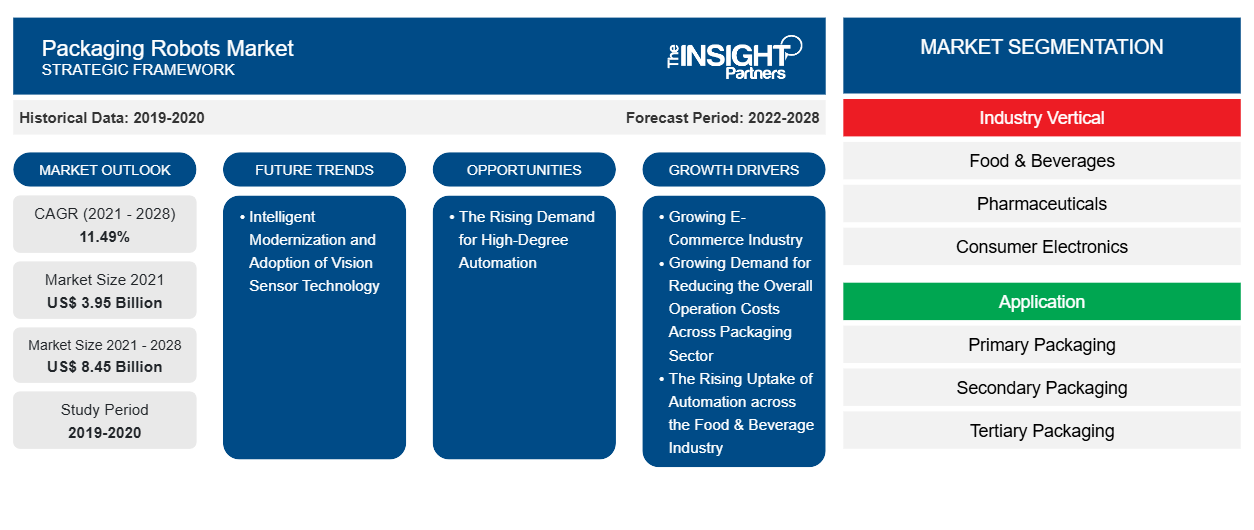

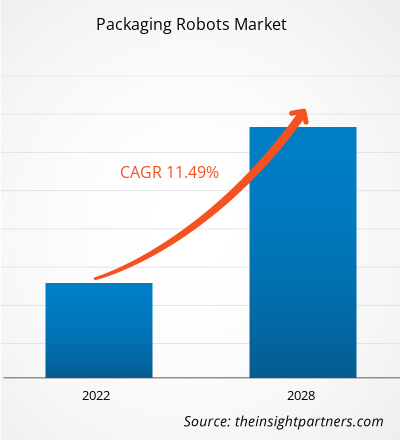

[Research Report] The packaging robots market is expected to grow from US$ 3,945.43 million in 2021 to US$ 8,448.21 million by 2028; it is estimated to grow at a CAGR of 11.49% during 2021–2028.

Analyst Perspective:

Packaging robots bring accuracy, speed, and productivity to material handling operations, and because of this, various manufacturers are implementing packaging robots to boost their throughput. Also, as packaging robots can lift more products at one time, they provide far higher uptimes than manual labor and create labor cost reduction in labor cost and overall operation, boosting the growth of the packaging robots market. In addition, the growing use of collaborative robots to fill hundreds of packages and bottles and perform other complex tasks more efficiently than humans in the food and beverage industry is fueling the growth of the packaging robots market. Also, the growing e-commerce industry worldwide is another factor fueling the growth of the packaging robots market. Furthermore, the rising demand for high-degree automation is expected to create an opportunity for the growth of the packaging robots market in the forecasted period.

