North America Micro Fulfillment Centers Market Key Players and Forecast by 2030

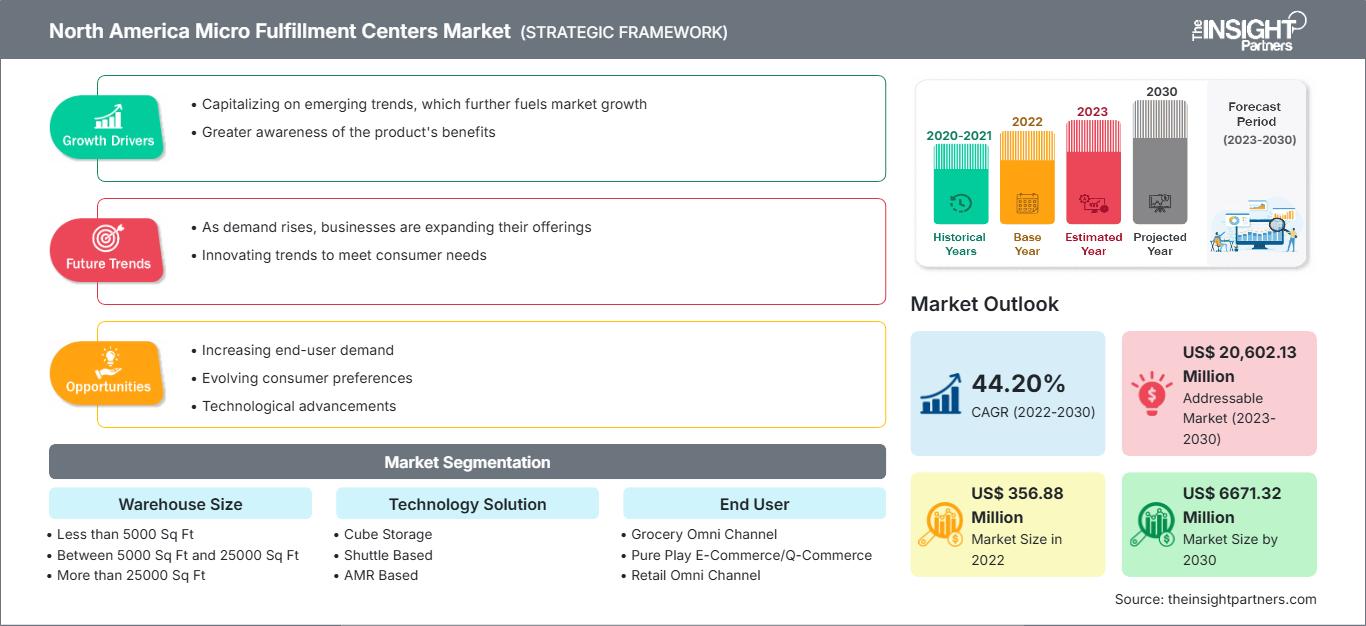

North America Micro Fulfillment Centers Market Size and Forecast (2020 - 2030) Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Warehouse Size (Less than 5000 Sq Ft, Between 5000 Sq Ft and 25000 Sq Ft, and More than 25000 Sq Ft), Technology Solution (Cube Storage, Shuttle Based, AMR Based, and Others), End User (Grocery Omni Channel, Pure Play E-Commerce/Q-Commerce, Retail Omni Channel, and Others), Retail Omni Channel (Pharmaceutical, Health & Beauty, Food & Beverage, Apparel, Consumer Electronics, Automotive Parts & Accessories, Toys/Hobbies, Hardware/Home Improvement, Sporting Goods, Houseware & Home Furnishings, and Jewelry), and Country

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jan 2024

- Report Code : TIPRE00037807

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 181

The North America micro fulfillment centers market was valued at US$ 356.88 million in 2022 and is projected to reach US$ 6671.32 million by 2030; it is expected to grow at a CAGR of 44.20% during 2022–2030.

Analyst Perspective:

The North America micro fulfillment centers market has been segmented into the US, Canada, and Mexico. In 2022, the US accounted for the largest share of the market in this region, and it is expected to retain its dominance during the forecast period. Market growth in the US is mainly attributed to the presence of a large number of technology integrators and micro fulfillment center companies such as Alert Innovation, Bastian Solutions, Davinci Micro Fulfillment, and Dematic. Canada is likely to record the fastest CAGR in the North America micro fulfillment centers market during the forecast period.

E-commerce with rapid order fulfillment requirements, awareness of the need to reduce labor costs, and technological leaps in the warehousing sector are a few of the major trends in the North America micro fulfillment centers market. These factors encourage e-commerce companies to integrate automation technologies in their business operations, boosting the demand for technologies required in micro fulfillment centers. The need for improved logistic management through smart parcel sorting systems, intelligent packaging systems, smart conveyor systems, and many other automation technologies across different small-sized warehouses is another major factor driving the growth of the North America micro fulfillment centers market. Several major retail franchises such as Walmart, Amazon, Costco Wholesale, Hy-Vee, and Kroger are also taking initiatives to proactively install new micro fulfillment centers to be able to offer better services and enable rapid delivery operations. In 2023, Walmart announced its plans to add micro fulfillment centers into 70% of its stores in Canada with an investment of ~US$ 2.6 billion. Such rapid growth of the E-commerce industry of Canada is driving the North America micro fulfillment centers market share of the country.

