Radiation Protection Apron Market Analysis, Size, and Share by 2030

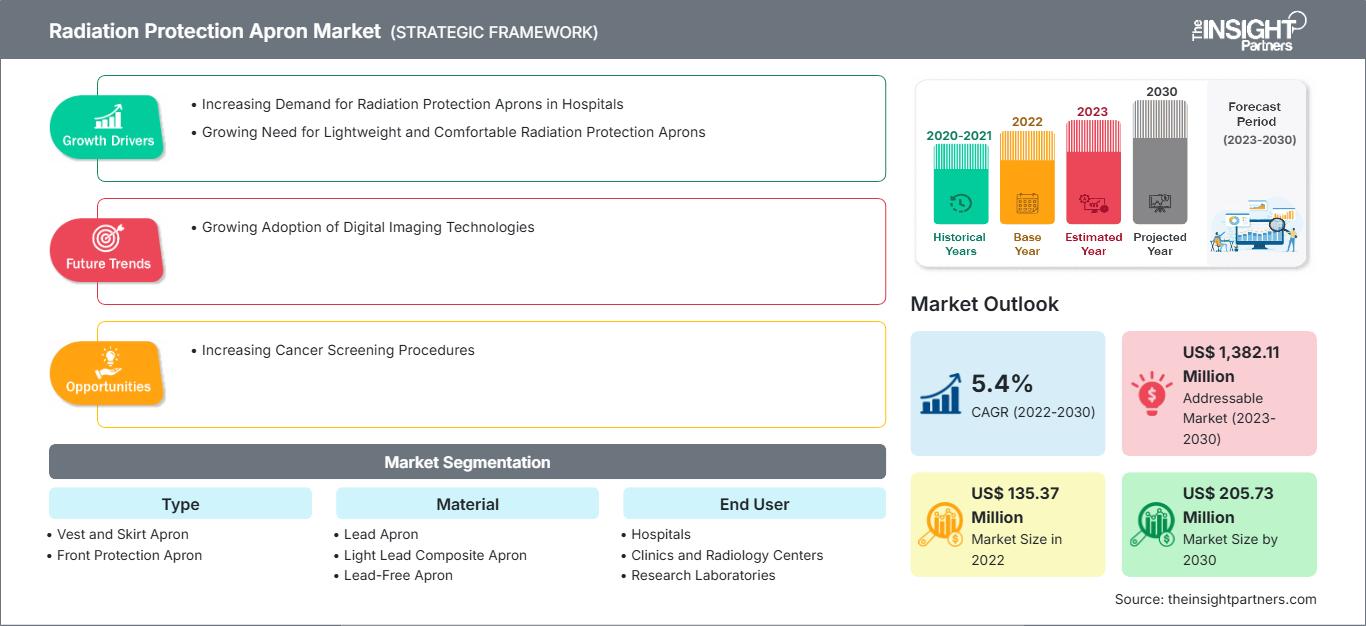

Radiation Protection Apron Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Vest and Skirt Apron, Front Protection Apron, and Others), Material (Lead Apron, Light Lead Composite Apron, and Lead-Free Apron), and End User (Hospitals, Clinics and Radiology Centers, Research Laboratories, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jan 2024

- Report Code : TIPRE00005397

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 166

[Research Report] The radiation protection apron market size is expected to grow from US$ 135.37 million in 2022 and to reach a value of US$ 205.73 million by 2030; it is anticipated to record a CAGR of 5.4% from 2022 to 2030.

Market Insights and Analyst View:

The radiation protection apron market is expected to grow steadily due to increasing awareness about radiation safety in medical and industrial settings. Advancements in materials and technology drive the demand for lightweight and lead-free aprons. Stringent safety regulations and the expanding healthcare sector globally are also contributing factors to the market growth. Market players focus on innovation and customization to cater to diverse end-user needs. Continuous research and development in radiation protection technologies are likely to shape the market's future dynamics. The increasing prevalence of cancer worldwide creates a significant opportunity for the radiation protection apron market. Cancer screening procedures, such as mammography, CT scans, and X-rays, are often necessary for early detection and treatment of cancer. To detect cancer in its early stages and lower the death rate, primary care physicians and governments in developed nations advise people to undergo cancer screening tests. To proceed with early-stage treatment and prevent disease occurrence, the US Preventive Services Task Force (USPSTF) advises screening for colorectal cancer in adults between 50 and 75 in the US. Guidelines for screening for colorectal cancer in adults aged 50–74 have also been adopted in Canada every two years. However, these procedures involve exposure to ionizing radiation, which can increase the risk of cancer in healthcare professionals. Owing to a growing number of testing procedures in diagnostic labs, the demand for aprons that provide radiation protection is likely to propel in the upcoming years.

