North America Mining Remanufacturing Components Market Growth and Recent Trends by 2031

North America Mining Remanufacturing Components Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine, Axle, Transmission, Hydraulic Cylinder, and Others), Equipment (Excavators, Wheel Loader, Wheel Dozer, Crawler Dozer, Haul Trucks, and Others), and Industry (Coal, Metal, and Others), and Region

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Jul 2024

- Report Code : TIPRE00039267

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 150

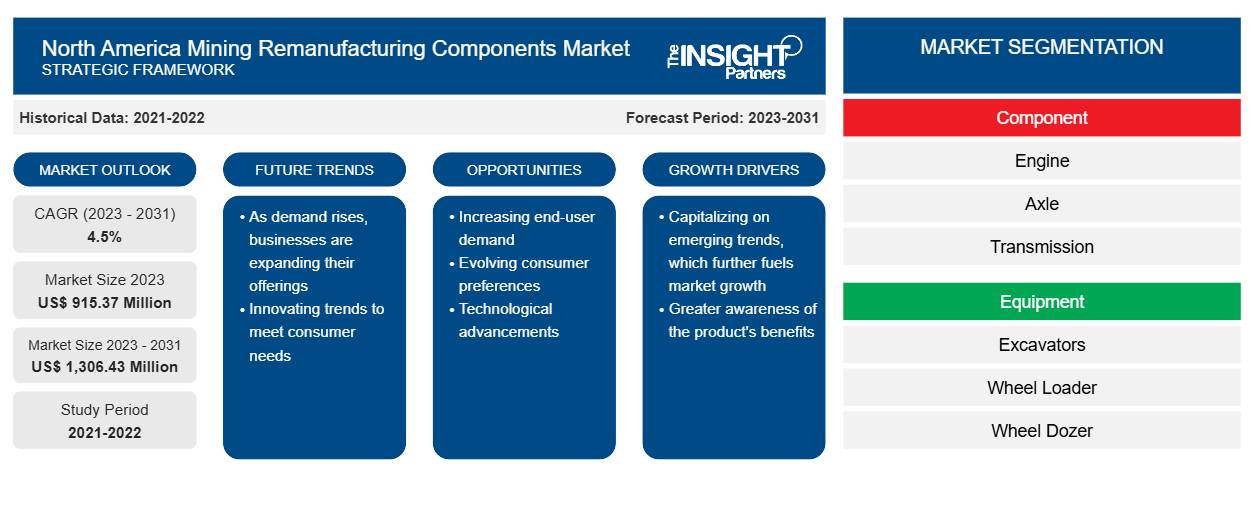

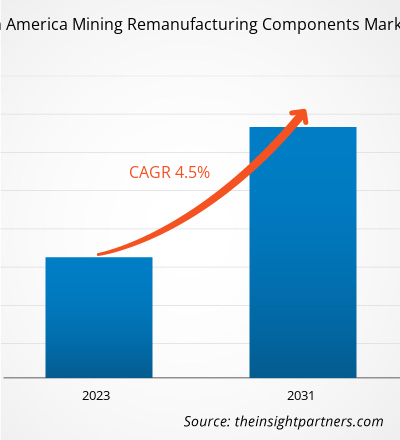

The North America mining remanufacturing components market size is projected to reach US$ 1,306.43 million by 2031 from US$ 915.37 million in 2023. The market is expected to register a CAGR of 4.5% during 2023–2031. The increasing adoption of additive manufacturing in the remanufacturing industry is likely to remain a key trend in the market.

North America Mining Remanufacturing Components Market Analysis

Continuous growth in the mining industry and a rise in awareness of sustainability are the primary factors driving the mining remanufacturing components market. As per the data published by government officials in 2020, metal mine production in the US reached US$ 27.7 billion in 2020, up 3% from 2019. Gold (38%), copper (27%), and iron ore (15%) were the major contributors to the total value of metal mining output in 2020. Per the annual coal data released in October 2023, year on year, coal production in the US climbed 2.9% to reach 594.2 million short ton (MMst). According to the data published by the US Geological Survey in 2019, mines produced ~US$ 86.3 billion in minerals, more than US$ 2 billion than the revised 2018 output totals.

Metal mining production in the US reached US$ 28.1 billion in 2019, up over US$ 500 million from 2018. In 2019, US domestic production of essential rare-earth mineral concentrates increased by 8,000 metric ton (more than 44% growth), reaching 26,000 metric ton. Further, according to the Australian Bureau of Statistics (ABS), mining delivered a record US$ 298.64 billion in export earnings to Australia in the fiscal year 2022–2023. This sum represents two-thirds of all export revenue for the country and is a 10.5% increase over the previous record registered during 2021–2022. The growth in the mining sector of the developed nations drives the mining remanufacturing components market.

