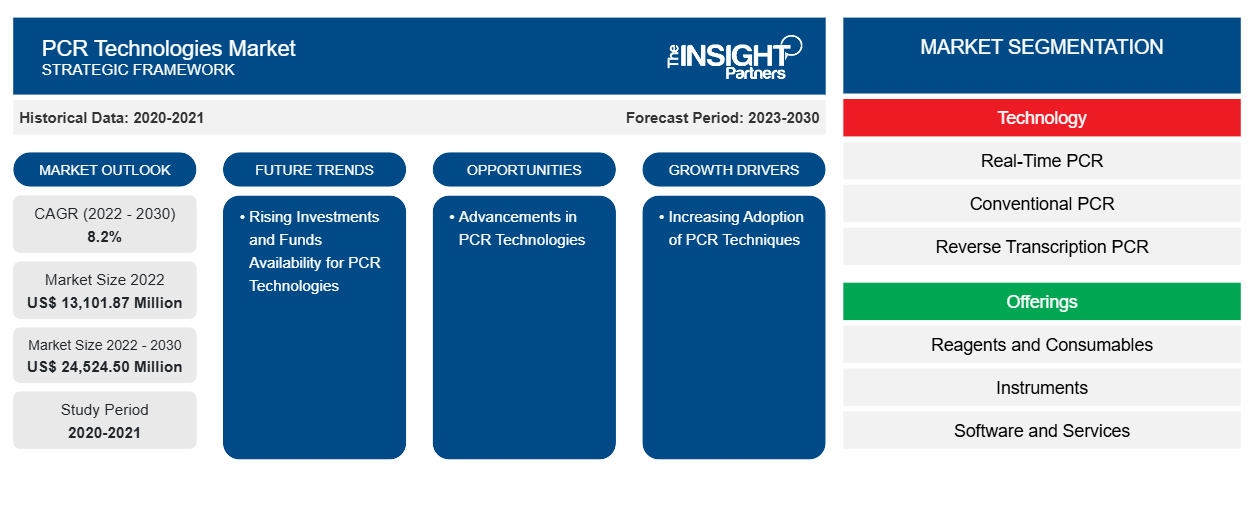

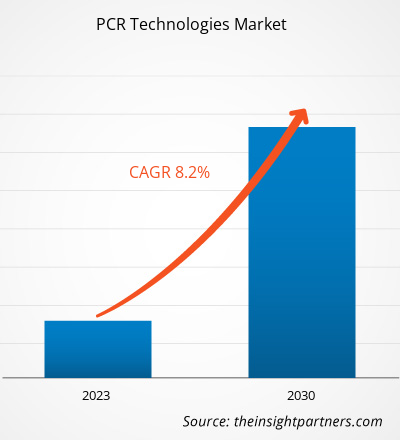

The PCR technologies market size is projected to reach US$ 24,524.50 million by 2030 from US$ 13,101.87 million in 2022. The market is expected to register a CAGR of 8.2% during 2022–2030. The advancements in PCR technologies are likely to serve as one of the key trends in the market.

PCR Technologies Market Analysis

Factors driving the PCR technologies market growth are the rise in the incidence of target infectious diseases and genetic disorders, continual improvements in PCR technologies, and growing funding and investments. Furthermore, rising market penetration in emerging nations is likely to provide growth opportunities for market players in the PCR technologies market. PCR has evolved significantly over the years, resulting in the creation of faster, more sensitive, and highly efficient PCR methods. These breakthroughs include real-time PCR, digital PCR, and multiplex PCR, among others. Each iteration brings enhancement in speed, accuracy, and the capacity to detect many targets simultaneously, therefore broadening its applications in diagnostics and research, which is likely to boost the growth of the PCR technologies market.