Growth Drivers and Challenges:

Healthcare professionals, especially in radiology and interventional procedures, require reliable protection without compromising comfort while working for long hours. This has led manufacturers to incorporate materials and designs in aprons that are effective in shielding against radiation and ergonomic for wearer convenience. For instance, in July 2022, Burlington Medical introduced the XENOLITE 800 NL (No-Lead) apron series—an X-ray radiation protection apron that is lead-free, incredibly light, flexible, and recyclable.

On these lines, the radiation protection apron market has expanded to cater to the needs of various fields, including veterinary medicine, industrial inspection, and nuclear energy sectors. The demand for radiation protection extends beyond healthcare, prompting innovation in apron technologies to meet diverse industry requirements. As technology evolves, the market will likely witness continuous improvements in lightweight materials, adjustable features, and enhanced protective capabilities. Thus, the radiation protection apron market is evolving to provide lightweight and comfortable solutions for healthcare professionals and other industry workers who require reliable radiation shielding. The ongoing innovations in materials and design reflect a commitment to ensuring safety without compromising wearer comfort across various applications.

Digital imaging technologies, such as digital radiography and computed tomography, offer higher-resolution images with lower radiation exposure. However, these technologies require healthcare professionals to be in close proximity to the patient during the procedure, which increases their risk of radiation exposure. As a result, radiation protection aprons have become even more crucial in these scenarios. The market for radiation protection aprons is expected to grow significantly in the coming years due to increased awareness about radiation protection and the adoption of digital imaging technologies. Thus, the radiation protection apron market has significant growth potential due to the increasing prevalence of cancer and the adoption of digital imaging technologies. Furthermore, manufacturers need to invest in education and awareness campaigns to increase knowledge and understanding among healthcare professionals about the importance of radiation protection and the use of radiation protection aprons. This can help increase demand and drive the radiation protection apron market growth in the years to come.

Healthcare professionals may not be aware of the risks associated with exposure to radiation or may not be familiar with the latest technologies and materials available for radiation protection. Over 3.7 billion diagnostic radiological procedures, 37 million nuclear medicine procedures, and over 7.5 million radiation treatments are performed globally, according to the World Health Organization (WHO). During such treatments, nurses are crucial in helping patients get ready, giving out radioactive and non-radioactive drugs, consoling patients, explaining the process, and ensuring they are safe. Nursing staff must be aware of and get over their phobias about radiation to carry out daily responsibilities, even if their radiation exposure is smaller than that of radiation workers.

Improving quality and education requires all nurses dealing with ionizing radiation to receive training and education. Nurses are reasonably aware of radiation safety, but their training in this area is inadequate, according to a 2016 study by Paulinus et al. assessing nurses' radiation protection expertise. Additionally, only 1% of nurses chose to work in radiology units, whereas most nurses (85%) prefer to be assigned to ward tasks. A moderate understanding of safety precautions was found in research among Egyptian professionals exposed to radiation at work, including physicians, nurses, physicists, and technologists. It also revealed inadequate worker protection procedures and a deficiency in applying radiation safety precautions in the workplace. This can lead to a lower demand for radiation protection aprons, as healthcare professionals may not prioritize their use.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRadiation Protection Apron Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The radiation protection apron market is segmented into type, material, and end user. Based on type, the radiation protection apron market is segmented into vest and skirt apron, front protection apron, and others. By material, the radiation protection apron market is categorized into lead apron, light lead composite apron, and lead-free apron. In terms of end users, the radiation protection apron market is classified into hospitals, clinics and radiology centers, research laboratories, and others. Geographically, the radiation protection apron market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, South Korea, Japan, Australia, India, and the Rest of Asia Pacific), Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the radiation protection apron market is segmented into vest and skirt apron, front protection apron, and others. The vest and skirt apron segment holds a significant market share in the radiation protection apron market. The vest and skirt apron, commonly referred to as a radiation protection apron, serves as a critical safeguard for medical professionals and patients during radiological procedures, shielding them from the potentially harmful effects of ionizing radiation. This specialized protective garment finds applications across various medical settings, including radiology departments, interventional radiology, fluoroscopy, and other radiation-intensive procedures. As a result, the radiation protection apron market growth is driven by the increasing emphasis on staff and patient safety, advancements in protective garment design, and the integration of innovative materials and manufacturing processes. As the demand for radiation protection aprons continues to rise due to healthcare facilities prioritizing radiation safety in medical imaging and interventional procedures, it has prompted the development of lightweight, ergonomically designed aprons, significantly enhancing wearer comfort and freedom of movement without compromising radiation shielding effectiveness. Additionally, combining lead-free and composite materials in apron manufacturing reduces weight and improves sustainability, aligning with the industry's commitment to environmental responsibility. Introducing personalized and customizable apron options has further augmented the radiation protection apron market, allowing users to select tailored designs that match their preferences and clinical requirements.

