during deployment.

- Wireline Conveyed Perforating Cost-effective and flexible. Ideal for vertical wells and quick operations. Increasingly integrated with digital firing systems.

- Pump Down Perforating Preferred in horizontal shale wells. Enables rapid deployment and efficient multistage fracturing.

By Well Completion Equipment Type:

- Packers Provide zonal isolation and pressure containment. Must be reliable under varying downhole conditions.

- Sand Control Tools Prevent formation sand from entering the wellbore. Essential for maintaining production and protecting equipment.

- Multistage Completion Tools Facilitate stimulation across multiple zones. Used in unconventional and horizontal wells for enhanced recovery.

- Liner Hanger Systems Support casing integrity and reduce drilling costs. Must withstand high loads and pressures.

- Control Valves Regulate flow and pressure. Increasingly integrated with smart systems for remote operation.

- Others This category includes niche equipment tailored for specialized completion operations.

By Service:

- Perforating Service Involves the precise execution of perforation jobs. Requires expertise, safety protocols, and advanced tools for optimal reservoir access.

- Well Completion Service Covers planning and execution of completion strategies. Focuses on maximizing production, minimizing downtime, and ensuring long-term well integrity.

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The oilfield service equipment market in Asia Pacific is expected to witness the fastest growth. The oilfield service equipment market in Asia Pacific is witnessing robust growth due to several converging factors. Rapid industrialization and rising energy demand across emerging economies like China, India, Indonesia, and Malaysia are driving increased exploration and production activities. Governments in the region are investing heavily in domestic oil and gas infrastructure to reduce import dependency and enhance energy security. Additionally, technological advancements in drilling and well-completion equipment, along with the adoption of enhanced oil recovery techniques, are boosting operational efficiency and fueling market expansion. The region’s vast untapped reserves, particularly offshore, present lucrative opportunities for service providers, while favorable regulatory reforms and foreign investments further support market development

Report Scope

Oilfield Service Equipment Market Regional Insights

The regional trends and factors influencing the Oilfield Service Equipment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Oilfield Service Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Oilfield Service Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 25,756.31 Million |

| Market Size by 2031 | US$ 36,874.37 Million |

| Global CAGR (2025 - 2031) | 5.39% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Location

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Oilfield Service Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Oilfield Service Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Oilfield Service Equipment Market top key players overview

Oilfield Service Equipment Market Share Analysis by Geography

The oilfield service equipment market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South America (SAM). North America dominated the market in 2024, followed by the Middle East and Africa and Asia Pacific.

North America leads the global oilfield services equipment market because of high crude oil production. Drilling and production activity are growing rapidly in the region. The US produces 13.2 million barrels per day as of 2024, while Canada and Mexico are increasing their exploration and development efforts. This rise in production also brings more incidents of stuck tools, lost equipment, and wellbore blockages. The complexity of well designs, especially with horizontal and directional drilling, raises the chances of these problems, which calls for improved oilfield services. In Mexico, investments from PEMEX and private companies, especially in projects like Ek-Balam, have intensified operations in recent years. At the same time, Alberta is focusing on cleaning up old and unproductive wells, which needs significant intervention and oilfield services to restore well integrity.

The growth of the oilfield services equipment market in Europe is attributed to the increasing offshore drilling activities, especially in the North Sea, Barents Sea, and other areas. As companies such as Equinor expand exploration efforts—such as the 2025 drilling permit in license 532—complex offshore operations heighten the risk of stuck or lost equipment, boosting demand for oilfield services. The rising demand for electricity in Europe intensifies the need for a stable energy supply, supporting oil and gas as part of hybrid systems. Players such as Baker Hughes, Weatherford, and Schlumberger are addressing this need with advanced oilfield services, which are essential for well maintenance and decommissioning.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Largest share globally due to extensive shale gas and tight oil activities, especially in the US.

- Key Drivers: High drilling activity, advanced technology adoption, and strong presence of oilfield service companies.

- Trends: Increasing use of digital oilfield solutions, automation, and environmentally compliant equipment.

2. Europe

- Market Share: Moderate share with focus on offshore operations in the North Sea and mature field management.

- Key Drivers: Stringent environmental regulations, aging infrastructure, and demand for enhanced oil recovery (EOR).

- Trends: Shift toward sustainable equipment solutions and increased investment in offshore wind-oil hybrid platforms.

3. Asia Pacific

- Market Share: Rapidly growing due to rising energy demand and exploration activities in China, India, and Southeast Asia.

- Key Drivers: Expanding oil & gas infrastructure, government investments, and regional energy security initiatives.

- Trends: Adoption of cost-effective equipment, digital monitoring tools, and local manufacturing partnerships.

