The global Battery Metals market size is projected to reach US$ 71.43 billion by 2034 from US$ 22.85 billion in 2025. The market is anticipated to register a CAGR of 13.5% during the forecast period 2026–2034. Key market dynamics include the rapid global transition toward decarbonization, the aggressive expansion of the electric vehicle (EV) ecosystem, and significant government policy support, such as subsidies and tax credits for green energy. Additionally, the market is expected to benefit from advancements in battery chemistry—including the shift toward high-nickel and solid-state batteries—and the increasing integration of large-scale energy storage systems (ESS) into national power grids to manage renewable energy intermittency.

Battery Metals Market AnalysisThe battery metals market analysis underscores a critical strategic shift toward supply chain resilience and vertical integration. As geopolitical tensions and resource nationalism heighten, procurement trends indicate that major automotive and technology firms are moving away from open-market purchasing toward direct investment in mining operations and long-term offtake agreements. Strategic opportunities are emerging in the development of circular supply chains, where battery recycling and urban mining offer a secondary source of lithium, cobalt, and nickel to mitigate primary supply deficits. The analysis also indicates that market players must focus on diversifying their geographic footprints to reduce reliance on specific regions, while investing in sustainable extraction technologies like Direct Lithium Extraction (DLE) to meet stringent Environmental, Social, and Governance (ESG) mandates.

Battery Metals Market OverviewBattery metals have transformed from a niche industrial sector into the foundational pillar of the global energy transition. Centered around key elements like lithium, nickel, and cobalt, the industry serves as the primary engine for the electrification of transport and the stabilization of renewable energy grids. While the market was historically driven by small-scale consumer electronics, the current landscape is dominated by the massive requirements of the EV industry. This shift has led to unprecedented volatility in commodity pricing and a rush for global exploration. The market is characterized by a mix of traditional diversified mining giants and pure-play energy metal companies, all navigating a complex landscape of fluctuating battery chemistries and evolving regulatory frameworks. For instance, the market in the US is undergoing a significant revitalization driven by federal initiatives to establish a domestic mine-to-battery supply chain. Increasing investments in localized refining and processing facilities aim to reduce import dependencies. There is a strong emphasis on sustainable mining practices and the development of next-generation battery technologies to support domestic automotive manufacturing.

Strategic Insights

Battery Metals Market Drivers and OpportunitiesMarket Drivers:

- Surge in Electric Vehicle (EV) Adoption: The global push by automotive manufacturers to phase out internal combustion engines is the primary driver for battery metal demand. Stringent emission regulations and consumer interest in sustainable transport are forcing a massive scale-up in the production of high-capacity lithium-ion batteries.

- Global Push for Renewable Energy Integration: As nations transition to solar and wind power, the need for stationary energy storage systems has skyrocketed. These systems require vast quantities of battery metals to store excess energy, ensuring grid stability and reliable power delivery during non-productive periods.

- Advancements in Battery Chemistries: Continuous R&D into increasing energy density and reducing charging times is driving the demand for specific high-purity metals. The evolution toward NCM (Nickel-Cobalt-Manganese) and LFP (Lithium Iron Phosphate) chemistries creates a dynamic demand environment for various metal types.

Market Opportunities:

- Investment in Battery Recycling and Recovery: With the first generation of EVs reaching the end of their life cycle, there is a burgeoning opportunity for companies to specialize in the recovery of high-value metals from spent cells, reducing the environmental impact and cost of raw material sourcing.

- Exploration of Alternative Extraction Technologies: Technological breakthroughs in Direct Lithium Extraction (DLE) and high-pressure acid leaching for nickel offer opportunities to unlock previously uneconomical or lower-grade mineral deposits, expanding the global supply base.

- Strategic Partnerships Across the Value Chain: Forming alliances between mining companies, chemical processors, and battery manufacturers can streamline the supply chain, ensuring a consistent flow of materials and reducing the risks associated with price volatility.

The Battery Metals Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Lithium: Recognized as the core component of modern battery technology, this segment is driven by its irreplaceable role in high-energy-density applications.

- Nickel: Increasingly vital for long-range electric vehicles, with high-nickel chemistries becoming the industry standard for performance.

- Cobalt: A key stabilizer in batteries, though the market is seeing a shift toward lower-cobalt formulations due to ethical sourcing concerns and cost.

