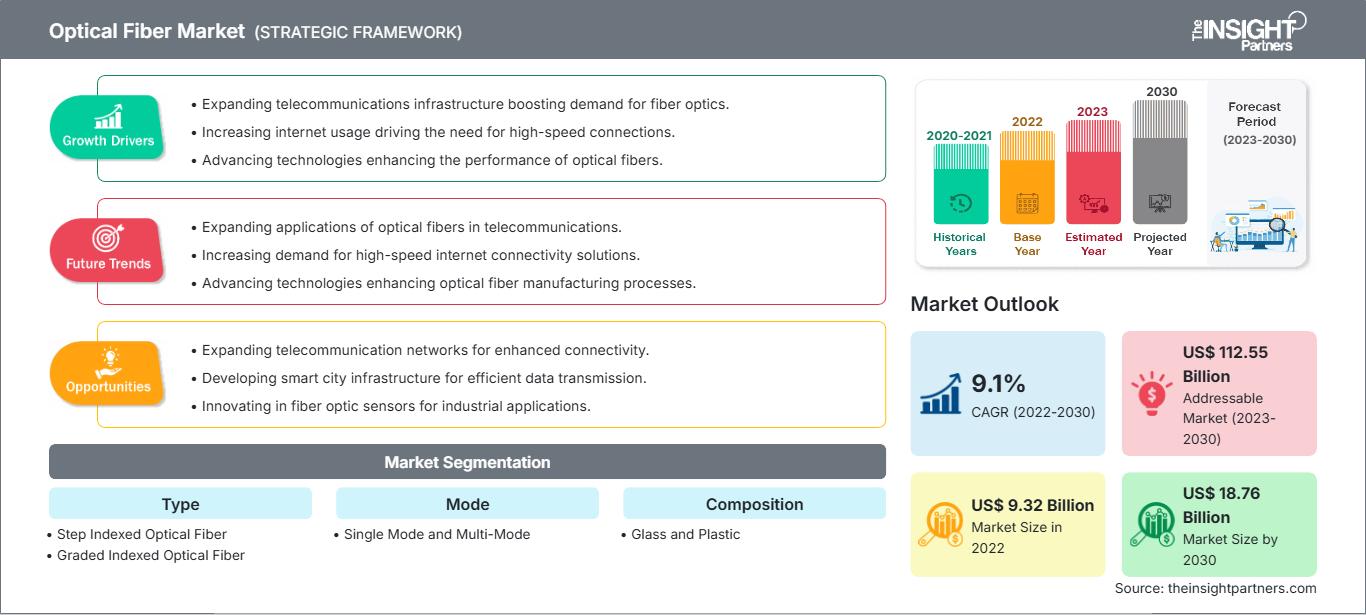

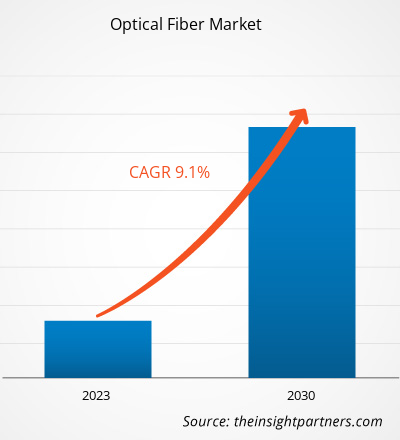

The Optical Fiber market is projected to grow from US$ 9.32 billion in 2022 to US$ 18.76 billion by 2030; it is expected to expand at a CAGR of 9.1% from 2022 to 2030. Growing demand for high-speed internet and developments in telecommunications infrastructure are expected to be key trends in the market.

Optical Fiber Market Analysis

The development of the optical fiber network is anticipated to be driven by the surge in consumer data demand and the rapid proliferation of Internet of Things (IoT) devices. Also, governments of numerous countries across the globe have made significant investments in optical fiber deployments, creating lucrative opportunities for market growth. For instance, the US requires a substantial expansion of fiber-optic infrastructure within the next five to seven years to support the upcoming 5G wireless network, promote broadband competition, and provide rural broadband coverage. This necessitates an estimated investment of ~US$ 130–150 billion in fiber cable deployment. These developments highlight the immense potential for businesses operating in the telecommunications industry to capitalize on the growing demand for fiber-optic infrastructure and leverage the opportunities created by the 5G revolution, further fueling the optical fiber market growth.

