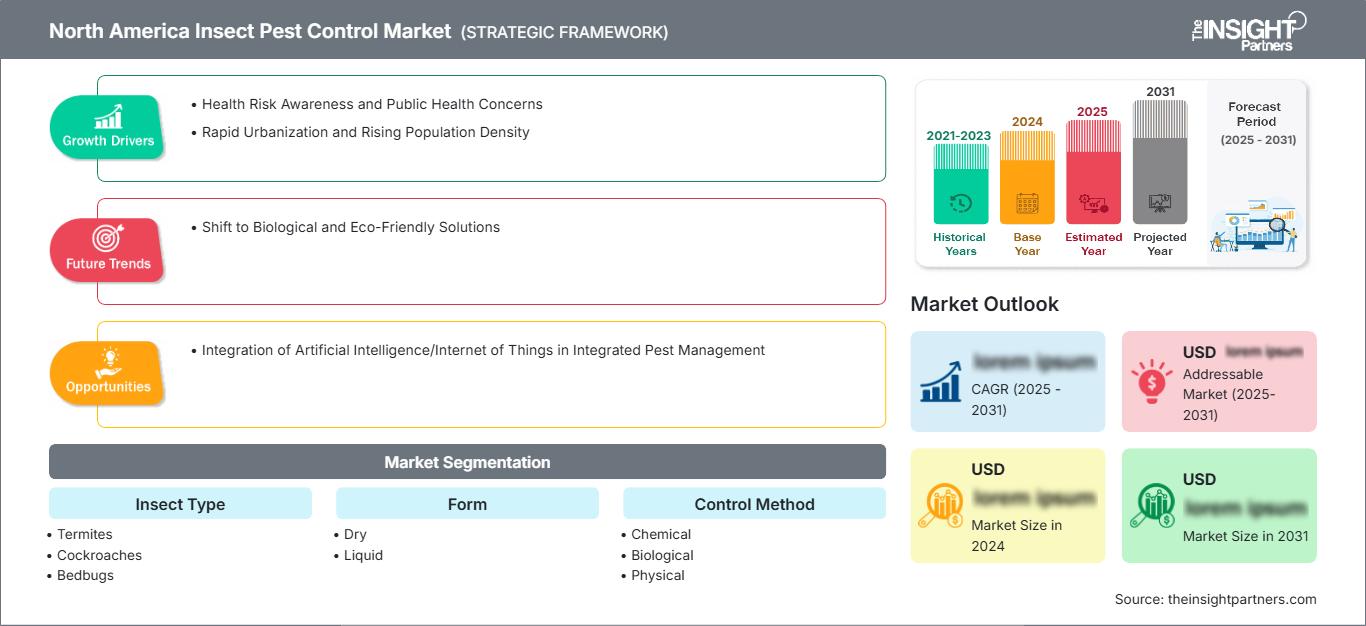

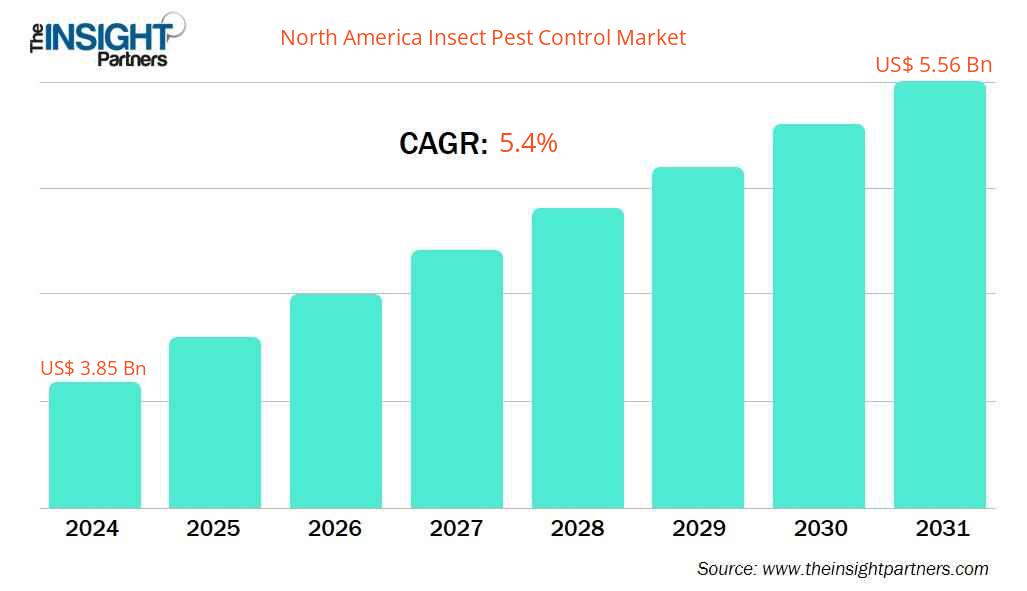

The North America insect pest control market is projected to grow from US$ 3.85 billion in 2024 to US$ 5.56 billion by 2031; the market is expected to register a CAGR of 5.4% during 2025–2031. The shift to biological and eco-friendly solutions is likely to emerge as a prominent future trend in the North America insect pest control market.

North America Insect Pest Control Market Analysis

Increasing health risk awareness and public health concerns, particularly due to the rising incidence of vector-borne diseases and infestations across residential, commercial, and public spaces, drive the market. The Centers for Disease Control and Prevention (CDC), Health Canada, and other governing bodies have intensified efforts to mitigate the spread of Lyme disease, West Nile virus disease, Zika virus infection, and dengue, among other infections caused by insects, which have led to an increasing trajectory of cases across states and provinces in North American countries. Additionally, the convergence of artificial intelligence (AI) and the Internet of Things (IoT) with integrated pest management (IPM) is emerging as a game-changing opportunity in the market. The USDA's National Institute of Food and Agriculture has funded millions in AI-centered IPM research studies, e.g., FACT‑AI, which will equip growers with open-source pest identification and decision‑support tools for small‑grain systems.

North America Insect Pest Control Market Overview

The North America insect pest control market is experiencing significant growth, driven by increasing pest infestations due to climate change and urbanization, resulting in the rising demand for sustainable pest management solutions. The market is further fueled by heightened awareness of IPM practices and stricter regulations on chemical pesticides. Advancements in precision pest control technologies, such as AI-driven monitoring systems and drone-based pesticide applications, also benefit the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Insect Pest Control Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Insect Pest Control Market Drivers and Opportunities

Rapid Urbanization and Rising Population Density

