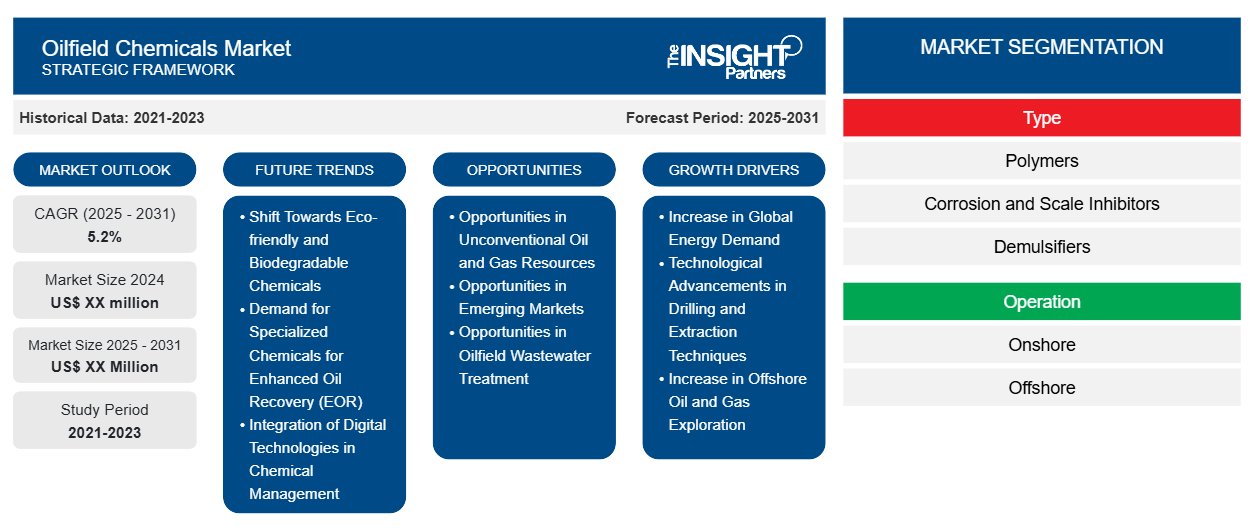

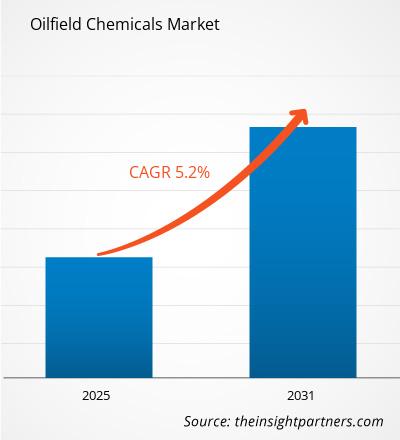

The Oilfield Chemicals Market is expected to register a CAGR of 5.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Polymers, Corrosion and Scale Inhibitors, Demulsifiers, Biocides, Friction Reducers, Flocculants and Coagulants, Fluid Loss Additives, and Others). The report is also segmented based on Operation (Onshore, Offshore) and Application (Drilling, Cementing, Production, Enhanced Oil Recovery, Stimulation, and Others). The report scope covers 5 regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America and key countries under each region. The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Oilfield Chemicals Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Oilfield Chemicals Market Segmentation

Type

- Polymers

- Corrosion and Scale Inhibitors

- Demulsifiers

- Biocides

- Friction Reducers

- Flocculants and Coagulants

- Fluid Loss Additives

Operation

- Onshore

- Offshore

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Oilfield Chemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Oilfield Chemicals Market Growth Drivers

- Increase in Global Energy Demand: The growing global demand for energy, particularly oil and gas, is a significant driver for the oilfield chemicals market. As exploration and production activities ramp up to meet energy needs, oilfield chemicals are critical for improving drilling efficiency, enhancing production, and managing reservoir conditions. This demand for oil and gas products is fueling the need for various chemicals used in exploration, extraction, and refining processes.

- Technological Advancements in Drilling and Extraction Techniques: Innovations in drilling technologies, such as hydraulic fracturing (fracking) and horizontal drilling, have increased the efficiency of oil and gas production. These advanced extraction methods rely heavily on the use of specialized oilfield chemicals that improve performance, reduce environmental impact, and ensure the safety and longevity of equipment. The ongoing evolution of drilling techniques is driving the growth of the oilfield chemicals market.

- Increase in Offshore Oil and Gas Exploration: The shift towards deepwater and offshore oil exploration is accelerating, and this requires specialized oilfield chemicals capable of performing in harsh environmental conditions. Offshore operations need chemicals for enhanced oil recovery, corrosion inhibition, and drilling fluid functions. The growing number of offshore projects is thus contributing to the increased demand for specialized oilfield chemicals in these challenging environments.

Oilfield Chemicals Market Future Trends

- Shift Towards Eco-friendly and Biodegradable Chemicals: There is a growing trend toward the adoption of eco-friendly and biodegradable oilfield chemicals due to increasing environmental concerns and tightening regulations. Companies in the oil and gas industry are focusing on reducing their environmental footprint, and using greener chemicals for drilling, production, and treatment processes is gaining traction. This shift is encouraging the development and adoption of sustainable alternatives in the oilfield chemicals market.

- Demand for Specialized Chemicals for Enhanced Oil Recovery (EOR): With the depletion of conventional oil reserves, there is a rising trend in enhanced oil recovery (EOR) techniques, which rely on the use of specialized chemicals such as surfactants, polymers, and solvents. These chemicals are used to improve the extraction of oil from mature fields. The growth in EOR operations is fueling demand for oilfield chemicals that enhance the efficiency and effectiveness of these recovery processes.

