Packaging Robots Market Segments and Growth by 2028

Packaging Robots Market Forecast to 2028 - Analysis By Industry Vertical (Food & Beverages, Pharmaceuticals, Consumer Electronics, and Others) and Application (Primary Packaging, Secondary Packaging, and Tertiary Packaging)

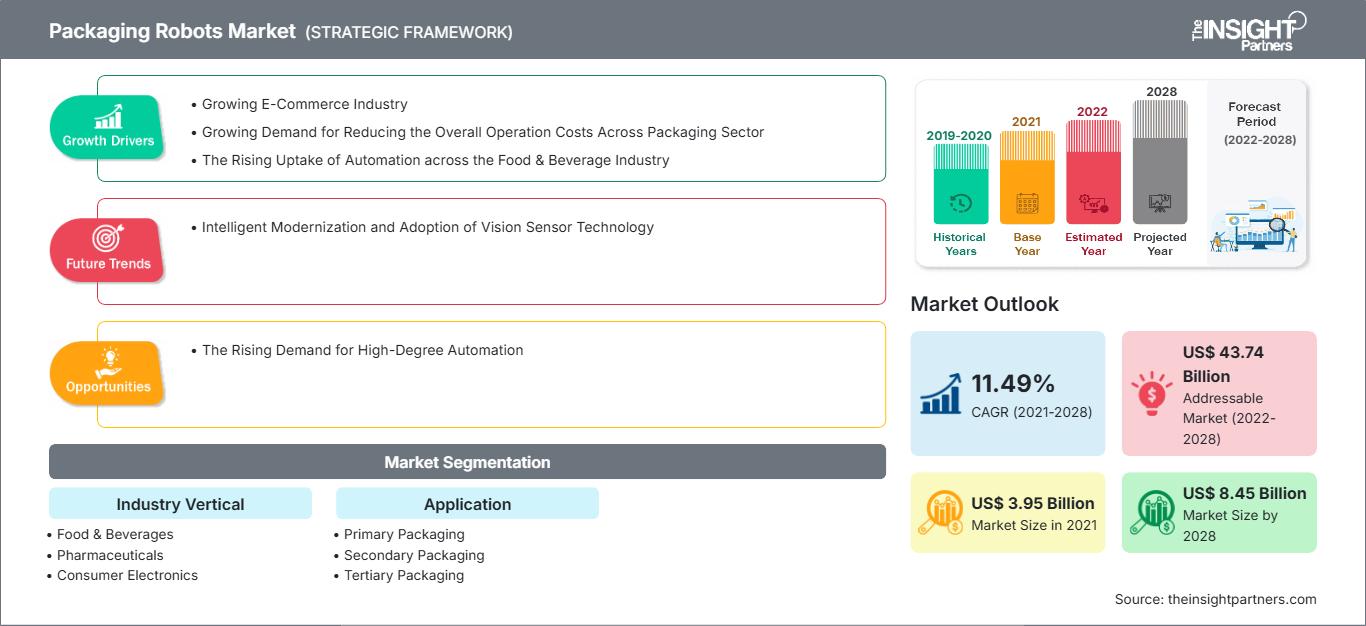

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Oct 2021

- Report Code : TIPRE00004103

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 149

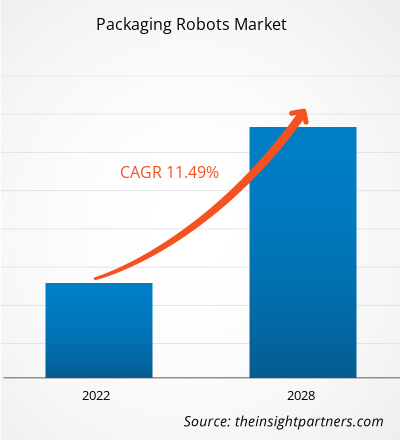

[Research Report] The packaging robots market is expected to grow from US$ 3,945.43 million in 2021 to US$ 8,448.21 million by 2028; it is estimated to grow at a CAGR of 11.49% during 2021–2028.

