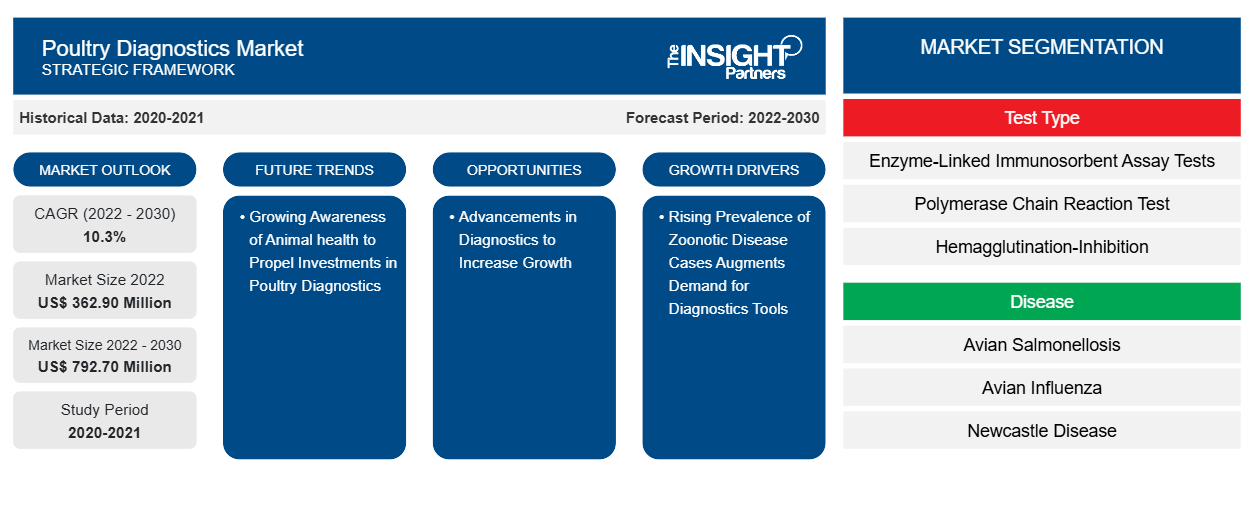

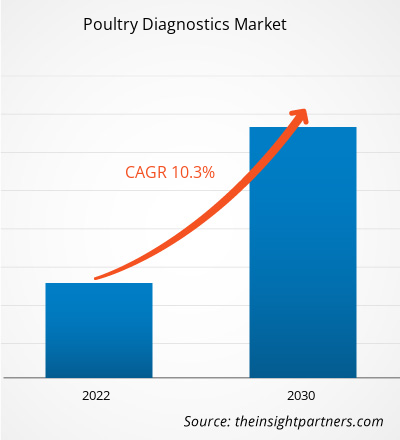

The poultry diagnostics market size is expected to grow from US$ 362.90 million in 2022 to US$ 792.70 million by 2030; the market is estimated to register a CAGR of 10.3% from 2022 to 2030. The growing adoption of farm-side diagnostic poultry platforms will likely remain a key trend in the market.

Poultry Diagnostics Market Analysis

In poultry medicine, the diagnostic process has shifted from focusing on individual animals to assessing the health of entire flocks. Flocks are considered "healthy" if they meet their genetic potential and are free from clinical disease. On-farm diagnostic activities involve routine sampling and investigations as part of health control programs. Nationally and internationally adopted control programs for specific Mycoplasma and Salmonella species are important examples. Factors including the increasing prevalence of zoonotic diseases and poultry diseases boost demand for poultry diagnostics. Additionally, new developments in the market contribute to the market growth during the forecast period.

Poultry Diagnostics Market Overview

Influenza A virus subtypes H9 and H6 have established lineages in domestic chickens and game birds such as quail and pheasant, which are farmed for consumption in Asia. In 2022, China reported several avian influenza virus strains, mostly belonging to the H5, H7, or H9 subtypes, often causing outbreaks in poultry and/or humans. Additionally, in India, the marek’s disease (MD) is one of the re-emerging poultry diseases. Although MD is considered well-controlled with vaccination, flock mortality of 10–40% was observed in vaccinated flocks during outbreaks. The market growth in Asia Pacific is due to the emergence of middle east respiratory syndrome coronavirus (MERS-CoV) and the spread of highly pathogenic avian influenza (H5N1) in many Asian countries. Avian influenza continues to cause significant losses in poultry and poses a zoonotic threat to human populations in many countries in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Poultry Diagnostics Market Drivers and Opportunities