PCR Technologies Market Overview

The use of PCR technology is being explored in several nonconventional applications, making molecular diagnosis more accessible and faster. Advancements in dPCR and RT-PCR are used to diagnose diseases, identify viruses and bacteria, and aid forensic investigations. Researchers are trying to reduce test time using some nanomaterials. In March 2023, the Center for Augmented Safety System with Intelligence, Sensing of the Korea Institute of Science and Technology (KIST) announced the development of an ultrafast PCR technology. The ultrafast PCR reduces the test duration by ten times compared to the previous tests by utilizing photothermal nanomaterials. In addition, the rise in the development of personalized medicine owing to the availability of particular genome testing and the developing field of nutrigenomics are fueling the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

PCR Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

PCR Technologies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

PCR Technologies Market Drivers and Opportunities

Rising Investments and Funds Availability for PCR Technologies to Favor Market Growth

Government and federal agencies around the world are progressively acknowledging the relevance of qPCR and dPCR products in genomics research. In the recent decade, the market has seen several funding programs to boost genomic research from both government and private institutions. Visby Medical (US), an infectious disease diagnostic business, obtained Phase 2 funding from the National Institutes of Health under its Rapid Acceleration of Diagnostics initiative in October 2020. EVONETIX LTD announced the completion of its Series B financing round in 2020. The company, led by new investor Foresite Capital, raised US$ 30 million (£23 million) in this round. These initiatives aim to conduct medical genomics-based investigations in customized medicine, such as PCR-based disease detection and treatment. Thus, with the increasing availability of financial support for maintaining R&D in disease-targeted genomics research activities, the need for PCR products is expected to increase, thereby driving market growth.

Increasing Adoption of PCR Techniques in Emerging Countries

In recent years, molecular methods such as PCR have progressed as diagnostic tools, enabling healthcare professionals to accurately diagnose various infectious diseases. PCR techniques are also being widely accepted and utilized in emerging countries. According to the World Health Organization (WHO) Report on the Establishment of PCR Laboratory in Developing Countries, WHO provides technical assistance to establish PCR laboratories in all 11 WHO Southeast Asia countries. Depending on their need, these facilities have adopted various PCR technologies such as reverse transcriptase PCR (RT-PCR), multiplex PCR, real-time PCR, in-situ PCR, and dPCR. The application of PCR technologies is increasing in clinical microbiology, biotechnology, virology, parasitology, and allied fields due to this tool's simple, rapid, and highly specific screening. Thus, the PCR technologies market in developing countries is expected to offer lucrative opportunities during the forecast period.

PCR Technologies Market Report Segmentation Analysis

Key segments that contributed to the derivation of the PCR technologies market analysis are technology, offerings, application, and end user.

- Based on technology, the PCR technologies market is classified into real-time PCR, conventional PCR, reverse transcription PCR, digital PCR, multiplex RT PCR, hot start PCR, and others. The real-time PCR segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR during the forecast period.

- In terms of offerings, the market is categorized into reagents and consumables, instruments, and software and services. The reagents and consumables segment held the largest share of the market in 2022 and is projected to register the highest CAGR during the forecast period.

- In terms of application, the PCR technologies market is segmented into gene expression analysis, genetic sequencing, genotyping, nucleic acid synthesis, standard validation, point of care diagnostics, environmental application, and others. The gene expression analysis segment held the largest share of the market in 2022 and is anticipated to register the fastest CAGR during the forecast period.

- Based on end user, the market is segmented into hospitals and diagnostic centers, academia and research institutes, pharmaceutical and biotechnology companies, and others. The hospitals and diagnostic centers segment held the largest share of the market in 2022 and is projected to register the fastest CAGR during the forecast period.

