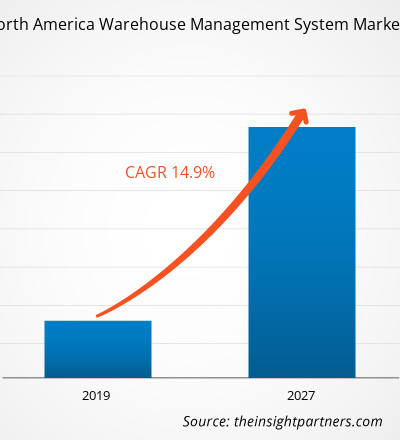

Warehouse Management System market in North America is expected to grow from US$ 1,150.6 Mn in 2018 to US$ 3,954.0 Mn by the year 2027. This represents a CAGR of 14.9% from the year 2019 to 2027.

Growth in the e-commerce market is fueling dramatic changes in the warehouse which is driving the warehouse management system market. For example, many online retailers have found themselves needing to accelerate order fulfillment and shipping to maintain their competitive place in the industry. As a result, organizations must work to gain a greater degree of control and transparency across their supply chains so they can not only keep up with demand, but move items into and out of the warehouse at the rapid pace required within the industry. All of this must be done without sacrificing key performance metrics, such as inventory shrinkage and customer satisfaction rates. Similarly, leveraging the latest supply chain technology and the Internet of Things (IoT), a "smart warehouse" can now serve as a hub to boost efficiency and speed throughout the entire supply chain is creating huge opportunity for the growth of warehouse management system market.

The supply chain industry in North America has been undergoing dramatic transformation, which is also having a substantial impact on the fundamentals of distribution and warehousing in the warehouse management system market. Majority of these transformations are related to the emerging technologies that have plummeted the gap between supply chain operations and customers. These digital changes, particularly those influenced by the penetration of e-commerce have enabled the customers in the North America to create an immediate and real-time demand impact on the order fulfilment operations. Such real time demand impact when coupled with the emerging multichannel distribution support business model is expected to drive the demand for highly adaptive and scalable Warehouse Management System (WMS). Traditionally the warehouse management were highly paper intensive, however the scenario has changed and the warehouse management systems today are almost completely automated and effective in terms of assisting the warehouse manager with product tracking at various levels of warehousing and distribution processes. Further WMS being implemented at present are relatively congruous, and span from simple computer automation systems to more sophisticated management programs which provide enhanced facilities such as monitoring inventory management, order picking, and enhanced dock logistics facilities. North America is a technologically advanced region. Big Data, IoT and Software as a Service technologies have witnessed high adoptions in this region. More deployments call for more competition in the region along with growth of the entire warehouse management system market leading to product development and innovations. The warehouse management system market in North America is well accomplished and comprises of myriad large and small warehouses including 3PLs (3rd Part Logistics). These factors are contributing to a good competition in the various companies in the North America for employment and thus fueling the warehouse management system market in the forecast period. The presence of a number of large enterprises in North America is driving the warehouse management system market. Increasing competition and a rapidly changing technology scenario pertaining to different businesses requires a high level decision-making before penetrating into new market or establishing a firm foothold in the established warehouse management system market.

US is anticipated to leads the warehouse management system market across the North American region through the forecast period. The region comprises of approximately 9000 U.S commercial warehousing facilities, which captures nearly 829 Mn Sq. Ft of area. With such extensive presence of warehousing facilities, and growing demand for extremely thin margins by the businesses have raised the warehousing completion. Thus, in order to sustain in such competitive environment the warehouse management system market companies in the region have been observed investing significantly into technologies like RFID and, voice enabled receiving, and packaging. The figure given below highlights the revenue share of Mexico in the North American warehouse management system market in the forecast period:

Mexico Warehouse Management System Market Revenue and Forecasts to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA WAREHOUSE MANAGEMENT SYSTEM - MARKET SEGMENTATION

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

By Component

- Software

- Services

By Implementation

- On-Premises

- Cloud Based

By Tier Type

- Tier 1

- Tier 2

- Tier 3

By Industry

- Manufacturing

- Automotive

- Food & Beverage

- Healthcare

- Retail & Ecommerce

By Country

- U.S.

- Canada

- Mexico

Companies Mentioned

- IBM Corporation

- PSI Software AG

- SAP SE

- Epicor Software Corporation

- Oracle Corporation

- JDA Software Group, Inc.

- Infor Inc.

- Manhattan Associates

- PTC Inc.

- TECSYS

North America Warehouse Management System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 1,150.6 Million |

| Market Size by 2027 | US$ 3,954.0 Million |

| Global CAGR (2019 - 2027) | 14.9% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Implementation, Tier Type, Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1. IBM Corporation2. PSI Software AG

3. SAP SE

4. Epicor Software Corporation

5. Oracle Corporation

6. JDA Software Group, Inc.

7. Infor Inc.

8. Manhattan Associates

9. PTC Inc.

10. TECSYS

Get Free Sample For

Get Free Sample For