Advancements in Poultry Diagnostics to Favor Market

In recent years, the expansion of diagnostic tools in clinical microbiology laboratories has significantly influenced bacteriological investigations in poultry medicine. There is a clear shift towards incorporating molecular techniques and proteomics, which either complement or replace traditional bacteriology methods. According to an article published in Frontiers in Artificial Intelligence in September 2022, in Africa, a deep convolutional neural network (CNN) model was developed to diagnose poultry diseases including Coccidiosis, Salmonella, and Newcastle by classifying healthy and unhealthy fecal images. The study concluded that this proposed Convolutional Neural Network (CNN) model utilizing deep learning technology is expected to be less expensive and effective in early detection than PCR diagnostics tests in the laboratory. Such advancements in poultry disease diagnostics boost the poultry diagnosis market growth.

Government Initiatives Brings Growth Opportunities

Poultry farming is an important source of revenue generation for farmers in developing countries. The poultry industry faces challenges related to immunity, health, and production including maintaining consumer confidence, product quality and safety, and disease management. Foodborne and zoonotic diseases are closely associated with poultry and pose significant challenges. Controlling and eliminating these pathogens is a major challenge for the industry. Additionally, addressing public health concerns related to consuming foods with high antibiotic residues is a critical issue. To overcome these challenges, multisectoral collaboration and government policies that reach smallholder poultry keepers are crucial. Successful control would enhance the livelihoods, nutrition, and gender equity for millions of rural families. According to an article published by the Veterinary & Animal Husbandry Services (V&AHS) in 2024, Scheme No. 1 aims to provide necessary animal health facilities and clinical aids for livestock to control and contain animal diseases through proper diagnosis, mass immunization, and delivery of rational treatment. Such government schemes and initiatives in supporting diagnostics for poultry farming would offer an array of market opportunities for poultry producers compared to simple diagnosis.

Poultry Diagnostics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the poultry diagnostics market analysis are test type and disease.

- The poultry diagnostics market is segmented based on test type into enzyme-linked immunosorbent assay (ELISA) tests, polymerase chain reaction (PCR) tests, hemagglutination-inhibition (HI), and others. The ELISA tests segment held the largest market share in 2023.

- By disease, the market is segmented into avian salmonellosis, avian influenza, Newcastle disease, avian mycoplasmosis, infectious bronchitis, and others. The avian influenza segment held the largest market share in 2022.

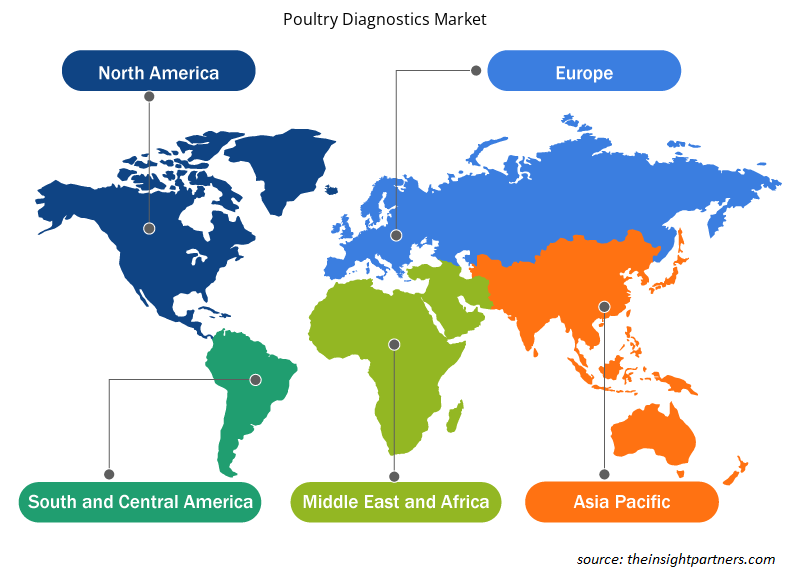

Poultry Diagnostics Market Share Analysis by Geography

The geographic scope of the poultry diagnostics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America holds the largest market share of the next-generation sequencing market. The Poultry Diagnostics market in North America is analyzed based on the US, Canada, and Mexico. The US is estimated to dominate the North America poultry diagnostics market in 2023. As per the statistics published by the United Nations Food and Agriculture Organization (UNFAO), there was an increase in the production of eggs and hens in North America in 2022. The government is contemplating a mass vaccination campaign for poultry. As of July 5, 2022, the US Department of Agriculture (USDA) stated 40.09 million birds to be infected with highly pathogenic avian influenza (HPAI) in 36 US states.