North America Mining Overview

Remanufacturing, the process of restoring discarded products to a like-new condition with a matching warranty, is witnessed as a more sustainable way of manufacturing because it can be more profitable and less harmful to the environment than traditional production.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Mining Remanufacturing Components Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Mining Drivers and Opportunities

Increasing Mining and Mineral Production Across North America

According to the US Geological Survey, in 2023, the total value of non-fuel minerals production in the US was US$ 105 billion, an increase of 4% from 2022 (revised total of US$ 101 billion). The total value of industrial mineral production in 2023 was ~US$ 69.9 billion, an increase of 7% from US$ 65.3 billion in 2022. The West US had the highest production of metals and metallic minerals, with an estimated value of US$ 25 billion in 2023. The mining remanufacturing components are widely used to reduce the total cost of mining equipment. The demand for mining remanufacturing components is increasing at a rapid pace in North America owing to the increasing investment in mining activities. For instance, in the third quarter of 2023, the US mining industry investments were valued at US$ 135 million by three private equity deals.

Further, Canada's mining and mineral production is increasing at a rapid pace, which is a major driving factor for the North America mining . According to the Natural Resources Department of the Canadian Government, the value of mineral production reached US$ 55.5 billion in 2021, an increase of 20% compared to 2020. Also, Ontario, a state in Canada, generated revenue of US$ 13.5 billion from mineral production in 2022, representing 22% of Canada's total mineral production value.

Mining remanufacturing components are widely used during the breakdown of new mining machinery. Mining equipment contractors or service providers prefer remanufactured components to new mining machinery. Mining machinery is costly, and significant capital is required to acquire new ones. Moreover, the cost of remanufactured mining components is less than original equipment manufacturer (OEM) products. Remanufacturing components cost ~25–35% less than new ones with similar performance. Therefore, the increasing mining and mineral production across the US and Canada is a major driving factor for the North America mining remanufacturing components market.

Rising Adoption of Electric and Autonomous Vehicles in Mining Industry

The mining sector is beginning to benefit from a new generation of low-emission "driverless" mining vehicles, which are changing the industry's image and moving it toward decarbonization. New electric vehicles (EVs) are being purchased, and existing diesel vehicles are being converted to EVs. These fleets are being used in both open-pit and underground operations. Toyota Motor Corp is ahead in the development of these new mining vehicles. In May 2023, Toyota and Komatsu signed a collaboration agreement to develop an autonomous light vehicle (ALV), which will run on Komatsu's GPS-enabled Autonomous Haulage System (AHS).

North America Mining Remanufacturing Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America mining remanufacturing components market analysis are component, equipment, and industry.

- Based on component, the North America mining remanufacturing components market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest market share in 2023.

- In terms of equipment, the North America mining remanufacturing components market is segmented into wheel loaders, wheel dozers, crawler dozers, haul trucks, excavators, and others. The crawler dozers segment held the largest share of the market in 2023.

- Based on industry, the North America mining remanufacturing components market is segmented into coal, metals, and others. The metals segment held the largest share of the market in 2023.

North America Mining Remanufacturing Components Market Share Analysis by Geography

The geographic scope of the North America mining remanufacturing components market report is segmented into the US, Canada, and Mexico. The mining sector in North America, particularly in countries such as the US, Canada, and Mexico, majorly drives the demand for mining remanufacturing components. The mining remanufacturing components market share in North America is expected to continue its growth trajectory due to the steady expansion of various end-use industries and continuous investments in infrastructure development. For instance, according to the data published by the government of Canada, with US$ 89 billion in capital expenditures spread across 119 major mining-related projects, the industry demonstrated continued interest in mine constructions, redevelopments, expansions, and processing facilities. The country witnessed an increase in capital expenditures from US$ 82 billion and 120 projects in 2020 to US$ 89 billion and 119 projects in 2021, which signifies continued interest in mining-related projects despite the challenges posed by the onset of the COVID-19 outbreak. The continued focus on infrastructure development, including construction projects, ports, and terminals, also contributes to the demand for mining remanufacturing components in the region. Thus, the increased demand for minerals and metals is propelling the growth of mining activities in the region, creating a growth opportunity for the mining remanufacturing components market in North America.

North America Mining Remanufacturing Components

North America Mining Remanufacturing Components Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 915.37 Million |

| Market Size by 2031 | US$ 1,306.43 Million |

| CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Mining Remanufacturing Components Market Players Density: Understanding Its Impact on Business Dynamics

The North America Mining Remanufacturing Components Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

North America Mining Remanufacturing Components Market News and Recent Developments

The North America mining remanufacturing components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America mining remanufacturing components market are listed below:

- Rolls-Royce's Power Systems Division has opened a new Remanufacturing and Overhaul Center on its mtu Aiken campus in South Carolina, US. The new facility is connected to the existing manufacturing operations and represents a low double-digit million-dollar investment. It supports the company's service initiative and sustainability approach for the expansion of the remanufacturing business. (Source: Rolls-Royce, Press Release, May 2024)

- SRC Holdings has completed its newest warehouse, occupied by SRC Logistics (SRCL), on North Mulroy Road in Springfield. The 413,000-square-foot facility, completed after 13 months of construction, is part of SRCL's plan to grow with current OEM partners and fulfill new business opportunities. The third expansion phase on North Mulroy Road follows the first in 2021. (Source: SRC Holdings, Press Release, July 2023)

North America Mining Remanufacturing Components Market Report Coverage and Deliverables

The "North America Mining Remanufacturing Components Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- North America mining remanufacturing components market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- North America mining remanufacturing components market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America mining remanufacturing components market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America mining remanufacturing components market

- Detailed company profiles

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For