Market Overview:

Packaging robots are robots that are programmed to move along a pre-defined route in order to pick up objects from different storage locations and place them onto shelves. These robots work without the assistance of a human and can help to save time by streamlining their production line and reducing the need for excess human intervention. They offer many important benefits across different industrial sectors by providing speed, accuracy, and productivity, all while delivering a relatively fast return on investment (ROI) when deployed correctly. Depending on the end of arm tooling (EOAT), packaging robots can complete many different tasks. Most often, packaging robots are designed to open, fill, transport, palletize, seal, code, and label product packaging. Because of the above benefits, they are most commonly used in the sectors where products must be packaged accurately, consistently, and with high quality to protect product integrity. The industrial sector has a high usage of packaging robots to speed up their cycle times and improve productivity, while the food and beverage industry uses packaging robots for similar reasons.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Packaging Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Packaging Robots Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Packaging Robots Market Driver:

The Rising Uptake of Automation across the Food & Beverage Industry is Driving the Growth of the Packaging Robots Market

Automation in the food & beverage industry refers to the integration of technologies across various production processes, such as inspection, packaging, and storage. Over the years, food & beverage companies have optimized different production processes by integrating automated systems, such as automated guided vehicles, delta robots, and robotic arms, to be in line with food safety & quality standards laid down by various regulatory bodies and reduce overall labor cost across production sites.

In addition, packed food & beverages require high accuracy and repetitive packaging processes, which is a challenge for humans. This factor is raising the demand for robotic technologies for various activities, including primary and secondary packaging and palletizing.

Also, vision-guided robots are experiencing a rise in demand across the food & beverage sector due to their efficiency in completing different repetitive tasks, such as bin picking, bottle handling, and tray loading. Additionally, numerous benefits, including improved efficiency, enhanced traceability, and high flexibility, have been boosting the need for automation in the food & beverage industry. Such factors are encouraging food & beverage producers to increase their investments in automated technology integration across their production facilities. For instance, in 2021, Utz Brands Inc., a US-based snack brand, announced its plans to integrate automated solutions across its production plants to reduce its overall operational cost. Similarly, in 2022, Hormel Foods also announced its plan to incorporate automation across its production facilities. Other food & beverage brands, such as Tyson Foods and Cargill Inc., are also working on adopting automated technology. Thus, the rising investment in automation across the food & beverage industry is fueling the growth of the packaging robots market.

Segmental Analysis:

Based on industry vertical, the packaging robots market is segmented into food & beverages, pharmaceuticals, consumer electronics, and others. The food & beverages segment held the largest market share in 2021, whereas the pharmaceuticals segment is anticipated to register the highest CAGR during 2021-2028. The food and beverage industry is witnessing a rapid integration of automation solutions. Packaging robots enable faster packaging while ensuring quality control. The integration of packaging robots also enhances worker safety, and end-to-end traceability increases output, waste reduction, and labor costs, making production more flexible. Due to these benefits, various food companies are working on optimizing their processes using vision-guided robotic arms, automated guided vehicles, delta robots, and advanced inspection systems to ensure food safety and quality standards and meet an ever-growing demand. Thus, the growing adoption of automation in the food and beverage industry to upgrade their existing infrastructure is fueling the market growth.

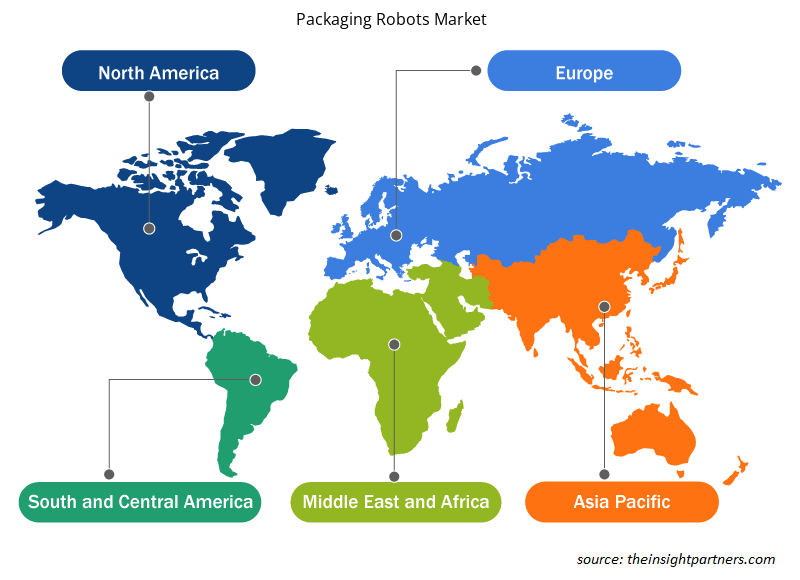

Regional Analysis:

Asia Pacific is expected to witness significant growth in the packaging robots market in the forecasted period. In the region, China will hold the largest market share in 2021, whereas India will register the highest CAGR during 2021-2028. The growing investments in automation to improve productivity and reduce costs are helping the manufacturers to meet the growing consumer demands. Also, as the integration of robots helps to improve packaging efficiency and reduces operational costs, its demand in various industry verticals is increasing. In addition, the demand for automation is driven by the flourishing e-commerce industry in the region. According to the International Air Transport Association (IATA), APAC leads the growth of the e-commerce market globally, with China accounting for a significant percentage of the growth. As per the International Trade Administration, the e-commerce market of China is the largest in the world and generates almost 50% of the world’s transactions. Similarly, the e-commerce market in other countries in APAC is also witnessing significant growth. For instance, according to the International Trade Administration, Australia—the eleventh-largest e-commerce market in the world—is expected to reach US$ 32.3 billion by 2024. According to the India Brand Equity Foundation (IBEF), the e-commerce market in India is expected to reach US$ 188 billion by 2025. Thus, the growing automation and e-commerce industry is fueling the market growth in APAC.

Key Player Analysis:

ABB Ltd, Brenton Engineering, FANUC Corporation, Krones AG, KUKA Roboter GmbH, Mitsubishi Electric Corporation, Remtec Automation LLC, Robert Bosch GmbH, Schnider Electric, and Yaskawa America are among the key packaging robots market players. These packaging robots market players are focused on continuous product development and innovation.

Packaging Robots Market Regional Insights

The regional trends and factors influencing the Packaging Robots Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Packaging Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Packaging Robots Market

Packaging Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.95 Billion |

| Market Size by 2028 | US$ 8.45 Billion |

| Global CAGR (2021 - 2028) | 11.49% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Industry Vertical

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Packaging Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Packaging Robots Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Packaging Robots Market are:

- ABB

- Brenton, LLC

- Fanuc Corporation

- Krones AG

- Kuka AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Packaging Robots Market top key players overview

Recent Developments:

Inorganic and organic strategies such as product launches, partnerships, collaboration, and mergers and acquisitions are highly adopted by companies in the market. A few recent key market developments by these companies are listed below:

- In April 2023, Shemesh announced the launch of the TKS-C60 complete robotics-enhanced packaging line for cosmetics, which is designed to handle the entire packaging process—feeding, filling, capping, labeling, case packing and palletizing cosmetics products of all shapes and sizes. The TKS-C60 ensures a seamless, uninterrupted bottling line for a range of products, from creams and foundations to fragrances and nail polish, at a rate of 60 bottles per minute.

- In March 2023, Proco Machinery, a manufacturer of automation systems for the custom bottling and packaging industry, announced the launch of a new collaborative robot packer to address the growing labor shortages in the packaging industry. This new Proco Collaborative Robot Packer is designed to work alongside human operators to increase efficiency and performance. The new robot packer can perform a range of tasks, from testing containers to packing them into cases.

- In February 2023, Rapid Robotics announced a new partnership with Universal Robots (UR), under which the Danish collaborative robot (cobot) producer will be supplying collaborative robot arms for Rapid Robotics’ deployment of cobot work cells across North America. Also, Universal Robots will enable Rapid Robotics to serve a greater number of customers and maintain the rapid deployment times they’ve come to expect even as Rapid Robotics continues to expand its national footprint. These collaborative robots have a wide variety of capabilities, such as palletizing, box building and packing, and operations requiring a heavier payload or longer reach.

- In November 2022, OSARO, a global leader in AI-driven robotics for e-commerce, announced a partnership with SVT Robotics to accelerate the integration of pick-and-place robotics systems for e-commerce and logistics businesses. SVT Robotics’ ground-breaking SOFTBOT Platform enables companies to integrate and deploy the robots, automation, and IoT devices they need in just days or weeks. As part of the agreement, SVT Robotics has joined OSARO’s partner program, which offers one-stop access for businesses looking to deploy robotic solutions in their fulfillment operations.