Therefore, the growth of the market in North America is due to rising incidences of poultry disease outbreaks and growing demand for poultry-derived products in the region.

Poultry Diagnostics Market Regional Insights

The regional trends and factors influencing the Poultry Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Poultry Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Poultry Diagnostics Market

Poultry Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 362.90 Million |

| Market Size by 2030 | US$ 792.70 Million |

| Global CAGR (2022 - 2030) | 10.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

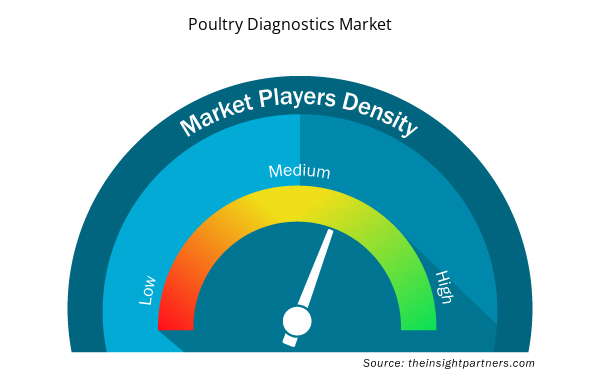

Poultry Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Poultry Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Poultry Diagnostics Market are:

- Thermo Fisher Scientific Inc

- Idexx Laboratories Inc

- Qiagen NV

- Eurofins Scientific SE

- IDVET

- Boehringer Ingelheim International GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Poultry Diagnostics Market top key players overview

Poultry Diagnostics Market News and Recent Developments

The Poultry Diagnostics market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes essential corporate publications, association data, and databases. A few of the developments in the Poultry Diagnostics market are listed below:

- IDEXX Laboratories, Inc. USA partnered with Haychem Bangladesh Limited (a subsidiary of Hayleys Agriculture Holdings Limited, Sri Lanka). The partnership aims to expand the product offerings in Bangladesh for IDEXX and increase veterinary vaccinations and diagnostics. (Source: Hayleys Agriculture Holdings Limited, Press Release, 2023)

- Qiagen N.V. announced US FDA approval for "therascreen PDGFRA RGQ PCR kit (therascreen PDGFRA kit). The new product is intended to aid clinicians in identifying patients with gastrointestinal stromal tumors (GIST) for treating "AYVAKIT (avapritinib) (Source: QIAGEN, Press Release, 2023)

Poultry Diagnostics Market Report Coverage and Deliverables

The “Poultry Diagnostics Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Poultry Diagnostics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Poultry Diagnostics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Poultry Diagnostics market analysis covering key market trends, global and regional framework, significant players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Poultry Diagnostics market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Test Type, Disease, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What is the expected CAGR of the Poultry Diagnostics market?

The poultry diagnostics market is anticipated to grow at a CAGR of 11.20% during 2023-2031.

What would be the estimated value of the poultry diagnostics market by 2031?

The poultry diagnostics market is estimated to reach US$ 934.57 million by 2031.

What are the future trends of the poultry diagnostics market?

The adoption of a farm-side diagnostic poultry platform is a future trend in the market.

Which are the leading players operating in the Poultry Diagnostics market?

Thermo Fisher Scientific Inc, Idexx Laboratories Inc, Qiagen NV, Eurofins Scientific SE, IDVET, Boehringer Ingelheim International GmbH, Zoetis Inc, BioCheck BV, Bioneer Corp, BioInGenTech Biotechnologies are some leading players operating in the poultry diagnostics market.

What are the driving factors impacting the poultry diagnostics market?

Factors rising zoonotic disease cases and technological advancements in diagnostics are driving the poultry diagnostics market growth.

Which region dominated the poultry diagnostics market in 2023?

North America dominated the poultry diagnostics market in 2023.

Get Free Sample For

Get Free Sample For