- Others: Includes metals like manganese, graphite, and aluminum, which are essential for anodes, cathodes, and structural battery components.

By Application:

- Electric Vehicles: The primary consumer segment, encompassing passenger cars, commercial fleets, and two-wheelers, dictates the overall market trajectory.

- Consumer Electronics: A mature segment that continues to demand high-purity metals for smartphones, laptops, and wearable technology.

- Energy Storage Systems: A high-growth area focused on utility-scale and residential batteries used to store renewable energy.

- Others: Includes industrial applications, aerospace, and specialized medical devices requiring portable power solutions.

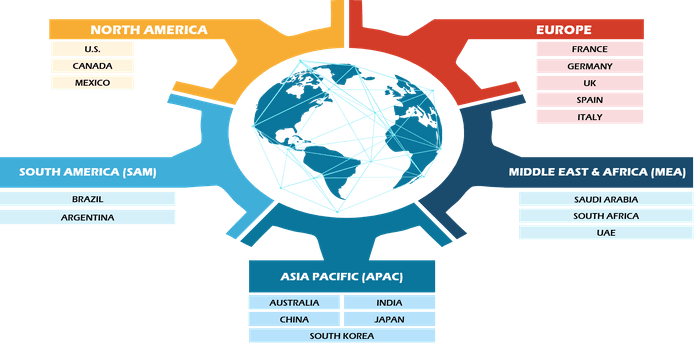

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Market Report Scope

Battery Metals Market Share Analysis by GeographyAsia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for manufacturers to expand.

The battery metals market is undergoing a significant transformation, moving from a traditional industrial commodity to a global high-value strategic asset. Growth is driven by the rising global demand for electric vehicles (EVs), a surge in renewable energy integration through storage systems, and the expansion of the high-performance consumer electronics sector. Below is a summary of market share and trends by region:

North America

- Market Share: A rapidly expanding segment driven by aggressive federal policy support and the localization of the battery supply chain.

- Key Drivers:

- Substantial government incentives, such as the Inflation Reduction Act (IRA), favor domestic mineral processing and EV manufacturing.

- Rapid expansion of Gigafactories and domestic refining facilities to reduce reliance on foreign supply chains

- Growing consumer preference for high-nickel battery chemistries to support long-range vehicle capabilities

- Trends: Scaling of lithium extraction from geothermal brines and the development of a circular economy through advanced battery recycling and localized urban mining initiatives.

Europe

- Market Share: Holds a significant global share, anchored by stringent decarbonization targets and a robust automotive manufacturing ecosystem.

- Key Drivers:

-

Aggressive mandates for the phase-out of internal combustion engines (ICE) across the European Union

- Strict regulatory frameworks, including the Battery Passport, are pushing for high ESG standards in metal sourcing.

- Strong institutional support for regional gigafactory pipelines to ensure energy security and industrial resilience

- Trends: A strategic shift toward prioritizing sustainable and low-carbon mineral extraction, with an increasing focus on localized precursor refining and high-purity nickel production.

Asia-Pacific

- Market Share: The dominant global region, serving as the world's primary engine for battery metal processing and battery cell manufacturing.

- Key Drivers:

- Massive manufacturing output in China, Japan, and South Korea, which control a vast majority of the global battery-grade chemical market

- Favorable government policies and the massive scale of NEV (New Energy Vehicle) adoption in China

- Access to diverse regional mineral resources and a highly integrated, cost-efficient supply chain

- Trends: Heavy investment in next-generation chemistries like Sodium-ion and LFP (Lithium Iron Phosphate) to cater to high-volume market segments, alongside significant R&D in solid-state battery materials.

South and Central America

- Market Share: A critical supply-side market, particularly within the Lithium Triangle of Chile, Argentina, and Bolivia.

- Key Drivers:

- Possession of the world's largest and most cost-competitive brine-based lithium reserves

- Modernization of extraction technologies, such as Direct Lithium Extraction (DLE), to improve yields and sustainability

- Strategic focus on moving up the value chain by developing localized refining and precursor manufacturing

- Trends: Transition from a purely raw-material export model toward a value-add hub, supported by strategic partnerships with global automotive OEMs looking to secure direct mineral access.

Middle East and Africa

- Market Share: Developing market with deep mineral roots, transitioning toward formalized commercial production and regional manufacturing.