4. Middle East and Africa

- Market Share: Significant share driven by vast reserves and high production rates in countries such as Saudi Arabia and the UAE.

- Key Drivers: National oil company investments, large-scale offshore and desert operations, and strategic global exports.

- Trends: Focus on high-capacity equipment, integrated service models, and sustainability in harsh environments.

5. South America

- Market Share: Emerging market with strong growth potential, led by Brazil’s offshore pre-salt developments.

- Key Drivers: Deepwater exploration, government-backed energy reforms, and foreign investments.

- Trends: Increased use of advanced completion tools, service outsourcing, and regional technology partnerships.

Oilfield Service Equipment Market Players Density: Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

The market experiences moderate competition due to the presence of established players such as Baker Hughes Company, Halliburton Company, NOV Inc., NCS Multistage, LLC, Hunting Plc, SLB, and Weatherford International.

This medium level of competition urges companies to stand out by offering the following:

- Wide range of equipment types (drilling, perforating, completion) tailored to diverse geological and operational needs.

- Moderate entry barriers allow regional service providers to compete with global players.

- Increasing demand for customized and modular equipment solutions encourages innovation.

- Strong presence of multinational oilfield service firms intensifies competition on technology, reliability, and cost.

- Digital transformation (IoT, AI, remote monitoring) raises the bar for smart and automated equipment offerings.

- Sustainability goals push manufacturers to develop eco-friendly and energy-efficient tools.

- Volatile oil markets have made operators increasingly price sensitive. This drives demand for cost-effective and performance-based service models.

Opportunities and Strategic Moves

- Smart Equipment Integration Develop IoT-enabled tools for real-time monitoring, predictive maintenance, and enhanced operational efficiency.

- Eco-Friendly Equipment Design Innovate low-emission, energy-efficient machinery to align with global sustainability and ESG goals.

- Digital Oilfield Expansion Implement AI and data analytics platforms to optimize drilling, completion, and production workflows.

- Strategic Alliances with Operators Partner with oil & gas companies for co-development of customized equipment suited to specific reservoir conditions.

- Growth in Emerging Energy Markets Expand into regions such as Southeast Asia, Africa, and Latin America with cost-effective and scalable equipment solutions.

- Modular and Mobile Equipment Systems Offer portable, modular rigs and service units for remote and unconventional field operations.

- Service-Based Business Models Transition from equipment sales to leasing, subscription, and performance-based service contracts to improve customer retention.

- Advanced Materials and Durability Use corrosion-resistant alloys and high-strength composites to extend equipment life in harsh environments.

- Remote Operations Enablement Develop equipment compatible with remote control and autonomous operation to reduce manpower and improve safety.

- Training and Support Ecosystems Build comprehensive training, simulation, and support platforms to enhance equipment adoption and operator proficiency.

Major companies operating in the oilfield service equipment market are:

- Welltec A/S

- Renegade Services

- Completion Products Pte Ltd.

- Baker Hughes Co

- NOV Inc

- Hunting Plc

- Schlumberger

- Weatherford International Plc

- Tenaris SA

- GEODynamics

- Halliburton Co

- Novomet FZE

- American Completion Tools, Inc.

- Repeat Precision LLC

- Completion Oil Tools Private Limited

- WellMax Oilfield Technologies.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- WellMax Oilfield Technologies

- Superior Energy Services

- OSS Oilfield Equipment Ltd.

- Oilfield Service Professionals

- Absolute Control, LLC.

- EnQuest Energy Solutions

- DNOW

- Integrated Energy Group (OEG)

Oilfield Service Equipment Market News and Recent Developments

- Welltec and Axter Announced Strategic Partnership Welltec and Axter announced a strategic and exclusive partnership aimed at delivering cutting-edge, advanced Intervention Solutions, including Plug and Abandonment (P&A) and Enhanced Oil Recovery (EOR) services. This collaboration combines the strengths of both companies to introduce state-of-the-art technologies that significantly broaden the scope of service within lightweight, wireline intervention operations to the energy industry on a global scale. (Source: Welltec, Press Release, September 2024)

- Baker Hughes Signed Completion Systems Contract with Petrobras Baker Hughes (NASDAQ: BKR), an energy technology company, announced a major, multi-year, fully integrated completions systems contract with Petrobras. The award followed an open tender and will leverage Baker Hughes’ innovative completions technology portfolio and extensive experience in Brazil to optimize production across multiple deepwater fields. (Source: Baker Hughes, Press Release, March 2025)

Oilfield Service Equipment Market Report Coverage and Deliverables

The "Oilfield Service Equipment Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Oilfield service equipment market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Oilfield service equipment market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Oilfield service equipment market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Oilfield service equipment market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For