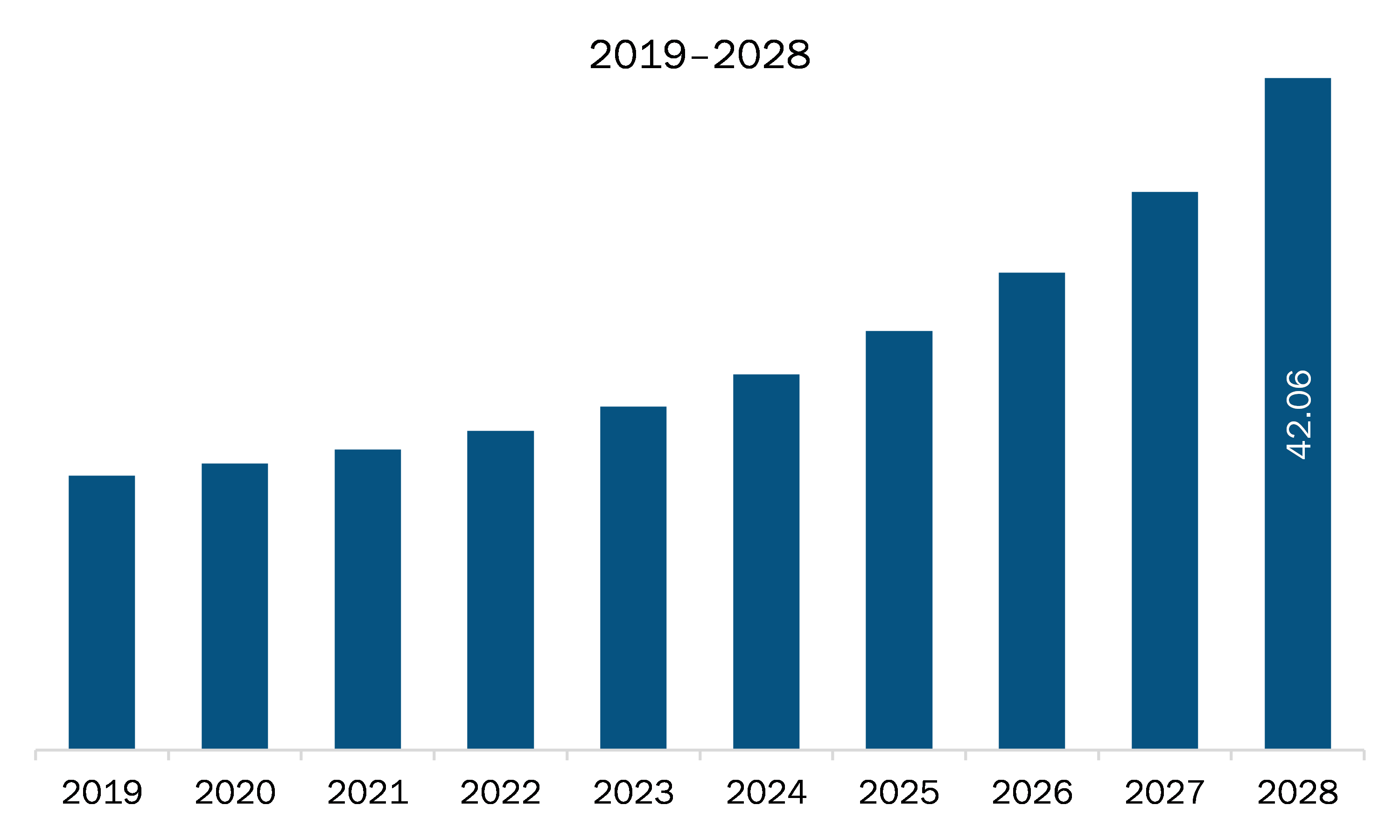

The wealthtech solution market in North America is expected to grow from US$ 18.81 billion in 2021 to US$ 42.06 billion by 2028; it is estimated to register a CAGR of 12.2% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Rising demand for financial analytics services is the major factor driving the growth of the North America wealthtech solution market. Organizations use financial analytics tools to gain insights into key present and future trends for improving their business performance. Financial analytics services include financial data quality analysis and data layout, client analytics, predictive analytics, principal component analysis, and financial data collection. These analytics require thorough financial and other relevant data to identify patterns; based on these predictions, enterprises may make predictions regarding what their customers would buy, how long their employees' tenures might be, and so on. Thus, financial analytics services help organizations improve the profitability, cash flow, and business value. They may use the insights gained through these analytics to improve their revenues and business processes. Accenture PLC provides the newest data and analytics solutions for financial service providers, along with assisting them in deploying the same. Its services for these firms include cost analytics and enterprise performance analytics. With a prime focus in income statements, balance sheets, and cash flow statements, financial analysis is employed to evaluate economic trends, set financial policies, formulate long-term business plans, and pinpoint projects or companies for investments. Financial service providers, including investment banks, generate and store more data than any other businesses, as finance is a transaction-heavy industry. The banks used data to estimate risks for improving the overall profitability in the subsequent years. Therefore, with multiple benefits in banks and investment firms, the demand for financial analytics services increasing significantly, thus boosting the wealthtech solutions market growth.

The US is the worst-hit country in North America due to the outbreak of COVID-19, with thousands of infected individuals facing severe health conditions across the country. Increasing number of infected individuals has led the government to impose lockdown across the nation’s borders during Q2. The majority of the manufacturing plants were either temporarily shut or are operating with minimum staff; the supply chain of components and parts is disrupted; these are some of the critical issues faced by the North American manufacturers. The US is one of the largest markets for wealthtech solution especially for services. Also, the country has a larger density of wealthtech solution vendors. However, the outbreak has severely affected the working process of banks and ongoing investments. Thus, the factors mentioned above have had a negative impact on the growth of the wealthtech solution market in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America wealthtech solution market. The North America wealthtech solution market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America WealthTech Solution Market Segmentation

North America WealthTech Solution Market – By Component

- Solution

- Services

North America WealthTech Solution Market – By End User

- Banks

- Wealth Management Firms

- Others

North America WealthTech Solution Market – By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

North America WealthTech Solution Market – By Deployment Mode

- Cloud-Based

- On-Premises

North America WealthTech Solution Market, by Country

- US

- Canada

- Mexico

North America WealthTech Solution Market - Companies Mentioned

- 3rd-eyes analytics AG

- BlackRock, Inc.

- FinMason, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Wealthfront Inc.

- WealthTechs Inc.

North America WealthTech Solution Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 18.81 Billion |

| Market Size by 2028 | US$ 42.06 Billion |

| CAGR (2021 - 2028) | 12.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For