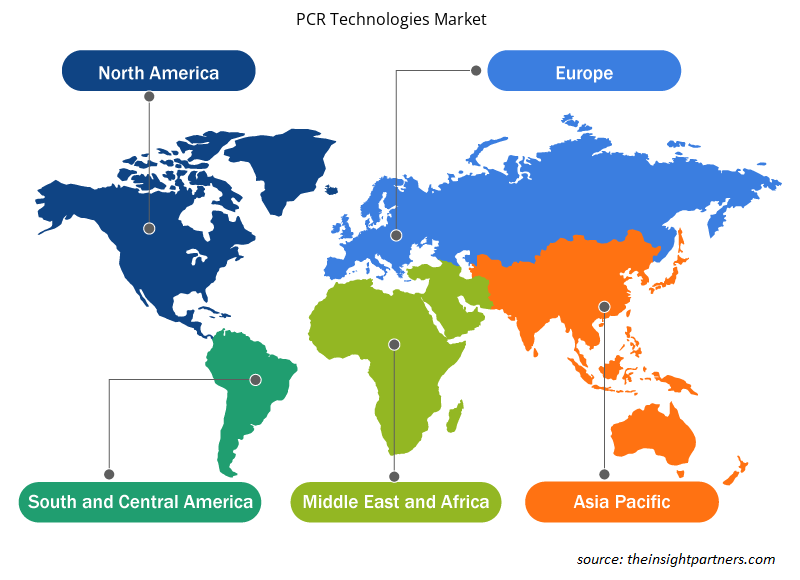

PCR Technologies Market Share Analysis by Geography

The geographic scope of the PCR technologies market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the PCR technologies market. The market growth in this region is attributed to the rising demand for state-of-the-art products from bioanalytical instrument manufacturers and PCR companies, extensive R&D conducted across various academic and research institutes, and the presence of significant market players. In addition, the well-known practice of adopting medical devices in healthcare operations to improve quality and reduce costs also benefits the PCR technologies market in the US and other North American countries. An upsurge in the acceptance and implementation of gene synthesis and editing tools such as CRISPR and PCR in research and therapeutics necessitates assays that aid in rapid quantification, alterations, and observation. The emergence of digital PCR in the form of droplet digital PCR offers new opportunities for screening, providing superior sensitivity and easy adaptability. The US is seeking significant funding from public and private organizations to encourage investments in advanced research methodologies. Further, Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

PCR Technologies Market Regional Insights

The regional trends and factors influencing the PCR Technologies Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses PCR Technologies Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for PCR Technologies Market

PCR Technologies Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 13,101.87 Million |

| Market Size by 2030 | US$ 24,524.50 Million |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

PCR Technologies Market Players Density: Understanding Its Impact on Business Dynamics

The PCR Technologies Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the PCR Technologies Market are:

- Atila Biosystems

- Thermo Fisher Scientific, Inc.

- Takara Bio Inc.

- Standard BioTools Inc.

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the PCR Technologies Market top key players overview

PCR Technologies Market News and Recent Developments

The PCR technologies market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the PCR technologies market are listed below:

- Agilent Technologies Inc. introduced a real-time reverse transcription (qRT) PCR-based diagnostic kit for SARS-CoV-2 RNA detection. The Agilent SARS-CoV-2 qRT-PCR Dx kit is an in vitro diagnostic reagent kit for detecting SARS-CoV-2 RNA using qRT-PCR. The single-tube assay enables greater efficiency, higher throughput, less consumption, and unambiguous results for testing outcomes confidence. (Source: Agilent Technologies Inc., Press Release, March 2021)

- Standard BioTools Inc. launched the X9 Real-Time PCR system, an innovative high-capacity genomics instrument offering superior efficiency. X9 provides high data output with over 9,000 individual nanoliter-volume reactions in a single run, providing cost-effective, comprehensive sample profiling with minimal operator involvement. (Source: Standard BioTools Inc., Press Release, October 2022)

PCR Technologies Market Report Coverage and Deliverables

The “PCR Technologies Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- PCR technologies market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- PCR technologies market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- PCR technologies market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the PCR technologies market

- Detailed company profiles

Frequently Asked Questions

Which region dominated the PCR technologies market in 2022?

North America region dominated the PCR technologies market in 2022.

What are the driving factors impacting the PCR technologies market?

The rising prevalence of genetic and infectious diseases and rising investments and funds availability for PCR technologies are the most influential factors responsible for market growth.

Which are the leading players operating in the PCR technologies market?

Atila Biosystems; Thermo Fisher Scientific, Inc.; Takara Bio Inc.; Standard BioTools Inc.; F. Hoffmann-La Roche AG; Bio-Rad Laboratories, Inc; Agilent Technologies; Biomerieux SA; QIAGEN NV; Promega Corporation; Becton, Dickinson, and Company; Visby Medical, Inc.; and Ellume Ltd are the market players in the PCR technologies market.

What would be the estimated value of the PCR technologies market by 2030?

The estimated value of the PCR technologies market accounted for US$ 24,524.50 million in 2030.

What is the expected CAGR of the PCR technologies market?

The global PCR technologies market is estimated to register a CAGR of 8.2% during the forecast period 2022–2030.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - PCR Technology Market

- Thermo Fisher Scientific Inc

- Promega Corp

- QIAGEN NV

- bioMerieux SA

- Hoffmann-La Roche Ltd

- Bio-Rad Laboratories Inc

- Becton Dickinson and Co

- Atila Biosystems Inc

- Takara Bio Inc

- Standard BioTools Inc

- Agilent Technologies Inc

- Visby Medical Inc

- Ellume Ltd

Get Free Sample For

Get Free Sample For