Optical Fiber Market Industry Overview

An optical fiber, also known as an optic fiber, is a highly flexible glass or plastic fiber that enables the transmission of light signals from one end to another. These fibers play a crucial role in fiber-optic communications, offering the advantage of longer transmission distances and higher bandwidths compared to traditional electrical cables. The utilization of optical fibers is preferred to metal wires due to their lower signal loss and immunity to electromagnetic interference, which is a common issue faced by metal wires. In addition to telecommunications, optical fibers are extensively used for applications such as illumination, imaging, and carrying light or images into confined spaces, similar to the application of fiberscopes. Moreover, specialized fibers are employed for various purposes, including fiber optic sensors and fiber lasers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Optical Fiber Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Optical Fiber Market Driver and Opportunities

Increase in Adoption of Fiber-to-the-Home (FTTH) Connectivity to Favor Market Growth

Traditional internet technologies cannot compete with quicker speeds and more dependable connections of FTTH. According to the study conducted by the Fiber Broadband Association (FBA), the number of residences in the US served by fiber internet surpassed 60 million in 2021, an increase of 12% from roughly 54 million in 2020. Moreover, the study also revealed that fiber internet is already available to 43% of American households and 60% of Canadian households. According to the survey, large market players such as Verizon, AT&T, and Lumen are among the top five cable Management Services Organizations (MSOs), forming around 72% of all fiber internet connectivity. In contrast, Tier 2 regional operators such as Frontier, Windstream, TDS, and Consolidated accounted for 10% of the expansion.

Growing 5G Infrastructure

The transition to 5G and the associated infrastructure upgrades are expected to boost the demand for optical fiber during the forecast period. The epidemic has caused a paradigm change in communication, with more individuals working remotely, taking online classes, and streaming information via digital platforms. As a result, fiber rollout services are expected to develop tremendously across the globe. This would allow for a faster implementation of 5G technology, which will substantially benefit the population by giving them access to faster connections for development and progress. Thus, growing 5G infrastructure is expected to boost the demand for optical fiber during the forecast period.

Optical Fiber Market Report Segmentation Analysis

The key segments that contributed to the derivation of the Optical Fiber market analysis are coverage by type, mode, composition, and end-user.

- Based on type, the optical fiber market is segmented into step-indexed optical fiber and graded-indexed optical fiber. The graded indexed optical fiber segment held a larger optical fiber market share in 2022 and is anticipated to record a higher CAGR in the market during the forecast period. Graded-indexed optical fibers have a differentiating refractive index in the core that decreases while moving outward from the center of the core. The light, when passed through the medium, travels faster at the edge than at the center in curved paths. Graded indexed optical fiber can be multi-mode as well as single mode. The multi-mode graded indexed optical fiber has larger core diameters than step-indexed ones and, hence, larger bandwidths. As a result of larger bandwidths, multi-mode graded indexed fibers are used for high-speed data transfer.

Optical Fiber Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

APAC held the largest optical fiber market share in 2022. Various countries in the Asia Pacific are experiencing a dynamic shift toward the technologically advanced landscape with a key emphasis on projects in smart cities, such as the integration of the Internet of Things (IoT) and advancements in healthcare systems. Optical fiber supports these projects by offering a high speed and minimal latency for data transmission and communication in real-time. Furthermore, the increasing use of optical fiber connectors in the region is vital in facilitating reliable and high-speed communications interfaces, which, in turn, is driving the market.

One of the main factors propelling the market's expansion in Asia is the increasing use of fiber optic cables underwater. In addition to increasing network capacity and spectral efficiency, it has enhanced connectivity between nations. As the need for dependable connectivity and quick data transmission grows, underwater fiber optic cables will probably be utilized more frequently, which will help the regional market expand. For instance, the Asia-Africa-Europe 1 submarine (AAE-1) cable system connects several nations in Asia, the Middle East, Africa, and Europe over a distance of more than 25,000 kilometers. The deployment of the AAE-1 submarine cable system has greatly improved the area's use of deployed fiber. Furthermore, total fiber broadband in APAC accounted for more than 85.1% of the share of the residential fixed-line broadband subscriber base.

Optical Fibers

Optical Fiber Market Regional InsightsThe regional trends and factors influencing the Optical Fiber Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Optical Fiber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Optical Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 9.32 Billion |

| Market Size by 2030 | US$ 18.76 Billion |

| Global CAGR (2022 - 2030) | 9.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Optical Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Optical Fiber Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Optical Fiber Market top key players overview

Optical Fiber Market News and Recent Developments

The Optical Fiber market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Optical Fiber Market are listed below:

- Corning Incorporated opened a new optical fiber manufacturing facility in Mszczonów, Poland, to meet the growing demand for high-speed connectivity in the European Union and surrounding regions. The facility, one of the largest optical fiber plants in the European Union, is Corning's latest in a series of global investments in fiber and cable manufacturing totaling more than US$ 500 million since 2020, supported by growing demand and strong customer commitments. (Source: Corning Incorporated, Press Release, September 2023)

Optical Fiber Market Report Coverage & Deliverables

The Optical Fiber market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Optical Fiber Market Size and Forecast (2020–2030)" provides a detailed analysis of the market covering below areas-

- Optical Fiber Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Optical Fiber Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Optical Fiber Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Optical Fiber Market

- Detailed company profiles.

Frequently Asked Questions

What are the options available for the customization of this report?

What are the deliverable formats of the Optical Fiber market report?

What are the future trends of the Optical Fiber market?

Which are the leading players operating in the Optical Fiber market?

Other players considered are STL Tech, Finisar Corporation, Prysmian Group, Incab, Molex, Delaire USA, LEONI AG, RS Components Pte Ltd, Glenair, Inc., Extron, and Coherent Corp are the major market players.

What is the expected CAGR of the Optical Fiber market?

What are the driving factors impacting the Optical Fiber market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For