Analyst Perspective:

Packaging robots bring accuracy, speed, and productivity to material handling operations, and because of this, various manufacturers are implementing packaging robots to boost their throughput. Also, as packaging robots can lift more products at one time, they provide far higher uptimes than manual labor and create labor cost reduction in labor cost and overall operation, boosting the growth of the packaging robots market. In addition, the growing use of collaborative robots to fill hundreds of packages and bottles and perform other complex tasks more efficiently than humans in the food and beverage industry is fueling the growth of the packaging robots market. Also, the growing e-commerce industry worldwide is another factor fueling the growth of the packaging robots market. Furthermore, the rising demand for high-degree automation is expected to create an opportunity for the growth of the packaging robots market in the forecasted period.

Market Overview:

Packaging robots are robots that are programmed to move along a pre-defined route in order to pick up objects from different storage locations and place them onto shelves. These robots work without the assistance of a human and can help to save time by streamlining their production line and reducing the need for excess human intervention. They offer many important benefits across different industrial sectors by providing speed, accuracy, and productivity, all while delivering a relatively fast return on investment (ROI) when deployed correctly. Depending on the end of arm tooling (EOAT), packaging robots can complete many different tasks. Most often, packaging robots are designed to open, fill, transport, palletize, seal, code, and label product packaging. Because of the above benefits, they are most commonly used in the sectors where products must be packaged accurately, consistently, and with high quality to protect product integrity. The industrial sector has a high usage of packaging robots to speed up their cycle times and improve productivity, while the food and beverage industry uses packaging robots for similar reasons.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPackaging Robots Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Packaging Robots Market Driver:

The Rising Uptake of Automation across the Food & Beverage Industry is Driving the Growth of the Packaging Robots Market

Automation in the food & beverage industry refers to the integration of technologies across various production processes, such as inspection, packaging, and storage. Over the years, food & beverage companies have optimized different production processes by integrating automated systems, such as automated guided vehicles, delta robots, and robotic arms, to be in line with food safety & quality standards laid down by various regulatory bodies and reduce overall labor cost across production sites.

In addition, packed food & beverages require high accuracy and repetitive packaging processes, which is a challenge for humans. This factor is raising the demand for robotic technologies for various activities, including primary and secondary packaging and palletizing.

Also, vision-guided robots are experiencing a rise in demand across the food & beverage sector due to their efficiency in completing different repetitive tasks, such as bin picking, bottle handling, and tray loading. Additionally, numerous benefits, including improved efficiency, enhanced traceability, and high flexibility, have been boosting the need for automation in the food & beverage industry. Such factors are encouraging food & beverage producers to increase their investments in automated technology integration across their production facilities. For instance, in 2021, Utz Brands Inc., a US-based snack brand, announced its plans to integrate automated solutions across its production plants to reduce its overall operational cost. Similarly, in 2022, Hormel Foods also announced its plan to incorporate automation across its production facilities. Other food & beverage brands, such as Tyson Foods and Cargill Inc., are also working on adopting automated technology. Thus, the rising investment in automation across the food & beverage industry is fueling the growth of the packaging robots market.

Segmental Analysis:

Based on industry vertical, the packaging robots market is segmented into food & beverages, pharmaceuticals, consumer electronics, and others. The food & beverages segment held the largest market share in 2021, whereas the pharmaceuticals segment is anticipated to register the highest CAGR during 2021-2028. The food and beverage industry is witnessing a rapid integration of automation solutions. Packaging robots enable faster packaging while ensuring quality control. The integration of packaging robots also enhances worker safety, and end-to-end traceability increases output, waste reduction, and labor costs, making production more flexible. Due to these benefits, various food companies are working on optimizing their processes using vision-guided robotic arms, automated guided vehicles, delta robots, and advanced inspection systems to ensure food safety and quality standards and meet an ever-growing demand. Thus, the growing adoption of automation in the food and beverage industry to upgrade their existing infrastructure is fueling the market growth.