- Integration of Digital Technologies in Chemical Management: The oil and gas industry is increasingly integrating digital technologies, such as data analytics and IoT-based systems, into chemical management processes. These technologies help optimize chemical usage, monitor chemical conditions in real-time, and reduce waste. As digitalization continues to grow, the oilfield chemicals market is benefiting from advancements that improve efficiency, performance, and cost management in chemical applications.

Oilfield Chemicals Market Opportunities

- Opportunities in Unconventional Oil and Gas Resources: The exploration and production of unconventional oil and gas resources, such as shale oil and gas, are creating significant opportunities for the oilfield chemicals market. These resources require specialized chemicals for hydraulic fracturing, well stimulation, and production enhancement. As the exploration of unconventional resources grows globally, there will be a rising demand for chemicals tailored to these specific applications.

- Opportunities in Emerging Markets: The increasing energy consumption in emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East, presents substantial growth opportunities for the oilfield chemicals market. As these regions expand their oil and gas exploration activities, there will be a higher demand for a wide range of chemicals used in drilling, production, and reservoir management. This growth will open up new markets for oilfield chemical manufacturers.

- Opportunities in Oilfield Wastewater Treatment: The oil and gas industry faces challenges with wastewater management, and oilfield chemicals are essential in treating and recycling wastewater during exploration and production activities. Chemicals used for water treatment, such as flocculants and biocides, play a critical role in maintaining water quality and minimizing environmental impact. With increasing regulations and the need for sustainable practices, the demand for oilfield chemicals in wastewater treatment is poised for growth.

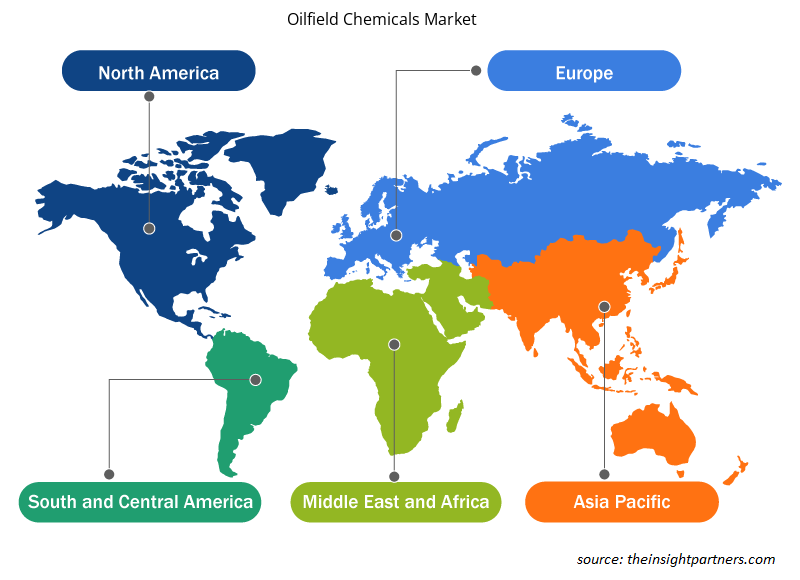

Oilfield Chemicals Market Regional Insights

The regional trends and factors influencing the Oilfield Chemicals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Oilfield Chemicals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Oilfield Chemicals Market

Oilfield Chemicals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

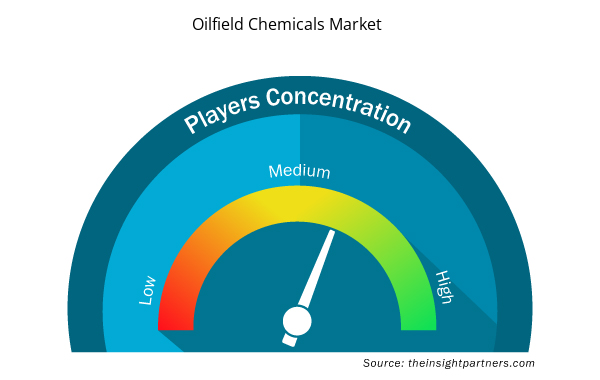

Oilfield Chemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Oilfield Chemicals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Oilfield Chemicals Market are:

- Albermarle Corporation

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- DowDupont Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Oilfield Chemicals Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Oilfield Chemicals Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Oilfield Chemicals Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on geography, which region is expected to growth at the fastest CAGR?

Based on geography, Asia Pacific is expected to register the fastest CAGR from 2023 to 2031.

What are the key opportunities of the oilfield chemicals market?

Growth in shale gas exploration is one of the key opportunities for the market growth.

Which are the leading players operating in the oilfield chemicals market?

Albermarle Corporation, BASF SE, Chevron Phillips Chemical Company LLC, Clariant AG, DowDupont Inc, Halliburton Energy Services Inc, Kemira Oyj, Kraton Corporation, Nouryon Chemicals Holding BV, and Solvay SA are among the leading players operating in the oilfield chemicals market.

What are the deliverable formats of the oilfield chemicals market?

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

What are the driving factors impacting the oilfield chemicals market?

Increased exploration and production activities is driving the market growth

What is the expected CAGR of the Oilfield Chemicals Market ?

The Oilfield Chemicals Market is estimated to witness a CAGR of 5.2% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

- Akzo Nobel N.V.

- Albemarle Corporation

- Baker Hughes

- BASF SE

- Ecolab

- Halliburton

- Newpark Resources Inc.

- Schlumberger Ltd

- Solvay

- The Lubrizol Corporation

Get Free Sample For

Get Free Sample For