Market Overview:

Robotics also play an essential role in Micro fulfillment center systems, where they are used to guide autonomous robots called” self-navigating robots.” Various industries such as automotive, aerospace, food & beverages, pharmaceuticals, and electronics are focused on reducing labor-intensive processes, increasing the accuracy and speed of the storage process, and retrieving their products whenever required. Various systems and components required in micro fulfillment centers are available in the market; many of them are highly flexible. Other benefits include better ergonomics, improved inventory control, and greater workplace safety. However, the high cost associated with installation, along with the overall maintenance cost, hinders the North America micro fulfillment centers market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Micro Fulfillment Centers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Focus on Reducing Waiting Time and Accelerating Goods Delivery Process is Driving the North America Micro Fulfillment Centers Market Growth

The rising demand for home delivery services for groceries and retail items is a major factor propelling the North America micro fulfillment centers market size. A majority of e-commerce companies have been focusing on reducing goods and service delivery times across this region. North America is one of the pioneers in the e-commerce industry, which signifies a conducive environment for innovation in this industry. To cater to the faster delivery demands generated by consumers, warehouse operators have been integrating different automation solutions across their premises to automate warehouse operations and achieve faster and more effective operations in warehouses or micro fulfillment centers. Further, a continuous increase in the adoption of online platforms among both sellers and buyers, especially after the onset of the COVID-19 pandemic, supports the North America micro fulfillment centers market growth across North America.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The North America micro fulfillment centers market, based on warehouse size, has been segmented into less than 5,000 sq ft, between 5,000 and 25,000 sq ft, and more than 25,000 sq ft. In 2022, the 5,000 sq. ft and 25,000 sq. ft segment dominated the North America micro fulfillment centers market, and it is likely to retain its dominance during 2022–2030. Many large-scale retailers such as Walmart and Amazon have been heavily investing in the establishment and deployment of small and large-scale micro fulfillment centers in different North American countries. A majority of the existing micro fulfillment centers in North America have sizes in the range of 5,000–25,000 sq. ft. In addition, plans and investment prospects of retailers for the construction of new micro fulfillment centers are likely to boost the growth of the North America micro fulfillment centers market for the 5,000–25,000 sq. ft segment in the coming years.

The demand for micro fulfillment centers of areas less than 5000 sq ft is mainly driven by an upsurge in the number of ultrafast delivery stores to cater to local residential colonies, wherein customers have subscriptions to quick delivery apps in large numbers. These stores generate the demand for new small-size micro fulfillment centers. In 2022, the segment accounted for the second largest share of the North America micro fulfillment centers market, based on warehouse size, and it is further likely to retain its position during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The US has the presence of a large number of retail companies fulfilling the demands of customers for their basic and leisure needs, including dairy products, grocery items, consumer electronics, pharmaceuticals, and so on. These businesses are investing heavily in the installation of new micro fulfillment centers. In November 2023, the Census Bureau of the Department of Commerce announced that the total retail e-commerce sales in the US in the third quarter of 2023 were estimated to be ~US$ 284 billion; the value surged at a rate of 2.3% compared to the second quarter of 2023. Further, sales in the third quarter of 2023 grew at a rate of 7.6% compared to the Q3 of 2022. A few of the major factors supporting the growth of the North America micro fulfillment centers market share in the US include the constantly growing e-commerce and q-commerce industries, surging retail commerce sales, rising number of online shopping subscriptions, and increasing number of warehouses along with the demand for automation across small-scale warehouses and retail stores.

Key Player Analysis:

Alert Innovation, Attabotics, Autostore, Bastian Solutions, Berkshire Grey, Davinci Micro Fulfillment, Dematic, Exotec, Fortna, Get Fabric, Hai Robotics, Hoj Innovations, Honeywell International, Kardex, Knapp AG, KPI Solutions, Locus Robotics, Nimble Robotics, Ocado Group, OPEX, Pacline Overhead Conveyors, PeakLogix, RightHand Robotics, StrongPoint, Swisslog, Symbiotic, Takeoff Technologies, TGW Logistic Group, The Hormann Group, and Urbx are the prominent players in the North America micro fulfillment centers market.

Recent Developments:

Strategies such as mergers and acquisitions are highly adopted by companies in the North America micro fulfillment centers market. The market initiative is a strategy adopted to expand their footprint across the world and to meet the growing customer demand. The North America micro fulfillment centers market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key market players in the market are listed below.

Year |

News |

|

November 2023 |

Southern Glazer's Wine & Spirits and Symbotic Inc entered into a strategic partnership with Symbotic to deploy its AI-powered software and robotics warehouse automation technologies in selected distribution centers of Southern Glazer. The companies have pledged to have the first of these systems in place by 2025. |

|

July 2023 |

SoftBank Group Corp and Symbotic Inc announced the formation of GreenBox Systems LLC, a new joint venture, to meet the annual warehouse-as-a-service business demands worth more than US$ 500 billion. Concurrently, Symbotic announced a new client deal worth ~US$ 7.5 billion with GreenBox, which would be the only provider of Symbotic systems in the warehouse-as-a-service sector. It would also offer supply chain services to its customers. |

North America Micro Fulfillment Centers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 356.88 Million |

| Market Size by 2030 | US$ 6671.32 Million |

| CAGR (2022 - 2030) | 44.20% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Warehouse Size

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For