Regional Analysis:

Asia Pacific is expected to witness significant growth in the packaging robots market in the forecasted period. In the region, China will hold the largest market share in 2021, whereas India will register the highest CAGR during 2021-2028. The growing investments in automation to improve productivity and reduce costs are helping the manufacturers to meet the growing consumer demands. Also, as the integration of robots helps to improve packaging efficiency and reduces operational costs, its demand in various industry verticals is increasing. In addition, the demand for automation is driven by the flourishing e-commerce industry in the region. According to the International Air Transport Association (IATA), APAC leads the growth of the e-commerce market globally, with China accounting for a significant percentage of the growth. As per the International Trade Administration, the e-commerce market of China is the largest in the world and generates almost 50% of the world’s transactions. Similarly, the e-commerce market in other countries in APAC is also witnessing significant growth. For instance, according to the International Trade Administration, Australia—the eleventh-largest e-commerce market in the world—is expected to reach US$ 32.3 billion by 2024. According to the India Brand Equity Foundation (IBEF), the e-commerce market in India is expected to reach US$ 188 billion by 2025. Thus, the growing automation and e-commerce industry is fueling the market growth in APAC.

Key Player Analysis:

ABB Ltd, Brenton Engineering, FANUC Corporation, Krones AG, KUKA Roboter GmbH, Mitsubishi Electric Corporation, Remtec Automation LLC, Robert Bosch GmbH, Schnider Electric, and Yaskawa America are among the key packaging robots market players. These packaging robots market players are focused on continuous product development and innovation.

Packaging Robots Market Regional InsightsThe regional trends and factors influencing the Packaging Robots Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Packaging Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Packaging Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.95 Billion |

| Market Size by 2028 | US$ 8.45 Billion |

| Global CAGR (2021 - 2028) | 11.49% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Industry Vertical

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Packaging Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Packaging Robots Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Packaging Robots Market top key players overview

Recent Developments:

Inorganic and organic strategies such as product launches, partnerships, collaboration, and mergers and acquisitions are highly adopted by companies in the market. A few recent key market developments by these companies are listed below:

- In April 2023, Shemesh announced the launch of the TKS-C60 complete robotics-enhanced packaging line for cosmetics, which is designed to handle the entire packaging process—feeding, filling, capping, labeling, case packing and palletizing cosmetics products of all shapes and sizes. The TKS-C60 ensures a seamless, uninterrupted bottling line for a range of products, from creams and foundations to fragrances and nail polish, at a rate of 60 bottles per minute.

- In March 2023, Proco Machinery, a manufacturer of automation systems for the custom bottling and packaging industry, announced the launch of a new collaborative robot packer to address the growing labor shortages in the packaging industry. This new Proco Collaborative Robot Packer is designed to work alongside human operators to increase efficiency and performance. The new robot packer can perform a range of tasks, from testing containers to packing them into cases.

- In February 2023, Rapid Robotics announced a new partnership with Universal Robots (UR), under which the Danish collaborative robot (cobot) producer will be supplying collaborative robot arms for Rapid Robotics’ deployment of cobot work cells across North America. Also, Universal Robots will enable Rapid Robotics to serve a greater number of customers and maintain the rapid deployment times they’ve come to expect even as Rapid Robotics continues to expand its national footprint. These collaborative robots have a wide variety of capabilities, such as palletizing, box building and packing, and operations requiring a heavier payload or longer reach.

- In November 2022, OSARO, a global leader in AI-driven robotics for e-commerce, announced a partnership with SVT Robotics to accelerate the integration of pick-and-place robotics systems for e-commerce and logistics businesses. SVT Robotics’ ground-breaking SOFTBOT Platform enables companies to integrate and deploy the robots, automation, and IoT devices they need in just days or weeks. As part of the agreement, SVT Robotics has joined OSARO’s partner program, which offers one-stop access for businesses looking to deploy robotic solutions in their fulfillment operations.

- In July 2022, ABB announced that it is expanding its FlexPicker Delta robot portfolio with the IRB 365. With five axis and a 1.5kg payload, the IRB 365 is both flexible and the fastest in its class for reorienting packaged lightweight products such as cookies, chocolates, peppers, candies, small bottles, and parcels. Responding to the rise in e-commerce and growing demand for shelf-ready packaged goods, the IRB 365 has been developed for applications including food and beverage, pharmaceuticals, and consumer goods, where production line speed and adaptability are essential.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For