North America Investor ESG Software Market Analysis and Forecast by Size, Share, Growth, Trends 2031

North America Investor ESG Software Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Software and Services (Training, Integration, and Other Services)] and Enterprise Size (Large Enterprises and SMEs)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00023471

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 117

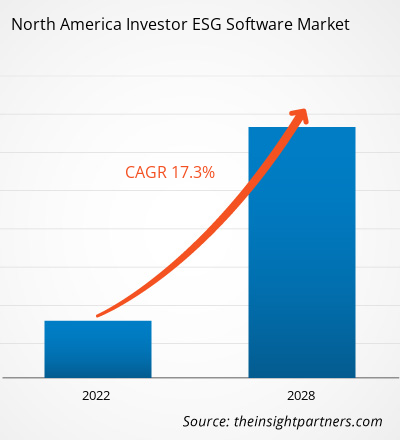

The North America investor ESG software market size is expected to reach US$ 1,135.82 million by 2031 from US$ 389.62 million in 2024. The market is estimated to record a CAGR of 16.5% from 2024 to 2031.

Executive Summary and North America Investor ESG Software Market Analysis:

The US, Canada, and Mexico are the key contributors to the North America investor ESG software market. The 15th edition of the US SIF Foundation's Report on US Sustainable Investing Trends identified climate action as the top sustainable investing priority over the long- and short-term. The report states that, at the beginning of 2024, around US$ 6.5 trillion of total sustainable investment are assets under management (AUM) in the US, representing 12% of the total US assets under professional management. The report also revealed that tackling climate change and advancing the clean energy transition were key priorities for businesses operating in the US. While 73% anticipate growth in the sustainable investment market over the next 1-2 years, only 39% expect their own organizations to boost their sustainable investment efforts. Sustainable investment assets are becoming a broader trend in the financial sector as investors increasingly align their portfolios with ESG guidelines. Investors increasingly focus on climate actions and adopt solutions that assist the transition to a low-carbon economy while targeting long-term wealth generation and risk reduction. ESG software assists them in analyzing and integrating climate-related risks, tracking sustainability key performance indicators (KPIs), and ensuring compliance with changing requirements.

In September 2023, AArete, a leading global technology and management consulting firm, officially launched AAchieve.ESG software. The new AAchieve.ESG software is designed with cutting-edge AI technology that provides clients across all industries with swift visibility into Scope 1, 2, and 3 emissions by streamlining sustainability impact reporting. Hence, rising concerns about sustainability among all investors and demand for AI-based software influence ESG investing, thus contributing to the growth of the investor ESG software market in North America.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Investor ESG Software Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Investor ESG Software Market Segmentation Analysis:

Key segments that contributed to the derivation of the North America investor ESG software market analysis are component and enterprise size.

- Based on component, the North America investor ESG software market is bifurcated into software and services. The software segment held a larger share of the market in 2024. The services segment is further sub segmented into training, integration, and other service.

- By enterprise size, the North America investor ESG software market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 389.62 Million |

| Market Size by 2031 | US$ 1,135.82 Million |

| CAGR (2024 - 2031) | 16.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Investor ESG Software Market Players Density: Understanding Its Impact on Business Dynamics

The North America Investor ESG Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

North America Investor ESG Software Market Outlook

The integration of generative AI into investor ESG software is expected to bring new trends into the market in the coming years. With generative AI, investors access, analyze, and interpret environmental, social, and governance (ESG) data. In ESG, this technology can play a pivotal role in enhancing ESG data analysis, reporting, and decision-making processes. One of the most significant benefits of integrating generative AI into ESG software is its ability to automate the creation of complex ESG reports. Generative AI can quickly analyze vast amounts of ESG data from various sources and generate tailored, insightful reports for investors. These reports can include standard metrics and predictive analyses, identifying emerging risks, opportunities, or trends in ESG performance. By automating these processes, investors can save valuable time while ensuring the reports are both accurate and comprehensive.

The integration of generative AI into the investor ESG software will drive significant advancements in data accuracy, reporting efficiency, and predictive analytics. For instance, in July 2024, a Paris-based sustainability platform, CO2 AI, launched Product Footprinting, a new generative AI-powered solution aimed at supporting companies to compute carbon emissions for products and reduce environmental impact. The platform offers solutions aimed at helping large and complex organizations evaluate impact and detect levers to reduce impact at scale, leveraging artificial intelligence. According to the company, the new solution comes to address a need for more precise and rapid product carbon foot printing, citing a study released by CO2 AI and BCG indicating that only 38% of companies receive adequate product-level data from suppliers. Similarly, in April 2024, Infor, the industry cloud leader, unveiled the launch of Infor GenAI and ESG Reporting, designed to assist customers in enhancing productivity and tracking their environmental impact. Infor's comprehensive suite of modern solutions, including industry-leading ERPs and supply chain tools, supports critical operations across manufacturing, distribution, healthcare, and public sectors. By combining the power of GenAI with unique industry-specific capabilities and insights, these solutions enable customers to efficiently harness the right data and workflows, accelerating value realization. Furthermore, these solutions comply with strict security and data privacy standards reinforced by Infor's OS platform. Additionally, by automating and personalizing ESG data analysis, generative AI will help investors make more informed, sustainable, and future-proof investment decisions, further enhancing the growth and adoption of ESG software in the investment space.

North America Investor ESG Software Market Country Insights

Based on country, the North America investor ESG software market comprises the US, Canada, and Mexico. The US held the largest share in 2024.

According to the US SIF Foundation, the US market for sustainability- or ESG-associated investments stood at US$ 6.5 trillion by the end of 2024, based on public disclosures. The foundation represents investor members who collectively manage US$ 5 trillion in assets. Various companies in the US are investing in ESG. For instance, in November 2023, Nasdaq, Inc. unveiled the Nasdaq Sustainable Lens, an AI-driven software-as-a-service (SaaS) platform designed to assist companies and investors in navigating and utilizing ESG data from thousands of organizations. The platform grants users access to sustainability-related documents from over 9,000 companies, enabling efficient summarization of ESG disclosures, the ability to address stakeholder inquiries with credibility, and the benchmarking of disclosures against emerging reporting standards and peer companies. Nasdaq Sustainable Lens works as an AI-powered ESG assistant that has the potential to replace traditional manual research processes. Thus, the rising interest in ESG investing and the surging trend of AI-based software across the country contribute to the investor ESG software market growth.

North America Investor ESG Software Market Company Profiles

Some of the key players operating in the market include MSCI Inc; Workiva, Inc.; London Stock Exchange Group Plc; Cority Software Inc; SAP SE; Sphera Solutions, Inc.; FactSet Research Systems Inc; Morningstar Inc; Bloomberg LP; and Prophix Software Inc., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Investor ESG Software Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For