The rapid urbanization and increasing population density throughout North America are primary factors contributing to the growth of the insect pest control market. As cities grow and populations concentrate in urban areas. According to the United Nations, nearly 82% of the population in North America lives in urban places, with both the US and Canada experiencing annual urban growth rates of 1.2% and 1.5%, respectively. As waste generation and development projects rise, urban living provides conducive environments for pests to thrive, particularly mosquitoes, rodents, cockroaches, and bed bugs. For example, cities such as New York, Los Angeles, and Toronto are reporting more and more outbreaks of bedbugs and an increase in the number of rodents, as a result of crowded housing and a lack of cleanliness in high-density urban zones. Highly dense housing areas, commercial development, and hospitality infrastructure harbor pest infestations, prompting municipalities and businesses to enforce stricter pest control measures, resulting in an increased demand for professional pest extermination and environmentally sustainable solutions.

Further, green urban initiatives promote using biological and nontoxic pest control products. For example, metropolitan cities such as San Francisco and Vancouver have launched their municipal pest control programs aimed at decreasing infestations through sustainable means, while minimizing environmental disruption. With uninterrupted growth in urbanization and emphasis by municipalities on maintaining sanitary conditions in urban ecosystems, the North American insect pest control market would continue to grow substantially in the coming years as well.

Integration of Artificial Intelligence/Internet of Things in Integrated Pest Management

The convergence of artificial intelligence (AI) and the Internet of Things (IoT) with IPM is emerging as a game-changing opportunity in the market. The USDA's National Institute of Food and Agriculture has funded millions in AI-centered IPM research studies, e.g., FACT‑AI, which will equip growers with open-source pest identification and decision‑support tools for small‑grain systems. On the other hand, the EPA‑USDA Biopesticides Demonstration Project incentivizes the adoption of biocontrol agents in IPM through competitive grants. Farmonaut has collaborated with Iowa farmers to aid the utilization of "InsectNet," an AI-driven IoT camera network providing real‑time field pest identification, allowing for instant, data‑driven pest control action. Similarly, AI-driven smart traps send instant notifications to food plant farmers, allowing them to undertake active pest control, thereby lowering the risk of contamination. These machine learning and sensor-integrated smart traps are reducing response time and labor barriers, fundamental aspects of contemporary IPM.