- Key Drivers:

- Critical role in the global supply of cobalt (DRC) and nickel/manganese (South Africa)

- Strategic investments in the GCC to build localized battery manufacturing hubs and support economic diversification

- High demand for grid-scale energy storage to manage large-scale solar power projects in arid climates

- Trends: Implementation of modern ESG and transparency standards to formalize the mining sector, coupled with investments in Smart Mining technologies to optimize mineral recovery.

Competition is intensifying due to the presence of established leaders such as Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL, and BASF SE, which also contribute to a diverse and rapidly expanding market landscape.

This competitive environment pushes vendors to differentiate through:

- Vertical Supply Chain Integration: Positioning as reliable long-term partners by controlling the entire value chain, from upstream mining assets to midstream chemical refining-to to ensure transparency and meet the clean-label ethical standards demanded by global automotive OEMs.

- Advanced Extraction and Refining Technologies: Companies are increasingly competing through the deployment of Direct Lithium Extraction (DLE) and high-pressure acid leaching (HPAL) for nickel. These technologies allow for the processing of lower-grade ores with a smaller environmental footprint, providing a significant competitive edge in an ESG-conscious market.

- Strategic Offtake and Joint Venture Models: Leading producers are moving beyond simple spot-market sales to form deep strategic partnerships with battery manufacturers (e.g., CATL, LG Chem) and automotive giants (e.g., Tesla, GM). These multi-year agreements stabilize revenue and de-risk the massive capital expenditures required for new mining projects.

- Sustainability and Circular Branding: Differentiating through low-carbon production profiles and integrated recycling capabilities. By offering closed-loop metals recovered from end-of-life batteries, vendors can appeal to European and North American customers facing strict secondary-material mandates.

- Develop Domestic Refining and Processing Hubs: Partner with governments in North America and Europe to tap into significant subsidies and tax credits (such as the US Inflation Reduction Act) aimed at localizing the mine-to-battery supply chain and reducing import dependencies.

- Invest in Next-Generation Metal Chemistries: Focus R&D on high-purity materials compatible with emerging battery technologies, such as Lithium-Sulfur, Sodium-ion, and Solid-State batteries, which are projected to enter initial commercial production phases by 2030.

- Expand into Emerging Recycling and Recovery Verticals: Establish dedicated urban mining facilities to recover cobalt, nickel, and lithium from the first generation of decommissioned EV batteries, creating a secondary, sustainable revenue stream that mitigates primary supply volatility.

- Albemarle Corporation

- Bolt Metals

- Ganfeng Lithium Co., Ltd.

- Umicore

- LG Chem

- Honjo Metal Co., Ltd.

- Vale

- Lithium Australia NL

- BASF SE

Disclaimer: The companies listed above are not ranked in any particular order.

Battery Metals Market News and Recent Developments- In August 2025, Glencore Plc. acquired Li-Cycle. This strategic move integrated Li-Cycle into Glencore's operations, ensuring that the Battery Metals specialist would continue to deliver value and enhanced service to their joint global customers.

- In October 2024, Rio Tinto and Arcadium Lithium plc announced a definitive agreement under which Rio Tinto acquired Arcadium in an all-cash transaction for US$ 5.85 per share. This acquisition, which valued Arcadium's diluted share capital at approximately US$ 6.7 billion, significantly strengthened Rio Tinto's position in the global Battery Metals market.

The Battery Metals Market Size and Forecast (2021–2034) report provides a detailed analysis of the market covering below areas:

- Battery Metals Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Battery Metals Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Battery Metals Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Battery Metals Market.

- Detailed company profiles

Have a question?

Shejal

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Key players include Albemarle Corporation, Bolt Metals, Ganfeng Lithium Co., Ltd., Umicore, LG Chem, Honjo Metal Co., Ltd., Vale, Lithium Australia NL, and BASF SE.

Some main challenges are high price volatility of raw materials, geopolitical risks in key mining regions, and the environmental and social impacts of large-scale mineral extraction.

Asia-Pacific is the fastest-growing region, driven by its unparalleled manufacturing capacity and the rapid adoption of electric vehicles across major economies like China and India.

Trends include the shift toward domestic supply chain localization in North America, the implementation of Battery Passports in Europe, and the expansion of value-added refining in South America and Africa.

The market is expected to reach approximately US$ 71.43 billion by 2034 from US$ 22.85 billion in 2025. The market is anticipated to register a CAGR of 13.5%.

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For