By material, the radiation protection apron market is categorized into lead apron, light lead composite apron, and lead-free apron. The lead aprons segment holds a significant market share in the radiation protection apron market. Lead aprons are a fundamental component of radiation protection gear, which is pivotal in shielding medical personnel and patients from the potentially harmful effects of ionizing radiation during radiological procedures. Lead has been the primary material for radiation protection due to its exceptional density and shielding properties. However, with a growing emphasis on reducing the weight and increasing the flexibility of lead aprons, the industry has adopted lead-composite materials. These lead-composite aprons utilize a blend of lead and other metals, resulting in effective radiation protection while offering reduced weight compared to standard lead aprons. This development has significantly mitigated the physical strain on medical personnel, enhancing comfort and wearability during extended use. However, increasing focus on environmental sustainability and workplace safety has led to the exploration of lead-free radiation protection apron materials, such as lead-free composites and other heavy metals, which limit the segment growth. These lead-free aprons offer radiation shielding properties comparable to lead-based aprons, addressing concerns related to lead exposure and environmental impact.

Based on end user, the radiation protection apron market is classified into hospitals, clinics and radiology centers, research laboratories, and others. In 2022, the clinics and radiology centers segment held the largest share of the market. Radiology centers perform various diagnostic imaging procedures, such as X-rays, CT scans, and mammograms, which expose healthcare workers to radiation. Clinics and radiology centers are also expected to contribute to the growth of the radiation protection apron market. For instance, dental professionals are exposed to radiation during procedures such as dental X-rays, and radiologists or X-ray technicians may be exposed to radiation during procedures such as animal X-rays and CT scans. Developing new materials and technologies that provide better radiation protection while being lightweight and eco-friendly is also expected to contribute to the market growth

Regional Analysis:

Based on geography, the radiation protection apron market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of the radiation protection apron market. The number of certified radiologic technicians, rising safety consciousness, an increase in orthopedic and spine procedures, and an increase in PET/CT scans are the key reasons propelling the expansion of the US radiation protection aprons market. Furthermore, the US plays a significant role in the healthcare sector, investing a substantial amount of money in medical treatment and diagnostics. Nearly seven out of ten Americans will receive a medical or dental imaging picture in 2021, according to the US FDA's 2021 overview on X-rays. In December 2020, a paper published in the Journal of Radiology demonstrated the significance of radiology in the US healthcare systems. The paper also included several recommendations for potential improvements in how radiography influences treatment choices, patient results, and societal advantages. During the projected period, the radiation protection apron market is anticipated to grow due to rising awareness of the importance of radiology and the growing number of radiologists working in the healthcare industry.

Asia Pacific is expected to be the fastest-growing market in the coming years. In Asia Pacific, China is the largest market for radiation protection aprons. The increasing incidence of cancer cases surges the demand for diagnostic and therapeutic radiology procedures. Lung cancer is the primary cause of cancer death in both China and the US. Thus, the rising prevalence of cancer underscores the critical need for protective measures in healthcare settings, driving the adoption of radiation protection aprons to ensure the safety of both medical professionals and patients. Beyond cancer, the expanding healthcare infrastructure and growing access to medical services contribute significantly to market growth. As China witnesses increasing diagnostic imaging procedures across various medical disciplines, the demand for radiation protection aprons expands accordingly. Technological advancements in apron design, such as incorporating innovative materials to enhance flexibility and comfort without compromising protection, further fuel market progression.

Radiation Protection Apron Market Regional InsightsThe regional trends and factors influencing the Radiation Protection Apron Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Radiation Protection Apron Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Radiation Protection Apron Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 135.37 Million |

| Market Size by 2030 | US$ 205.73 Million |

| Global CAGR (2022 - 2030) | 5.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Radiation Protection Apron Market Players Density: Understanding Its Impact on Business Dynamics

The Radiation Protection Apron Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Radiation Protection Apron Market top key players overview

Competitive Landscape and Key Companies:

Alimed; AmrayGrou; Burlington Medical; Barrier Technologies; BLOXR Solutions LLC; INFAB, LLC; Epimed International Inc; Shielding International; Wolf X-Ray; and Protech Medical are a few prominent players operating in the radiation protection apron market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For