Commercial biological control services are expanding through tech-enabled platforms. UAV‑IQ, a California‑based agri‑tech company, employs drones to dispense beneficial insects, demonstrating the intersection of AI, IoT, and biocontrol. Nano‑UAV swarms can find and directly target pest hotspots, indicating the potential of AIoT systems to detect and treat infestations autonomously with high accuracy. Collectively, these advancements reflect a rapidly evolving ecosystem, driven by government-supported grants, a rise in academic research and development, and the launch of commercial products. Thus, such collaboration, innovation, and implementation efforts highlight the strong prospects for AI-powered pest control across agriculture and food safety sectors in North America, subsequently propelling the insect pest control market growth in the region.

North America Insect Pest Control Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America insect pest control market analysis are insect type, terms of form, control method, category, and end user.

- Based on the insect type, the market is segmented into termites, cockroaches, bedbugs, mosquitoes, ants, flies, and others. The mosquitoes segment is expected to register a significant CAGR from 2025 to 2031.

- In terms of form, the insect pest control market is bifurcated into dry and liquid. The dry segment held a significant market share in 2024.

- By control method, the market is segmented into chemical, biological, and physical. The chemical segment is anticipated to hold a significant insect pest control market share in the coming years.

- Based on category, the market is bifurcated into synthetic and herbal/natural. The herbal/natural segment is expected to register a significant CAGR from 2025 to 2031.

- In terms of end user, the insect pest control market is segmented into residential/household, commercial facilities, animal husbandry, industrial, and crop protection. The residential/household segment held a significant market share in 2024.

North America Insect Pest Control Market Share Analysis by Country

The scope of the market report focuses on the market scenario in terms of historical market revenues and forecasts. Based on country, the market is segmented into the US, Canada, and Mexico. Mexico is expected to grow at the fastest CAGR during the forecast period. The insect pest control market in Mexico is experiencing steady growth, driven by urbanization, climate change, and awareness about vector-borne diseases such as dengue and Zika. Key end users of insect pest control solutions include the agriculture, residential, and commercial sectors; the demand for chemical methods is currently high, with biological and eco-friendly solutions gaining traction amid regulatory pressures. The rise in IPM practices and government initiatives, e.g., the National Program for Phytosanitary Surveillance in Mexico, are shaping the insect pest control industry. Major players, including Rentokil Initial, Bayer, and BASF, are focused on expanding their operations in Mexico, while local companies focus on offering cost-effective solutions. Market players operational in the country are also investing in digital pest monitoring technologies to enhance efficiency.

North America Insect Pest Control Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.85 Billion |

| Market Size by 2031 | US$ 5.56 Billion |

| CAGR (2025 - 2031) | 5.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insect Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Insect Pest Control Market Players Density: Understanding Its Impact on Business Dynamics

The North America Insect Pest Control Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Insect Pest Control Market top key players overview

North America Insect Pest Control Market News and Recent Developments

The North America insect pest control market is evaluated by gathering qualitative and quantitative data post-primary and secondary research. This data includes important corporate publications, association data, and databases. Key developments in the market are as follows:

- Dr. Killigan's launched the Six Feet Under: Barricade Insect Kit, a unique, eco-friendly pest control solution, trusted by over 1.5 million households. The kit is available for purchase on DrKilligans.com and Amazon.com. (Source: Dr. Killigan's, Newsletter, March 2025)

North America Insect Pest Control Market Report Coverage and Deliverables

The "North America Insect Pest Control Market Share and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- North America insect pest control market trends and forecast for all the key market segments covered under the scope

- North America insect pest control market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- North America insect pest control market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the North America insect pest control market?

What is the expected CAGR of the North America insect pest control market?

What are the future trends in the North America insect pest control market?

Which are the leading players operating in the North America insect pest control market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For