- In July 2022, ABB announced that it is expanding its FlexPicker Delta robot portfolio with the IRB 365. With five axis and a 1.5kg payload, the IRB 365 is both flexible and the fastest in its class for reorienting packaged lightweight products such as cookies, chocolates, peppers, candies, small bottles, and parcels. Responding to the rise in e-commerce and growing demand for shelf-ready packaged goods, the IRB 365 has been developed for applications including food and beverage, pharmaceuticals, and consumer goods, where production line speed and adaptability are essential.

Frequently Asked Questions

Which region is expected to dominate the packaging robots market in the forecast period ?

The Asia Pacific packaging robots market was estimated to be the largest as well as fastest growing regions in the global packaging robots market in 2020, according to the research study. The packaging robots’ market in Asia-Pacific (APAC) is further sub-segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The region holds the largest market share owing to well established manufacturing sector. A continuous rise in increasing disposal income across economies such as India and China are resulting in elevated consumer demand for diverse range of products. In addition, the availability of cheap laborers in the region attracts many foreign manufacturers to establish their manufacturing bases in the region. Increased investments in automation to reduce costs and improve productivity is driving the manufacturers to meet the growing consumer demands. The integration of robots improves packaging efficiency and reduces operational costs.

Which industry vertical is expected to dominate the market during the forecast period ?

The food and beverage industry is witnessing rapid integration of automation solutions, including vision-guided robotic arms, packaging robots and advanced inspection systems to streamline and optimize operations. Food and beverage industry is one of the early adopters of advanced technologies. Factories in the developed nations are investing in the smart factory concept by integrating mobile devices, sensors, and connectivity devices. Before the industrial 4.0. automation in the food industry was achieved through end-of-line technologies such as computer mechanical bagging systems. One-third of processing operations employ robots, according to research by Association for Packaging and Processing Technologies..

Which application is expected to dominate the market in the forecast period?

Primary packaging is the first layer that contains the finished product and preserves it from contamination. The packaging is intended for consumers to communicate important information about the products and make it more appealing. Factor such as production parameters, product’s attributes and how products are delivered to and from the packaging equipment is crucial while considering the automation of a packaging process. Automating primary packaging through robots offers greater flexibility and provides a product to be placed in any configuration.

What are market opportunities for packaging robots market?

Packaging is a critical procedure in manufacturing facilities, especially those that produce goods for the consumer market. The installation of a robotic packaging system increases flexibility and improves the packaging line's overall production. Furthermore, packaging robots can work in a variety of temperatures and take up significantly less floor area than people. Increased demand for various items is forcing enterprises to focus on improving production efficiency and implementing better operations management. The implementation of robotic automation in packaging units can help achieve overall equipment efficiency (OEE), which is a necessary need for long-term production efficiency. Robotic installation in packaging lines improves high-speed efficiency of product selecting, packing, and palletizing by reducing physical dexterity.

What are reasons behind packaging robots market growth?

Growing customer demand for high-quality goods has resulted in advancements in manufacturing technology. The food and beverage, trucking and logistics, and fast-moving consumer goods (FMCG) businesses are all focused on getting products to customers in a short amount of time, which has boosted robotic packaging use. Packaging robots has been a great potential in food and beverage industry. The deliberate integration of technology across various processes in the food and beverage industry is known as automation.

What trends are expected to drive the demand for various packaging robots ?

Increased demand for a variety of products from manufacturing industries like food and beverage, pharmaceutical as well as from the ecommerce industry is prompting businesses to concentrate on improving production efficiency and implementing improved operations management. Robotic automation in packaging units achieves overall equipment efficiency, which is a requirement for long-term production efficiency. Furthermore, new innovations like human-robot collaboration are further contributing in the market growth. Human-robot collaboration, in which robots and people work together closely, is referred to as collaborative robot. The robot can comprehend human commands, including speech, gestures, and so on, and begin activities accordingly.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Packaging Robots Market

- ABB

- Brenton, LLC

- Fanuc Corporation

- Krones AG

- Kuka AG

- Mitsubishi Electric Corporation

- Remtec Automation, LLC

- Syntegon Technology GmbH (Bosch Packaging Technology)

- Schneider Electric SE

- Yaskawa Electric Corporation

Get Free Sample For

Get Free Sample For